Orbon Alija/E+ via Getty Images

Thesis

First Trust New Opportunities MLP & Energy Fund (NYSE:FPL) is a closed end fund focusing on MLP equities. The corporate structure of the portfolio companies includes C-corporations, partnerships and energy infrastructure real estate investment trusts. As per the fund’s literature:

The Fund’s investment objective is to seek a high level of total return with an emphasis on current distributions paid to common shareholders. The Fund seeks to provide its common shareholders with a vehicle to invest in a portfolio of cash-generating securities, with a focus on investing in publicly traded master limited partnerships (“MLPs”), MLP-related entities and other companies in the energy sector and energy utility industries that are weighted towards non-cyclical, fee-for-service revenues. There can be no assurance that the Fund’s investment objective will be achieved.

Master Limited Partnerships (or MLPs) are a form of incorporation that allows for tax advantages for both the companies themselves as well as investors. Their status has been heavily debated in the past few years which has seen some transformations from MLPs to C-Corps. The FPL portfolio for example contains a 50/50 split between MLPs and C-Corps.

Fundamentally the sector is now on a much better footing than pre-Covid. In the “Covid-19 Impact’ section below we discuss extensively the changes the management teams have implemented. With Oil & Gas set to go through an extensive super-cycle, transportation infrastructure will be critical going forward. However please note that the sector is known for its dividend yield, not its upside potential:

YTD Performance (Seeking Alpha)

The FPL performance year to date is good, but pales in comparison with the energy sector ETF (XLE). Moreover FPL has failed to outperform the unleveraged vehicle (AMLP). The CEF has a deeply negative 5-year total return.

The fund is extremely volatile with a 3-year standard deviation of 40.7 and a low Sharpe ratio of 0.15. Long term FPL is a value destruction tool being down almost -35% since inception. And that performance is before inflation is factored in. We are not big fans of asset classes which long term fail to perform. That being said, looking forward this asset class is on the mend and will represent an important cog for the Oil & Gas sector in the U.S. However why buy FPL, a 20% leveraged vehicle, when the unleveraged AMLP provides for the same or better total return? The fund is indeed trading at a discount to NAV but we expect that discount to persist.

All in all FPL is a CEF with a very poor historical total return but encompassing an asset class which is on the mend. Oil & Gas infrastructure is going to play a large role going forward and management teams will need a few more years before they start over-leveraging the balance sheets again. That being said FPL has a 20% leverage factor but an extremely high volatility and a return profile which does not beat AMLP (the unleveraged ETF in the space). We are not big fans of MLPs and feel they are extremely cyclical. However if you already own this fund, you can hold to clip the yield if you can stomach the volatility. New money looking to enter the space would do well to wait for a market sell-off and choose a vehicle with better risk/reward ratios than FPL.

What are MLPs

FPL is a CEF that provides investors access to a lesser known asset class, namely Master Limited Partnerships from the Oil & Gas sector. MLP is a fancy way of describing a form of incorporation for a company that generally runs pipeline and processing infrastructure for the Oil & Gas sector. In a nutshell, a classic MLP is a company which owns transportation (pipelines) and storage facilities for oil and gas. Since this business has traditionally been very stable (irrespective of oil prices, the actual liquid has to be transported from the extraction site to a port or storage facility) many large corporates chose to spin off their transportation and storage arms into free standing companies with long-term standing transportation contracts. The MLP format provided tax advantages for both the respective companies as well as investors.

Covid-19 Impact

The Covid-19 market shock brought renewed focus for many management teams on balance sheet optimization and debt levels. With the share prices of many MLPs plummeting in the beginning of 2020, a number of executives started talking about debt wall management, utilizing cash flows to reduce debt and in a number of instances cutting distributions to preserve cash.

The post Covid-19 MLP world has seen a number of trends occurring:

- Debt load maturity transformation – many MLPs are now proactively trying not to have any debentures due in the upcoming 1-3 years to insulate themselves from any downturns (so that their ability to roll debt is not questioned).

