Brandon Woyshnis/iStock Editorial via Getty Images

Investment Thesis

Given the surprisingly robust September CPI at 8.2% and sequentially increased spending on new vehicles index by 0.4% and 9.4% YoY, it is apparent that the US consumer consumption remains robust for now. New trucks remain in hot demand as well, with a 9.1% YoY growth and 0.4% sequentially. Combined with the massive growth in demand for Ford’s (NYSE:F) F-150 Lightning, we do not expect the insatiable appetite to be destroyed anytime soon, due to the intensely sticky inflation rates and tremendous consumer spending power. There is a reason why the F Series pick-up has remained the industry’s most popular truck for the past 45 consecutive years and America’s best-selling vehicle for a 40th straight year.

Nonetheless, the F stock has also been massively moderated from its previous high, to arrive at our price target of the low $10s. Assuming that the historical support level holds ahead, we expect to see a meaningful stock recovery over the next few months, since most of the pessimism from its underperforming FQ3’22 earnings call is already baked in by now.

In the meantime, we do not expect to see a sustained stock performance over the next two quarters, given the impact of supply chain issues and the worsening macroeconomics in general. With 98.4% of analysts expecting another 75 basis points hike in the Fed’s next meeting in November, and likely again in December, it is not overly pessimistic to assume that we may see a raised terminal rate beyond 5% as well. Combined with the underperforming S&P 500 Index that has plunged below its previous June low thrice by now, it is apparent that we are in for more uncertainties ahead.

Ford Continues To Suffer From Supply Chain Issues

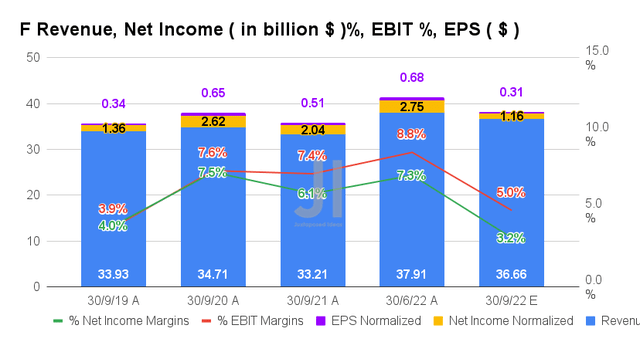

For its upcoming earnings FQ3’22 earnings call, F is expected to report revenues of $36.66B and an EBIT margin of 5%, indicating a notable decline of -3.29% and -3.3 percentage points QoQ, respectively. This is attributed to the massive inventory of 45K vehicles undelivered, worth approximately $2.25B with an Average Transaction Price of $50K. Otherwise, these numbers still represent decent YoY growth of 10.38% though a moderation of -2.4 percentage points, respectively.

Nonetheless, Mr. Market has also downgraded F’s performance, with an EPS of $0.31 for FQ3’22, indicating a tremendous fall of -54.41% QoQ and -39.21% YoY. We shall see, given the inflation-related Q3 supply costs of approximately $1B.

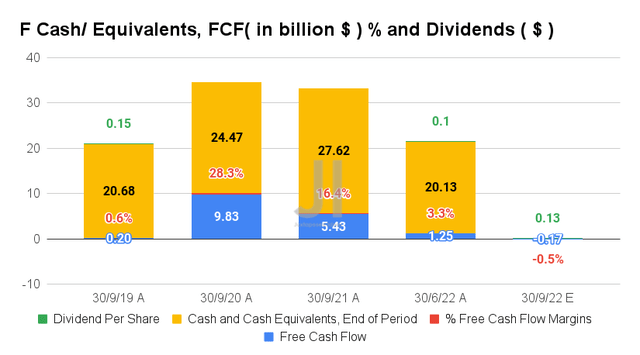

Due to its aggressive capital expenditure of $6.41B in the last twelve months, we do not expect F to report positive Free Cash Flow (FCF) generation in FQ3’22. Consensus estimates that the company will report an FCF of -$0.17B and an FCF margin of -0.5% for the next quarter, indicating massive declines QoQ and YoY. However, combined with its ambitious expansion plans in China and the US through 2026, we expect to see these investments paying off and contributing to its top and bottom lines growth moving ahead.

