Justin Sullivan

What Happened?

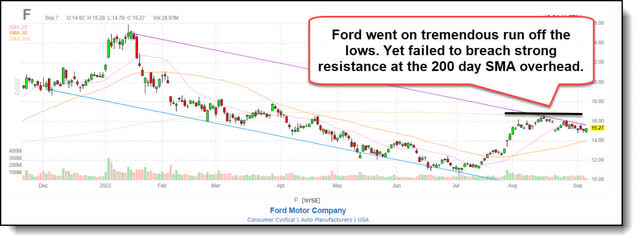

Ford’s rally fails at 200 Day SMA

Ford Motor Company (NYSE:F) has gone on a tremendous run as of late, yet failed to breach strong resistance overhead at the 200 day SMA.

The rally based on Ford crushing earnings

Ford Motor shares went on a significant run after the carmaker reported stronger-than-expected second quarter earnings, while confirming its full-year profit guidance, even as it cautioned on surging costs.

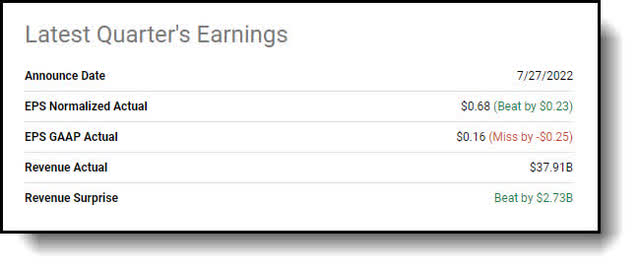

Ford earnings results (Seeking Alpha)

Adjusted earnings for the June quarter rose more than five-fold from last year to 68 cents per share, substantially besting analyst estimates, as price increases offset input cost pressures and currency headwinds. Revenues surged 66.5% to $40.22 billion, with first half free-cash flow estimated at around $3 billion. The company also reaffirmed guidance for the remainder of the year.

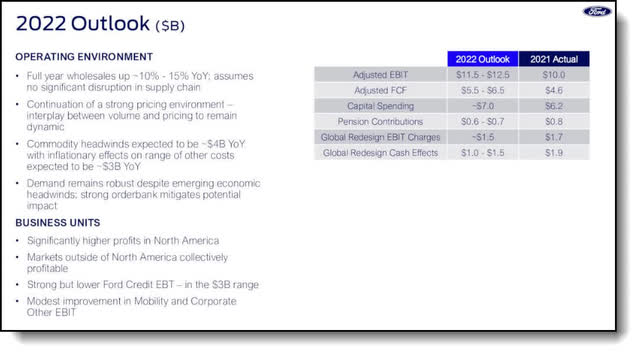

Ford reaffirms guidance

Moving forward, the company reaffirmed earnings guidance that includes a full-year profit based upon “continued strong pricing” and cost-cutting efforts.

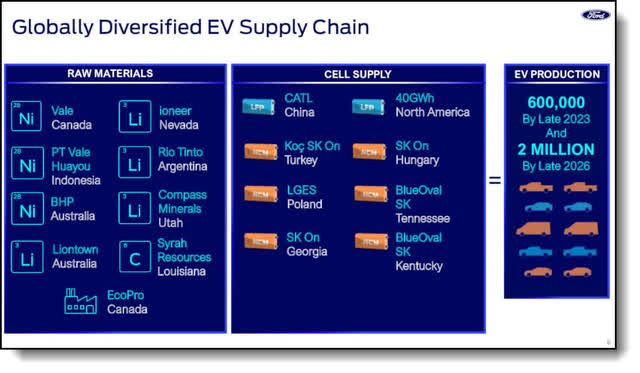

The company anticipates adjusted EBIT to range from $11.5B to $12.5B, up 15% to 25% from 2021, while adjusted free cash flow is expected to reach a range of $5.5B to $6.5B. The automaker also affirmed its intention to produce electric vehicles at a rate of 600K globally per year by late in 2023.

The bottom line is that the Ford team delivered a very solid second quarter in a challenging environment where the company saw supply chain disruptions, new economic headwinds, and increased uncertainty. CEO Jim Farley emphasized Ford achieved these results by advancing the Ford+ plan, which Farley stated was the biggest opportunity to create value at Ford since the company scaled the Model T. Even so, there remains a substantial number of market participants and analysts who don’t believe the hype.

