Sundry Photography/iStock Editorial via Getty Images

Four Corners Property Trust (NYSE:FCPT) is a net lease real estate investment trust (“REIT”) that is a spin-off of Darden Restaurants (DRI).

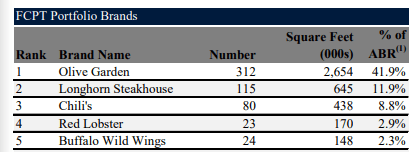

At present, about 54% of their current portfolio is attributable to the original DRI spin properties. This includes a current brand exposure to their single largest tenant, The Olive Garden, of 42% of total annualized base rents (“ABR”). While this is elevated, it is down from 74% at the time of spin off.

Q3FY22 Investor Supplement – Partial Summary Of Top Tenants

The company has since diversified their exposure to the auto service and medical retail industries, which collectively account for 10% of ABR.

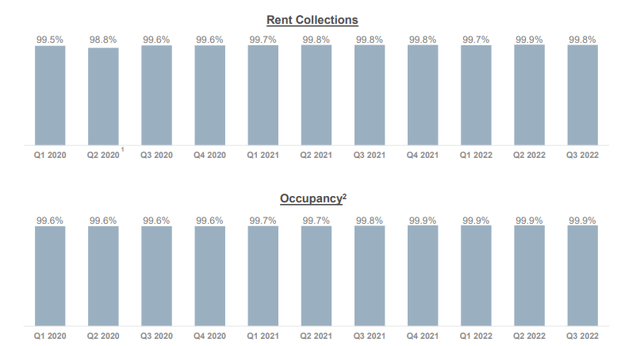

While some would express concern at the company’s significant exposure to restaurants, it’s worth noting that 62% of their tenant base is investment-grade rated. And this is backed up by consistently strong cash collection and occupancy rates.

YTD, the company is down just 8%. This compares favorably to the broader REIT index, which is down over 20% over the same period. For existing shareholders, shares offer a surprising sense of stability in otherwise volatile markets, in addition to a stable dividend payout yielding 5% at current prices. But in terms of new or added positioning, shares appear fairly valued and are unlikely to provide significant upside from current levels.

Recent Performance

FCPT turned in Q3 portfolio results that largely reflected the strength of the company’s tenant base. Rental collections and occupancy, for example, both remained just shy of 100%. This is a consistent characteristic of operations going back to even the worst months of the COVID-19 pandemic.

November 2022 Investor Presentation – Quarterly Summary Of Cash Collection & Occupancy Rates From Q1FY20 To Present

In addition, management commentary noted that their restaurant operators are continuing to post strong results through Q3, though many are expecting a downturn and are thus placing additional emphasis on affordability, which has pressured pricing.

Nevertheless, rent coverage levels still stand at 4x for 75% of their portfolio that reports the statistic. This reflects the strength of their tenant base to cover their rental obligations even during difficult economic environments.

Furthermore, through the date of their release, their quick service and casual dining restaurants were operating at 120% and 103%, respectively, of weekly sales levels as compared to 2019, according to management, citing data provided by Baird.

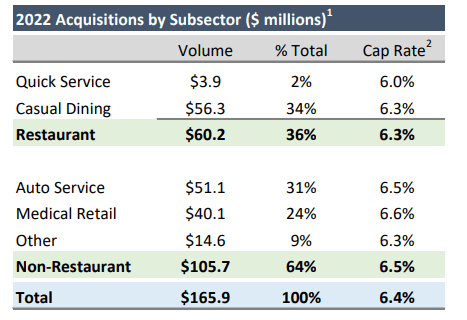

On the acquisitions front, which is a key aspect of the company’s growth prospects, FCPT acquired 26 properties during the quarter at an initial cash yield of 6.3%. This brings their YTD total to +$166M, split 36% to restaurants, 31% to auto service, 24% to medical retail, and 9% to all other.

November 2022 Investor Presentation – YTD Acquisition Summary

In a positive update on the acquisition environment, management noted that pricing continues to improve in response to the higher hurdle rates present in the current capital environment, with higher cap rates now more entrenched in sellers’ expectations.

