imaginima

Where did all the workers go?

That’s the question that everyone has been asking over the last year or two as people emerged from the pandemic to find many more “help wanted” signs in store and restaurant windows.

But the labor shortage goes well beyond retail and restaurants and into manufacturing, healthcare, logistics, truck driving, and many other corners of the economy.

Why hasn’t the labor shortage been sorted out by now? And if the shortage is permanent, as more experts appear to be concluding, should investors allocate investment dollars to the obvious solution of labor-saving technologies like robots, automation, and artificial intelligence?

In the first section below, we identify a major reason for the labor shortage. In the second section, we explain why it isn’t necessarily a good idea to invest in robotics and automation. In the third section, we explain our approach to this new characteristic of the economy.

Labor Force Participation Rate By Age Group

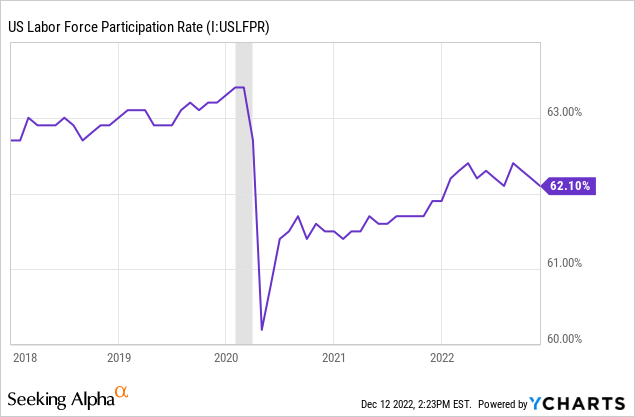

To start, let’s show the chart that clearly illustrates the lingering labor shortage. While the consumer has remained strong and continues to spend, the workers needed to meet consumer demand have continuously been too low.

The overall labor force participation rate is about 125 basis points below its pre-pandemic level.

There are about 3 million fewer workers in the labor force today compared to February 2020. Where did these workers go?

To answer that question, we need to look into who those workers are who left the workforce. Surely you could slice and dice the data in multiple ways, but one of those is to break it out by age group.

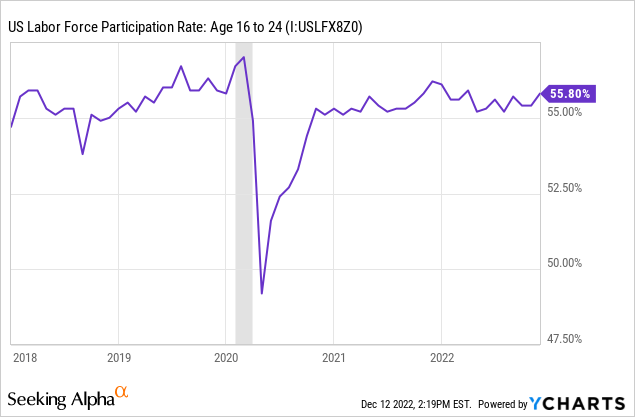

Let’s start with younger workers from age 16 to 24. While there is indeed a smaller share of this age group (many of whom live with their parents) in the workforce than there was in February 2020, the level isn’t significantly lower than where it was for most of 2019.

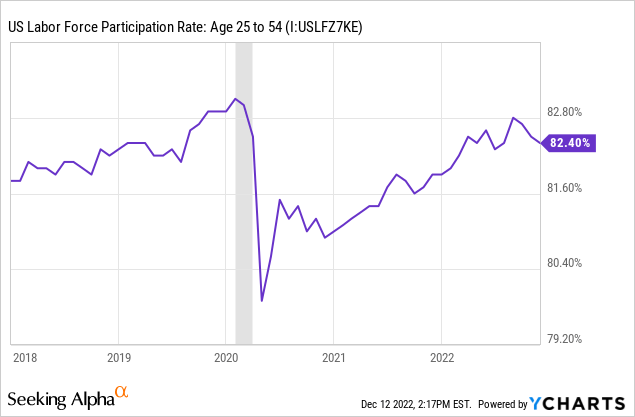

How about prime-aged workers from age 25 to 54? These workers represent the bulk of the workforce. While the recovery in LFPR in this age group was swift from early 2021 to mid-2022, it has faltered in recent months.

Even so, it should be noted that prime-aged workers are mostly back to work, and the LFPR for this group is roughly back to where it stood in early 2019.

