Noam Galai/Getty Images Entertainment

It appears that UiPath (NYSE:PATH) has finally found some relief from the brutal tech crash of the past year. The stock ticked up after reporting earnings that beat on guidance. The stock had previously fallen heavily due to both valuation and the conservative guide given in March. While the deceleration in growth rates remains a cause for concern, the lower valuation has arguably made the new growth outlook more acceptable. I still see this stock growing with secular tailwinds over the long term, charting a clear path to $50 per share – and beyond.

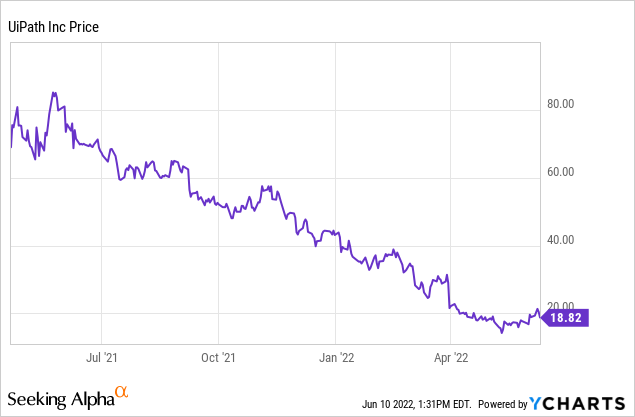

PATH Stock Price

PATH peaked around $85 per share and has since crashed around 80%.

PATH is now trading over 60% lower than its $56 IPO price in early 2021. It may not feel wonderful to buy after the hype has faded, but fading hype can do wonders for valuation.

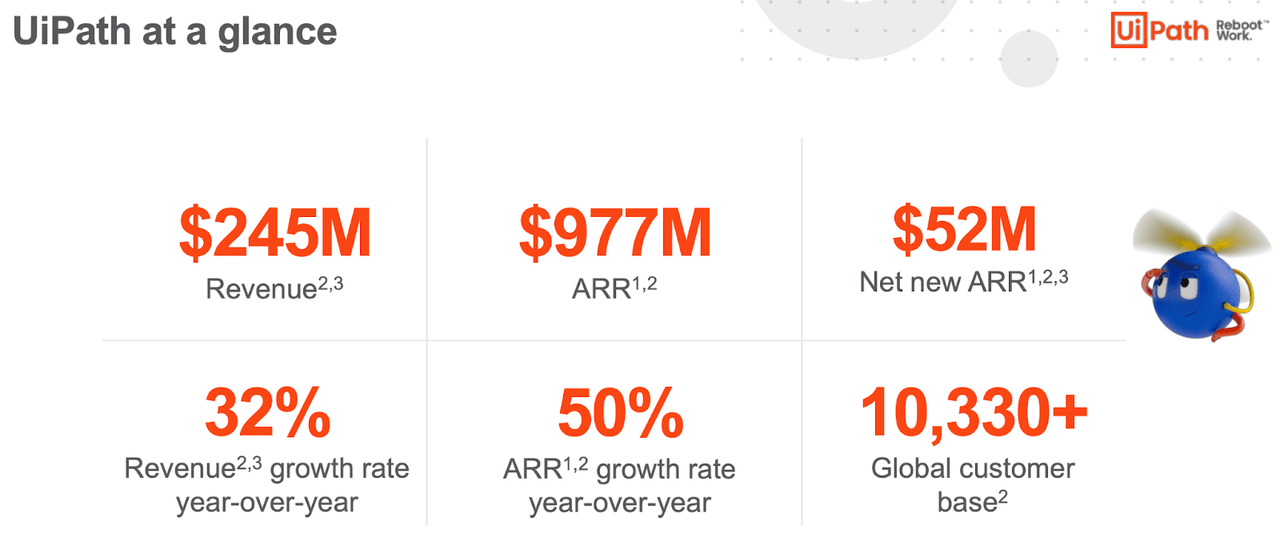

PATH Stock Key Metrics

In the latest quarter, PATH reported revenue of $245 million and annualized renewal run-rate (‘ARR’) of $977 million. The company had previously guided for $225 million of revenue and $965 million of ARR.

FY2023 Q1 Presentation

While operating margins improved on a GAAP basis, that was largely due to the fact that 2021 saw elevated stock-based compensation related to its IPO. On a non-GAAP basis, operating margin dipped from 9% last year to negative 4% this year.

