10’000 Hours/DigitalVision via Getty Images

Fiverr (NYSE:FVRR) has crashed by around 90% from all time highs – an astounding fall. That fall shows both the magnitude of the bubble that it had previously traded at, as well as the undervaluation that it trades at today. While growth is expected to slow this year due to both tough comparables and a slowing economy, the long term secular growth story of freelancing remains intact. This is the kind of stock that I could see exploding higher once valuations return to healthy levels in the tech sector. I rate the stock a buy and I have purchased a small position myself.

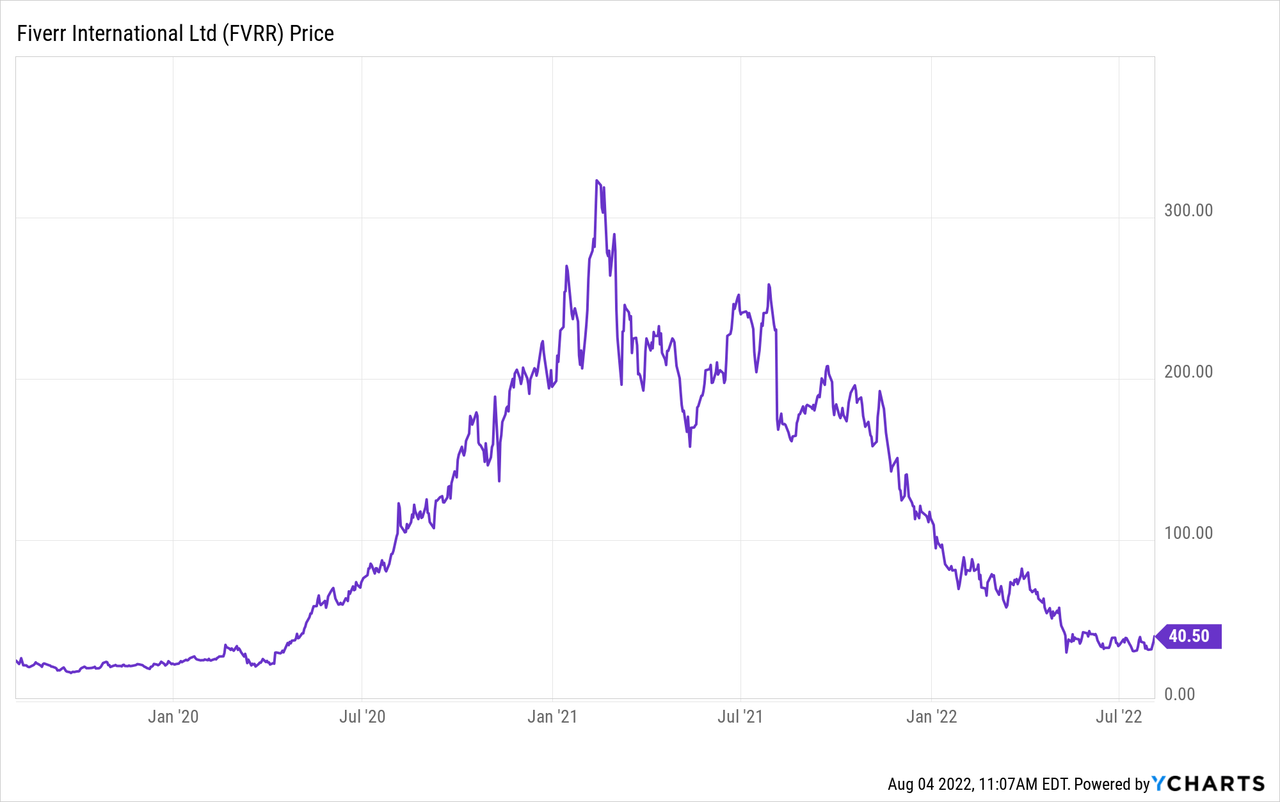

FVRR Stock Price

FVRR reached its all time high around $323 per share in early 2021 but has since crashed around 87%.

I last recommended buying the stock in March and it has since fallen 45%. The stock was already cheap at that time but I had not yet purchased the stock officially due to my desire for more of a discount to account for the elevated risk. The 45% slide since then has provided that discount – and then some.