Nattering nabobs of negativism are out in force

Just for those who are unfamiliar, the phrase “nattering nabobs of negativism” was famously used by Vice President Spiro Agnew to refer to the members of the media with whom he had a very acrimonious relationship.

While speaking to the California Republican state convention on September 11, 1970, Agnew stated:

“In the United States today, we have more than our share of the nattering nabobs of negativism. They have formed their own 4-H Club — the ‘hopeless, hysterical hypochondriacs of history.’”

While the phrase is generally attributed to Agnew, it was actually written by White House speechwriter William Safire. I love this alliteration! So I choose to share it now and again for those unaware. Now back to business!

There is still a substantial cohort of negative analysts and bloggers who don’t have faith in Ford – or Farley, for that matter. There are several hold ratings and even one person stated they expect Ford’s stock to be down over 5% in the next 12 months.

As you probably have figured out by now, I beg to differ! I say don’t be fooled again! There are actually several major bullish catalysts and current indicators that lead me to believe the run has just begun! Do not miss the boat! Here are the major reason why!

Ford stock showing major relative strength

Ford stock significantly outperformed the market over the past few months

Ford Relative Strength (‘CNBC’)

Ford’s stock is up 11% over the past three months while the S&P 500 is down 6%. This augurs well for the stock going forward. The substantial current relative strength of Ford’s stock bodes well regarding future performance. In fact, the stock potentially is about to perform the much-sought-after Golden cross very soon.

Potential Golden Cross fulfillment

The Golden Cross occurs when the 50 day SMA crossed above the 200 day SMA. It has been my experience that after this technical event occurs, a stock usually goes on a pronounced run of at least 20%. Furthermore, August sales just came out, and Ford sales were outstanding

Ford’s bestselling blowout August sales

Ford reported strong U.S. sales growth for the month of August, as the all-time favorite SUVs sales rose 47.7%, to 71,201 units, versus a year-ago. The Michigan-based automaker reported that total vehicle sales increased 27.3% year-over-year, growing to 158.09K units sold in the month. That contrasts with the relatively subdued 4.8% sales growth that the overall industry recorded.

The automaker posted sales of 65,446 pickups in August, up 8% from a year ago. These were led by growing demand for the F-Series, Ranger, and Maverick lines. Hybrids saw an increase of 9% during the month. That takes Ford’s share of the hybrid vehicle segment to 13% year-to-date, up 3.3% Y/Y, placing Ford second to only Toyota this year in hybrid vehicle sales. F-150 and Maverick hybrids totaled 47,091 trucks through August – up 87.6% year-to-date over a year ago.

Ford’s retail sales rose 29.7%, where more than half of sales came from previously placed orders. Electric vehicle sales expanded four-fold during the month, outperforming the competitors’ electrical vehicle (“EV”) segment roughly sitting at a 60% growth rate for the month. Ford Blue Vice President of Sales, Distribution & Trucks, Andrew Frick, stated:

“F-Series was America’s best-selling truck, best-selling hybrid truck and bestselling electric truck with F-150 Lightning in August. Ford’s overall electric vehicle portfolio expanded four–fold in August, while conquesting from competitors at a rate over 60 percent. The all-new electric F-150 Lightning had its best month since launch, while sales of our gas engine lineup grew 25%, electric vehicles 307% and hybrids achieved a new August sales record with 7,302 vehicles sold.”

Ford’s blowout bestselling sales numbers are incredible. This is definitely a sign that great things lie on the horizon, recession or no recession. What’s more, I don’t think people are giving enough credit to Ford’s focus on greatly increasing the level of customer service by enriching the customer experience, thereby deepening the loyalty quotient with the implementation of the Ford+ initiative.

