Kevin Hagen

News Corp (NASDAQ:NWS) is a $10bn market cap diversified media company operating in real estate listing/advertising, news/business information (owns WSJ) and book publishing. NWS used to be part of media conglomerate Fox Corporation (NASDAQ:FOX) before the spin-off in 2013 in the aftermath of a hacking scandal related to NWS’s tabloid. The move – which was intended to shield FOX’s high-growth entertainment assets from financial fallout – left parent FOX with legacy cable news, broadcast TV, and film businesses. In 2019, FOX sold film assets in a $71bn deal to Disney (DIS), providing a rationale for a FOX-NWS recombination ever since. Both NWS and FOX have been largely owned by billionaire Rupert Murdoch’s family trust: 40% voting power and 14% economic interest of NWS and 43%/19% of FOX. Recently, Murdoch came out, arguing that FOX and NWS should recombine. Subsequently, FOX and NWS formed special committees to evaluate potential merger.

Interestingly, shortly after the formation of special committees, prominent activist Irenic Capital reportedly acquired a 1.5% stake in NWS. Irenic suggests that NWS might be worth $34/share. The activist has also stated that splitting up NWS would unlock value, pushing for a spin-off of the RE business, which includes stake in ASX-listed real estate classifieds business REA Group (OTCPK:RPGRF), currently worth 63% of NWS market cap. Importantly, Irenic and other shareholders stated they would reject a potential merger if it undervalued the target. A merger of the two companies would likely require approval from minority equity holders on both sides. That said, the potential merger would be a strategic move for Murdoch / FOX and might value NWS at a premium.

- Firstly, FOX core live news assets are facing secular pay-TV headwinds with decreasing number of Fox News and Fox Business subscribers (-12% since 2018). A merger with NWS would complement these in distribution, content creation, and bundling. NWS digital outlets would provide extra distribution/promotion channels, for instance, NWS-owned Dow Jones and the New York Post may benefit from cross promotion with FOX’s television businesses. There are several other expected synergies, including between publishing arms of both companies as well as between REA and FOX-owned consumer finance marketplace Credible. Cost savings – estimated at $500m – would help ahead of a potential economic downturn and/or allow FOX more room for investments into other areas, primarily sports betting which FOX’s management has been particularly bullish on.

- Secondly, NWS seems to be a much more attractive business than in 2013. The company has successfully pursued strategic transformation, shifting from print media to higher-margin digital. This has materially raised NWS’s profitability – $1.7bn EBITDA in 2022 vs $770m in 2014. The business has generated $3.8bn in FCF since the spin-off. Dow Jones has been the primary growth driver, with growing digital audiences (such as WSJ and Barron’s subscribers up 13% and 18% YoY) and rapid expansion of financial data businesses, such as Risk & Compliance (~20% annual growth). This has moved DJ towards more digital and recurring (75%) revenue base, raising EBITDA margins from 15% to 22% just since 2020 (when NWS started reported DJ as a separate segment). With acquisitions of commodity-focused data and analytics providers OPIS and Base Chemicals, the management expects to continue pushing up the segment’s margins:

We are focused on further expansion of PIB (Professional Information Business), which was significantly enhanced with the acquisitions of OPIS and CMA. These acquisitions continue to move Dow Jones to a more recurring and digital revenue base, with very high retention rates, strong margins, premium products and optionality into new market verticals. While we don’t break out margins specifically for PIB, it is fair to assume that the products in the business have attractive margins, which we expect to be enhanced by our recent acquisitions.

-

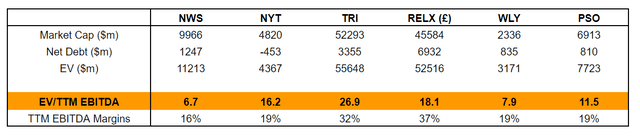

Despite solid performance, NWS is cheap trading at only 6.7x TTM EBITDA (including REA stake). This is below business information competitors Thomson Reuters (TRI) at 26.9x and RELX (RELX) at 18.0x, news peer New York Times (NYT) at 16.2x and publishing comps John Wiley & Sons (WLY) at 7.9x and Pearson (PSO) at 11.5x. Likewise, NWS appears undervalued on SoTP valuation. Currently, REA stake – which the activist wants to spin-off – is worth $6.3bn, leaving the remaining business at $5.1bn EV valuation or only 4.5x TTM EBITDA.

-

Finally, the merger would also seem to nicely fit within 91-year-old Murdoch’s succession plans. Amid a decades-long succession battle among Murdoch’s children, Murdoch is apparently willing to hand over control over both companies to his son Lachlan who has lead FOX since 2019. Interestingly, Lachlan Murdoch has taken an active approach to M&A at FOX, overseeing numerous acquisitions valued at more than $7bn in total since taking the reins of the company.