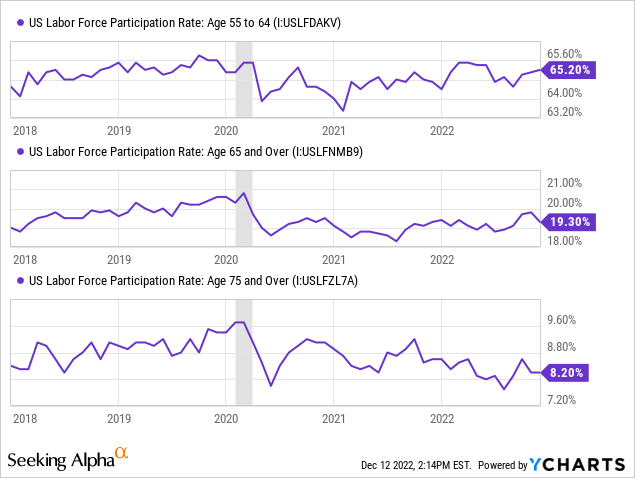

That leaves older workers, which in this case we’ll define as those over age 55. Here we find a major cause of the lingering labor shortage.

The trend we find is that the older the worker, the more likely they were/are to retire in the wake of COVID-19. The 55-64 age group is within 50 basis points of its pre-pandemic level, but the 65+ age group’s LFPR has dropped by about 120-130 basis points from its pre-pandemic level.

Meanwhile, the small minority of 75+ workers is getting smaller and smaller as the post-COVID trend shows a steady decline in this group’s LFPR.

Much of this is due to early retirement. According to Richard Alaniz, in 2020, among the 65+ age group, “there were 7% more retirements than would otherwise have been expected in a given year.”

Airlines offered buyouts to many of their oldest and most experienced pilots as an incentive to retire early. Those pilots have not come back, and their experience will take years to replace, hence the numerous flight cancellations and delays experienced this year as air travel has made a resurgence.

A similar story could be told in the healthcare sector, especially in hospitals. Amid the difficulty and risk of treating a flood of COVID patients, numerous older nurses and doctors burned out and quit, exiting the workforce completely.

Likewise, trucking companies have had major issues in recent years attracting younger drivers to replace their largely older driver base. At the beginning of the pandemic, when the economy froze and inventories were being whittled down, many older drivers simply retired or took buyouts rather than wait to see how this once-in-a-century pandemic played out.

And, of course, the 65+ age group is the one most vulnerable to being involuntarily removed from the labor force due to “long COVID” or other health complications.

The Solution: Robots, AI, And Automation

For many, the obvious solution to the seemingly permanent labor shortage is greater adoption of robotics, automation, and artificial intelligence as means of reducing the need for labor.

With this backdrop, we find BlackRock’s (BLK) recent report titled “Investing In Robotics: Why Now Could Be The Right Time.”

BlackRock’s Jeff Spiegel sees multiple catalysts driving demand growth for robotics and automation machinery going forward:

- Labor shortage (inability to find willing workers)

- Wage inflation (inability to find the right worker at the right price)

- Supply chain evolution (concentration and modernization in home countries)

- Onshoring manufacturing (production moving from low-tech countries to high-tech countries)

- Technology deflation (falling costs of automation products).

On that last catalyst, consider that the average cost of an industrial robot has halved in the last three decades. As labor costs rise and automation costs fall, the value calculus should increasingly shift toward replacing workers with robots and automation.

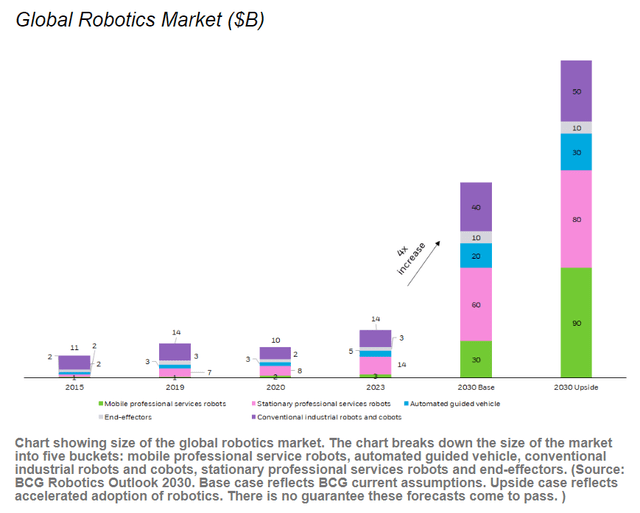

Together, these four catalysts could come together to more than quadruple the size of the global robotics market, according to Spiegel.

