Brandon Woyshnis/iStock Editorial via Getty Images

Investment Thesis

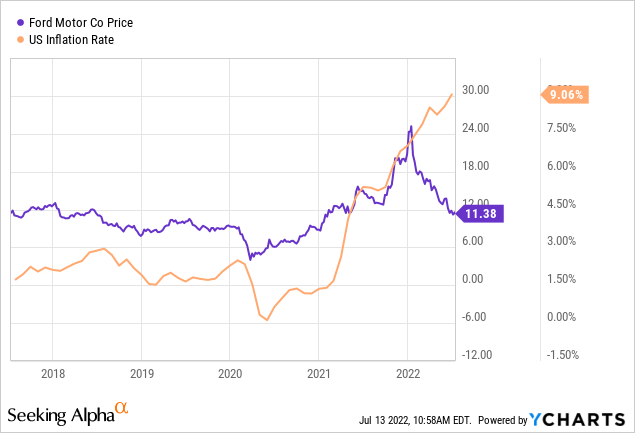

The automotive industry is highly exposed to economic and business cycles, recessions, and other factors that might disturb the supply chain. As a result, the current global automotive headwinds, with higher commodity costs, the semiconductor shortage, and a strong dollar impacting demand, pose a high risk to Ford Motor Company (NYSE:F), suppressing its stock.

Empirically, we know that a stock market is a forward-looking machine, implying that a large part of the negative sentiment, unprecedented high inflation rates, and bad outlook, have already been priced in the stock. However, it’s not yet safe to call a market bottom. Therefore, despite F earning a buy rating with a medium-term horizon, investors should consider splitting a potential investment into small buy tranches amidst the prolonged bear market.

Depressed Volumes Amid Chip Shortage

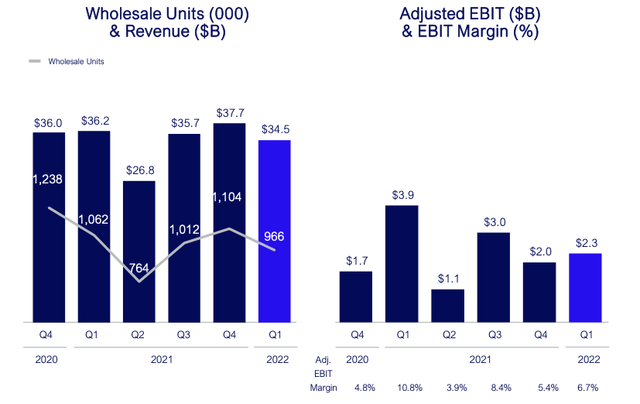

Ford reported underwhelming Q1 2022 results with revenues at $34.5 billion, down 4.7% YoY, and shipments of 970,000, down 9% from the same period last year. In addition, the reported adjusted EPS of $0.38 during the quarter saw a significant decline of $0.32 from the first quarter last year. Ford’s U.S. sales of new vehicles declined 17% during the first quarter as it battles a global shortage of semiconductor chips. However, Andrew Frick, Ford’s vice president of sales, distribution, and trucks, said the company experienced some positive signs heading into the spring selling season.

Ford Q1 2022 Earnings Presentation (shareholder.ford.com/investors)

In Q1 2022, amid ongoing volume constraints attributable to the global semiconductor shortage, Ford North America’s earnings softened considerably relative to the prior year. However, the segment’s EBIT margin remained sound at 7.1%. Slight volume declines, weaker product mix, increased warranty expense, and higher commodity and freight costs represented negative factors. Nevertheless, these were partly offset by ongoing pricing gains.

The management stated that the company continued to face a global shortage of semiconductors which held down Ford’s January and February production and shipments. However, manufacturing rates significantly improved during March. As a result, the company entered the second quarter with an “extremely healthy” order bank. Market participants will keenly observe Ford’s F-150 Lightning deliveries as a legacy automaker’s first high-volume commitment to the Electric Vehicle (EV) space.

