fredrocko

Ford Earnings Overview

Ford (NYSE:F) is set to report its second quarter earnings results after the market closes on Wednesday. Ford shares have fallen sharply from their 52-week high in January.

Ford Current Chart (Finviz)

Since that point, the stock has been nearly halved. In the weeks prior to the earnings release, performance data in the US reflected a 31% jump in June sales. However, sales in China fell about 22% in the second quarter to mark the worst sales report in the region since 2020.

China sales review

During the second quarter, Ford sold 120,000 vehicles in Greater China marking an approximately 22% year-over-year decline led by rising COVID cases and ongoing global supply chain complications. The sales were the worst since first quarter of 2020 (89,000 units) when government COVID restrictions halted production in the country.

Nonetheless, June sales exceeded 50,000 units, up 3% year-over-year and 38% month-over-month with Lincoln sales higher by 19% year-over-year and 70% month-over-month. Demand for Ford and Lincoln brand vehicles was up significantly in June with the resumption of normal business activities, improved supply chain, and launch of new vehicles. In the second quarter, the company launched four new vehicles in the Chinese market. In another recent development, Bloomberg reported that Ford plans to lay off 8,000 workers.

Potential layoffs

Bloomberg reported that Ford plans to lay off approximately 8,000 workers to fund expanded EV efforts. Ford is preparing to lay off the workers in the coming weeks as it seeks to boost profits to fund its push into the electric vehicle market. The job cuts will come in the newly created Ford Blue unit responsible for producing internal combustion engine vehicles, as well as other salaried operations throughout the company, according to the report. The cuts may come in phases, but likely will begin this summer. Ford employs around 31,000 salaried workers in the U.S., where most of the reductions are expected.

CEO Jim Farley has previously stated the 100-year-old car company plans to cut $3 billion in costs by 2026. Farley has specifically stated cutting staff is a key to improving profits. Nevertheless, these reports are not confirmed. Ford would not comment on the report that it could lay off as many as 8,000 employees to cut expenses to finance its ambitious EV goals. It called the report by Bloomberg News speculation. Yet, Farley warned in February that Ford has too many people and too much complexity, and said it didn’t have the expertise to transition to battery-electric vehicles. “That’s the simple answer. There’s waste,” he said at a Wolfe Research conference. Not let’s move on to current earnings expectations.

Ford reports Q2 2022 earnings on July 27, 2022

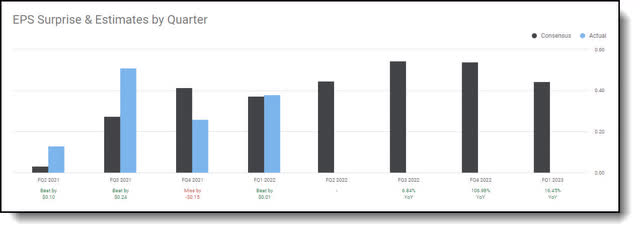

Ford has missed EPS expectations only once in the past two years, coming up short of revenue estimates twice in that span.

Ford Earnings History (Seeking Alpha)

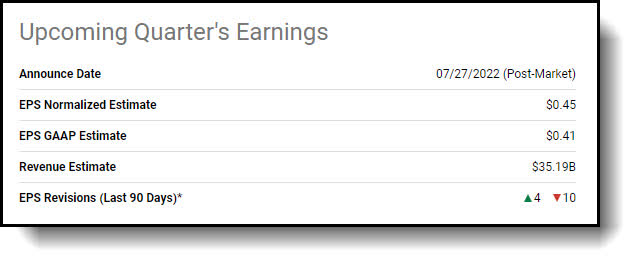

The following earnings expectations chart is for the fiscal period ending on June 30, 2022, Ford’s fiscal second quarter of 2022 to be reported on July 27, 2022.

Ford Upcoming Earnings Estimates (Seeking Alpha)

The consensus EPS estimate is $0.45 which implies 242.99% year-over-year growth over the $0.13 EPS reported last year. The low estimate is $0.37 EPS and high is $0.58 EPS on $35.19 billion in revenue.

Out of the 16 analysts covering the stock there were four upward revisions and 10 downward revisions. This candidly confirms the perplexing puzzle the current earnings environment presents. There’s an excess of inputs to consider in this increasingly dynamic environment for the auto manufacturers. First let’s take a closer look at last quarters report and guidance to set the table.

