dgdimension/iStock via Getty Images

FET Focuses On Key Objectives

Increased demand for drilling and completion equipment has prompted Forum Energy Technologies (NYSE:FET) to cash in on short-cycle product sales, including artificial lift products, new well completions, and well workovers. It has improved its operating leverage remarkably over the past year, thus lowering the cost structure. In the medium-term, the company will increase its share of business from methane emissions control, carbon capture use and storage, and offshore wind.

However, the lower backlog in Drilling & Downhole and Completion segments have marred the short-term revenue outlook. On top of that, the supply chain constraints can lower the operating margin expansion. It has sufficient liquidity in the balance sheet, and in the event of convertible debt turning into equity, the balance sheet would de-leverage substantially. I think this will lower the concerns stemming from negative cash flows, and investors can hold the stock with expectations of modestly positive returns in the medium term.

The Strategic Positioning

In my previous article, I discussed FET’s business portfolio more here. The company is subtly placed in the oilfield services industry such that it is somewhat insulated from the sudden changes in the industry drivers. Its sand management systems help run the electric submersible pumps efficiently. Its ROVs help operates offshore support vessels. Its high-strength tubing and greaseless cable allow drillers to complete more stages per month.

Apart from the legacy energy servicing model, it focuses on methane emissions control, carbon capture use and storage, and offshore wind. Although decarbonization consists of a small part of its total revenues, the contribution is expected to grow as new technologies are commercialized, and demand increases. So, it is partially insulated from the energy price-driven service demand.

Cost Restructuring And New Product Benefits

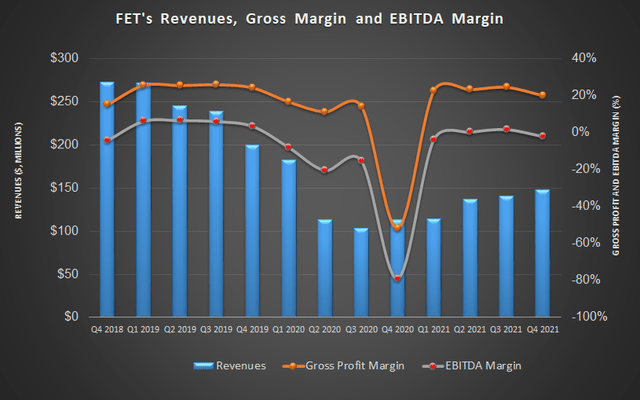

FET’s second key aspect is organizational restructuring and its portfolio optimization strategy. The cost-efficiency can be observed from the decrease in the cost structure. The US onshore rig count increased 14% during Q1 2022 versus Q4 2021. With the current rig count comparable to 2020, its profitability in FY2021 exceeded FY2020 by $40 million following better operating leverage. However, it faces challenges from supply chain delays and input price inflation. Also, to smoothen the delivery delays, the company took additional airfreight costs and other expediting charges. These factors reduced its Q4 2021 EBITDA by $4 million.

Some of the essential addition to FET’s repertoire in Q4 were Hawker Well Works and Reach Production Solutions. The Reach acquisition helped consolidate the compression technology, which can extend to applications in artificial lift and emissions control. It strengthened its drilling capital product offering by adding products from Hawker, expanding the customer base, and increasing operating efficiency. Acquired for $5.7 million, the acquisition is expected to add $2 million in EBITDA in 2022.

Q1 and FY 2022 Guidance

The supply chain disruption, commodity price inflation, wage hike, and problems related to last-mile trucking can slow down the company’s revenue generation modestly. Still, it will have a more profound impact on the EBITDA in Q1. So, the management expects its Q1 revenues to increase by 8% (at the guidance midpoint) compared to Q4 2021. Adjusted EBITDA, however, can shrink in Q1.

In FY2022, the logistic delays from supply chain issues and other SG&A cost hikes will continue. So, FET will try to mitigate that by raising prices. Also, it is building inventories for key products, which can increase near-term costs. However, as we advance, this can lower the overall cost structure (assuming cost inflation continues) and improve profitability. So, in FY2022, the management expects EBITDA to reach $50 million to $60 million, or 175% higher than in FY2021.

