naphtalina/iStock via Getty Images

Investment Thesis

I previously covered Franklin Electric (NASDAQ:FELE) a couple of months back where I talked about elevated backlog and pricing action helping the company’s near-term revenues and margins. However, I was concerned about medium-term headwinds in the housing and agriculture end market. FELE reported its second-quarter earnings after our previous article and the stock performed well as it posted good revenue growth and margin improvement. Franklin Electric is experiencing healthy demand for its water systems and fueling systems. The supply chain constraints are improving along with the lead times for electronic components and the company was able to convert more of its backlog into revenue in the last quarter. The improvement in supply chain constraints, healthy demand, and higher price realization should drive revenue and margin growth in 2H FY22. However, medium-term concerns around a potential slowdown in housing and agriculture still remain. Hence I have a neutral rating on the stock.

Revenue Outlook For FELE

The near-term demand across all three business segments of FELE has been strong, reflecting the growing need for its Water and Fueling system products. The backlog in the last quarter was approximately $290 million, flattish sequentially compared to the first quarter. The pricing actions taken by the company to offset inflation and volume growth from strong demand is benefiting the company’s sales. About two-thirds of the organic growth in Q2 FY22 was driven by price increases. In the Water Systems segment, the demand is strong across all major product lines such as groundwater pumping, surface pumping, dewatering equipment, and water treatment. The groundwater pumping business grew 38% Y/Y last quarter, whereas all surface pumping equipment businesses grew 29% Y/Y. The end market is driven by dry weather conditions in the U.S. and other regions in the world and food scarcity in the agriculture business, whereas the population migration to rural areas in the U.S. post-Covid is driving growth in the residential business. On the inorganic side, the integration of Puronics and Aqua Systems is moving forward as per the company’s plan.

In the Fueling systems segment, the robust demand for infrastructure build-out in the U.S. is driving the growth. As the major oil marketers invest in new locations and industry consolidation progresses, the demand for fueling systems should rise in the U.S. and other parts of the world. Outside the U.S., the greater focus on vapor recovery, environmental management, and monitoring should drive demand. The geopolitical tensions have highlighted the need for expansion of agriculture, mining, and energy infrastructure as pressure from recent conflict impacted the food, material, and energy supplies which is driving the demand for Water and Fueling systems of FELE.

The strong demand in the market has led to supply chain constraints in the market earlier this year. However, these issues are now moderating. This could be seen in the company’s backlog numbers, which were flattish compared to the prior quarter despite strong demand as the company was able to convert more of its backlog into revenues. Even though the lead times are at higher levels for the electronic components, it is improving sequentially. I believe, supply chain constraints should further ease in 2H FY22, benefiting the company sales.

Over the last couple of years, the company has also benefited from rural migration. The installed base of wells in the U.S. is approximately 13 million to 14 million and with more people moving towards the rural setting, these wells were getting utilized more. This resulted in more wear out the systems in these wells, benefiting FELE’s Water systems segment in recent years. The healthy demand in the end market and improvement in supply chain constraints should drive the growth in 2H FY22. Last quarter, the company has raised its revenue guidance range from $1.9 billion to $2.05 billion to $2 billion to $2.15 billion for FY22, helped by these strong near-term demand trends.

However, I am worried when it comes to the company’s medium-term prospects. As the Covid pandemic is now over and in-office work is getting started, the rural migration trend which benefited FELE might reverse. Also, the housing end market is weakening with rising interest rates. Further, Agri commodities prices have corrected meaningfully over the last couple of months. This might impact the company’s sales in the agriculture end market in the medium term. So, while the company may see good growth in the near term on the back of a strong backlog and price increase, I see a good probability of a slowdown in sales growth from the next year onwards.