Global Chip Shortage To Ease In H2

The seasonally adjusted annualized selling rate (SAASR) is one of the key metrics for developing a reasonable expectation for the business cycle. More specifically, the current SAASR hovers around 13 million units signaling a recession. However, in contrast to 2008, when the drop was related to weak demand, today, the shortage of semiconductors has plunged supply, creating an imbalance in the demand/supply dynamics. Not surprisingly, Deloitte has revised its previous expectation as they no longer expect the shortage to last throughout 2023, and we are closer to the end in light of easing demand and the U.S.’s plans to boost semiconductor manufacturing.

Light Weight Vehicle Sales: Autos and Light Trucks (fred.stlouisfed.org)

The management in the earnings call noted that:

While the global semiconductor chip shortage continues to create challenges, the company saw improvement in March sales, as in-transit inventory improved 74% over February. F-Series had a record 50,000 new retail orders in March, while a record 41% of overall retail sales came from previously placed retail order.

Similarly, as per Fitch Ratings, due to increased capacity and the potential for demand to moderate from high levels, Global semiconductor supply shortages could start easing out in the second half of 2022, despite pockets of near record-low inventories throughout the supply chain.

Ford’s Efforts To Mitigate Chip Shortage

Last year, Ford signed a deal with chip maker GlobalFoundries to help solve the company’s semiconductor supply shortfalls holding up production lines. Ford and GlobalFoundries did not disclose any terms of the deal or say whether Ford was providing funding or other commitments to reserve capacity at any of GlobalFoundries’ current or future factories.

Undertaking An Ambitious Transformation Plan

Ford is pursuing an aggressive plan to split the company into two distinct operations, Ford Model E and Ford Blue. Ford Model E, which includes products like the Mustang Mach-E and Ford F-150 Lightning, reflects the company’s drive into electric cars. At the same time, Ford Blue will oversee all of the legacy Internal Combustion Engine (ICE) vehicles.

Venturing Into The EV Market

Accordingly, the Company announced the creation of a new distinct EV business named Ford Model E. The Company’s notable EV product launches include the Mustang Mach-E and, more recently, the F-150 Lightning. The Company has committed to allocating $50 billion toward electrification investments by 2026; in 2022, $5 billion in EV investments are planned. Ford is currently targeting more than 2 million units in annual EV production by 2026, with EVs projected to account for half of the Company’s global volumes by 2030.

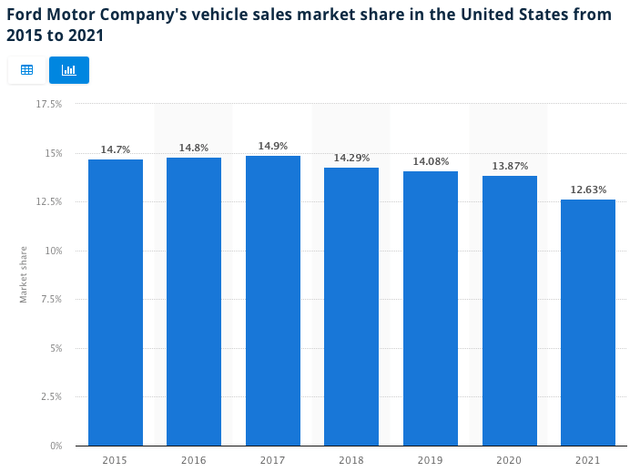

U.S.’ EV market share doubled to 3.4% in 2021, gradually gaining momentum as legacy and nascent producers begin to nibble at Tesla’s 70% share. Ford’s fast-selling Mustang Mach-E and the oversubscribed F-150 Lightning pickup are enough to stake an EV claim until the technology becomes more profitable. Still, a broader lineup is needed to drive consumer adoption and protect its 13% U.S. market share.