FVRR Stock Key Metrics

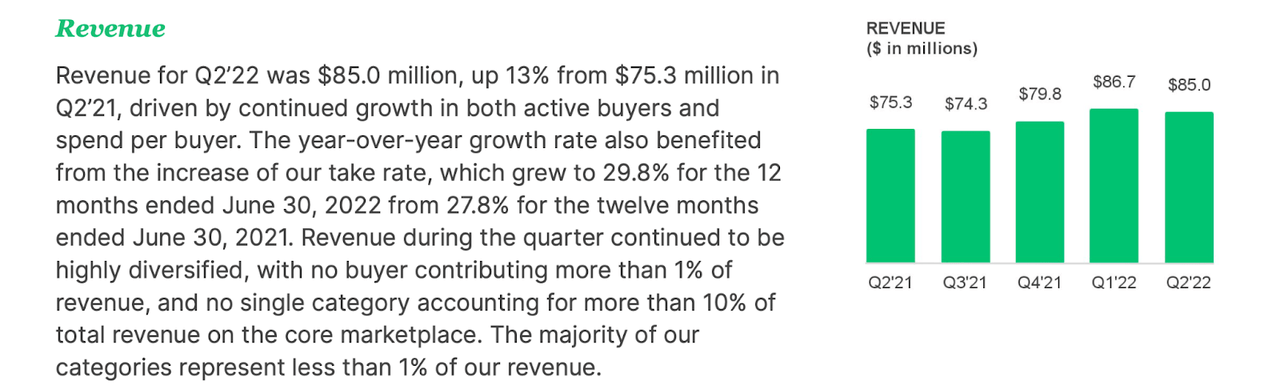

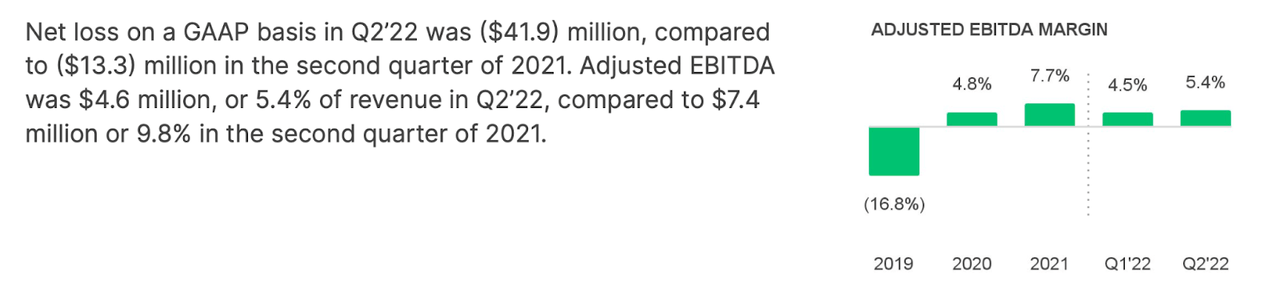

FVRR delivered results which fell short of guidance. Revenue came in at $85 million, below the $86 million to $87.5 million range given last quarter.

