jhorrocks

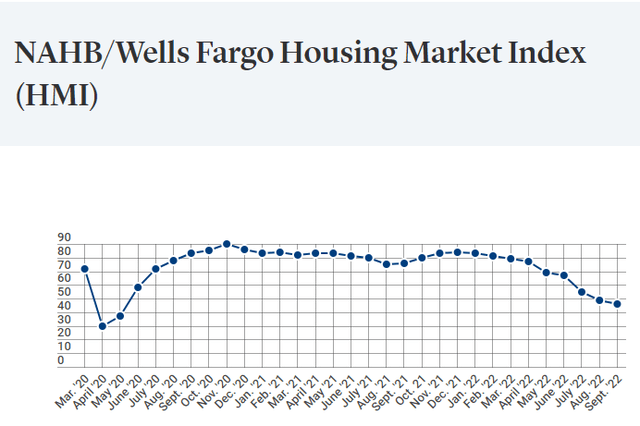

Every month, the National Association of Homebuilders (NAHB) surveys its members to gain insight into how builders perceive market conditions in the current environment and over the next six months. At 46, September’s survey provides a gloomy forecast for the shares of homebuilders. This article takes a contrarian view and identifies Forestar Group (NYSE:FOR) as a compelling option for investment in the sector.

NAHB

Down from a December high of 84, the survey results have slipped each month with every new piece of economic bad news.

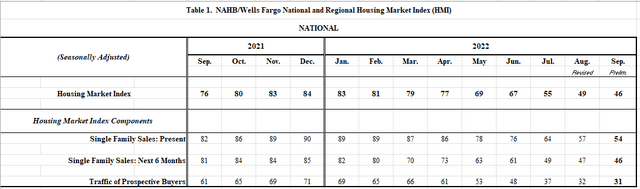

NAHB

Mortgage rates have nearly doubled since the start of the year and the Fed promises to continue hiking. Traffic of prospective buyers is plunging to new lows and purchasers are breaking sales contracts. On Monday, the Wall Street Journal reported that desperate builders are offering bulk sale discounts to single family rental (SFR) investors in hope of off-loading unsold inventory.

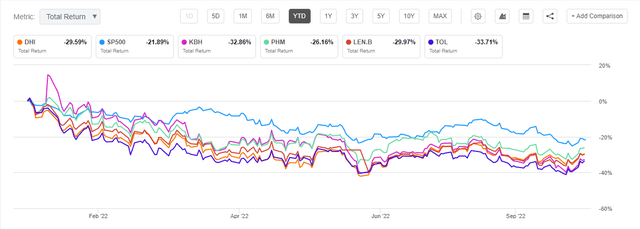

Shareholders have voted with their feet

Though demand for housing remains strong and supply remains constrained, numerous metrics like inflation, fear of recession, and rising mortgage rates cloud the near-term prospects for the homebuilding industry. Investors seem to have started giving up hope on homebuilders way back in January, and with the prospect of higher interest rates and a hard landing/recession, shares are down 30% to 40% year to date. We hear no rumblings of optimism that might bring the sector back to prominence any time soon.

Seeking Alpha

Per share earnings growth for the home builders as a sector has been astounding, but consensus estimates indicate that earnings have peaked and will decline over the next couple of years. Even considering the declining earnings forecasts, the sector seems oversold. Within the sector, D.R. Horton (DHI) is particularly interesting due to its affiliation with and ownership of one of the industries primary vendors.

Forestar Group, Inc.: The Excellent One Trick Pony

Bringing a single home, let alone a whole new community, from draft table to existence is an organizational feat on many complex levels. Prior to building and coincident to planning, a builder must acquire land, secure zoning, and necessary entitlements, and install municipal infrastructure; this necessitates capitalization and exposure to all the attendant risks relating to the economy, local politics, and a multitude of other factors. Acquiring, capitalizing, entitling, and redeveloping buildable land is a serious proposition for a home developer and DHI has significantly addressed this task through its relationship with and ownership of Forestar.

