xavierarnau

Written by George Spritzer, co-produced by Alpha Gen Capital

FBRT Logo (FBRT Website)

(Data below is sourced from the Franklin BSP Realty Trust website unless otherwise stated.)

Benefit Street Partners or BSP is a leading, credit-focused alternative asset management firm for both institutions and high net worth investors. It has $39 Billion in assets under management. BSP is a wholly owned subsidiary of Franklin Templeton. BSP Real Estate is a middle-market focused real estate team within the BSP platform.

In October, 2021, BSP Realty Trust merged with Capstead Mortgage Corporation to create Franklin BSP Realty Trust (NYSE:FBRT). The merger produced a significant increase in FBRT’s scale. It also provided a liquidity event for legacy FBRT shareholders who can now sell their shares via the public listing on the NYSE.

As part of the merger plan, FBRT has been using a strategy to transition $7 Billion+ worth of Capstead’s lower-yielding residential ARM assets into higher-yielding commercial mortgage loans with lower volatility.

According to nasdaq.com, institutions currently own about 31% of the fund’s shares outstanding. A large portion of the shareholder base consists of prior holders of Capstead Mortgage (which previously traded under the ticker CMO) or legacy FBRT. Many of these prior investors have likely been selling off their shares of FBRT.

Many of the legacy FBRT shareholders have likely used the publicly traded shares as a source of liquidity which was unavailable to them before. Some of the prior CMO shareholders have also likely sold shares because they may be unhappy with the new investment strategy. I believe this selling has caused a discounted price for both FBRT and the FBRT preferred.

FBRT Uses A Highly Flexible Lending Approach

FBRT customizes each loan to a specific property. As a general rule, each first mortgage loans meets the following criteria:

- Loan size of $10 million to $250 million

- Up to 80% loan-to-value

- 3-5 year term for transitional loans

- 10 year term for stabilized loans

- Any commercial property type

Investment Strategy

FBRT uses four different sub-strategies to manage the portfolio.

- Middle Market: Focused on value added transitional opportunities which are less competitive and more fragmented than the large loan market. There are opportunities for additional structural protections compared to larger, broadly syndicated loans. Generally offers higher yields with attractive LTVs.

- Direct Origination: BSP has a strong origination team in the middle market space. It has established relationships with brokers and borrowers sourcing repeat business. Over half of the FBRT portfolio is sourced from repeat borrowers.

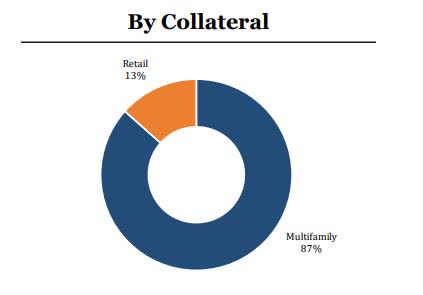

- Multi-family Focus: Attractive segment of the middle market due to strong loan demand, attractive risk-adjusted yields and excellent credit performance. 72% of the core portfolio is multi-family.

- Conduit Business: Offers a competitive advantage in deal sourcing and ability to offer multiple solutions to borrowers. The “gain on sale” model enhances the FBRT return-on-equity with limited credit exposure.

Portfolio Overview

- Total portfolio of $5.3 Billion principal balance.

- 174 commercial real estate loans with an average size of $30 million.

- 170 senior loans with average size of $31 million.

- 4 mezzanine loans with average size of $4 million.

- Two loans on non-accrual status.

