peepo/E+ via Getty Images

Investment Thesis

It is apparent that Ford (NYSE:F) had recently rallied, due to its excellent FQ2’22 earnings call. The stock had reported a massive 32% gain, since our previous pre-earnings article in July 2022. The company also recently doubled down on its EV plans, with a production capacity of 600K vehicles by the end of 2023 and 2M by the end of 2026. The sum is even more ambitious than our previously aggressive estimate of 1.7M vehicles. Therefore, we are not surprised by the recent optimism surrounding the Ford stock, significantly aided by the recent Inflation Reduction Act.

However, it remains to be seen if the Ford stock can sustain its current levels, since the gains look a little too fast and furious. Therefore, we prefer to advise some patience to interested investors before adding at these levels. There may be some potential downside if the rally is digested post-Fed’s next interest hike in September 2022. We shall see.

Ford Reported Excellent Profitabilities In FQ2’22

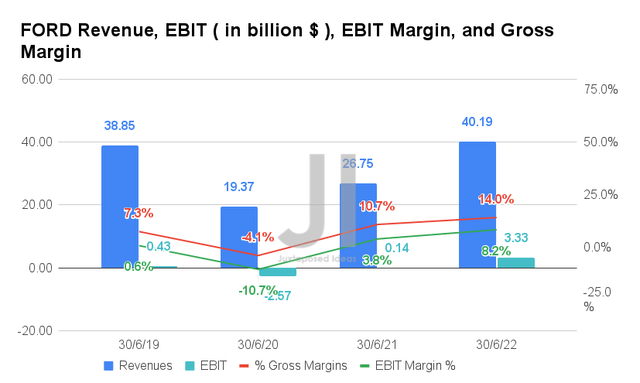

In FQ2’22, Ford reported revenues of $40.19B and gross margins of 14%, representing tremendous YoY growth of 50.2% and 3.3 percentage points YoY, respectively. Otherwise, an increase of 3.4% and 6.7 percentage points from FQ2’19 levels, which is definitely impressive given the current rising inflationary costs and global supply chain issues in comparison. Though the improved gross margins still remain a far distance away from Tesla’s (TSLA) of 25% in FQ2’22, it represents a notable progress over General Motors (GM) at 12.5% for the same quarter.

In the meantime, Ford reported GAAP EBIT of $3.33B and EBIT margins of 8.2% in FQ2’22, representing an exemplary boost of 2378.5% and 4.4 percentage points YoY, respectively. Otherwise, still an excellent increase of 774.4% and 7.6 percentage points from FQ2’19, respectively. Given the massive expansion in its profitability, it is no wonder that the stock has rallied by 46% to $16.15 at the time of writing, since hitting its bottom at $11.06 on 6 July 2022.

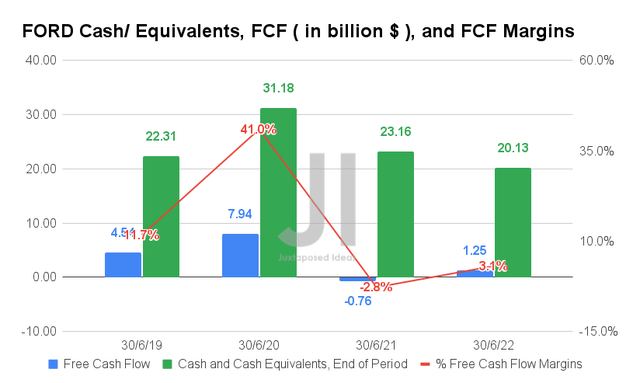

Ford also reported an improved Free Cash Flow (FCF) generation in FQ2’22, with an FCF of $1.25B and an FCF margin of 3.1%, representing an increase of 164% and 5.9 percentage points YoY, respectively. If we were to study its cash from operations, the company reported $2.94B in FQ2’22, representing a remarkable increase of 388.8% YoY. Otherwise, still a reasonable distance away from FQ2’19 levels of $6.46B.

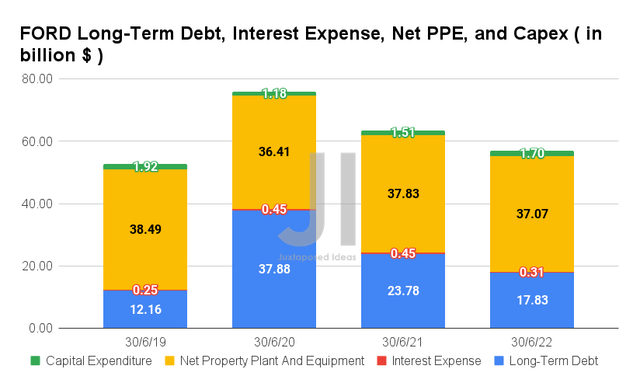

If we were to study Ford’s long-term debts ( excluding Ford Credit ), it is also immediately evident that the management has been regularly deleveraging since the heights of the pandemic. By FQ2’22, it reported $1.53B of debts maturing within a year and $17.83B beyond a year, which proved to be a much lesser amount compared to $25.91B in FQ2’21 or $37.4B in FQ2’20. Thereby, pointing to the company’s competent capital allocation.

