gopixa

Ford’s (NYSE:F) shares are down 43.4% year to date and the company is set to report a major loss for the second-quarter later this month. This is because Ford’s investment in electric vehicle maker Rivian Automotive (RIVN) — whose IPO hugely disappointed after initial excitement — lost about half of its value during the second quarter. Additionally, Ford may be looking at higher raw material costs which could add to margin pressures!

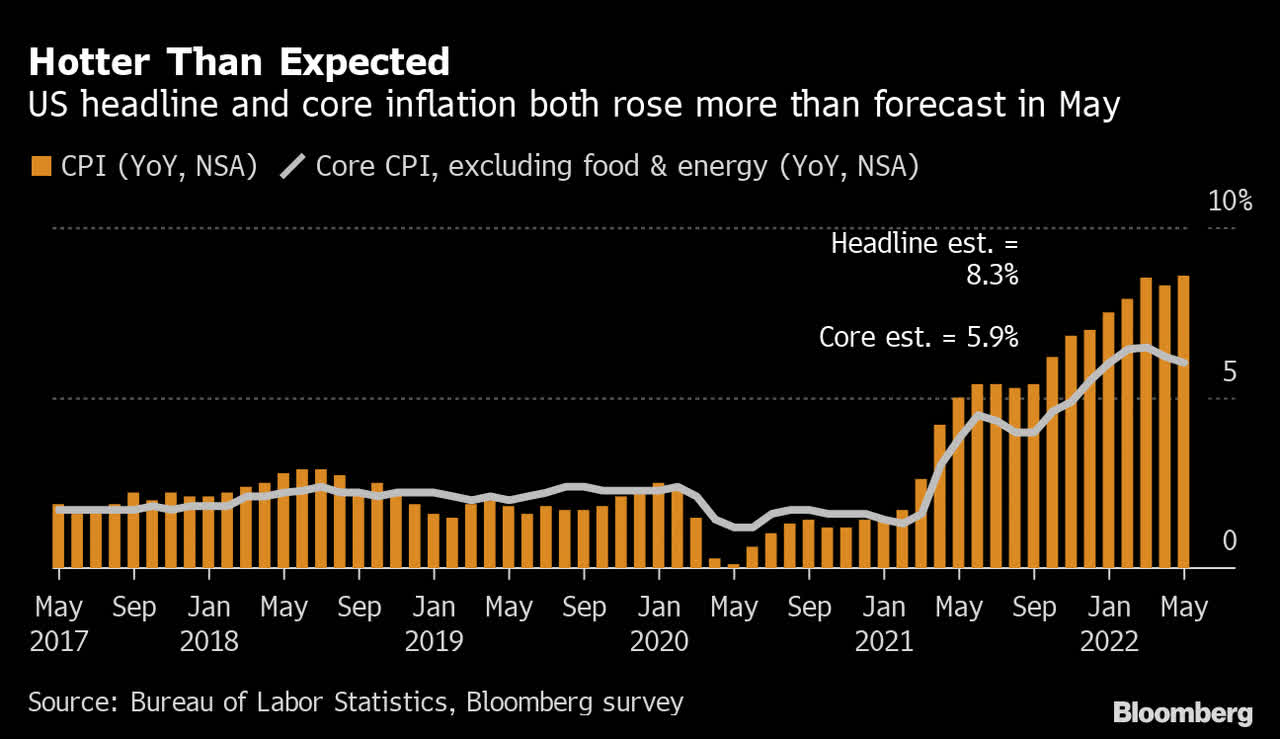

Soaring inflation translates to additional margin risks

Inflation, which has been the talk of town lately, may not have peaked yet… which could expose companies that heavily rely on raw materials, like Ford, to additional commodity headwinds and compressing margins. For that reason, inflation numbers for the month of June — which are set to be released on Wednesday — may affect the firm’s EBIT guidance for FY 2022.

The annual inflation rate rose to 8.6% in May, which was the highest inflation rate the U.S. has seen since December 1981. With energy prices continuing to rise in June, it is likely that next week’s inflation report could spark a turbulent week for stocks and could affect those companies that use a lot of commodities in their businesses.

Bloomberg

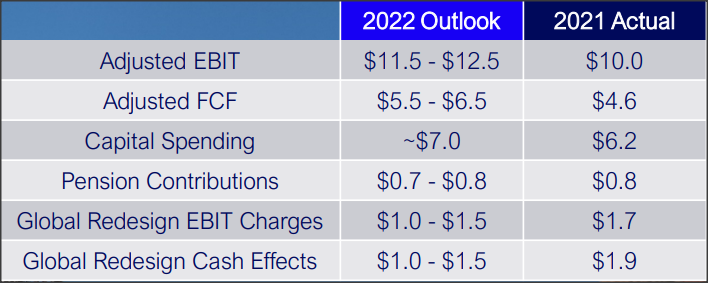

Specifically, higher inflation poses risks to Ford’s estimate of commodity costs which directly influence Ford’s EBIT guidance. The car brand expects $11.5-12.5B in adjusted EBIT for FY 2022 which implies commodity headwinds estimated at $4.0B. A continual surge in commodity costs could push Ford to refresh its EBIT guidance for FY 2022… which would likely be considered a reason for many to sell the stock.