Ford+ Plan

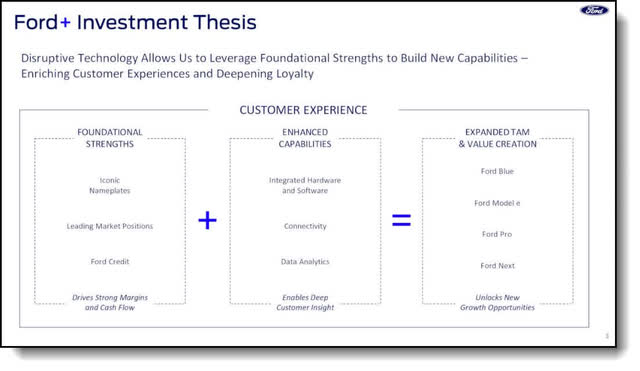

At the core of Ford+ are three fundamental promises to customers: Distinctive and breakthrough products and experiences; an always on relationship with Ford; and an ever-improving post-purchase user experience powered by software.

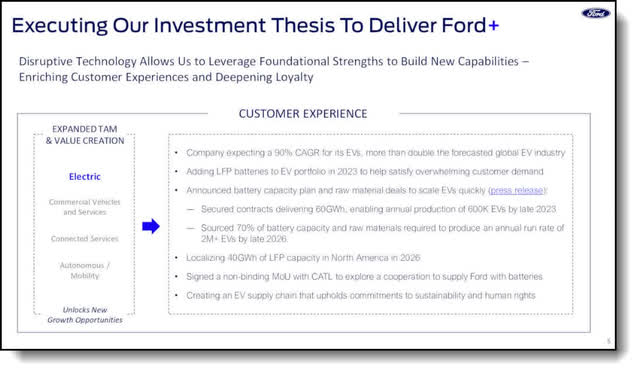

Disruptive technology leveraging strengths

I am in total agreement with the Ford+ initiative. This is exactly what people are looking for at this time. I credit CEO Farley for this and the general turnaround of Ford in the first place.

Ford remains markedly undervalued

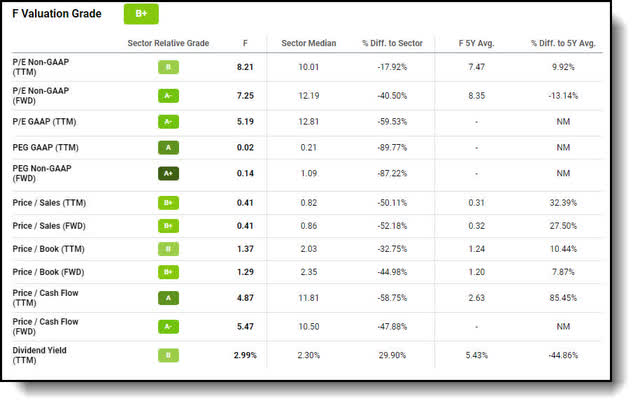

The stock passes a review of the valuation fundamentals with flying colors. According to Seeking Alpha data, the stock’s valuation gets an overall grade of A-.

Seeking Alpha valuation Metrics

Ford Valuation Metrics (Seeking Alpha)

As you can clearly see, Ford stock remains materially unvalued even after the major run. It is at a fraction of sales at 0.41 and just slightly over book value at 1.37. What’s more, it is trading for a mere 5.47-times forward free cash flow. Anything under 15-times free cash flow is traditionally considered vastly undervalued. Look, I get it, this “undervaluation status” has been a persistent condition for Ford stock. Yet, I posit the tide has turned with the advent of the new Ford EV lineup, led by the Ford Lightning Pickup.

Even so, not many think Ford stock can break out above the 200-day SMA. The current median price target is $16.25. That’s exactly why I believe it will. Moreover, the fact Ford stock is trading at a bargain bin price with solid fundamentals provides a solid margin of safety notably reducing the downside risk.

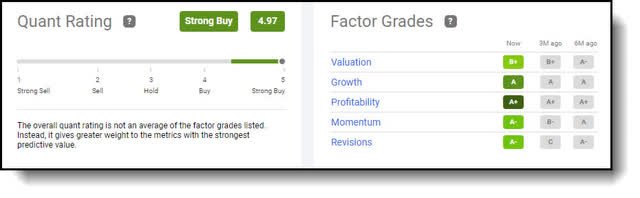

Next, let’s review Seeking Alpha’s overall Quant rating for the stock just to double check our work.