Despite this, a heightened lag remains between price agreement and closing, reflecting the continued uncertainty in the environment. In addition, management expressed caution in jumping in on increasingly attractive investment opportunities, which, in some cases are at going-in cap rates at or above 7%.

An entry point at those rates could likely pay off handsomely in later periods, since their current dispositions are capturing caps of 5.5%. And this is for their more underperforming assets.

Any setback in the acquisition environment could ultimately weigh on their cash rental rate growth, which is currently benefitting from a 14% compound growth rate of their property portfolio from the 4th quarter of 2015 to present, growing at an 11% compound rate over the same period.

But if recent news is any indication, the company continues to charge ahead on closings, despite caution conveyed to the contrary, with approximately +$50M in announcements since the date of their release.

Liquidity And Debt Profile

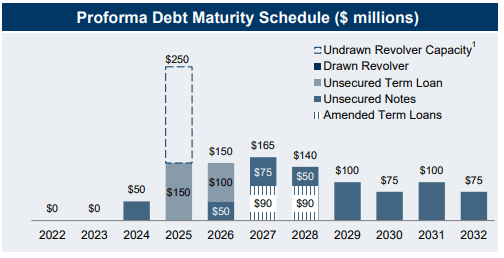

During Q3, FCPT raised approximately +$79M of common stock via their at-the-market (“ATM”) program at an average price of $28.09. Together with their existing cash on hand and availability on their revolving credit facility, the company had +$358M of total available liquidity at September 30.

This is more than enough to cover their nearest debt maturity, which is not due until 2024 at the earliest.

November 2022 Investor Presentation – Debt Maturity Schedule

And in the interim, FCPT’s fixed charge and interest coverage ratios of 4.9x and 5.6x, respectively, are adequate to meet their reoccurring debt servicing obligations.

In addition to existing liquidity, the company also generates healthy cash from operations on a consistent basis. On a net basis after considering dividend payments, the company still has about +$29M left on the hand to apply to other priorities.

Granted, acquisitions represent a sizeable portion of their use of cash, though the pace of growth appears to be slowing.

YTD through Q3, for example, the company has spent $171.8M on real estate purchases. While this represents a significant use of cash, it’s about 12% lower than last year over the same period. And looking ahead, acquisitions are likely to slow further, given management’s more prudent outlook.

Dividend Safety

FCPT recently hiked their quarterly dividend payout by 2.3% to $0.34/share. Annualized, the payout now yields about 5% at current pricing.

While the yield may not be the most appealing, it comes with reassurance that the company has the capacity to enact modest increases.

And at just above 80% of their Q3 adjusted funds from operations (“FFO”), the company certainly doesn’t have to stretch to make the payments, though the payout is on the higher side, nevertheless, compared to the sector average adjusted payout ratio of 72%.

Takeaway

FCPT owns a high-quality portfolio of assets with a tenant base of nationally established brands. This portfolio is further characterized by relatively low rents and high EBITDAR/rent coverage levels of over 4.0x, which is amongst the strongest within the net lease industry.

Additionally, rents as a percentage of tenant sales averages approximately 5% for the Darden portfolio, which comprises 54% of the company’s total portfolio. This is in contract to an industry average of about 8-10%.

The strong rent coverage levels have continuously enabled full rent collections, even through some of the worst months of the COVID-19 pandemic. This is the case with occupancy levels as well, which have been and still are at or above 99.5%.

While current portfolio strength is certainly a positive, the growth opportunities from here appear limited. The company has significantly expanded their portfolio through acquisitions, but the pace is likely to slow in the periods ahead.

In addition, the company is posting positive leasing spreads, but their markup opportunities are inhibited by the limited number of near-term expirations.

Recent disposition activity also provides a general ballpark of the reasonableness of the company’s current valuation. At present, the company is trading at an implied cap rate of 5.3% based on its current enterprise value and annualized Q3 net operating income.

This is a slightly higher premium than at the end of Q3, where shares fetched 5.7%. And at that time, the company’s dispositions came in at a 5.5% rate. By this measure, shares appear fairly valued at present pricing.

Management also raised +$79M of equity in Q3 at an average price of $28.09/share. If that was considered a high point for issuance, that would represent a premium of just 4% over today’s prices.

While FCPT is an interesting stock to follow, it doesn’t have enough zest to entice new initiation.

Be the first to comment