jetcityimage

What happened?

On 9/19, Ford Motor Company (NYSE:F) disclosed disappointing news that it would have around 40k to 45k vehicles in inventory at Q3 end due to parts shortages, noting that a high percentage of vehicles awaiting missing parts include models of high demand and high margins such as trucks and SUVs. Inevitably, some of the lost revenue will be shifted to Q4 and Q3. Adjusted EBIT is expected to come in between $1.4-$1.7 billion, including an additional $1 billion supply costs arising from inflation. The updated adj. EBIT is materially lower than the Street’s $2.9 billion. On the bright side, the company reiterated its 2022 adj. EBIT between $11.5-$12.5 billion, in line with the Street’s $11.9 billion despite limited inventory availability and higher supply chain costs.

Idiosyncratic or industry-wide?

Ford’s issue seems to be a surprise to the market given most companies have been reporting improving supply chain issues. That said, in Q2 rival General Motors (GM) highlighted similar challenges which resulted in 95k vehicles with missing components. Toyota (TM) saw revenue fell 23% in Q2 due to supply chain issues and its North America EVP of sales said the current chip shortage is unlikely to get better until summer 2023.

It’s also interesting to note that not every carmaker is treated evenly in an environment of chip scarcity. For example, in 2021 Ford faced problems with the Renesas fire in Japan in Q2, while GM did not. In Q3, GM had issues with the Covid-19 outbreak in Malaysia and Ford did not. The key takeaway here is that supply chain challenges are still present and will likely persist into 2023.

What’s the impact?

Assuming the 40-45k missing vehicles can each generate roughly $10k contribution margin, this equates to $400 to $450 million of impact in 3Q22. Adding this to the additional $1 billion from higher supply costs, the total impact on Q3 EBIT should be $1.4 to $1.45 billion. This largely explains why Q3 EBIT is now estimated to come in between $1.4-$1.7 billion vs. almost $3 billion consensus. Nevertheless, the fact that management maintained full year 2022 EBIT was encouraging and suggests favorable pricing or mix could be a factor. That said, macroeconomic factors such as higher interest rates may have some investors start to question the sustainability of positive pricing from a demand standpoint.

Final thoughts

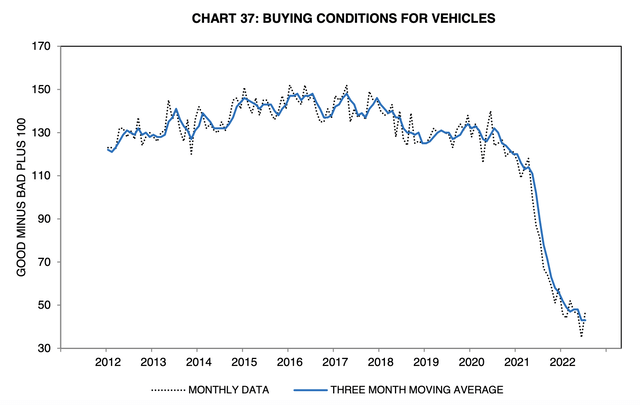

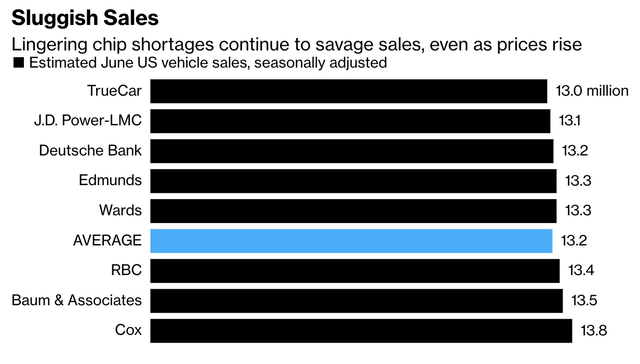

Inflation and supply chain challenges remain largely a wild card for Ford and the auto industry in general, and demand is not entirely immune to higher sticker prices and interest rates. While some investors may still see Ford as an attractive investment driven by critical redesign and restructuring initiatives (Ford+, electrification and autonomy), my sense is that Ford’s 2022 EBIT target could be at risk as higher supply costs and worsening macro may cause consumers to think twice before purchasing a new car. The seasonally adjusted annual rate (SAAR) of light vehicle sales in the U.S. was down 9% YoY to 13.5 million in July 2022. I’d also note that the University of Michigan’s Buying Conditions for Vehicles survey is now at a 10-year low.