Previous quarter Q1 2022 earnings results

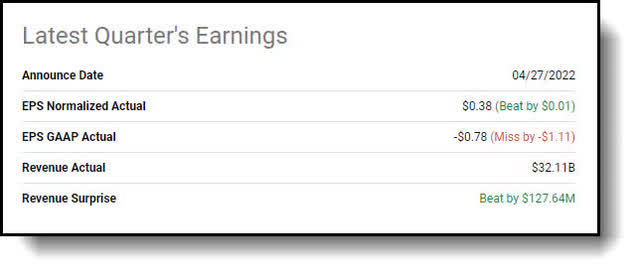

Ford Motor shares pushed higher after printing a beat on top and bottom lines for earnings and solidifying full year guidance on April 27, 2022.

Ford Last Quarter Results (Seeking Alpha)

For the first quarter, the automaker edged past estimates on EPS by a penny while cents, roaring past revenue expectations by about $1 billion after adjusting for a mark-to-market loss of $5.4 billion on the company’s investment in Rivian (RIVN). Rivian’s stock price has held up since the last earnings release so there should not be a huge write down as before. But don’t hold me to that because things can change in a flash.

Rivian Current Chart (CNBC)

For the full year, the company expects to achieve $11.5 billion to $12.5 billion in adjusted EBIT while vehicle wholesale volumes increase 10% to 15% from 2021.

The bullish guidance was bolstered by hopeful commentary on the semiconductor shortage, which the company noted as a major impact on January and February results. CEO Jim Farley explained that March manufacturing trends improved significantly and professed that the company has an “extremely healthy” order bank at present. Farley said:

“The appeal of these products – Bronco, Bronco Sport, Maverick, Mustang Mach-E, E-Transit and now the F-150 Lightning – is undeniable. That’s translating into orders, typically with rich configurations that deliver great experiences to those customers and healthy pricing for us.”

He added that the company’s “innovative EVs” are particularly important to gaining new customers at a rapid rate. The release noted that the company is anticipating the production of 600,000 EVs by late 2023, including E-Transit vans in the U.S. and Europe and F-150 Lightning pickup in the U.S. To be sure, the guidance offered by management made a number of assumptions. Namely, the outlook “assumes that disruptions in the supply chain and local vehicle manufacturing operations resulting from renewed COVID-related health concerns and lockdowns in China do not further deteriorate.”

The fact of the matter is this quarter’s results are important, but it will be the guidance given going forward that will augur the stock price one way or the other. Let’s delve into what lies ahead at this time, shall we?

What Lies ahead for Ford?

Guidance

Ford updated its electric vehicle goals on Thursday, July 14. The automaker said it has contracts to deliver enough batteries to produce electric vehicles at a rate of 600,000 globally per year by late in 2023. Furthermore, the company set a target to manufacture EVs at a rate of two million per year globally by the end of 2026. Not bad. What’s more, Ford reiterated that it plans for half of its global production to be electric vehicles by 2030 and has secured contracts delivering 60 GWh of annual battery capacity.

Nomura upgrade on news

Nomura upgraded Ford to Neutral from Reduce. The firm no longer sees the Detroit automaker as overvalue and pointed to strong Bronco sales and moderating aluminum prices that could help offset a potential slowdown in pickups and EV cost inflation.

Analyst Anindya Das stated:

“While we expect output to go up from 3Q22 onwards as chip supplies improve, we now expect full production recovery for the company to be pushed out into early 2023. Thus, we expect pricing to stay firm in 2H22, especially in the US, given low dealership inventory and solid demand for new vehicles.”

Let’s now turn our focus to recent demand news.

Demand Outlook

At the “Management Presents at Deutsche Bank 2022 Global Automotive Conference,” Ford CFO John Lawler stated:

“It continues to be an extremely dynamic environment. One thing I will say is when you look at Ford, demand continues to be very robust. Our new lineup, our new products, they’re sold out for the most part. Mach-E, Lightning, E-Transit, the order bank is very large. We’ve got Bronco, Bronco Sport, Maverick. So, demand remains long to supply. Consumer demand continues to be strong for us in our lineup. So, we’re not seeing we can — our order bank is still very robust. We have over 300,000 orders across many of our vehicles. And so, we’re continuing to see strength there

Now we have seen changes this quarter with the disruptions that have occurred in China with the lockdowns on supply chain. So that’s put stress into the system. Everybody’s seen that. So, we’re managing through that.

