cagkansayin

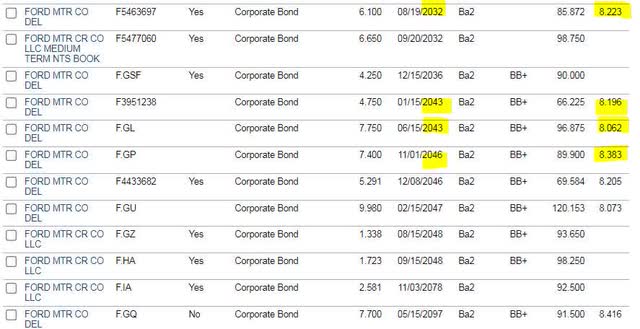

With the recent rise in interest rates, Ford Motor Company’s (NYSE:F) long term bonds have begun trading at yields above 8% to maturity. Currently, the spread between the 2032 and 2097 maturity is quite negligible, but even at 8+% returns, I have serious concerns regarding Ford’s short-term outlook that make me hesitant towards making an investment.

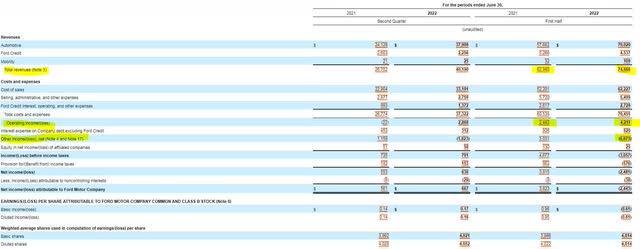

For the first six months of 2022, Ford’s revenue strongly outperformed the first half of 2021, driven by sales on the automotive side of the business. While expenses were higher year over year, the company was still able to generate operating income of $4.2 billion in the first half of the year, a $1.8 billion increase from the same period a year prior.

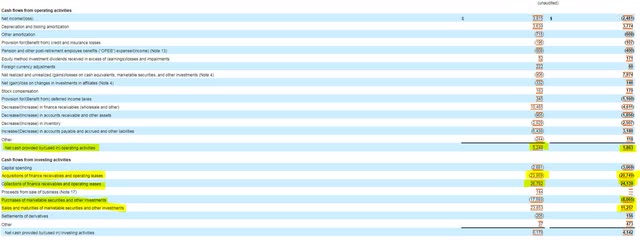

Ford’s cash flow when comparing the same periods was more of a mixed bag. Operating cash flow declined by more than half to $1.86 billion. This was mainly driven by a decline in the company’s receivables. When factoring in the $3 billion in capital spending for the first half of the year, Ford technically had a free cash flow deficit of $1.2 billion in the first half of 2022. One saving grace for the company was that it collected over $3 billion more in receivables than it lent out. This allowed Ford to have the cash needed to reduce debt and pay a dividend.

SEC 10-Q, 2021 (left) vs 2022 (right) SEC 10-Q, 2021 (left) vs 2022 (right)

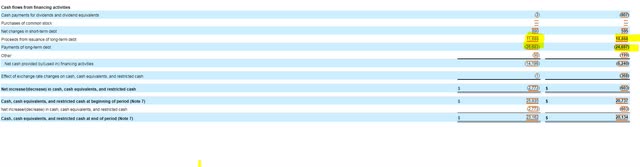

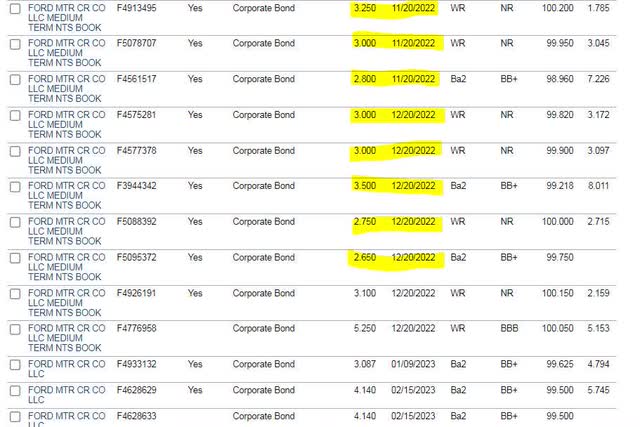

Where things become problematic for the potential Ford investor comes upon examination of the balance sheet. While Ford’s debt is approximately $10 billion lower than the year prior, the company has approximately one third of its total debt load, or nearly $44 billion, coming due in the next year. That’s a large amount of refinancing needing to be done in a tighter credit market.