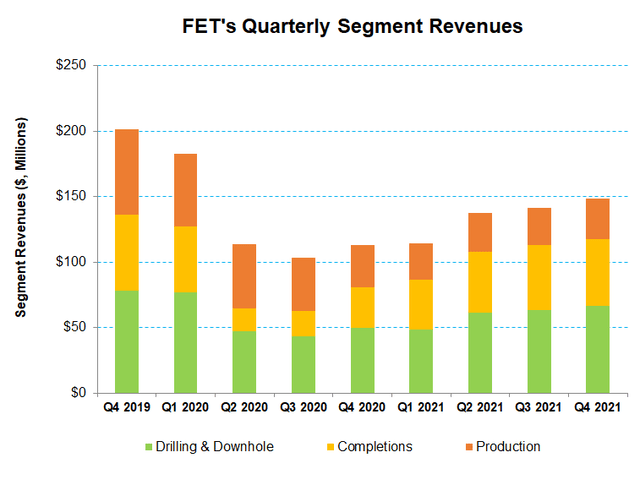

Segment Value Drivers In Q4

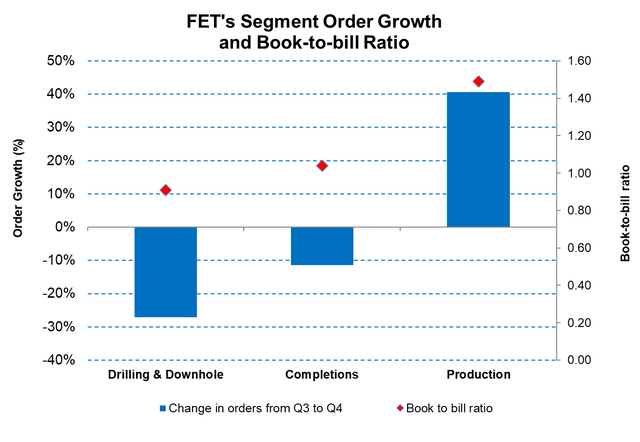

Drilling & Downhole segment: Revenues in the Drilling & Downhole segment increased by 5.2% in Q4 2021 compared to Q3 2021, although the operating margin fell. The primary reason for the improved performance was the higher artificial lift product sales, new well completions, and well workovers, and accelerated international spending. Quarter-over-quarter, the segment order decreased by 27%.

Completions segment: The spurt in coil tubing and stimulation product sales following the recovery in North American well completions activity in the past few quarters is reflected in the Completions segment revenue growth (2.6% up quarter-over-quarter). Also, during the quarter, the company commercialized Enviro-Lite cables, which lowered the cost of upgrading the customers’ wireline units. However, the segment order declined sharply in Q4 (~11% down), which may lead to decreased product delivery over the next few months.

Production segment: This segment witnessed the highest revenue growth (by 8.4%) in Q4 compared to the previous quarter. The introduction of new products, including the commercialization of vapor recovery units at well site and storage facilities, helped gain market share. The order book swelled (40.5% up) during this period.

Cash Flows And Debt Refinancing

Forum’s cash flow from operations (or CFO) turned negative (-$15.8 million) in FY2021. In Q1, it plans to build inventories to mitigate supply chain constraints and make other necessary payments. Although year-over-year revenues remained steady, adverse changes in working capital contributed to the fall. So, the cash outflow can exceed the current level, and free cash flow can deteriorate more.

FET’s liquidity stood at $174 million as of December 31, 2021. Its debt-to-equity was 0.71x as of that date. Investors may note that about half of its total debt ($232 million) is convertible to equity. The management also believes that a conversion is plausible given the current industry condition, which can significantly de-lever the balance sheet and increase enterprise value.

Linear Regression Based Forecast

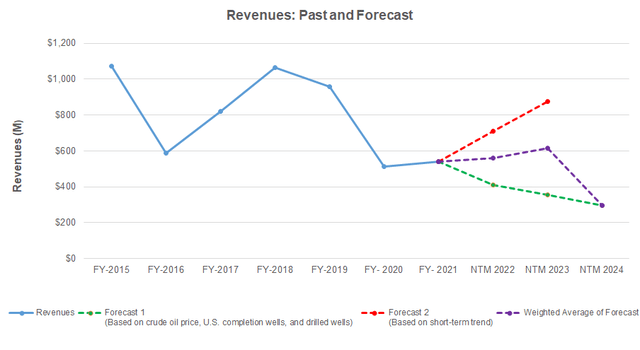

Author created, Seeking Alpha, and EIA

Based on a regression equation between the key industry indicators (crude oil price, US completion wells, and drilled wells) and FET’s reported revenues for the past seven years and the previous four quarters, revenues should remain steady in the next 12 months (or NTM 2022). The growth rate can accelerate in NTM 2023 but may decrease sharply in the following year.