Surveys of Consumers – University of Michigan

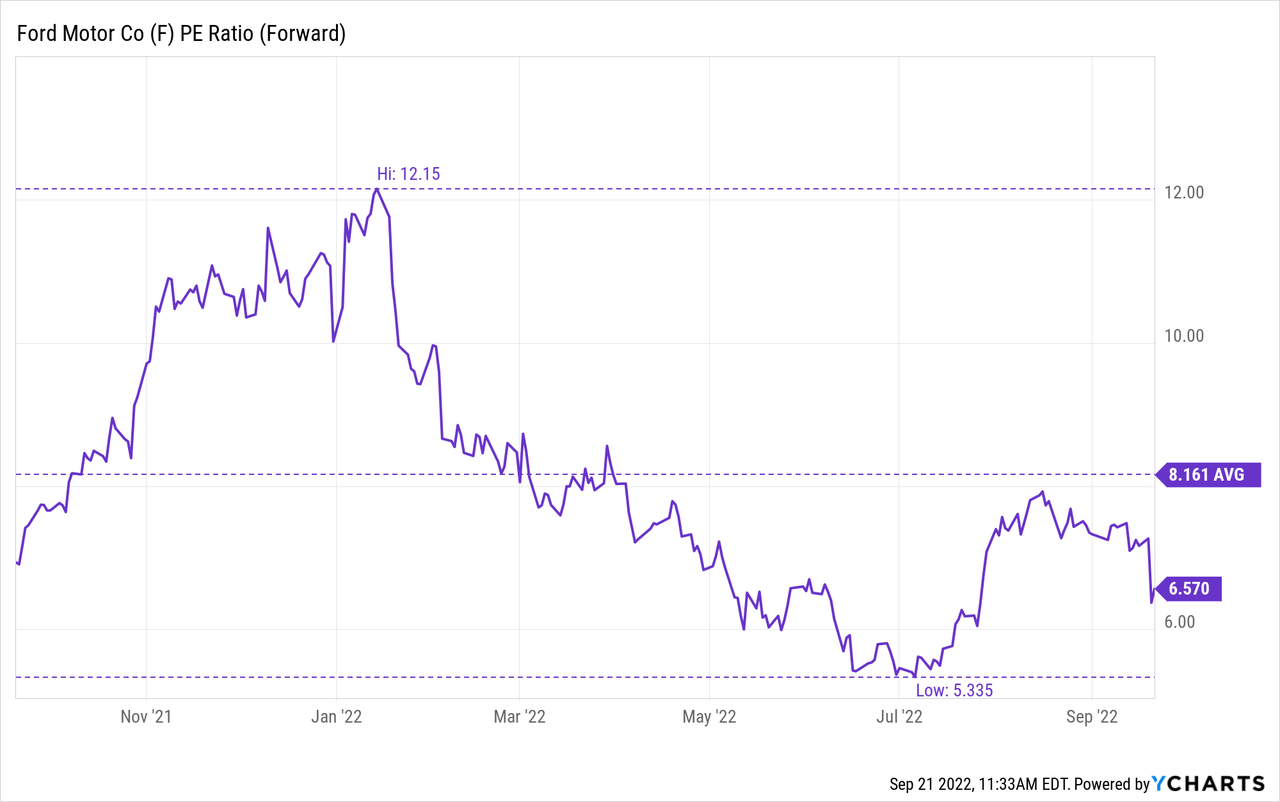

From a valuation standpoint, Ford is commonly understood as cheap at 6.6x forward earnings vs. 1-year average of 8.2x. 2022 EPS. It has seen 17 upward revisions while revenue saw 5 upward revisions over the last 3 months, indicating a high level of confidence amongst the analyst community that Ford will meet expectations. However, those estimates may now be in question as Ford will continue to deal with higher supply costs and may be forced to raise prices to maintain margins. If demand weakens and profitability gets squeezed, shares may be re-rated to the downside.

Be the first to comment