Dia Dipasupil

Foot Locker, Inc. (NYSE:FL), through its subsidiaries, operates as an athletic footwear and apparel retailer.

In today’s article, we will go through the highlights of the company’s latest earnings report and give an updated view on our previously established rating on FL.

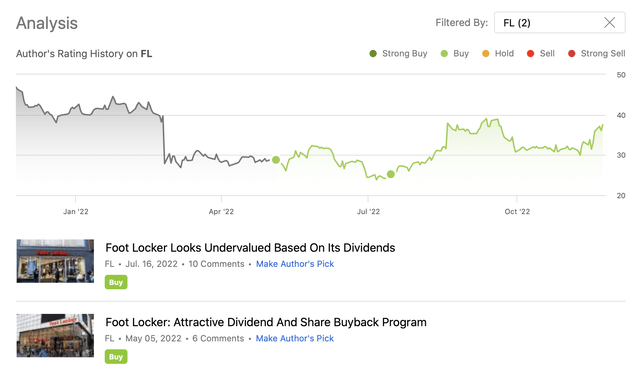

This year, we have published already two articles about FL on Seeking Alpha. These were:

- Foot Locker: Attractive Dividend and Share Buyback Program

- Foot Locker Looks Undervalued Based On Its Dividends

Both times, we have rated FL’s stock as a buy, due to its undervaluation and the firm’s strong commitment to return value to its shareholders.

So let us see, is our previously established thesis and rating still intact? Can the firm maintain its dividend and share buyback program based on the latest earnings?

Q3 earnings results

After the announcement of the results, the stock price has increased substantially. In our opinion, the results may have been interpreted too optimistically.

The key financial results are summarized under the following bullet points:

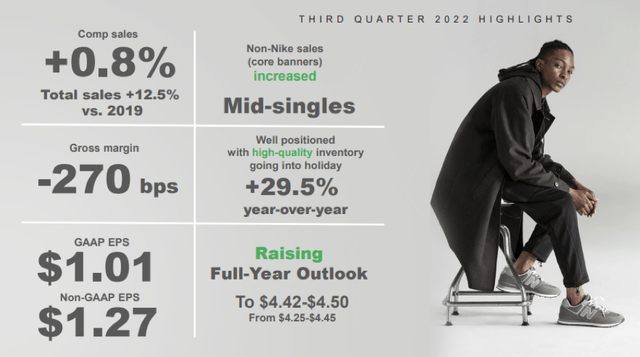

- Third quarter sales and earnings above expectations

- Total sales decreased 0.7% from 2021 on a reported basis; increased 3.3% in constant currency

- Comparable-store sales increased 0.8% year-over-year

- EPS of $1.01 and Non-GAAP EPS of $1.27

- Raises 2022 EPS guidance to $4.42-$4.50, compared to prior range of $4.25-$4.45

Sales

Comparable-store sales have been up by 0.8% compared to the year ago quarter, primarily driven by the continuing strong demand for the firm’s products. While the growth is not stellar, we believe that these results can be interpreted as quite strong, in light of the challenging macroeconomic environment. It is potentially also a proof that the firm’s diversification efforts to reach a wider range of social groups may be working.

On the other hand, total sales have slightly decreased, by 0.7% year-over-year. If excluding the effect of foreign exchange fluctuations total sales growth for Q3 would be 3.3%.

While we are happy with the sales results, the cost side of the equation is raising some concerns.

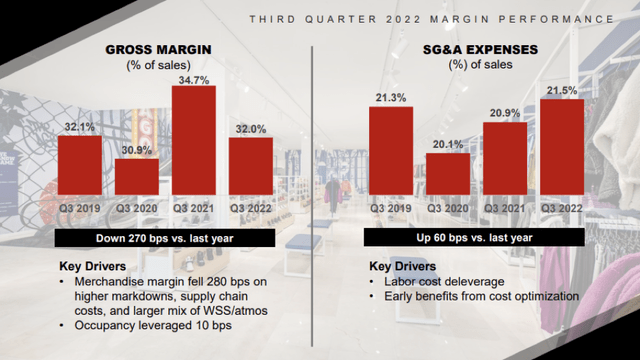

Costs

The gross margin has decreased by as much as 270 bps, compared to Q3 2021. The primary drivers were supply chain cost pressures and higher markdowns.

So what is exactly concerning us here?

While the firm had to use higher markdowns to keep the demand high, their inventory has by almost 30% year-over-year. The company has been positive about this development, stating:

Current inventory quality and aging continue to be healthy and position the Company well to fulfill demand for the holiday season and the fourth quarter overall.

On the other hand, we are not so optimistic. Consumer confidence in the Unites States is still very poor. We believe that the in the near future, the company will have to keep using higher markdowns to be able to keep the demand high and get rid of their excess inventory, before it becomes obsolete. In turn, we expect the downward pressure on the gross margin to continue.

SG&A expenses have also increased by as much as 60 bps year-over-year, drive by the labor inflation, which the company managed to at least partially offset with early savings from their cost optimization program.

The increasing costs are naturally having an impact on the earnings too.

Net income

The company’s net income for the third quarter came in at $96 million, substantially down from the $158 million recorded in the same period last year. It represents a roughly 40% decrease year-over-year.

So what is our outlook for the near future?

We believe that the elevated costs, along with the poor consumer confidence are likely to keep negative impacting FL’s financial performance in the near term. While inflation has somewhat eased in the recent months, most of the consumers remain uncertain about their financial outlook in the near term.

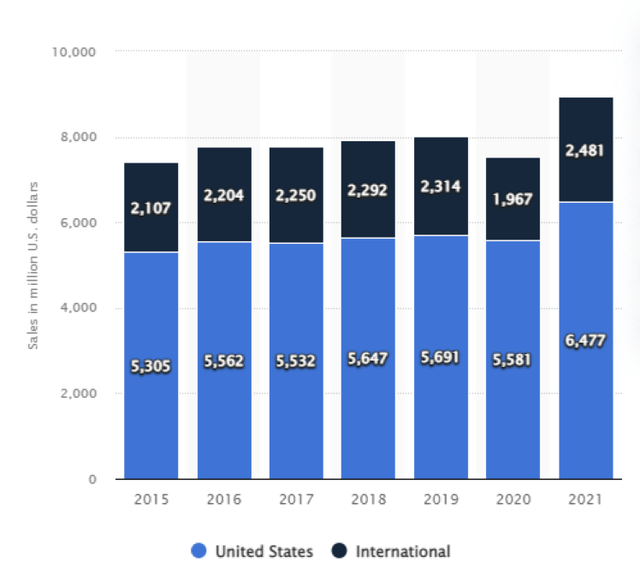

We also do not expect a rapid change in the unfavorable FX environment, as the Fed has so far have not shown any indication of slowing or pausing its interest rate hikes. The relative strength of the USD compared to other currencies have been hurting the company’s financials this year, as a substantial portion of the sales is generated outside of the United States, not only now, but also historically.

Sales by region (Statista.com)

Is our previous “buy” rating intact?

We are not particularly impressed with the Q3 results, despite the raised earnings outlook. But we do maintain our “buy” rating on the stock. Our arguments in the previous writings were based on the commitment to returning value to shareholders and the undervaluation. In our opinion, even if earnings decline, the firm will be able to execute its share buyback program, along with continuing dividend payments. The current dividend payout ratio (TTM) (GAAP) is 34%, indicating the sustainability of the dividend in the near term. And despite the recent increase in the share price, the stock still appears to be trading in value territory.

Be the first to comment