Ford’s Quant Rating

Seeking Alpha’s Quant Ratings are an objective, unemotional evaluation of each stock based on data, such as the company’s financial statements, the stock’s price performance, and analysts’ estimates of the company’s future revenue and earnings.

Ford Quant rating (Seeking Alpha)

According to Seeking Alpha’s objective quantitative evaluation of the data, Ford is a STRONG BUY. The strong buy rating is based on positive valuation, growth, profitability, momentum, and revisions data.

I am a data-driven investor at heart, with a little intuition sprinkled in, along with a love of the product and the CEO’s no-quit winning attitude. Plus, I have a long history with Ford as their auditor and consultant while working with Ernst & Young.

Oh! And how can I forget the “pièce de résistance,” the reinstatement and raising for the dividend.

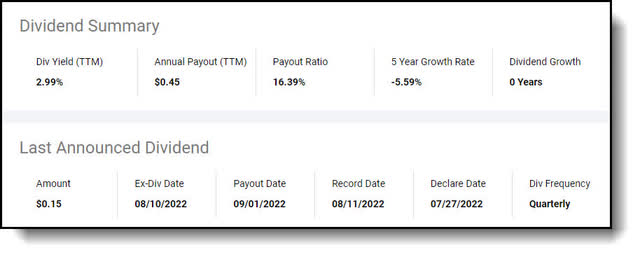

Ford reinstates and raises the dividend

Ford Motor raised the dividend by 50%, to $0.15.

Ford Dividend Summary (Seeking Alpha)

To summarize: Ford Motor declared $0.15/share quarterly dividend, a 50% increase from prior dividend of $0.10. Forward yield of 3.99%. (Seeking Alpha Summary TTM yield), payable Sept. 1; for shareholders of record Aug. 11; ex-div Aug. 10.

This is a bold show of strength about Ford operations and EPS, as well as an homage to current shareholders. It lets us know Ford management hasn’t forgotten about us and that return of capital to us income investors is important to management. CEO Farley knows what he is doing! He stated:

“The company is not joking around by saying the electric F-150 lightning could be as big a product for the automaker as the Model T back in 1908.”

Nonetheless, there are always downside risks, so let’s review the current issues at hard.

Potential Downside Risks

It would be remiss of me not to include the positional downside risks, as no investment comes without risk. Even so, the higher the risk, generally the higher the reward. The following is a list of downside risks as I see them.

- A decline in Ford’s market share.

- Lower-than-anticipated market acceptance of Ford’s new or existing products.

- Further issues with chip supply.

- China’s economy not coming back online.

- Fluctuations in foreign currency exchange rates, commodity prices, and interest rates.

- Inflation continuing to rise, causing a recession leading to a further selloff as multiples contract.

- Ford recalls

- Ford legal issues

The bottom line is that no matter when you decide to buy a stock, there will always be a “wall of worry” to climb. Now let’s wrap this up.

Investor Takeaway

The primary drivers of Ford’s growth will be the Ford+ program, and the success of their foray into the EV space. On top of all this, the company has decided to reorganize into three distinct segments: Model E; Ford Blue; and Ford Pro.

I see this as a huge positive for the stock and company. By splitting the company into three distinct segments, the clarity of purpose and focus for each of the teams should increase drastically. The distinct mission focus of each group should drive a much quicker clock speed, allowing Ford to make decisions much faster and creating a more efficient design and cost structure.

Ford Credit is showing no signs of weakness at present, either. I believe the stock will soon fulfill the Golden Cross and continue much higher as reports of the company’s successes stack up. My 12 month price target is $20, implying 30% upside from current levels.

Final Note

There’s a fine art to investing during highly volatile markets such as these. It entails layering into new positions over time to reduce risk. You will want to have plenty of dry powder if the stock you’re interested in continues lower. As a Veteran Winter Warrior of the U.S. Army’s 10th Mountain Division, the attributes of patience and perseverance were instilled in me, hence my investing motto “patience equals profits.” So, always layer in or “dollar-cost average” when building a new position and use articles such as these as starting points for your own due diligence. Those are my thoughts on the matter – I look forward to reading yours! The true value of my articles is provided by the prescient comments from the well-informed Seeking Alpha members in the comment section. Do you believe Ford is a Buy or Sell at present? Why or why not?

Be the first to comment