Margins

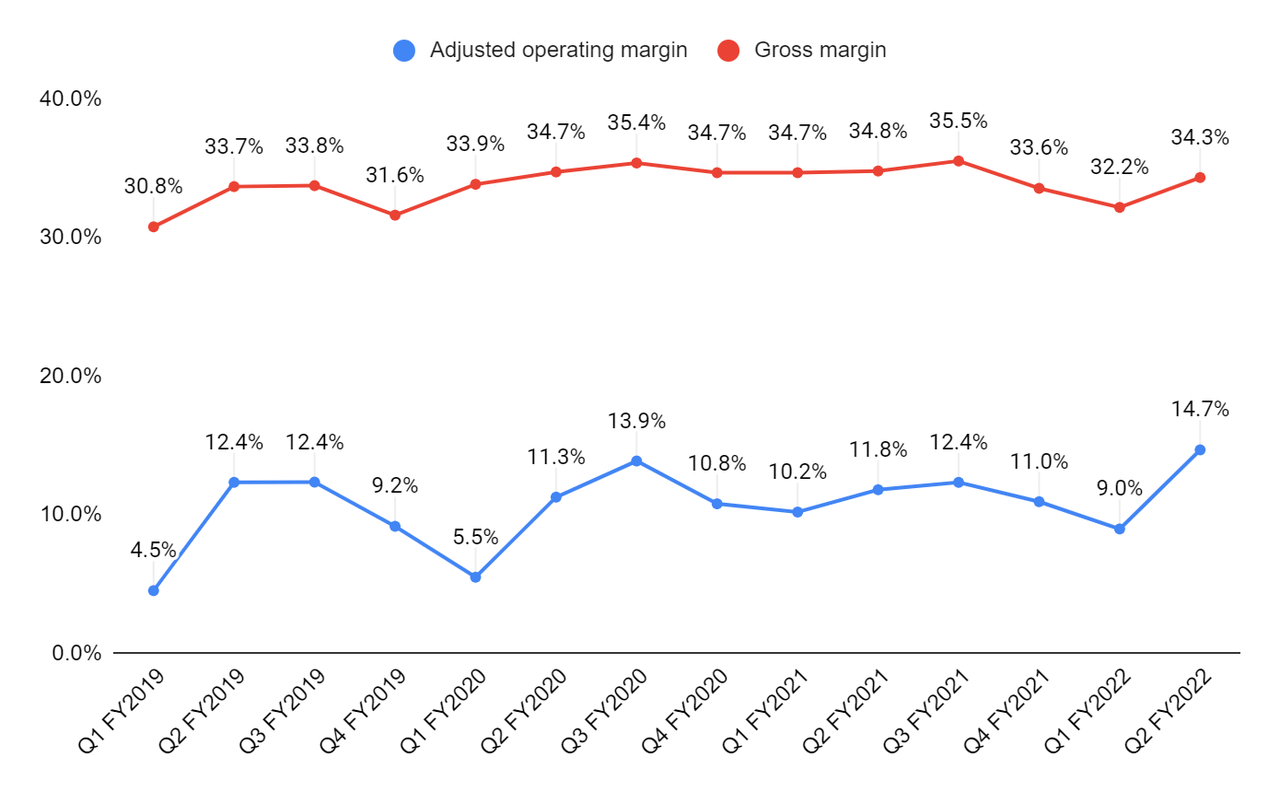

Even though the company has been able to offset higher inflationary costs through price hikes, supply chain disruptions, and higher transportation and manufacturing costs are impacting gross margins which declined 50 bps last quarter. The company is trying to cover these costs through growth and operating leverage. The operating environment for the company improved sequentially last quarter with the moderation in supply chain challenges. As a result, the adjusted operating margin in Q2 FY22 improved 290 bps Y/Y to 14.7%, driven by leverage on fixed costs through higher sales, price realization, and cost management. Looking forward, I believe the improvement in supply chain challenges should drive the margin growth in 2H FY22 along with higher price realization. Beyond FY22, in the medium term, I expect margins to stabilize around 2H22 levels.

FELE’s gross margin and adjusted operating margin (Company data, GS Analytics Research)

Valuation & Conclusion

The stock is currently trading at 20.79x FY22 consensus EPS estimate of $4.12 which is lower than its five-year average forward P/E of 24.68x. The company’s revenue and margin should improve in 2H FY22 with the improvement in supply chain constraints, healthy backlog, and higher price realization. However, there are medium-term concerns regarding a potential slowdown in housing and agriculture end markets. Also, while the stock is trading at a lower valuation compared to its historical levels, there are various other industrial stocks which have seen a steeper correction in their valuation multiple. So, I believe there are better opportunities elsewhere. Hence, I have a neutral rating on the stock.

Be the first to comment