Distribution History

The table below shows recent quarterly distributions plus one interim distribution paid by FBRT. The ex-dividend dates are 1 business day before the record dates.

|

Record Date |

Payment Date |

Amount |

|

03/31/2021 |

04/01/2021 |

$0.275 |

|

06/30/2021 |

07/01/2021 |

$0.275 |

|

09/30/2021 |

10/01/2021 |

$0.355 |

|

10/13/2021 |

10/18/2021 |

$0.07 (interim) |

|

12/31/2021 |

01/10/2022 |

$0.285 |

|

03/31/2022 |

04/11/2022 |

$0.355 |

|

06/30/2022 |

07/11/2022 |

$0.355 |

FBRT Portfolio Breakdowns

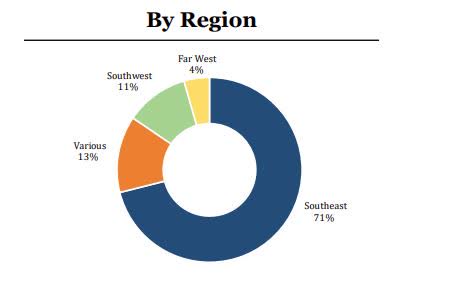

Collateral breakdown (FBRT website) Region Breakdown (FBRT Website)

Share Repurchase Programs

During the first quarter, FBRT Advisors purchased 572,940 shares for $7.5 million at an average gross price of $13.15 per share. This was done using the $35 million open market share purchase program that the Advisor agreed to implement when FBRT acquired Capstead.

From April 1, 2022 through May 3, 2022, the Advisors purchased another 1,794,505 shares for $24.9 million at an average gross price of $13.89 per share. After the quarter-end, from July 1 through July 8, the Advisor purchased 190,199 shares for $2.5 million at an average price of $13.33 per share completing the Advisor Purchase Program.

The FBRT board of directors has authorized another $65 million share repurchase program that is now operative following the conclusion of the Advisor’s program.

FBRT 7.5% E Preferred Stock

The 7.5% preferred stock for FBRT was hurt by the rapid rise in interest rates earlier this year, and now trades well below its $25 par value. While it is not an investment grade issue, the dividends seem quite secure. The preferred payments come “in front of” the generous common dividend payouts.

The FBRT preferred pays a quarterly dividend of $1.875 which equates to an annual yield of 8.78% based on the closing price of August 5.

Franklin BSP Realty Trust

- Total Assets Investment Exposure= $6.2 Billion

- Total Equity Value= $1.6 Billion

- 99% Senior Secured Mortgage Loans

- Dividend Yield on Book Value= 8.98%

- Annual Distribution Rate= 9.90%

- Dividend Frequency= Quarterly

- Current Quarterly Distribution= $0.355 per share ($1.42 annually)

- Operating Expenses on Equity Value= ~5.0%

- Net Debt/Equity Leverage Ratio= 2.4x

- Recourse Net Debt/Equity Ratio= 0.5x

- Price/Book Value= ~0.95

- Average 3 Mos. Daily Trading Volume= 1.28 million shares

- Average 3 Mos. Daily $ Volume= $19.3 million

- FBRT-E yield= 8.78%

Sources: FBRT website, Yahoo Finance

I think the FBRT common shares should do well over the longer term. It may pay to buy a smaller “starter” position here for tracking purposes, and then add more shares of the common on a pullback closer to the $14.50 price level.

The FBRT common is quite liquid and often trades over million shares a day. It is easy to buy using smaller market orders or limit orders.

In the current low interest environment, it can be hard to find safe fixed income investments which generate a decent yield. Based on current pricing, I think the FBRT-E preferred provides an excellent value now on a risk adjusted basis.

More care must be taken when purchasing the FBRT-E preferred stock which usually trades around 20,000 shares a day. Care must be used executing orders since the bid-asked spread is often fifteen cents or higher. I would definitely recommend using smaller size limit orders. To accumulate a larger position, simply break up the large order into multiple small orders. Since most brokers now offer zero commissions, this should not be a problem.

For those in a high tax bracket, it is probably best to own FBRT and FBRT-E in a tax deferred retirement account. In 2021, 97.2% of the FBRT and FBRT-E dividends were ordinary income and 2.8% were capital gains. The ordinary income portion may be eligible for the 20% deduction applicable to qualified REIT dividends under IRC Section 199A.

Be the first to comment