Irenic Capital Management is a newly established activist hedge fund co-founded by Elliott Investment Management’s veteran Adam Katz. At Elliott, Katz previously successfully led several high-profile activist campaigns, including at Alcoa and Arconic. Considering the activist’s involvement, strategic rationale and NWS’s solid yet undervalued business, an interesting setup might be brewing up here. Among the likely outcomes are either a merger at premium to current prices and/or potentially lucrative spin-off of NWS’s RE listing business.

News Corp Business, Financials And Valuation

NWS operates in five segments:

- Digital Real Estate Services. The segment comprises 61.4% stake in REA Group and an 80% interest in US real estate service provider Move (operates Realtor.com).

- Subscription Video Services. Consists of 65% interest in Australia’s subscription television company Foxtel Group and Australian News Channel. Provides sports, entertainment and news services to subscribers (both pay-TV and streaming).

- Dow Jones. Includes numerous consumer products, including the WSJ, Barron’s, MarketWatch, as well as Professional Information Products, such as Factiva and Dow Jones Risk & Compliance, among others.

- Book Publishing. Includes HarperCollins – the second largest consumer book publisher in the world on global revenue.

- News Media. Comprises media outlets, such as News Corp Australia, News UK and the New York Post.

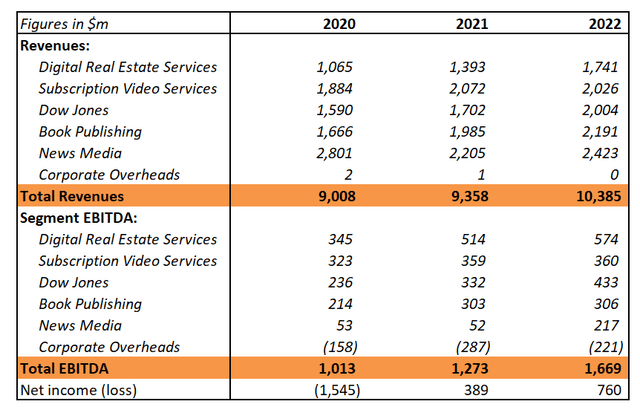

NWS Historic Financials (Company Filings)

Note: NWS started to report Dow Jones as a separate segment in 2020.

Recently, growth has been seen across most segments, with digital RE services, Dow Jones and Book Publishing leading the pack. Notably, the management has stated that these three segments are core. In particular, NWS has pursued significant expansion of Dow Jones business into the enterprise space, with favorably-priced acquisitions of OPIS and Base Chemicals. Some quotes from the management, showing the leadership’s willingness to pursue other similarly accretive mergers:

To be specific about the segments, Dow Jones is already seeing the tangible benefits of OPIS and Base Chemicals, which we have rebranded, Chemical Market Analytics, or CMA to the (inaudible). These 2 businesses complement each other, and they certainly complement Dow Jones. We were fortunate to acquire them at a favorable price as their sale was required by regulators for approval of the S&P Global-IHS Markit merger. We thank those companies and the regulators for the opportunity bequeathed to us. […] Not only are OPIS and CMA starting to benefit us financially, but they have contributed to the depth and breadth of Dow Jones’ overall expertise in commodities, in traditional fuel sources, in essential chemical products and in renewables and more.

And you can see from the impact already of the OPIS and the CMA acquisitions at Dow Jones, the base chemicals, that there’s no doubt that, that has already made a difference to the profile of the Dow Jones profit. As I said, Dow Jones Professional Information business was up 47% Q4. And that was at a time when other bits of consumer media were already starting to be under pressure. But that’s not a pressure we saw — I mean advertising was up at Dow Jones. Q4 subscriptions were up. So we’re — it’s a different kind of business, say, for example, to a New York Times or Washington Post or a more, what you would call, mainstream media business.

Those were great assets acquired at reasonable prices, which wasn’t characteristic of the market at that time. And so there are other great assets that can be acquired at reasonable prices without being specific. We would be interested, one. And two, we have the resource. And three, we have a team that is very conscious of the responsibilities of consolidation.

Valuation-wise, NWS trades below peers from news, business information and book publishing:

NWS Relative Valuation (Company Filings)

Interestingly, the Dow Jones segment alone might be a significant portion of the current market cap. Although the segment’s EBITDA margins (22%) are still below those of peers TRI and RELX, assigning a 16x EV/EBITDA multiple – in line with another peer NYT – would value Dow Jones at $6.9bn or 70% of the current market cap. Likewise, HarperCollins would be worth $2.5bn if valued at 8x – where a peer WLY is trading.