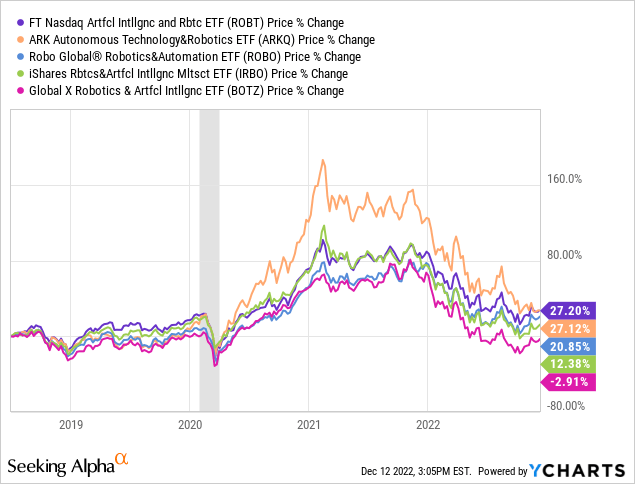

Spiegel recommends investing in ETFs that focus specifically on robotics developers and enablers. Examples include:

- First Trust Artificial Intelligence & Robotics ETF (ROBT)

- ARK Autonomous Technology & Robotics ETF (ARKQ)

- Robo Global Robotics & Automation ETF (ROBO)

- iShares Robotics & Artificial Intelligence Multisector ETF (IRBO)

- Global X Robotics & Artificial Intelligence ETF (BOTZ).

Over the last 4.5 years, the pure-play robotics and automation exchange-traded funds (“ETFs”) have varied in performance from over 27% to -3%, although their general patterns have been highly correlated.

After soaring 60-160% from mid-2018 to mid-2021, they’ve slid by 40% or more year-to-date.

Does that make them good buys today?

We aren’t so sure.

Even after the sharp pullback this year, there remains a lot of optimism priced in. For example, the weighted average P/E ratio for IRBO sits at around 56x. For BOTZ, which has performed the worst over the last 4.5 years, the P/E ratio sits at 36x.

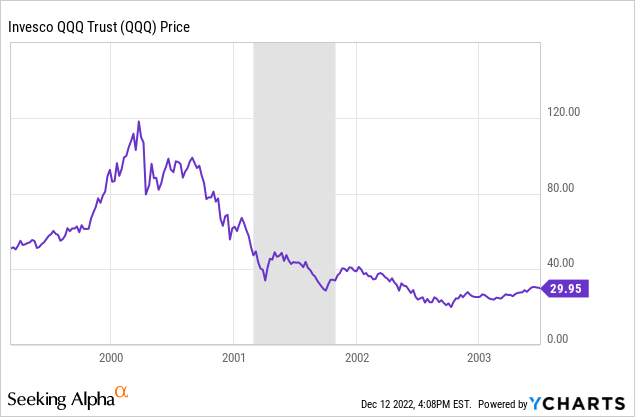

We see a lot of overlap in the current optimism about robotics stocks with the optimism about Internet stocks during the early 2000s. Just as it would have been foolish and outmoded to be bearish on the Internet generally back then, we think it is foolish to be bearish on automation and robotics now.

However, after the peak in Internet stocks in early 2000, at which time valuations were sky-high on investor euphoria and FOMO, it took years for stock prices to bottom out even as the Internet itself burgeoned.

Imagine buying the Nasdaq 100 (QQQ) in early 2001, after the index had already lost 50% of its value from the peak, only to see it halve again before it finally bottomed out.

Valuation matters, even after big selloffs

We do not invest in these robotics ETFs because of the risk that, like the QQQ after the Dot Com bubble bursting, they will struggle to find a bottom for years until the valuation seems more reasonable.

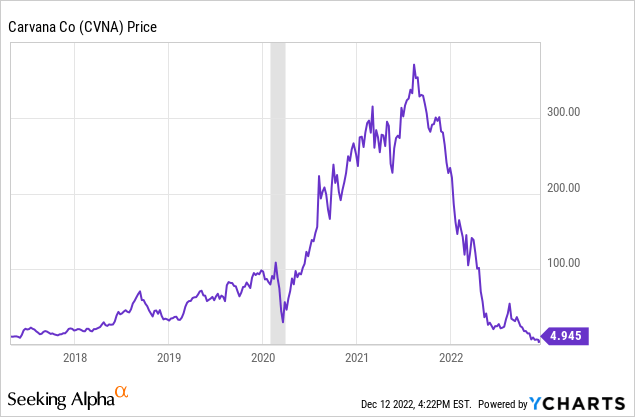

And we generally steer clear of individual robotics stocks because of the extreme difficulty in determining which will end up being the big winners akin to Amazon.com (AMZN).