The Lot Factory

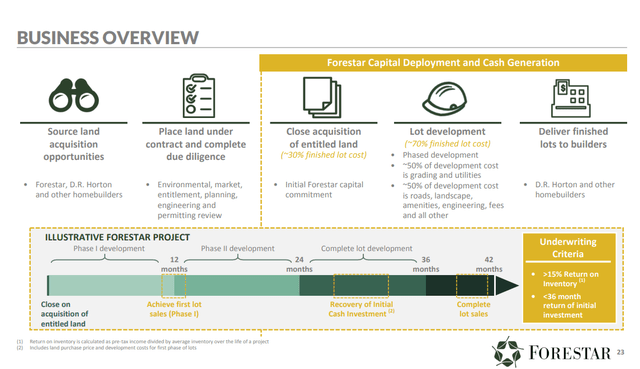

Forestar management likens its business to a precise manufacturing process and that is what makes them a synergistic complement to DHI and other builders.

FOR

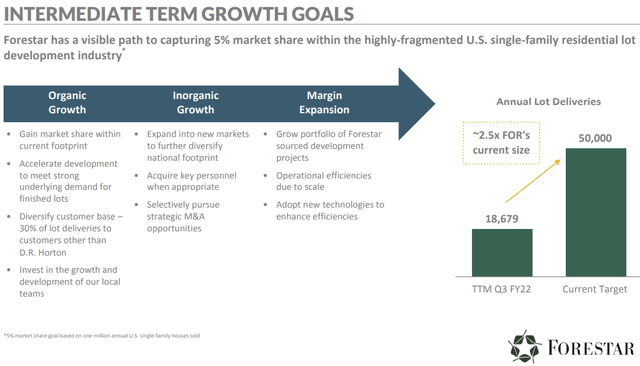

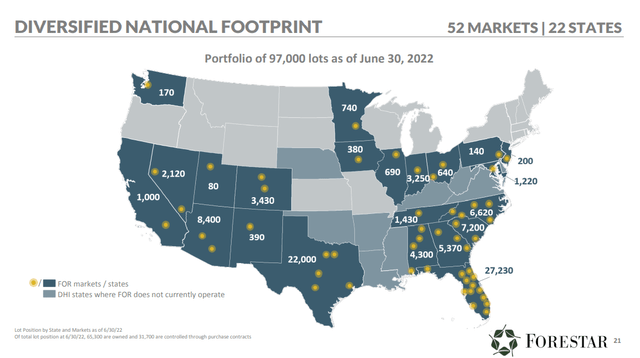

Scale and strict adherence to the calendar allows for timely delivery of attractively priced lots to builders while FOR recycles capital over 36 months and earns a 15% + return on inventory. Forward planning allows this capital recycling to smoothly repeat for high profit margins, regardless of the pace of new home starts. In targeting 3-4 years of owned lot inventory (currently ~65,000 lots), Forestar unburdens builders with the task of land inventory management. With control of 97,000 lots, FOR can accelerate or tap the brakes depending on market demand.

Land, lot, and community development are the first, very capital-intensive steps in home building. Forestar’s owned lot inventor is there to get the building started.

FOR

Managing land inventory is a primary focus not just for DR Horton, but for any builder. Looking to optimize capital deployment in these uncertain times, many builders will turn to a vendor like Forestar to streamline their production. While DHI is and will remain FOR’s top customer, during the most recent quarter other builders account for 13% of lots sold (a 213% increase over the prior year).

Growth Aspirations

Forestar recently reduced their fiscal 2022 expected lot deliveries to 17,000, down from 19,500, but their intermediate growth ambitions have not changed.

FOR

They expect to accomplish this, in part, by increasing their non-DHI lot deliveries to 30%, up from the recent 13%. They also intend to expand their market share within the high in-migration, high job growth communities within their current footprint.

FOR

While rent and home prices increases have started to slow, 50%+ of FOR’s lots are in the still red-hot, high demand growth markets spread across Florida and Texas. Those state geographies and demographics make Forestar’s goals look attainable. And that is the contrarian opportunity.

Land at a 50% Discount to Book Value

Higher interest rates and inflated home prices have combined to make homes unaffordable. We earlier pointed out that investors have been selling down shares of the home builders in anticipation of declining new home starts and revenues. That is reasonable, but it has started to look over done. At these prices we like the sector and are long Lennar Corporation (LEN.B, not LEN) and KB Home (KBH).

We have studied D.R. Horton, the nation’s largest home builder, and its performance has been impressive. In analyzing DHI we came to see a different opportunity that would let us participate in DHI’s success but at a more appealing entry price. That opportunity is Forestar Group.