FOX Business, Financials And Valuation

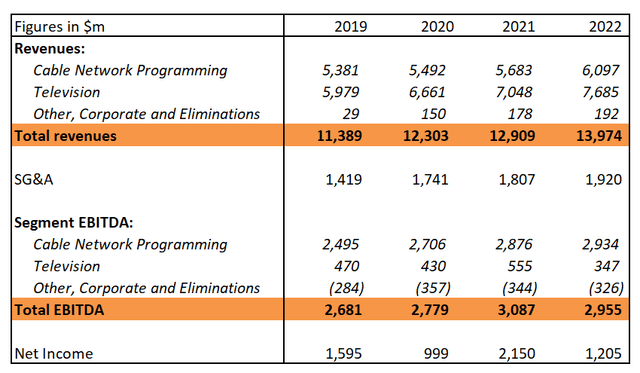

FOX segments its activities into Cable Network Programming (produces news and sports content), Television (owns and operates TV stations) and Other. While Television generates 55% of revenues, on an EBITDA basis Cable segment contributes almost the entire earnings (89% excluding corporate overheads). Fundamentally, FOX derives revenues from affiliate fees and advertising sales. Affiliate fees (49% of total TTM revenues) are paid by MVPDs (multichannel video programming distributors, i.e. cable or satellite operators) per subscriber. 42% of revenues in FY2022 were derived from advertising which includes political advertising.

FOX Historic Financials (Company Filings)

After the sale of 21st Century Fox to DIS, FOX has primarily focused on live sports and news content, seeking not to operate in the increasingly competitive SVOD (subscription video on demand) industry – CFO during Bank of America Media, Communications and Entertainment Conference in Sep’22:

So we created FOX Corp. in 2019, and our strategy is to remain really resolute around it, right? We have absolutely chosen not to try and compete in the SVOD wars because we basically traded the assets that we had to compete in those and gave Disney the better hand in that. And so we have a fantastic set of assets with News and Sports.

Notably, the company’s News/Business channels have faced pay TV headwinds, with subscriber count declining in recent years. Going forward, however, the management has been particularly bullish on political content amid the upcoming political cycle and numerous sporting events (such as FIFA World Cup) – these are expected to materially boost advertising top line, albeit in the short-term. It is also worth noting here that FOX has been very bullish on sports betting as it continues to legalize across more states. From the CFO during the Bank of America Media, Communications and Entertainment Conference:

And so we’ve been long-term believers in the category, and we will remain that way. We think over the — and we’ve got sort of various assets, whether it be our sort of quasi joint venture in FOX Bet or the options that we have over FanDuel. We’re taking a long-term view and those deals are structured as long-term deals because we see this as being a really important part of sort of our sports business. And so yes, the valuations and the excitement have come off over the last 6 months like it has across tech. But our sort of 5- to 10-year view of this remains unchanged, which is it’s going to become a really, really important category, and we want to be on the ground floor of that from an opportunity perspective.

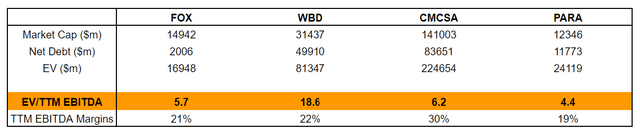

FOX Relative Valuation (Company Filings)

FOX currently trades at 5.7x TTM EBITDA – in line with peers CMCSA and PARA. Notably, these peers have derived a similar percentage of revenues/EBITDA from cable network programming as FOX – 53% for CMCSA and 50% for PARA in terms of revenues and 76%/84% in EBITDA, respectively.

Risks

- Historically, FOX used to trade at a discount compared to peers, driven by the phone hacking scandal and a diverse portfolio of FOX’s holdings. Moreover, FOX has recently been facing a $1.6bn defamation lawsuit related to 2020 presidential election. While reputation of FOX might be somewhat of a risk from NWS shareholder approval perspective, currently FOX seems to be valued fairly, suggesting a deal might go through if announced at a reasonable premium.

- Given the size of both companies, the merger would be subject to regulatory approvals, including from the FCC. The risk, however, seems limited by relatively insignificant horizontal overlap and the fact that FOX is a much leaner company post 21st Century Fox sale to Disney. Moreover, the merger of CBS and Viacom in 2019 – the combined company is known today as Paramount (PARA) – seems to be a comparable industry transaction. The merger combined Viacom’s TV/film assets and CBS’s cable/broadcast television. At the time, the combined company was valued at $30bn compared to the current combined EV of FOX and NWS at $28bn.

Be the first to comment