Here’s an example. Just a few years ago, investors were euphoric in their optimism for Carvana (CVNA) and its innovative approach to selling cars through its highly automated, vending machine-like glass towers.

Going into the pandemic, it looked like Carvana might have been able to fundamentally disrupt the car sales industry. Now its very survival is in question.

Our Approach

At High Yield Investor, our approach is to invest in companies that we believe will be big indirect beneficiaries of automation rather than the “developers and enablers” of automation, to use the words of the BlackRock report.

These indirect beneficiaries include both users and facilitators of automation. We think these indirect beneficiaries should see huge boosts to their operational performance from automation, but the lack the inflated and euphoric valuations attached to the specific automation companies.

Let’s give one example of each.

User of Automation: Leggett & Platt, Incorporated (LEG)

LEG is a diversified manufacturer of various products in the bedding, furniture, automotive, and aircraft industries. The company has manufacturing plants spread across five continents with particularly heavy concentrations of production taking place in the U.S., Canada, Europe, and Mexico. That makes its factories a prime customer and beneficiary of automation today and in the years ahead.

GoPal 400 robots at a Leggett & Platt factory (Robotize)

This venerable and well-established firm has huge economies of scale and a global presence, as well as #1 or #2 market positions in most of its product categories.

Given the tailwinds from automation, LEG’s skilled and conservative management team should be able to continue the firm’s long history of earnings and dividend growth. LEG is a Dividend Aristocrat with 51 consecutive years of dividend growth under its belt.

The stock’s 5.25% dividend yield provides an attractive entry point for patient investors.

Facilitator of Automation: W. P. Carey Inc. (WPC)

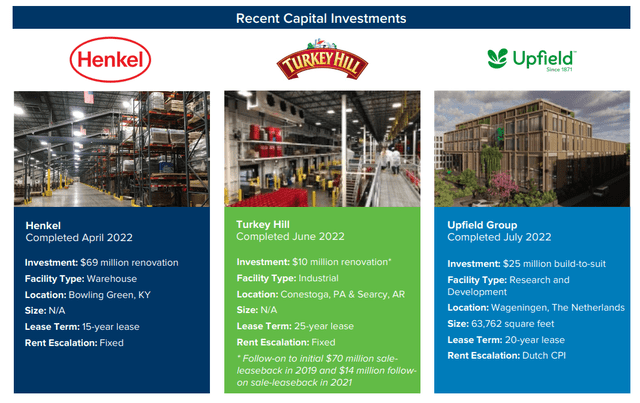

WPC is a triple-net lease real estate investment trust (“REIT”) that owns a diversified portfolio of property types in both the U.S. and Europe. The REIT specializes in sale-leaseback deals with industrial companies, buying their real estate while simultaneously signing long-term leases.

WPC not only facilitates by mere owning manufacturing and logistics buildings, but also sometimes in the direct financing of robotics and automation upgrades to its existing properties.

Here is one example. Below, on the left, you’ll see a description of a recently completed renovation project at a Henkel logistics facility in Bowling Green, Kentucky, that WPC helped to fund in exchange for certain lease terms like higher rent.

What exactly were these renovations? In short, they were mostly automation upgrades to the facility.

Henkel’s State-of-the-Art Bowling Green Logistics Facility (Henkel)

Here’s how Mark Fratamico, a Henkel VP, describes this upgrade:

Increased automation allows us to provide efficiencies and superior customer service, help our retailers meet consumer demand and increase operational agility so we can continue to respond to a rapidly changing business environment.

In essence, the $70 million automation upgrade project, completed over three years’ time, was funded through capital financing from WPC, and the landlord will be repaid via higher rent and a longer lease term over time.

Since WPC owns a sizable portfolio of industrial and logistics facilities (half its portfolio by NOI), we expect to see more capital investments into automation upgrades like this one in the future.

With increased focus on industrial real estate where WPC will have more opportunities like this, we like the REIT and its 5.4%-yielding dividend.

Bottom Line

The labor shortage is looking increasingly permanent, as older workers who retired early during and in the wake of the pandemic are unlikely to return to the workforce en masse. That makes the solution of greater utilization of robots and automation an attractive one.

But rather than invest in overvalued robotics stocks or ETFs, we at High Yield Investor choose to focus on indirect beneficiaries of the automation megatrend like LEG and WPC.

Be the first to comment