DedMityay/iStock via Getty Images

Fortive’s Strengths And Challenges

I discussed Fortive Corporation’s (NYSE:FTV) strategies more in my previous article. The company has started benefiting from the return of a secular trend in the legacy retail fueling and vehicle repair markets. The hardware product backlog has more than doubled since 2021, while healthcare and software businesses have become the leading drivers. The company seeks enhanced market positions in environmental health and safety, facilities, and asset life cycle.

Although adverse currency movements continued to affect its bottom line and can shave off the earnings growth in Q4, the company’s balance sheet has inherent safety measures. During Q3, it also boosted its liquidity and extended its debt maturity profile. The stock is overvalued versus its peers at this level. Nonetheless, given the free cash flow recovery, investors might want to hold and consider further investment at a lower price.

The Quest For Growth

FTV has transformed its business, trusting a more diversified end market than retail fueling and vehicle repair-specific markets as it did earlier. Healthcare has become the leading driver, mainly because of the recurring revenues. The company’s hardware product backlog has more than doubled since 2021, while the software businesses grew by a “double-digit” rate. Its Fluke and Tektronix businesses should get traction despite the expected component constraints in 2023.

FTV’s Fortive Business System (or FBS) is a productivity enhancement tool that helps increase productivity and reduce time in the renewables market. This has also created significant market opportunity through new early-stage innovation efforts via FBS Growth Accelerator. Such initiatives can mitigate the foreign exchange headwind in the company’s top line and improve its operating margins.

Q4 and FY2022 Forecast

In Q4, the management expects core revenues to increase by 11% year-over-year (at the guidance mid-point). Year-over-year, adjusted operating profit margins can grow by 100 basis points. Adjusted earnings per share can increase by 4%-7%, which is lower than the previous estimates. The management now estimates that adverse currency movements can shave off the earnings growth in Q4.

In FY2022, it expects to record adjusted earnings per share of $3.10 to $3.13. In comparison, in FY2021, it recorded $1.63 in earnings per share. So, the management expects earnings to improve significantly year-over-year, despite the forex-related losses. If we look at the industry indicators, the situation has worsened somewhat in recent months. In September, the US unemployment rate (3.5%) was higher, but only marginally, than in the previous three months. The new privately-owned housing units decreased (by 9%) in September compared to three months earlier. The unemployment rate contraction and housing units decline will add to the near-term uncertainty and lower growth opportunities.

The 2023 Outlook Explained

In the hardware products business, the backlog crossed the pre-pandemic level by the end of Q3. A positive secular trend in the industry now benefits its Fluke, Tektronix, and Sensing Technologies businesses. The development of innovations drives market expansion for the company.

SaaS and license revenue streams can see “double-digit” growth in the software services and digital business in 2023. Enhanced market positions in environmental health and safety, facilities and asset life cycle, and Provation should benefit the bottom line.

Although workforce scarcity can challenge healthcare business growth, the management believes it has built a resilient revenue and earnings profile that can withstand the pressure. However, it may face headwinds from a potential decline in new customer orders in the hardware products business in 2023. Despite that, its operating profit may not see much downside because the supply chain is expected to normalize. Investors may also note that its healthcare business has 70% recurring revenue with consumables and services, which should stabilize its cash flows.

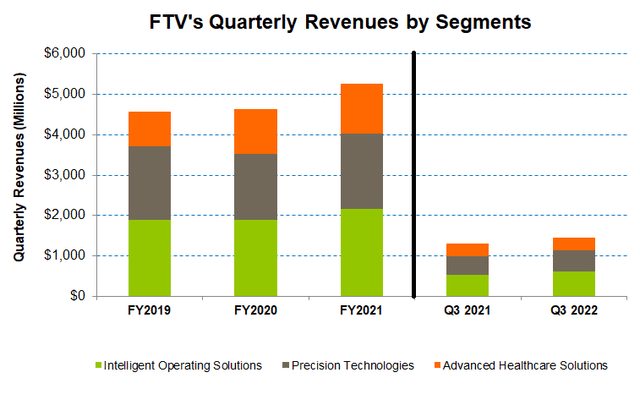

Analyzing The Segment Performance

Revenues in the Intelligent Operating Solutions segment increased by 14% year-over-year in Q3. Growth in North America, China, and Western Europe led to a 345-basis point operating margin expansion in Q3 in this segment. Fluke, which provides compact professional test and measurement tools, saw rapid growth. It launched a platform serving the renewables market that would halve the time to test solar installations.

Revenues in the Precision Technologies segment increased by 15% in Q3 2022 compared to Q3 2021, due primarily to core revenue growth. Almost all of its end markets witnessed steady growth. Orders growth in Tektronix following mainstream scope product launches and new entries caused sales to increase during the quarter. Higher shipments and strong price realization also resulted in 280 basis point adjusted profit margin expansion.

In Advanced Healthcare Solutions, revenue growth was insignificant in Q3 because its core revenue declined during the quarter. Supply chain constraints impacted growth at ASP (Advanced Sterilization Products business) and Fluke solutions. Lower volumes and foreign exchange headwinds significantly affected AHS core segment margins. This adversely affected its sales in North America and China. On a positive note, the effects of the lockdown in China have started to taper off while capital equipment growth begins to recover.

