photoman

This should be gold’s time to shine.

In a time of high global inflation caused in part by massive money printing and fiscal stimulus experiments, gold should be rocking.

But instead, gold hit a 2-year low this week. For decades, investors have linked gold and inflation together.

- The Theory: As inflation rises, the purchasing power (or the quantity of goods) that $1 can buy, will go down.

Which, in layman’s terms, means the dollar bill in your pocket today will buy less stuff tomorrow than it will today.

Gold and other real assets like art and real estate tend to hold their value much better and retain their purchasing power. This means they should be a better asset class to invest in during inflationary periods.

The Test: Gold and Inflation

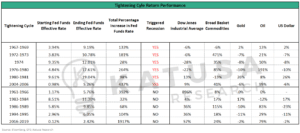

Below is a table that shows the performance of gold, dollars, oil, and equities during periods of U.S. tightening cycles over the last 60 years.

Bloomberg

Gold’s allure is loved and hated by many.

For some like Warren Buffett, the pet rock is worthless because it has a negative carry. Meaning, it costs money to store, and it does not provide any income.

For others like Ray Dalio, it is a cornerstone position because it provides diversification and an inflation hedge.

Over the past year, what started out as a “transient” inflationary period, gave way to full-out inflation at scale.

What was misunderstood initially was the supply chain shock caused by global economic reopening post-COVID.

This led to higher materials prices, which then were passed on to consumers with higher prices for everything from milk and eggs to gasoline.

Now, here’s where you really need to pay CLOSE attention…

Real Yield’s Effect on Gold

A real yield is the yield on a fixed income instrument, adjusted for inflation.

- KEY POINT: There is a very clear negative relationship between the “real” yield on US treasury bonds and gold prices.

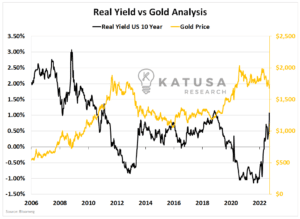

In the chart below, you can see that from 2006-2012 as the gold price rallied, real yields fell.

Then, as real yields rose from 2013 through 2019, the price of gold fell and traded sideways. Then in 2019-2020, as real rates cratered, the gold price took off.

Bloomberg

Gold’s Forecast Chart

Over the past few months, the linkage between gold and inflation has massively decoupled.

The steep appreciation in real yield is in large part due to the aggressive hiking cycle of the US Federal Reserve.

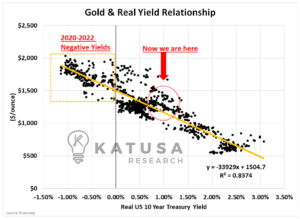

As you can see below, real rates have gone from -1% to +1%, while gold price action remains relatively rangebound.

This chart shows the strong correlation between gold and “real yields”…

You can see the incredibly strong linear relationship between gold and real yields.

Each data point below represents a weekly data point since 2006, with each dot representing the gold price and real yield that week.

Bloomberg

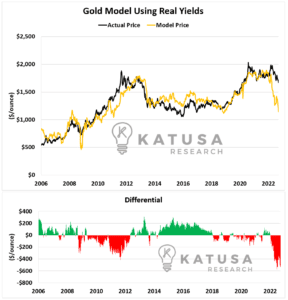

Using the equation provided from the linear relationship, you can forecast the gold price.

And we don’t want to be the bearer of bad news. It’s not what gold investors want to hear, but the data is clear.

Gold Price Plunge

Below is the actual gold price since 2006, and the modeled price.

It’s not a perfect fit, but it is reasonably close. Until recently…

As you can see, the model price has plunged in recent weeks, resulting in the largest differential between the model price and the actual price since 2006.

Bloomberg, Katusa Research

The model price has crashed because real interest rates are shooting higher.

And forecasts a lower gold price than it is today.

High inflation rates are proving tough to curb, and the surprise 8.3% CPI print from the other week fanned the flames for Jerome Powell and the US Federal Reserve to raise rates again.

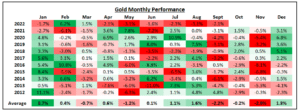

Gold Seasonality

This comes at a time that is typically a weak period of performance for gold.

Over the last 10 years, on average, gold has been a negative performer in the fourth quarter.

Katusa Research

Real rates rising + weak gold seasonality + gold/inflation theory collapsing…

Doesn’t look like any good news or data for gold.

What is important to understand is that gold is catalyst driven.

Gold price action is driven by changes in economic policy, interest rates, and currencies.

- Given the economic conditions today, it seems near certain that interest rates are going to stay elevated for some time.

Central bankers around the world are looking to pull money out of the economy for the first time in years.

Soft landing or hard landing, this is a risky time for all investors. And one that the TikTok investment gurus have never faced before.

Regards,

Marin Katusa

Be the first to comment