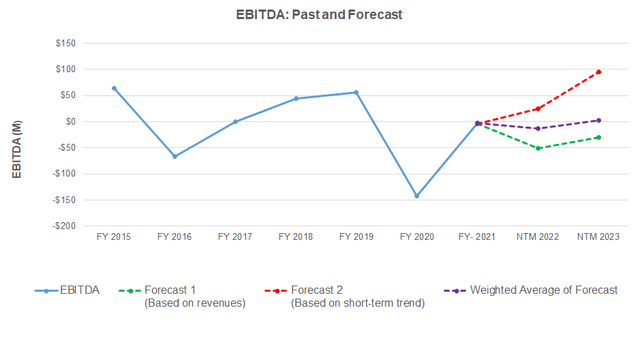

Author created and Seeking Alpha

Based on the regression model using the forecast revenues, I expect the company’s EBITDA to remain negative and deteriorate in NTM 2022. It may, however, recover in NTM 2023.

Target Price And Relative Valuation

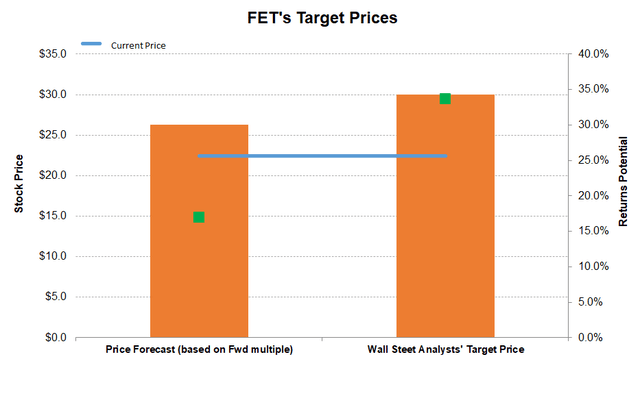

Author Created and Seeking Alpha

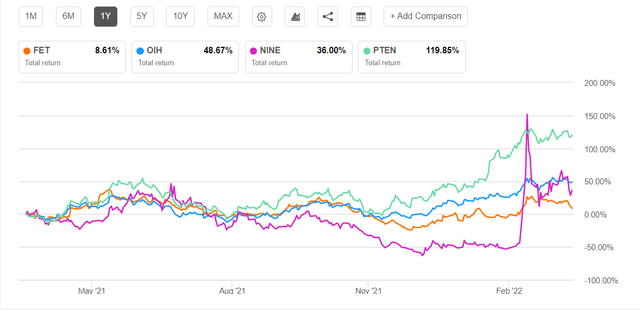

I have calculated the EV using FET’s forward EV/Revenue multiple. Returns potential using the forward EV/Revenue multiple (0.60x) is lower (17% upside) compared to the sell-side analysts’ expected returns (~33% upside) from the stock.

FET’s current EV/Revenue multiple (0.68x) to the forward EV/Revenue multiple contraction implies higher revenue in the next four quarters. The contraction is less steep than its peers’ (NINE, OIS, and PTEN) average fall. This typically results in a lower EV/Revenue multiple than peers. The stock’s current EV/Revenue multiple is lower than its peers. So, it is reasonably valued compared to its peers at the current level.

None of the sell-side analysts rated FET “Buy,” while one rated it a “Hold.” Also, none of the sell-side analysts rated a “Sell.” The consensus target price is $30, which yields a 34% return at the current price. I think the stock price has a reasonable upside in the short term.

What’s The Take On FET?

Following the steep rise in energy prices and the other energy indicators, there is an increased demand for drilling and completion equipment. So, it now sells higher volumes of artificial lift products, new well completions, and well workovers. International spending has accelerated, too. In recent times, one of the primary objectives has been the company’s focus on improving operating leverage and lowering the cost structure. As a result of higher efficiency, its profit margin is better than the comparable industry conditions a couple of years ago.

However, FET’s Drilling & Downhole short-term outlook has decayed with a book-to-bill ratio of 0.9x. Also, the supply chain constraints can lower the operating margin expansion. Negative cash flows were concerning in FY2021. So, the stock underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. However, since a part of its debt is convertible to equity, it can significantly de-leverage the balance sheet and increase enterprise value in the coming months. Investors can expect modest returns if they decide to hold the stock in the medium term.

Be the first to comment