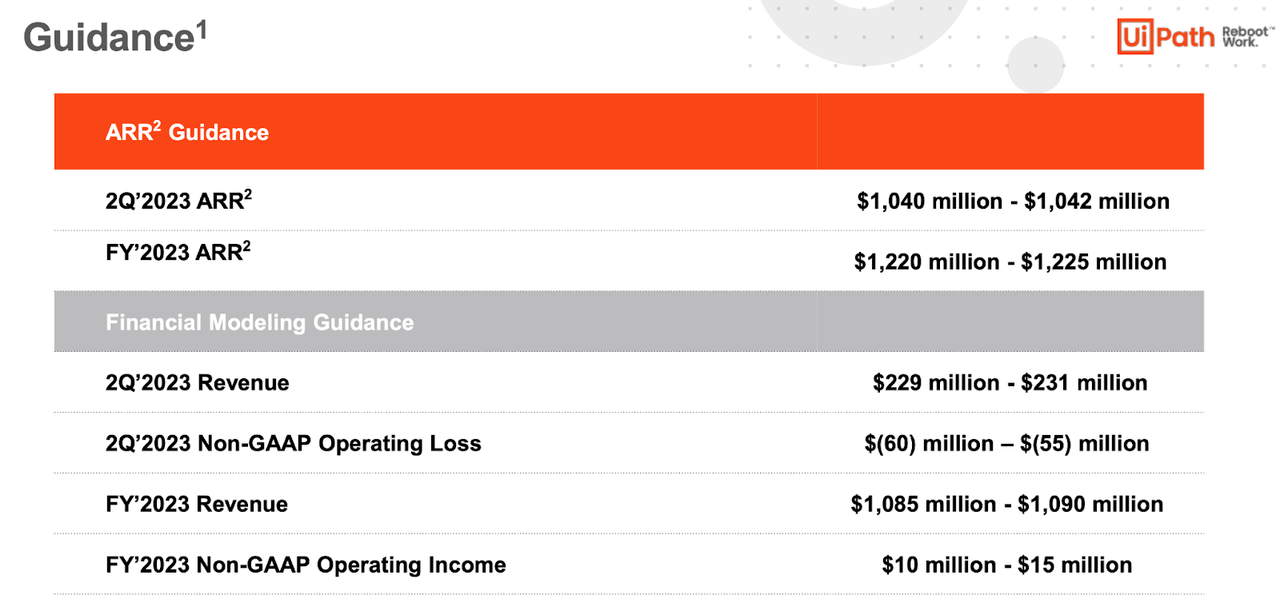

Looking forward, PATH has slightly increased guidance for full year ARR by $15 million to $1.225 billion.

FY2023 Q1 Presentation

That guidance suggests a steep slowdown in growth rates in the second half of the year. On the conference call, the company guided for positive cash flow in the second half of the year, which explains the guidance for positive non-GAAP operating income.

Why Is UiPath Stock Going Down?

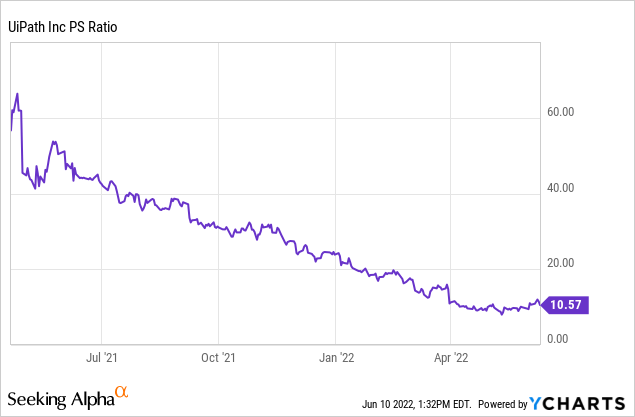

Those results were “good enough” to help the stock recover some losses. But it may be too early to declare the downtrend to be over. PATH and other tech stocks continue to trade quite weakly. For many tech stocks as well as PATH, the problem was the egregious valuations that they had previously traded at. We can see that PATH’s price to sales multiple has compressed significantly over the past year.

Some of that compression is due to underlying growth, but the near 80% decline from all-time highs has obviously been the primary driver. While some multiple compression was undoubtedly warranted, I am of the opinion that it has become overdone.

Will PATH Stock Grow Again?

PATH has repeatedly blamed its slowing growth on the difficult macro conditions this year, ranging from the Russia-Ukraine war, rising interest rates, and inflation. Consensus estimates expect growth to accelerate next year.

Seeking Alpha

Is UiPath Stock A Good Long-Term Pick?

That kind of growth outlook is understandable. PATH benefits from secular growth tailwinds as it empowers its customers to automate many processes previously done by hand. The benefits range from cost savings to improved performance.