- Overall reduction in Debt/EBITDA metrics – a number of companies are now targeting Debt/EBITDA metrics sub 4x

- Finding alternative sources of financing, namely receivables securitizations – we have seen a number of companies engaging in funding optimization trades via receivables securitizations which carry a much lower coupon

Holdings

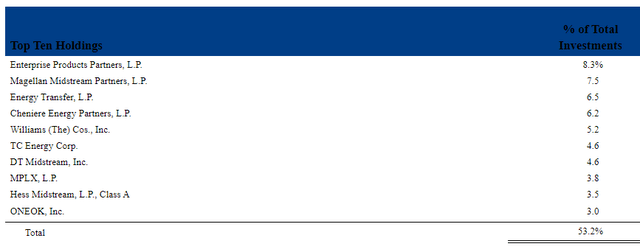

The fund’s top holdings contains a mix of MLPs and C-Corps:

Top Holdings (Semi-Annual Report)

Source: Semi-Annual Report

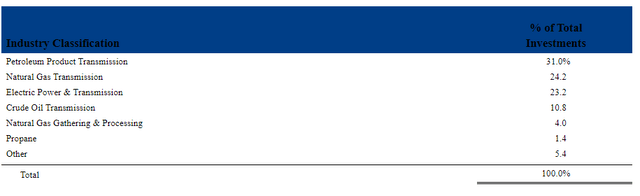

The vast majority of the holdings represent companies which engage in transportation/transmission services for the Oil & Gas sector:

Industry Classifications (Semi-Annual Report)

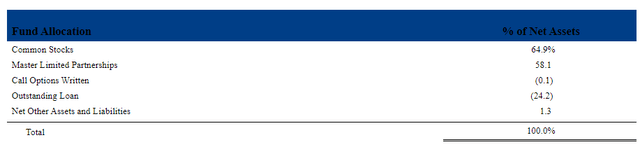

We can see in the fund disclosures the split between pure MLPs and C-Corps:

Fund Allocation (Semi-Annual Report)

Performance

FPL is up almost +17% year to date but its performance pales in comparison with the unleveraged ETF AMLP and the energy sector ETF XLE:

YTD Performance (Seeking Alpha)

On a five year time-frame the CEF has a deeply negative total return:

5-Year Total Return (seeking alpha)

Premium/Discount to NAV

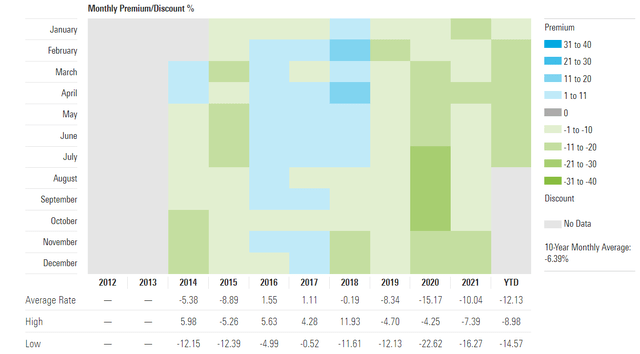

The fund has traded at substantial discounts to net asset value in the past few years:

Premium / Discount to NAV (Morningstar)

We can observe that the CEF traded at consistent premiums to net asset value during 2016-2018, but reverted to a discount after. In the past three years the vehicle has traded at discounts that have averaged -10% to -15%. This corresponds with a debasing of the MLP asset class which suffered a very severe downturn during the Covid crisis on the back of permanent value destruction for some operating companies that got overleveraged. We expect the discount to NAV to persist for the asset class for the foreseeable future.

Conclusion

FPL is a closed end fund focused on MLPs and C-Corps in the Oil & Gas infrastructure subsector. The fund is up year to date but has not outperformed the unleveraged AMLP ETF. The vehicle has deep negative total returns on a 5- and 10-year basis. While the asset class is on the mend it exposes deep volatility metrics. FPL is a vehicle to be embarked for the yield not for the upside since the asset class is very cyclical and the Covid drawdown is behind us. However if you already own this fund, you can hold to clip the yield. New money looking to enter the space would do well to wait for a market sell-off and choose a vehicle with better risk/reward ratios than FPL.

Be the first to comment