SEC 10-Q, 2021 (left) vs 2022 (right)

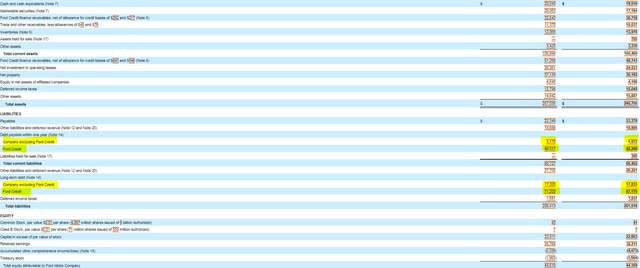

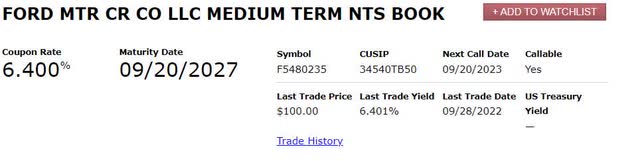

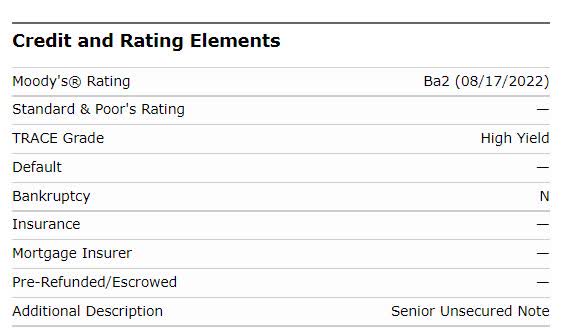

A deeper dive into the company’s upcoming debt reveals just how costly higher interest rates will become for Ford. Most of the company’s upcoming debt maturities are coming due at an interest around 3%, while the company refinanced through a recent note issue at 6.4%. Using an optimistic 300 basis point spread, a back of the envelope equation comes to $1.2 billion in new interest expense over the next year. While operating income could still remain positive, the drain on cash will threaten the dividend and the possibility of needing new financing.

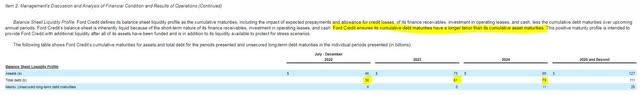

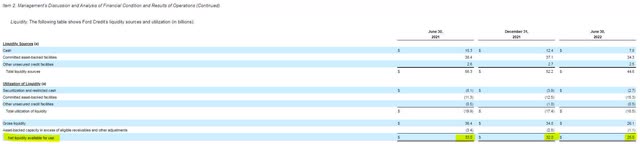

Further drilling down the 10-Q shows that Ford will have a total of $97 billion in debt coming due in an 18-month period ending December 31, 2023, with $79 billion more in the calendar year 2024. Management has tried to remain optimistic by stating that their receivables are more current than their debt, allowing them the flexibility to reduce their debt load if they needed to. The unfortunate reality, however, is that Ford’s liquidity has been declining by their own admission. While $25 billion may seem enough, it would only support the company for six months should they be cut out of the debt market.

SEC 10-Q for Q2 2022 SEC 10-Q for Q2 2022

Since Ford is a big company that relies heavily on the credit markets, it is quite possible the company’s debt will trade at extreme discounts should a liquidity event arise in our economy. An investor who believes the company could survive such an event may be apt to take an investment at that time. Currently, I don’t find Ford to be an attractive debt investment until the company’s liquidity can support at least one year of debt maturities.

Be the first to comment