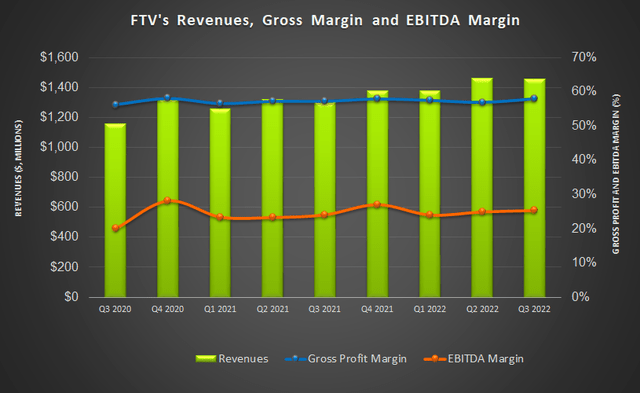

Despite the forex headwinds, FTV’s adjusted gross margins expanded by 80 basis points, and adjusted operating margins expanded by 160 basis points in Q3. This reflects better volume and price realization following improved products and solutions.

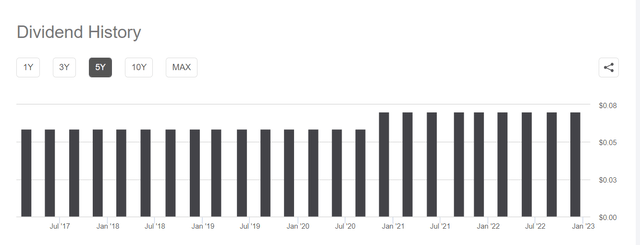

Steady Dividend

FTV pays a steady dividend of $0.28 per share (annual), translating into a 0.41% dividend yield. In comparison, Dover Corporation’s (DOV) forward dividend yield is 1.43%, while Snap-on Incorporated’s (SNA) dividend yield is 2.77%.

FCF Improves

In 9M 2022, FTV’s cash flow from operations increased by 22%, led by higher year-over-year revenues, lower accounts receivable, inventories, and higher trade accounts payable. Capex, including the ServiceChannel acquisition in 2021 part, decreased steeply in 9M 2022, leading to significantly higher free cash flow in the past year. The management anticipates that Q4 FCF will be strong and FY2022 FCF will be $1.17 billion.

FTV’s liquidity (cash plus commercial paper) totaled $2.0 billion as of September 30. Its debt-to-equity ratio (0.38x) is lower than its competitors (DOV, TTNDY, and IR) average of 0.63x. It recently extended the $2 billion revolving credit facility to 2027, subject to its commitment to reduce greenhouse gas emissions by 50%. It also refinanced a $1 billion loan due to maturity in December 2022.

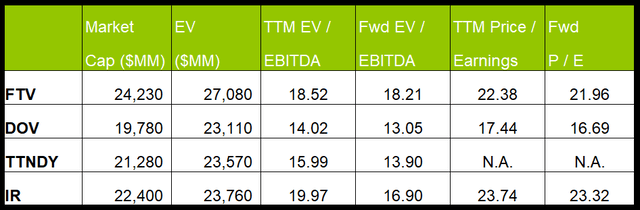

Returns Potential And Relative Valuation

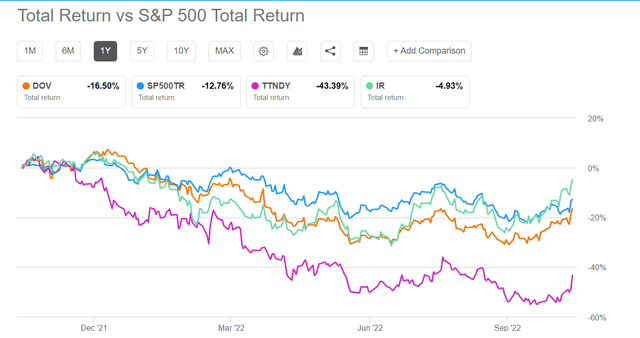

FTV’s forward EV/EBITDA multiple can compress more steeply versus the current EV/EBITDA than its peers. This means its EBITDA can increase less sharply than its peers in the next year, typically resulting in a lower EV/EBITDA multiple. The stock’s EV/EBITDA multiple (18.5x) is higher than its peers’ (DOV, TTNDY, and IR) average. So, the stock is relatively overvalued. The Wall Street analysts’ estimates suggest an 8% upside at the current price.

Why Do I Maintain My Rating On FTV?

In my previous article, I drew investors’ attention to FTV diversifying into other businesses while working on productivity tools. I was cautiously optimistic about the company. I wrote:

Fortive Corporation’s focus on the healthcare business away from the legacy retail fueling and vehicle repair markets over the past few years have led to a stable operating margin. Its investments in Fortive Business System tools drove productivity savings and improved adjusted operating margins. I expect its core business to grow for the remainder of 2022 due to a resilient product portfolio and continued customer demand.

After Q3, I noticed the nuances of its strategic shifts. It now focuses on the healthcare, hardware, and software businesses as the backlog grows. Its leverage remains low, while a liquidity boost can mitigate financial risks. The relative valuation remains elevated. So, I maintain my “hold” rating on Fortive Corporation.

What’s The Take On FTV?

Fortive Corporation’s hardware product backlog has doubled since 2021, while healthcare and software businesses have become the leading drivers. Its Fluke, Tektronix, and Sensing Technologies businesses grew in Q3. The company’s continued investments in Fortive Business System tools drive productivity and improve adjusted operating margins.

Although adverse currency movements continued to affect its bottom line and can shave off the earnings growth in Q4, Fortive Corporation’s balance sheet has inherent safety measures. Its leverage is low, while robust liquidity and free cash flow generation can mitigate any imminent risk. Over the past year, the stock underperformed the SPDR S&P 500 Trust ETF (SPY). Given the mix of factors driving the company, investors might still want to hold the stock.

Be the first to comment