We’re focusing very much on improving the production stability which is one of the things as we work with the supply base that’s very important for them because as we take our schedules down, it impacts their production, etc., so we’re working on that. And we’re seeing increased transparency and cooperation through the supply chain all the way down to the fabs.

So, it continues to be a dynamic environment. We continue to work through the issues that we’ve seen from supply chain, chips, COVID, et cetera, and we continue to manage it.”

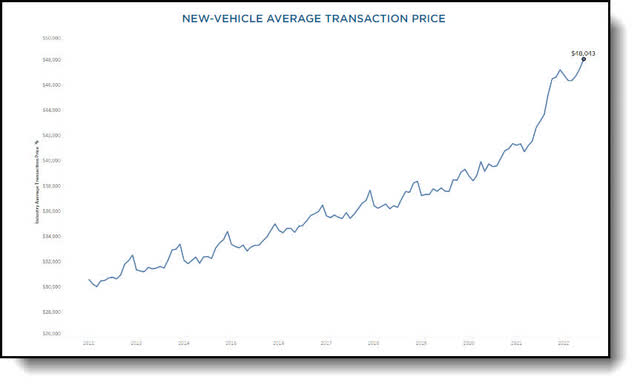

While demand continues to be long to supply, Lawler stated is continuing to see pricing stack, meaning they have pricing power at present. The company has been able to offset headwinds from commodities and inflationary pressures with price increases. Double checking his statement, it appears to hold up as new-vehicle ATPs (average transaction price) increased to $48,043 in June 2022, according to Kelley Blue Book, beating the previous high of $47,202 set in December 2021. June prices rose 1.9% ($895) from May and were up 12.7% ($5,410) from June 2021.

KBB ATP Prices (KBB)

Let’s take a look into another large money center for the company, Ford Motor credit.

Ford Motor Credit

After hearing what AT&T (T) had to say on their earnings call, you would expect Ford to express similar trends regarding car loan delinquencies. As a matter of fact, they are. Yet, based on the fact they’re starting from a very solid position, it’s not a major concern at this time. CFO Lawler stated when questioned about it recently:

“Going back to what we’re seeing as far as the consumer, one lens that we have into the consumer that I think is an advantage through our credit company. So, we’re looking at all kinds of data. But one thing we are seeing, Emmanuel, is we are seeing delinquencies start to increase. It’s not yet a concern for us because it’s, as you know, coming out of last year and through the first part of this year, they were very low. Seems like we’re reverting back more towards the mean. Severity still isn’t an issue because the residuals are so high, but we think those have peaked. But we’re looking at it, and we’re looking for every indication and every data point we can to get a read on where the consumer is, where they’re headed given everything that we see out there, the inflationary pressures, the economic issues, et cetera.”

Now let’s wrap this up.

The Wrap up

In conclusion, your guess is as good as mine on whether Ford will beat expectations or not. Please excuse me for the play on words! I was kidding!

I see market factors pressuring margin even as the company maintains pricing power. Commodity and inflationary pressures, freight and logistics costs, and employment costs will weigh on profits, but it may not be as bad as many anticipate. The company is working on additional cost reductions to offset cost increases as much as possible. Ford has assured investors it’s hammering out additional efficiencies throughout the system and thoroughly reviewing every line item on the income statement to wring out any waste.

The future looks bright for Ford and I’m a buyer. My 12-month price target is $23. With the world heading into an economic environment where a potential recession may occur, Ford is actually positioned very well to handle it. Typically, dealers would be stocked up with large inventories with already high incentives, and be increasing incentives to try to move vehicles. Now, inventories are very lean and they actually have a backlog of more than 300,000 units with no incentive.

Furthermore, the auto giant is going to begin splitting out earnings by business segment next year which I see as a huge positive for the stock and company. There will be five separate segments; E, Blue, Pro, Credit, and Next. The clarity of purpose and focus for each of the teams should increase drastically. The distinct mission focus of each group should drive a much quicker clock speed allowing Ford to make decisions much faster creating a more efficient design and cost structure.

Just for full disclosure, I was previously on the audit team for Ford while working for Ernst & Young. I have an affinity for the name. In my time auditing and consulting for Ford I found the company and its employees to be an upstanding group. I even audited their facilities in Mexico as well. One of my primary goals was to identify any areas where cost avoidance and reduction could be improved. They were always looking to improve procedures to increase efficiencies and lower costs.

Be the first to comment