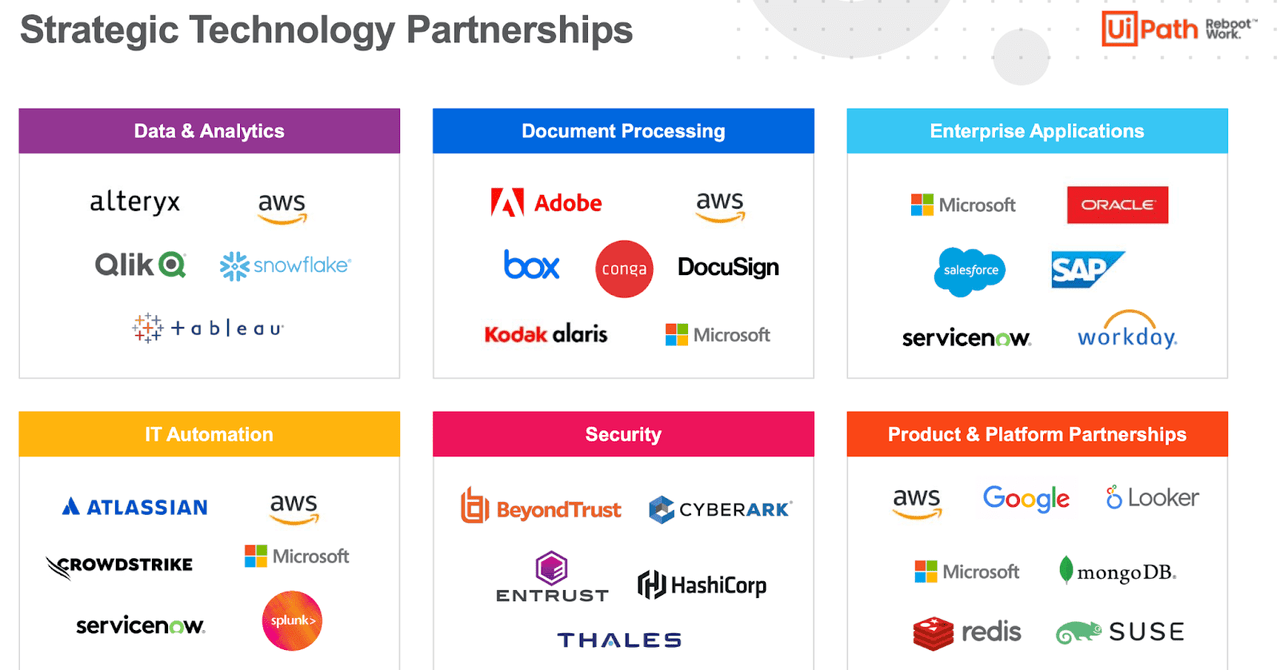

PATH is recognized as a clear leader in its space, as evidenced by its wide-ranging partnerships.

FY2023 Q1 Presentation

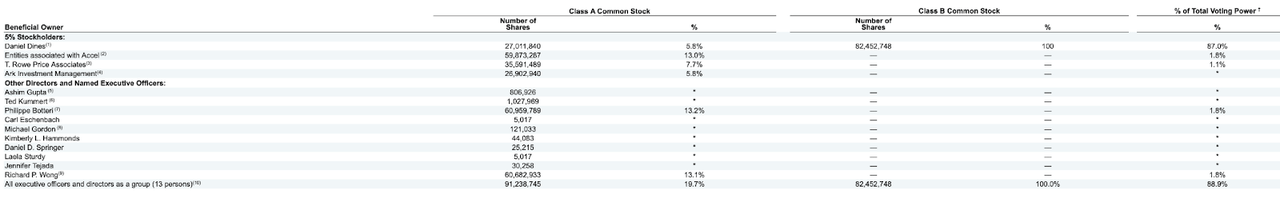

Besides having a clear secular growth story, PATH is also run by management that has skin in the game. We can see insider ownership below:

2022 DEF 14A

Among tech companies, this high level of insider ownership is not necessarily common. I often look for high insider ownership in stocks because the management may be more focused on creating long term shareholder value.

Is PATH Stock A Buy, Sell, or Hold?

At recent prices, the stock looks like a buy here. The stock is priced at less than 10x forward sales. The company has $1.8 billion of cash on its balance sheet versus no debt – net cash makes up 15% of the market cap. The company is operating near cash flow breakeven, further reducing any financial solvency risk. Sure, the name isn’t growing as fast as some tech peers, but the strong balance sheet and margins help offset that. I could see this name sustaining 30% net margins over the long term. Based on 20% projected growth in 2028 and beyond, I could see the stock trading at a price to earnings growth ratio (‘PEG ratio’) of 1.5x and a price to sales multiple of 9x in 2027. That represents a stock price of $57 per share in 2027, or around 25% annual upside over the next five years. I see the main risk here being competition and, specifically, how that impacts future growth. PATH will need to continue growing in order to achieve operating leverage and my projected long term profit margins. If that does not occur, then the stock would present substantial downside, as it would disappoint on both the net margin assumption and growth outlook. I view PATH as being buyable as part of a basket of cheap tech stocks, as such a strategy may do well amidst this crash in tech stocks. This is the kind of stock I have been buying in the Best of Breed portfolio to take advantage of the tech crash.

Be the first to comment