Ford

Equity valuation loss related to investment in EV maker Rivian

Ford is set to disclose another significant loss on its investment in electric vehicle manufacturer Rivian later this month. Ford’s equity investment in Rivian was valued at $5.1B at the end of the first-quarter and it was because of Rivian’s stock under-performance in Q1’22 that Ford had to record a $5.4B mark-to-market loss last quarter.

Rivian’s stock valuation has dropped approximately 49% in the second-quarter which means that fair value accounting rules require Ford to report another billion-dollar equity valuation loss for Q2’22. Ford did address its Rivian problem by selling shares in the second-quarter, reducing its exposure to the EV company by approximately 15M shares. The car brand still retained a considerable position in Rivian totaling 86,947,494 shares and the remaining share block was worth approximately $2.2B at the end of the second-quarter. Because of the continual decline in Rivian’s share price and considering stock sales that have occurred in May, Ford is set to reveal an impairment loss exceeding $2.0B for Q2’22.

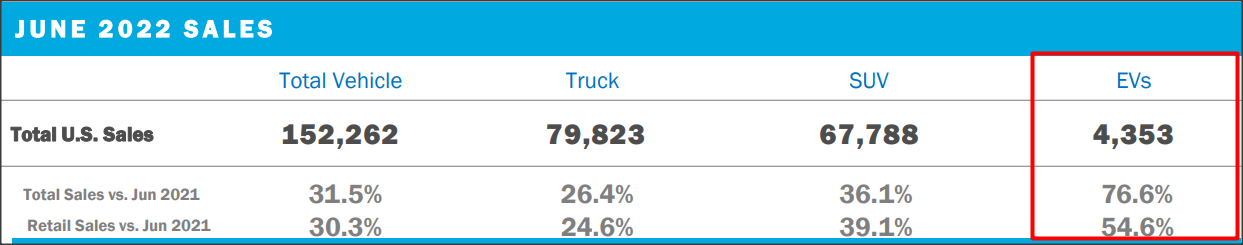

Ford’s EV sales continue to surge

Not all is bad and there are strong reasons why Ford is an attractive investment in the electric vehicle space in the longer term. One reason is Ford’s electric vehicle ramp which has taken a backseat lately to headline-grabbing inflation concerns. But Ford is doing a great job in the EV segment and stands to gain from increasing production capacity as well as new electric vehicle models coming to market.

Ford sold 4,353 electric vehicles in June, showing 76.6% year over year growth. The sharp increase in sales is the result of a denser product line-up as well as accelerating adoption of electric vehicles in the U.S. market. Ford’s electric vehicle share, however, declined from 4.0% in May to 2.9% in June. With improved availability of Ford’s F-150 Lightning truck and Mustang’s Mach-E electric sport utility vehicle, electric vehicle sales for July are likely going to be stronger than in June.

Ford

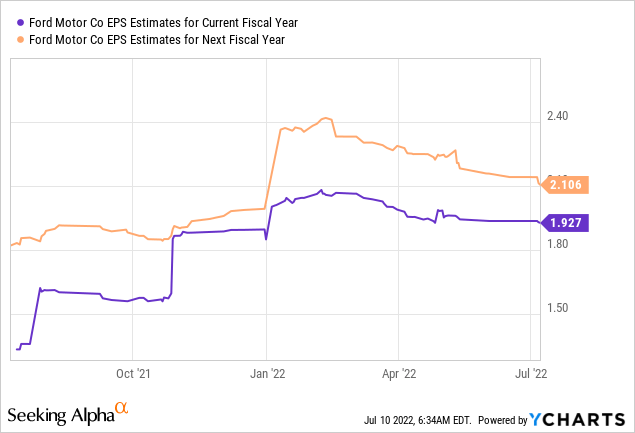

EPS revisions

While the long-term outlook in the EV industry is great, I believe that it will be harder for Ford to stick to its EBIT guidance in a market that has to deal with a continual acceleration of inflation. Ford’s earnings estimates have already begun to trend down as the market expects higher commodity costs to make a margin impact and reduce the firm’s EPS. For that reason, I expect to see earnings predictions for Ford to further decline, especially if the car brand fumbles around with its commodity cost and EBIT guidance for FY 2022.

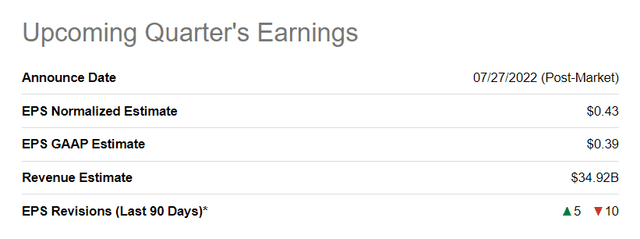

The expectations are for Ford to report normalized EPS of $0.43 for the second-quarter, but earnings estimates have been down-graded 10 times in the last ninety days… reflecting my concerns mentioned here.

Final thoughts

Shares of Ford have had a rough first half of the year and the year-to-date valuation loss calculates to 43.4%. Ford is set to report a significant loss related to its Rivian equity investment. While EV sales performance remained solid throughout the quarter, higher commodity costs change the risk analysis and increase Ford’s risks. If Ford makes any changes to its EBIT/margin guidance when it releases earnings later this month, the stock might skid lower. Longer term, I expect Ford to become a force in the EV industry, but the market may temporarily disagree with this assessment!

Be the first to comment