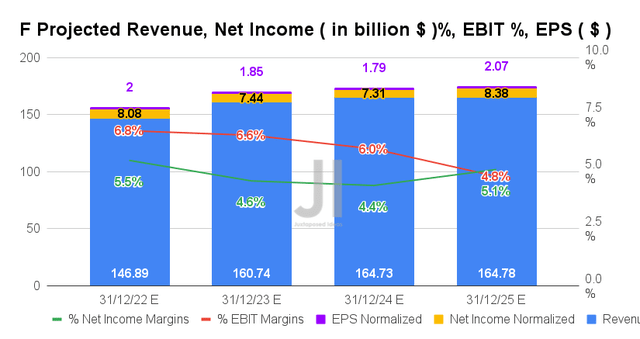

Over the next four years, F is expected to report revenue and adj. net income growth at a CAGR of 4.85% and 6.85%, respectively. Despite the perceived destruction of demand by UBS, it is essential to note that the company’s top-line estimates remain relatively in line, with a notable -20.80% moderation in profitability since our analysis in April 2022. Otherwise, another fall of -8.16% since August 2022.

Thereby, indicating robust demand of consumer demand despite the recessionary fears, as discussed above. Margins will naturally improve moving forward, given F’s raised prices for consumers’ hot favorite, the F-150 Lightning Pro series, and the eventual improvement of global supply chain issues from 2023 onwards. Investors must not forget the excellent performance pulled by Ford Credit as well, at a 41.15% of adj. EBIT margin by H1’22.

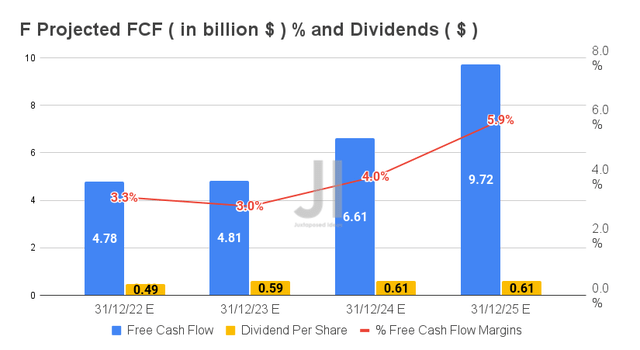

The improvement in F’s profitability remains excellent, from adj. net income/ FCF margins of 3.3%/1.9% in FY2019, 5.1%/7.6% in FY2021, and finally settling at a stellar 5.1%/5.9% by FY2025. Thereby, boosting the growth in its dividend payouts as well at a CAGR of 7.57% over the next four years. Investors that load up at current levels would see attractive dividend yields of up to 5.15% by then, or up to 6.1% assuming another drastic correction in its stock prices to $10.

In the meantime, we encourage you to read our previous article on F, which would help you better understand its position and market opportunities.

- Ford: Lightning Charge To $20s – Get, Set, Go!

- Ford: Lightning Strike To $18 – The Time To Add Is Near

So, Is F Stock A Buy, Sell, or Hold?

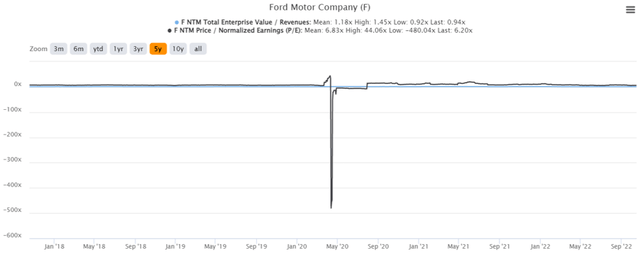

F 5Y EV/Revenue and P/E Valuations

F is currently trading at an EV/NTM Revenue of 0.94x and NTM P/E of 6.20x, lower than its 5Y mean of 1.18x and 6.83x, respectively. The stock is also trading at $11.83, down -54.27% from its 52 weeks high of $25.87, nearing its 52 weeks low of $10.61. Nonetheless, consensus estimates remain bullish about F’s prospects, given their price target of $18.33 and a 54.95% upside from current prices.

F 5Y Stock Price

Nonetheless, this time of maximum pain has also created the most opportune and contrarian time for bottom-fishing investors, who have been waiting to load up F at these near-bottom levels. Its dividend yield of 5.15% is more than decent as well in this bearish market condition, insulating those with higher risk tolerance and long-term trajectory for portfolio growth and investing. Therefore, we revise our rating on the F stock to a Buy. Load up the truck boys!

Be the first to comment