In the meantime, Ford continued to invest heavily with a capital expenditure of $1.7B to net PPE assets of $37.07B in FQ2’22. Given the reasons stated above, we are highly confident of the company’s financial performance and balance sheet moving forward. Thereby, potentially triggering a steady long-term stock appreciation ahead, barring any detrimental events.

The Market Continues To Be Optimistic Of Ford’s Forward Execution

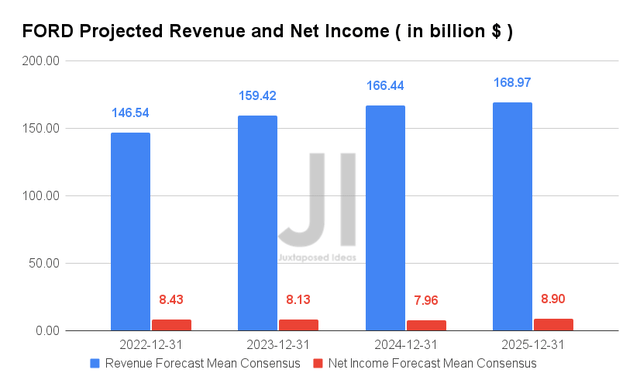

Over the next four years, Ford is expected to report excellent revenue and EBIT growth at a CAGR of 5.51% and -2.35%, respectively. Its lowered profitability could be attributed to its aggressive expansion in the EV market, at which the company guided an ambitious 2M EVs production capacity by 2026. Nonetheless, it is also essential to note that consensus estimates continue to upgrade Ford’s revenue growth by 8.4% since our analysis in May 2022. Thereby, indicating Mr. Market’s confidence in the company’s forward execution.

In the meantime, Ford is expected to report revenues of $146.54B and EBIT of $8.43B for FY2022, representing a notable increase in estimates by 5.7% since May 2022. It also indicates a growth of 7.4% though a decrease of -13.8% YoY, respectively, with the latter mainly attributed to its loss of investments in Rivian (RIVN). Therefore, referring to Ford’s FY2022 guidance in adj. EBIT of up to $12.5B, we may potentially see a more accurate and robust YoY growth of 25% in its profitability then. Impressive indeed, given its aggressive ramp-up in the EV market.

We encourage you to read our previous article on FORD, which would help you better understand its position and market opportunities.

- Ford: Lightning Strike To $18 – The Time To Add Is Near

- Ford: Potential $32B Of Enterprise Value Recovery In H2 Aided By F-150 Lightning

So, Is FORD Stock A Buy, Sell, Or Hold?

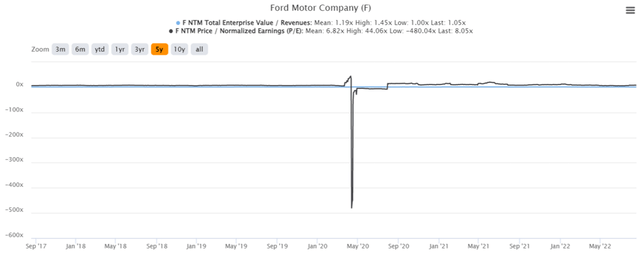

FORD 5Y EV/Revenue and P/E Valuations

FORD is currently trading at an EV/NTM Revenue of 1.05x and NTM P/E of 8.05x, lower than its 5Y EV/Revenue mean of 1.19x though elevated from its 5Y P/E mean of 6.82x. The stock is also trading at $16.15, down 37.5% from its 52 weeks high of $25.87, though at a premium of 52.2% from its 52 weeks low of $10.61.

FORD 5Y Stock Price

Though consensus estimates were more pessimistic with a price target of $17.02 and a minimal 5.3% upside from current prices, we beg to differ. Assuming that Ford is able to sustain its current financial performance ahead, we expect the stock to easily hit over $20s by the end of FY2022, if not by FQ3’22. Combined with the halo effect of the Inflation Reduction Act and Ford’s recent price hikes for the F-150 Lightning, we may see a sustained stock appreciation in the short term.

However, investors must also read the fine print in the revised tax credit, since only trucks and SUVs below <$80K would qualify. Therefore, only applicable to Ford’s more basic models of F-150 and Mach-Es. In addition, there is still the battery’s critical issue that “materials and critical minerals must come from the US or a country with a free trade agreement with the US.”

Ford currently partners with Contemporary Amperex Technology Co. Ltd (CATL), SK Innovation, and LG Chem for its battery supplies. Though the latter two may seem like a non-issue in the revised tax credit, it is also important to note that these South Korean battery producers imported more than 80% of their key minerals from China in 2020. Therefore, providing temporary headwinds to Ford’s qualification for the tax rebate at the moment, barring a significant change in its global supply chain.

Nonetheless, we believe that Ford would eventually find a solution, since the 2023 tax credit of up to $7.5K is already ardently advertised on its websites. Many mineral producers in the US, such as Livent (LTHM) and Albemarle Corporation (ALB), are already supplying to Tesla and GM as well. However, we suspect that the resulting battery prices may not be as cheap as from the East, given the currently elevated prices for its raw materials and higher domestic labor costs involved. We shall see.

As a result, we rate FORD stock as a Hold, despite its improved financial performance. Nonetheless, as always, the bulls may always nibble at dips, given the excellent and unique position Ford occupies in the EV truck segment in the US and EV vans in the EU.

Be the first to comment