gopixa

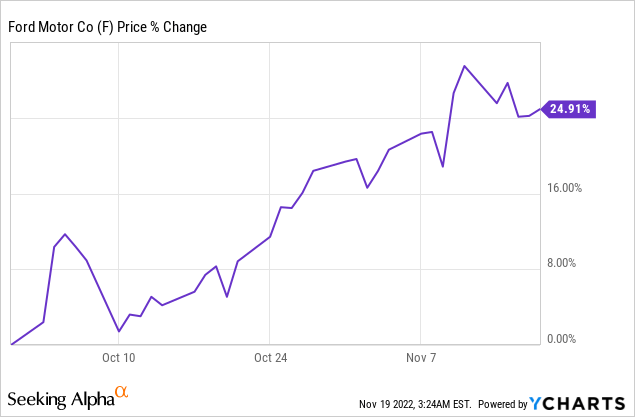

Shares of Ford (NYSE:F) moved into a new up-leg in October in anticipation of strong results from the car brand which the company provided. Ford raised its free cash flow guidance for FY 2022 significantly due to strong product demand for Ford’s (electric) vehicles as well as easing constraints on the supply chain. However, I believe a global recession could weigh heavily not only on Ford’s electric vehicle sales but also on the company’s margins and free cash flow next year. While, in my opinion, Ford is a long term buy for investors that want to bet on the company’s EV transformation, I believe the current rally in Ford’s shares can’t be trusted!

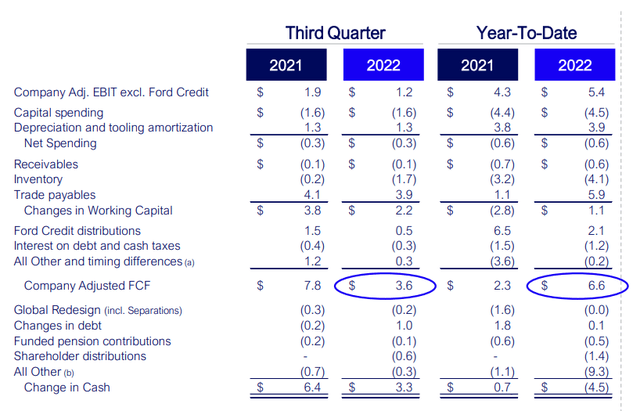

Ford raised its free cash flow guidance for FY 2022

The biggest take-away from Ford’s third-quarter earnings card in October was that the company generated solid free cash flow due to a strong commercial performance in the Automotive business as well as favorable working capital impacts. Ford’s free cash flow in Q3’22 was $3.6B, the same amount Ford generated in the previous quarter. YTD, Ford generated $6.6B in free cash flow, meaning the car brand exceeded its previous full-year free cash flow forecast of $5.5-6.5B after just three quarters.

If the fourth-quarter works out well for Ford regarding EV adoption and sales, the company is set to see materially higher free cash flow in FY 2022. Since the car brand expects a continually strong pricing environment and a better calibrated supply chain in Q4’22, Ford raised its guidance for the full-year to a new free cash flow range of $9.5-10.0B, showing an increase of $4B at the low-end of guidance.

Ford confirmed its adjusted EBIT guidance, however, meaning higher free cash flow won’t translate to higher profitability for Ford in FY 2022. Ford expects to see approximately $11.5B in adjusted EBIT this year which represents the low-end of its previous EBIT guidance of $11.5-12.5B.

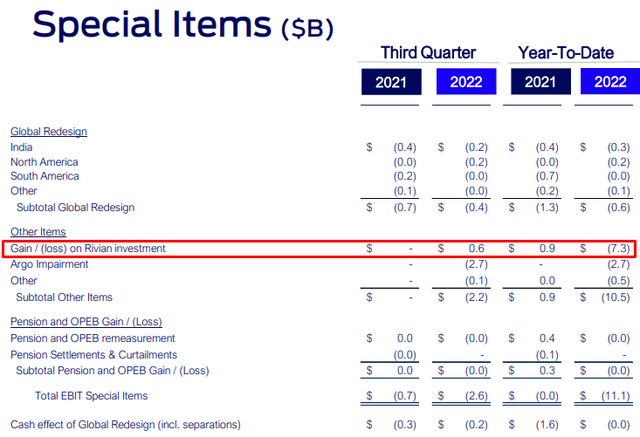

Ford is selling a significant amount of shares in its main EV investment

In the third-quarter, Ford sold 51.9M of its shares in Rivian Automotive (RIVN) for $1.8B. Rivian debuted on the stock market a year ago and the EV start-up has seen a rapid decline in its market cap since. Due to existing lock-up periods, Ford was prevented from selling shares earlier this year but the company has significantly ramped up its stock sales lately: in the second-quarter, Ford sold 25.2M shares, so stock sales more than doubled quarter over quarter.

Due to the rebound in Rivian’s share price in the third-quarter, Rivian booked a $600M gain on its stock sales. Since Ford is subject to mark-to-market accounting and Rivian’s shares have nevertheless declined 71% this year, the car brand still had to recognize a $7.3B loss on its investment in the electric vehicle start-up in the first nine months of the year. I expect Ford to keep selling Rivian shares in the coming quarters and ultimately close its investment out (Ford still owns approximately 25M shares of Rivian).

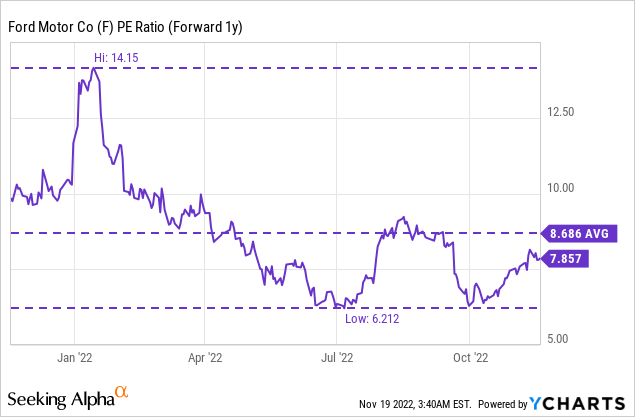

Ford’s valuation is cheap, but for a reason

Shares of Ford have an attractive valuation based off of P/E, but there are good reasons for this. Ford is highly dependent on consumer spending and strong macro conditions, and an economic down-turn paired with high inflation that is pressuring the wallets of consumers would possibly be the worst outcome for Ford in FY 2023.

Based off of earnings, Ford is valued at a P/E ratio of 7.9 X which is only slightly lower than the average P/E ratio of 8.7 X in the last year.

Risks with Ford

The two biggest commercial risks for Ford are an economic down-turn and persistently high inflation rates which are making auto parts more expensive and which could create free cash flow challenges in FY 2023. Ford said in October that it expects $9B in commodity and other inflationary headwinds in FY 2022 and warned of higher supplier costs before Q3’22 earnings. In the second-quarter, Ford expected $7B in cost headwinds. On the positive side, a favorable pricing environment has allowed Ford to raise product prices.

Final thoughts

Ford raised its guidance for FY 2022 free cash flow by a significant amount, but the firm’s adjusted EBIT guidance was not upgraded. Ford also continues to suffer from higher than expected costs, although cost pressure have started to ease. Ford still benefits from a strong EV product line-up and from a strong pricing environment that allows Ford to pass higher costs on to consumers. But given the growing macro risks and unchanged EBIT guidance, I don’t trust the current rally in Ford’s shares. If I didn’t own shares of the car brand already, I would wait until Ford submitted its free cash flow forecast for FY 2023, which the company typically does at the beginning of January.

Be the first to comment