Ford’s Market Share (statista.com)

Fleet buyers loyal to legacy automakers are a competitive advantage as the companies launch EVs into established segments. Ford’s leadership in full-size pickups with F-Series gives the automaker an annual $8 billion fleet market opportunity as the transition to electric drivetrains occurs. The appetite for Ford’s F-150 is at high levels, with reservations capped at 200,000 for the new vehicle. The company plans to raise production of the new EV to 150,000 annually by mid-2023 and reach a capacity of 600,000 units in 2024.

Transition Towards Electrification

Supply and battery strategy are vital to winning in EVs. As automakers accelerate the transition toward electrification, the focus will be on securing enough raw materials to support the planned volumes in the years to come. Amid increasing demand and a temporary lack of supply in North America, there appears to be an impending shortage of EV battery materials on the horizon. Through a joint venture with SKI and individual material producer agreements, Ford should be able to lock much of its targeted volumes, allowing it to capture a considerable share in the market. This will be key to positioning itself as a winner in the EV race, as early volumes will give automakers a competitive advantage in shortening the time horizon to margin accretion.

Ford continues to emphasize that it can’t grow a profitable EV business without a healthy ICE business. Thus, it will continue to invest in targeted ICE business to build its more popular and profitable vehicle lines. In addition, the company is taking a disciplined approach to capital as it deploys ICE products, recognizing the need to support EV endeavors with cash generated from the ICE business as the mix towards BEVs increases.

As part of the company’s restructuring plan, Ford is looking to achieve $3 billion in cost savings from Ford Blue through simplifying operations and increasing productivity. The targeted timeline to complete the restructuring is the next 24 months, intending to accelerate this as much as possible and unlock much of the savings by next year.

Ford Blue & Model E (ford.com/ford-blue-ford-model-e/)

In addition, Ford’s Lightning is expected to beat EV truck offerings by GM and Tesla to market, with Rivian beginning deliveries but struggling to scale output. Ford also has access to the base of fleet customers that pure EV players won’t for years. Despite the industry-wide slowdown in car sales, Ford recorded an increase in sales of 31.5% YoY in June versus a decline of 11% in the industry. The growth was fueled by a 26.4% increase in sales of F-series trucks and a 76.6% increase in EV sales. Ford’s all-electric truck, F-150 Lightning, booked 1,837 sales in its second month on the market, making it the second-best seller of plug-in models behind Tesla. On the contrary, delays in Tesla’s Cybertruck are now expected at some point in 2023, which means the Lightning and GM’s Silverado EV will gain a short-lived competitive advantage. As a result, Ford is well-positioned to capitalize on the commercialization of the EV trend.

Ford Strategic Shift Well-aligned With The Trend

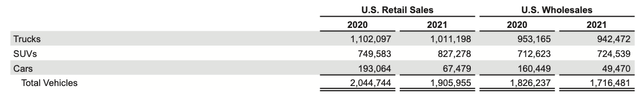

Last but not least, the industry sales in the U.S. continue to migrate away from cars toward light trucks, including compact utility vehicles and SUVs. Such vehicles represented 78% of total U.S. auto industry sales in 2021, compared with 2018 levels of 69%. This trend is advantageous for Ford, which is well represented in the light-truck segment. Ford’s sales continue to be relatively overweighted in trucks and utility vehicles; these segments combined represented approximately 96% of the Company’s 2021 U.S. sales. This representation of utility vehicles and trucks is subject to further increases as a function of Ford’s progressive exit from the passenger car segment.

Ford Annual Report 2021 (shareholder.ford.com/investors)

Concluding Thoughts

Lastly, the company’s announcement of the worst quarterly sales in China since the pandemic had a negligible effect on the stock, implying that the market anticipates a drop during Q2 and therefore reflected in the stock price. Thus, despite the headwinds the company faces, the market seems to have significantly priced in the major risks, and in light of an ending semiconductor shortage era in the next 12 months, F moves closer to an inflection point.

Be the first to comment