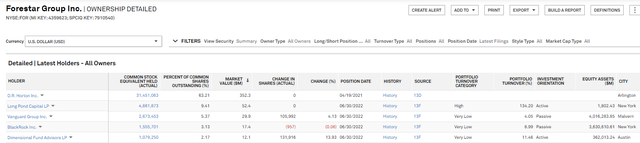

Today, DHI owns just over 63% of FOR’s outstanding equity. The table is unusual in that it depicts what looks more like a family enterprise; 85% of shares are held by just five entities.

S&P Capital IQ

FOR closed trading on October 3rd at $11.20/share, just 48.6% of its 06/30/22 stated book value. We like the resiliency of the home building industry and its going forward prospects. We perceive a skewed valuation in DHI and FOR on a “store of value” investment proposition.

Even before measuring all the good things FOR has going on, we might want to consider valuations for DHI and FOR back in “normal” times, before COVID.

Seeking Alpha

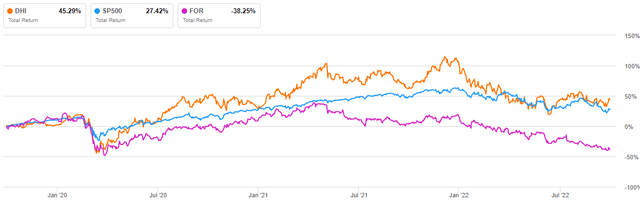

The graph describes that over the last three years, the shares of DHI has produced a total return of more than 45%. Over the same time span, FOR’s share price has declined almost 40%.

During the pandemic, DHI enjoyed strong earnings growth. Since DHI is FOR’s largest customer it is understandable that D.R. Horton’s success would spill over to Forestar. Somehow, that success has not yet translated to FOR’s share price.

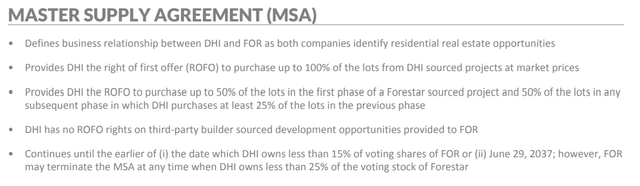

Under terms of a Master Supply Agreement (MSA), DHI has significant rights of first offer (ROFO) to purchase a large portion of FOR’s lots. However, as we stated earlier, FOR has made meaningful progress in delivering a growing number of lots to other builders and they aim to take that non-DHI share to 30%.

FOR

A recent Wall Street Journal article, in alarming terms, illustrated the growing nationwide scarcity of land for new housing. The article described a sort of mad scramble of builders and speculators bidding up prices for residential land. This is part of what will become the 30% non-DHI deliveries for Forestar.

Risks to the Buy Thesis

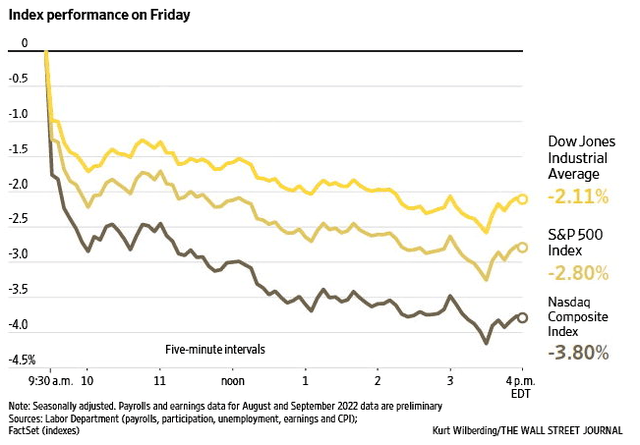

The Bureau of Labor Statistics September jobs report released on October 7th is a reminder of how unsettled our current economy is. The month’s 263,000 jobs increase in nonfarm payrolls showed that the labor market was slowing, but maybe not slowing enough to dampen the Fed’s hawkishness. The stock markets responded accordingly.

Wall Street Journal

The risk to Forestar is that fear or uncertainty spills beyond investor sentiment and into the decision-making process at D.R. Horton and other home builders. If the builders decide to further curtail the number of housing starts, FOR’s ambitions will be harder to realize.

Time

Post-World War II, home builders have endured boom and bust. Recession. High inflation. Double digit mortgage rates. Our currently rising mortgage rates are already bringing home prices down, bringing home purchase closer to affordability. Demand is still strong and supply is scarce; it will find a balance.

If an investor has patience and a mid-range time horizon, the market will deliver $1 for the $0.50 with which you can buy Forestar Group today.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment