damircudic

A Quick Take On FLEETCOR Technologies

FLEETCOR (NYSE:FLT) reported its Q2 2022 financial results on August 4, 2022, beating expected revenue and EPS estimates.

The company provides a range of business payments technologies and services worldwide.

The firm is exposed to slowing macroeconomic conditions and higher debt service costs as its interest rate hedges come off in 2023, exposing it to a higher cost of capital.

I’m on Hold for FLT for the near term.

Overview

Atlanta, Georgia-based FLEETCOR was founded in 1986 to provide a variety of supplier and employee payment solutions to organizations globally.

The firm is headed by Chairman and CEO Ron Clarke, who joined the firm in 2000 and was previously president and COO of AHL Services and Chief Marketing Officer at ADP.

The company’s primary offering categories include:

-

Accounts Payable Automation

-

Employee Purchasing Cards

-

Virtual Cards

-

Cross-Border Payments

The firm acquires customers via direct sales and marketing efforts, as well as through partner referrals.

Market & Competition

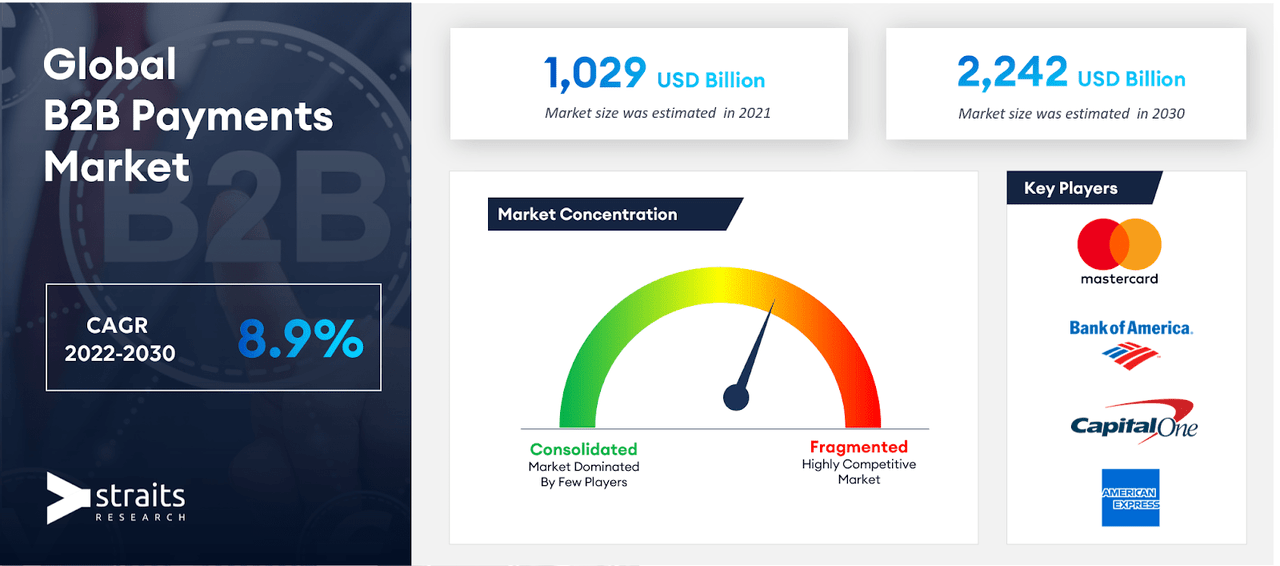

According to a 2022 market research report by Straits Research, the global market for B2B payments was an estimated $1 trillion in 2021 and is forecast to reach $2.2 trillion by 2030.

This represents a forecast CAGR of 8.9% from 2022 to 2030.

The main drivers for this expected growth are increasing demand from businesses for more efficient processing capabilities and a move to cloud-based systems amid growing global trade and supply chain challenges.

Also, the chart below shows the estimated market growth and relatively fragmented nature of the B2B payments market:

Global B2B Payments Market (Straits Research)

Major competitive or other industry participants include:

-

American Express

-

Bank of America

-

Capital One

-

Mastercard

-

Payoneer Inc

-

PayPal Holdings

-

Block

-

Stripe

-

TransferWise Ltd

-

Visa

Recent Financial Performance

-

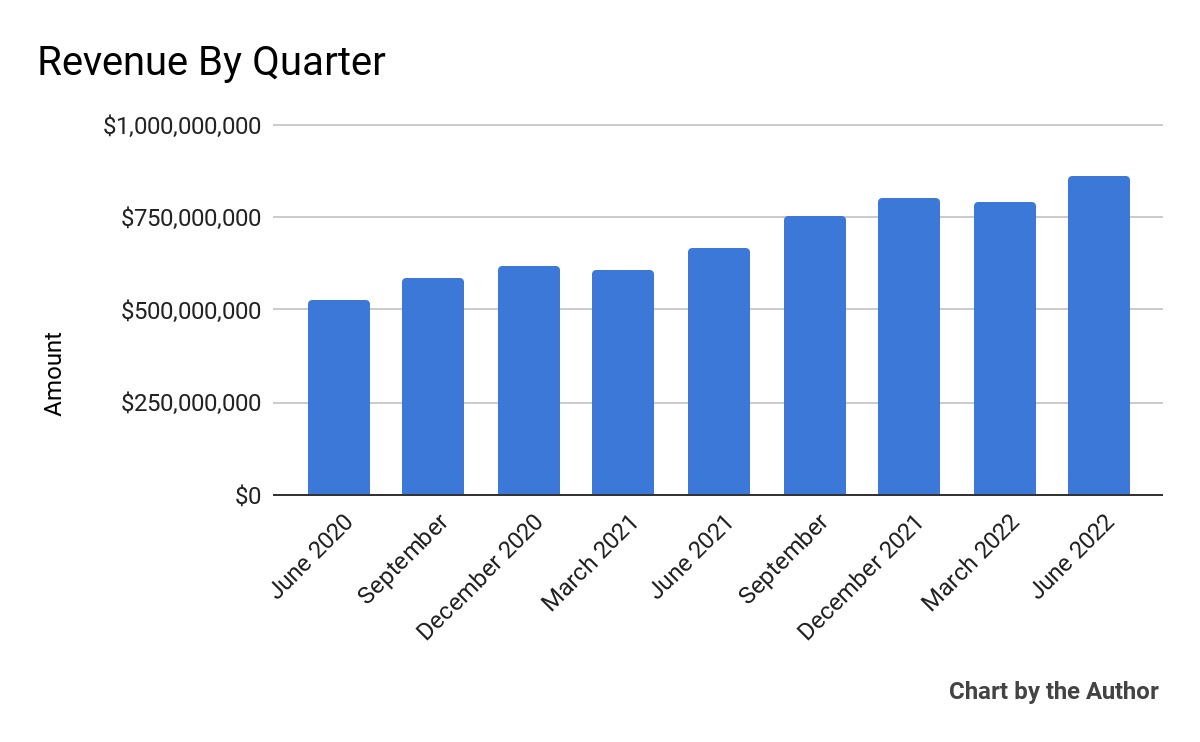

Total revenue by quarter has risen in the past several quarters as follows:

9 Quarter Total Revenue (Seeking Alpha)

-

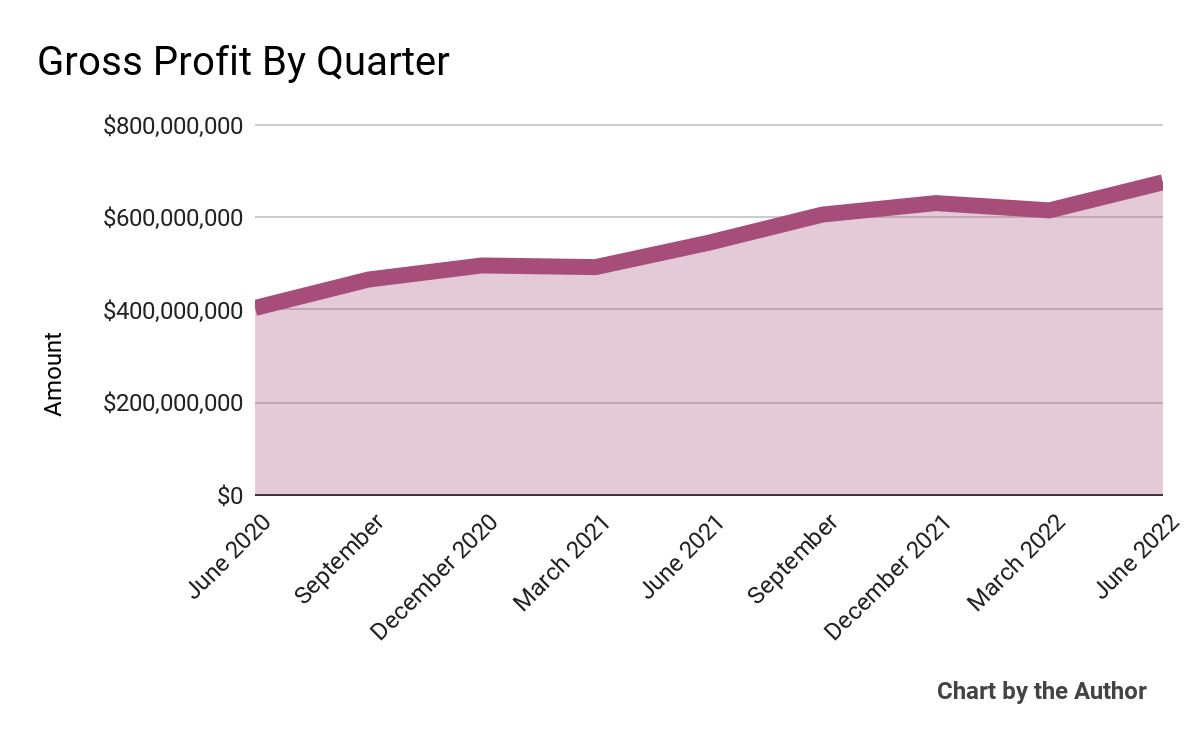

Gross profit by quarter has also risen accordingly:

9 Quarter Gross Profit (Seeking Alpha)

-

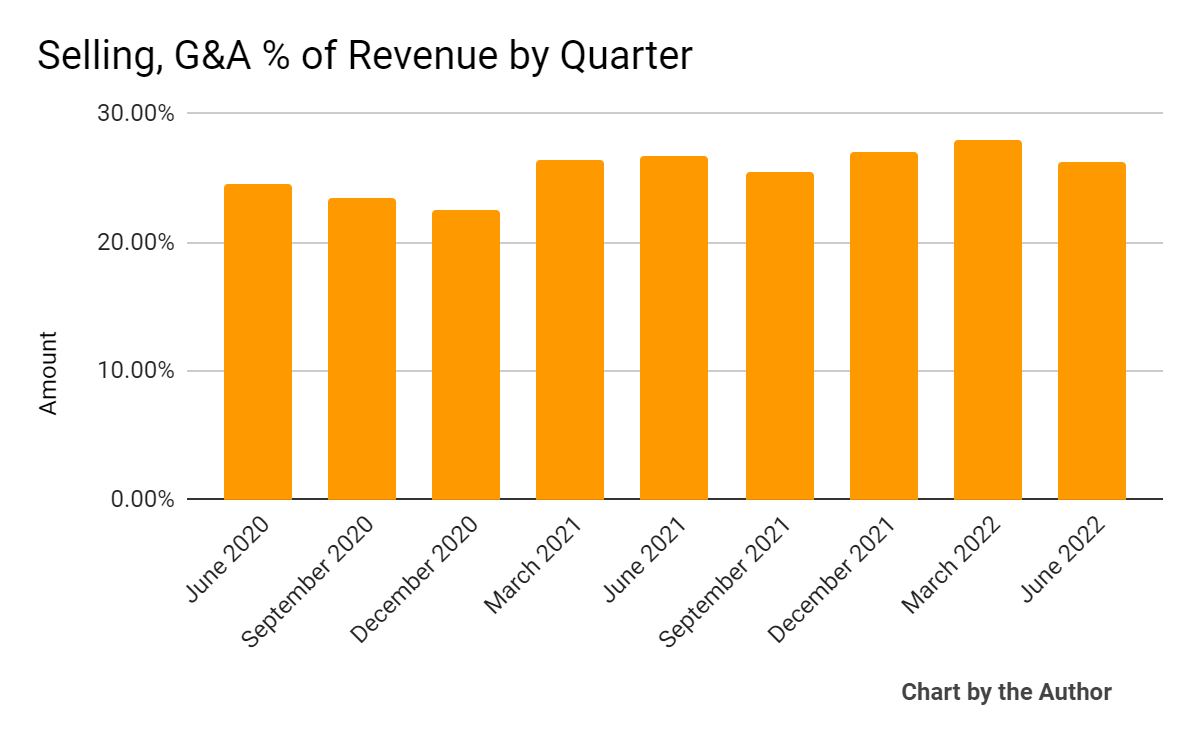

Selling, G&A expenses as a percentage of total revenue by quarter have remained in a relatively narrow range:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

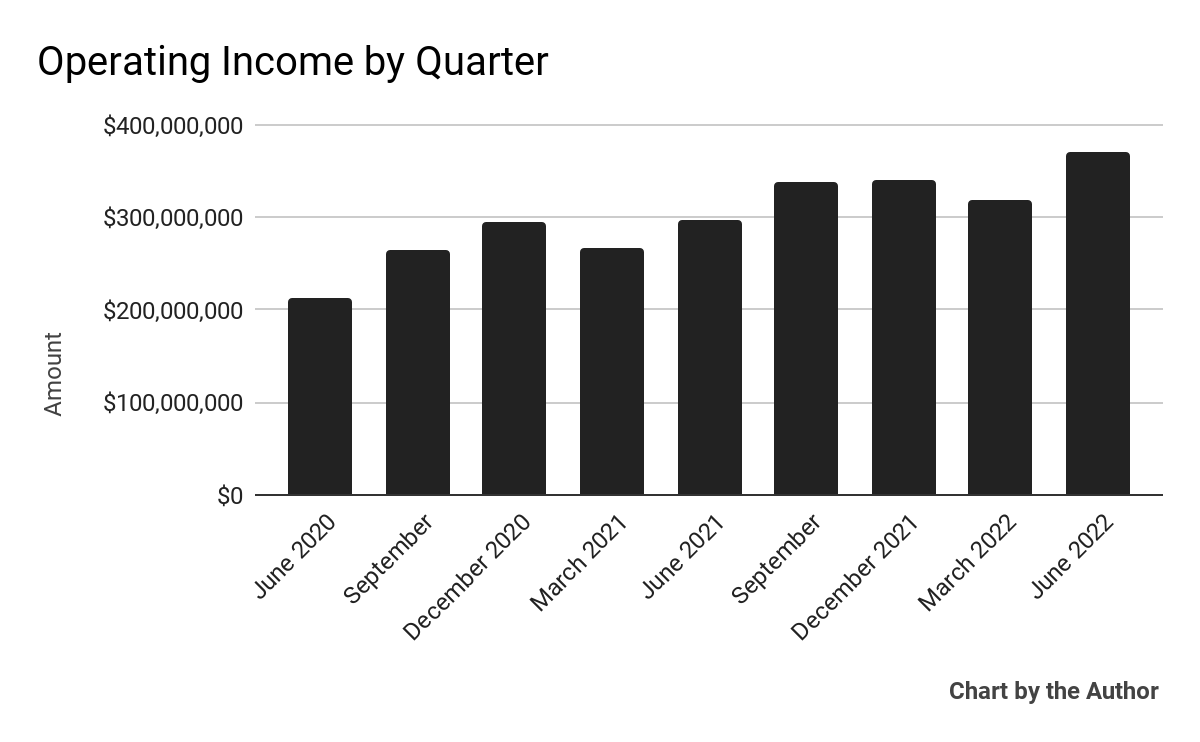

Operating income by quarter has trended higher:

9 Quarter Operating Income (Seeking Alpha)

-

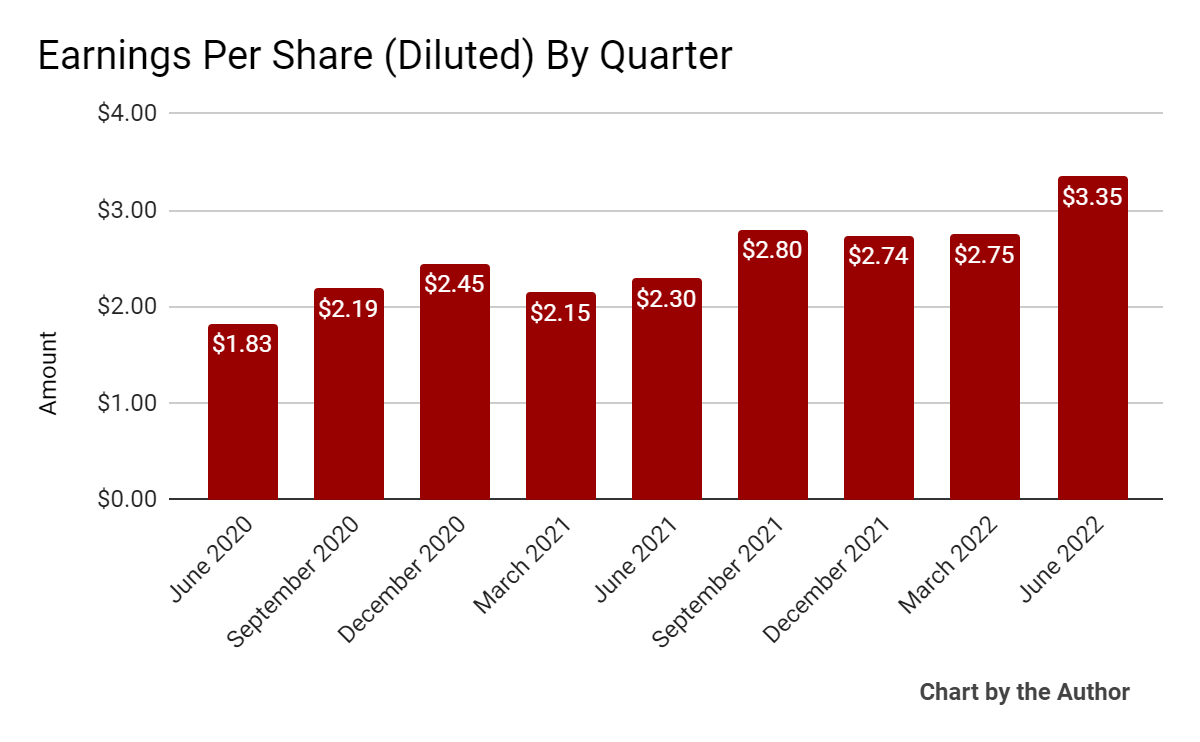

Earnings per share (Diluted) have also trended upward:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

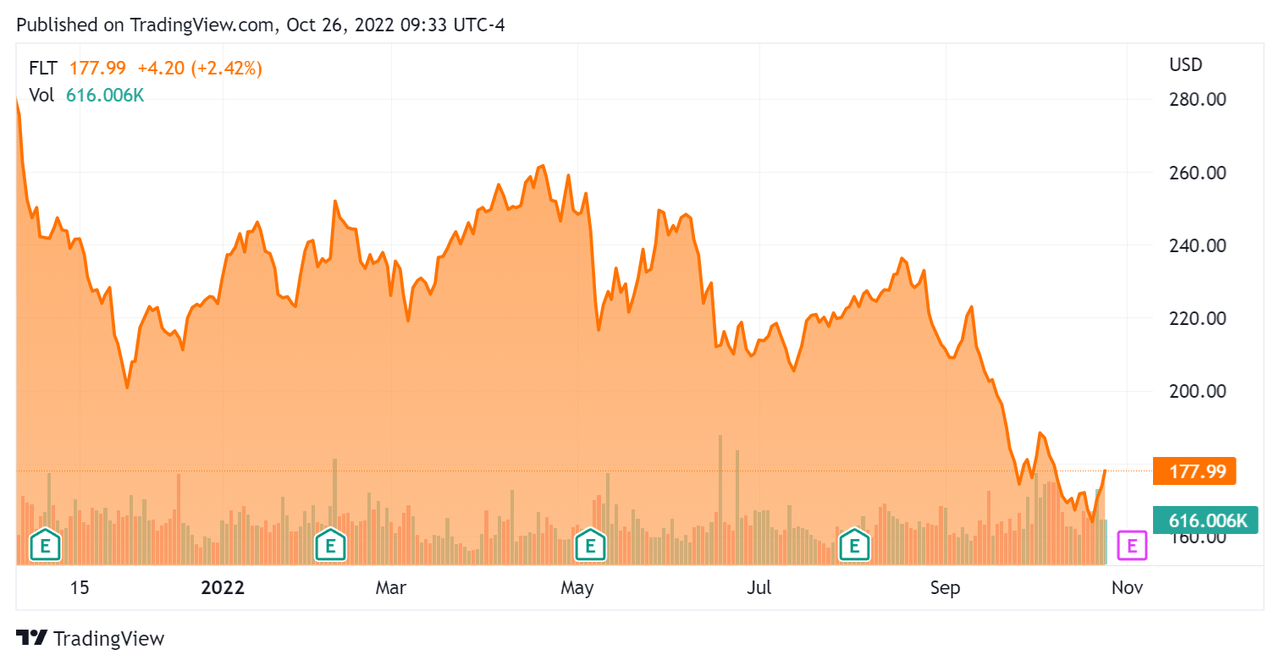

In the past 12 months, FLT’s stock price has dropped 36.7% vs. the U.S. S&P 500 index’ drop of around 16.1%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

5.76 |

|

Revenue Growth Rate |

29.4% |

|

Net Income Margin |

29.3% |

|

GAAP EBITDA % |

50.6% |

|

Market Capitalization |

$13,040,000,000 |

|

Enterprise Value |

$18,490,000,000 |

|

Operating Cash Flow |

$882,470,000 |

|

Earnings Per Share (Fully Diluted) |

$11.64 |

(Source – Seeking Alpha)

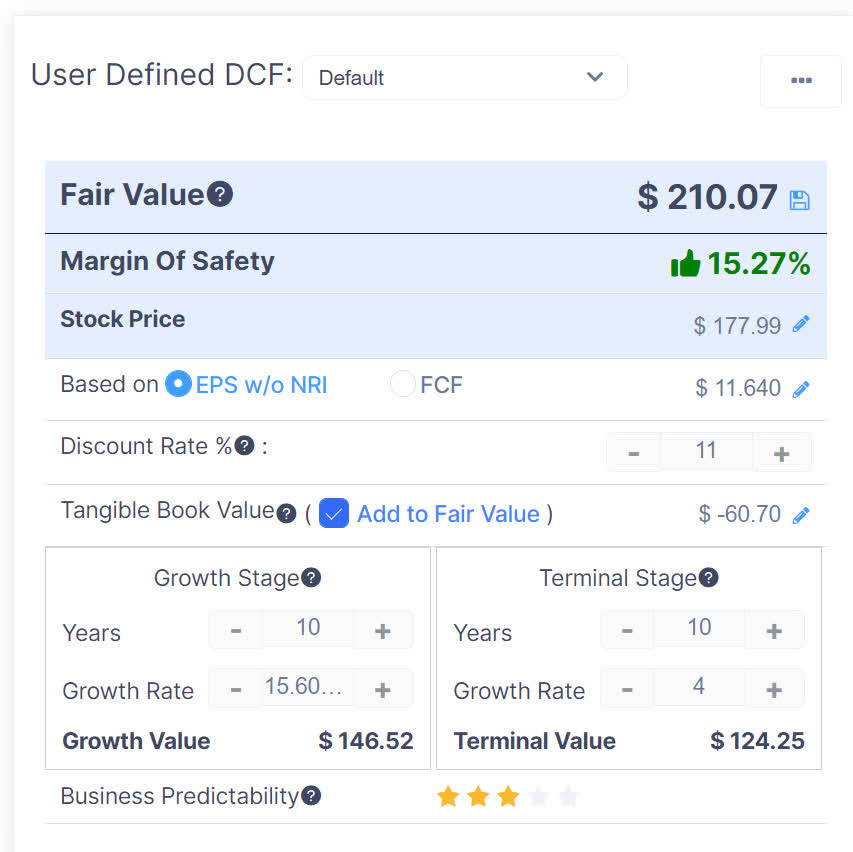

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

FLEETCOR Discounted Cash Flow (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $210 versus the current price of $178, indicating they are potentially currently undervalued, with the given earnings, growth and discount rate assumptions of the DCF.

Commentary On FLEETCOR

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted revenue above its previous expectations amid ‘continued recovery in Corporate Payments and Lodging.’

CEO Ron Clarke sees post-COVID growth going forward, including with its proprietary gas station, hotel, toll and virtual card networks.

The benefit of its proprietary networks also includes receiving ‘more data and deeper discounts than [its] general purpose competitors.’

Its efforts to ramp up electric vehicle charging station payments continues to gain speed, especially after the quarter end with its acquisition of Plugsurfing, a European EV charging network.

As to its financial results, topline revenue rose 29% due to organic growth, M&A activity and macro conditions.

EBITDA margin dropped year-over-year due to higher stock-based compensation and bad debts, while earnings per share jumped sequentially.

For the balance sheet, the firm ended the quarter with $1.4 billion in cash, equivalents and trading asset securities and $6.9 billion in total debt.

Over the trailing twelve months, free cash flow was $750.1 million, including $132.4 million in CapEx.

Looking ahead, management expects the second half macro and foreign exchange conditions to have a net neutral effect on its results.

However, the firm increased revenue guidance for the full year 2022 to be at around 20% growth over 2021, with cash EPS growth of 21%.

Regarding valuation, the market has punished FLT in recent quarters since interest rates have risen sharply, likely due to the firm’s significant debt load and increasing cost of capital as its existing hedges come off in January and December 2023 and its debt service costs escalate.

The primary risks to the company’s outlook include a macroeconomic slowdown in the regions in which it operates, thereby reducing payments growth, and the pending escalation in interest expense due to its material debt load.

While FLT is investing in growing its EV charging and related payments capabilities in Europe, its earnings results may be reaching a near-term peak as its debt service costs grow markedly throughout 2023.

As economies slow, the firm will see an increase in bad debts and fraudulent usage activity, also adding to expenses.

For patient investors, FLT may represent a bargain here, but I’m more cautious and on Hold for the time being.

Be the first to comment