2022 Q2 Shareholder Letter

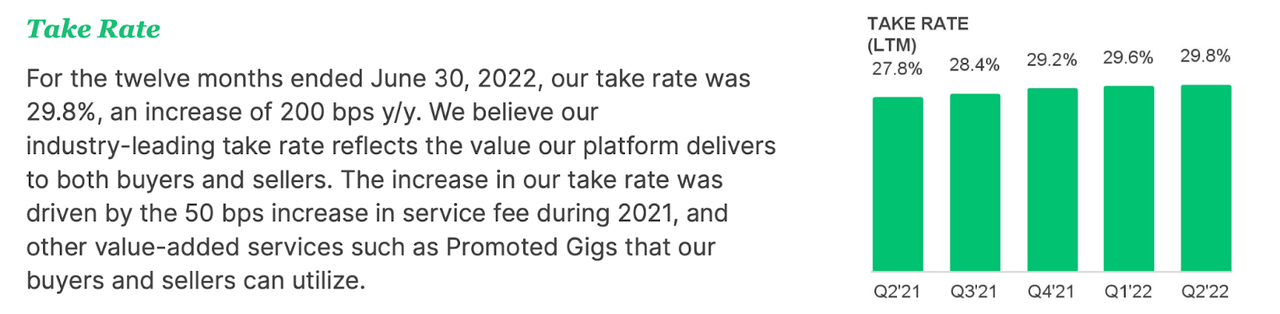

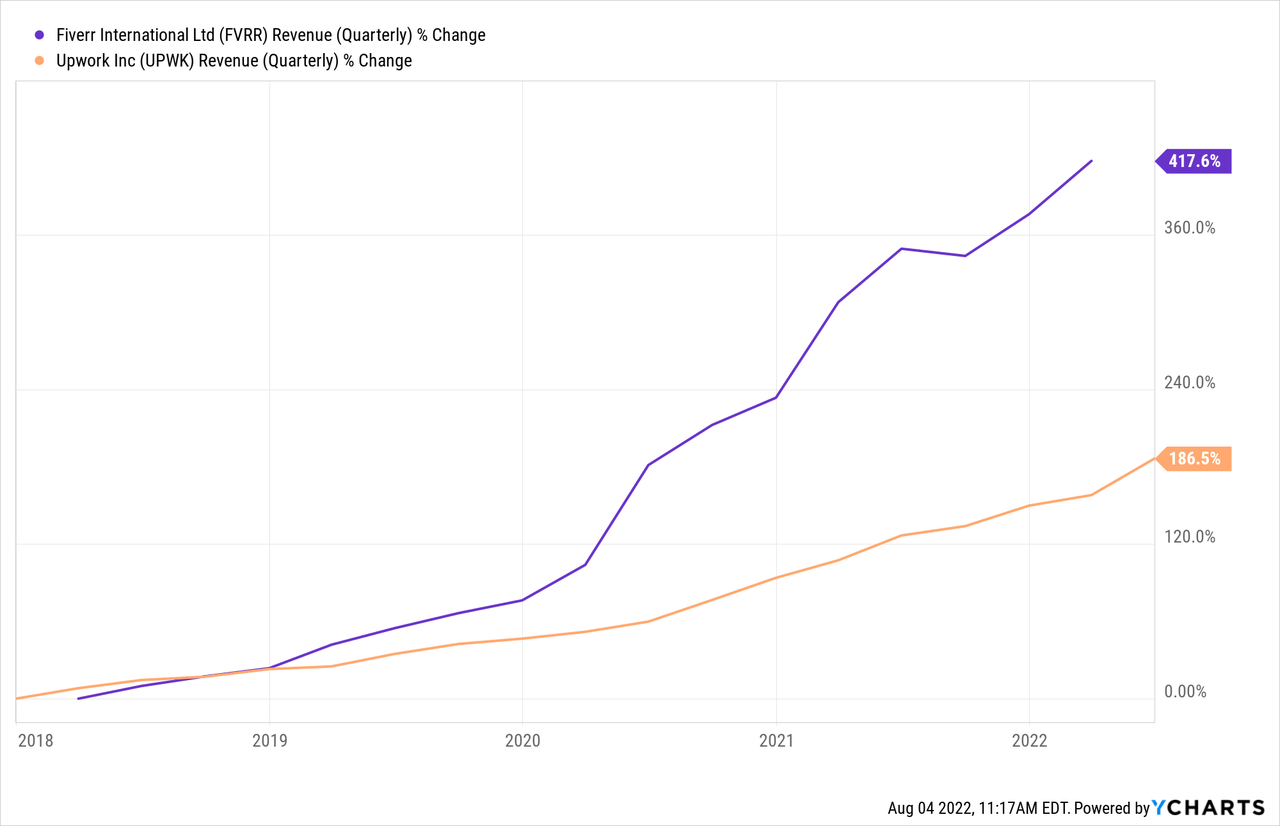

That growth rate fell short of the 26% growth rate seen at Upwork (UPWK). I suspect the discrepancy to be due to FVRR’s greater exposure to recessionary fears, as its projects tend to be smaller than UPWK. FVRR drove much of the revenue growth due to a 200 bps jump in its take rate.

2022 Q2 Shareholder Letter

FVRR has historically had a higher take rate than peers like UPWK, which had a take rate of 15% in its latest quarter. FVRR has typically justified its higher take rate due to the smaller size of its projects and its arguably stronger sales funnel, as evidenced by its stronger growth rate.

FVRR is not yet profitable on a GAAP basis, but has been sustaining a low single digit adjusted EBITDA margin.

2022 Q2 Shareholder Letter

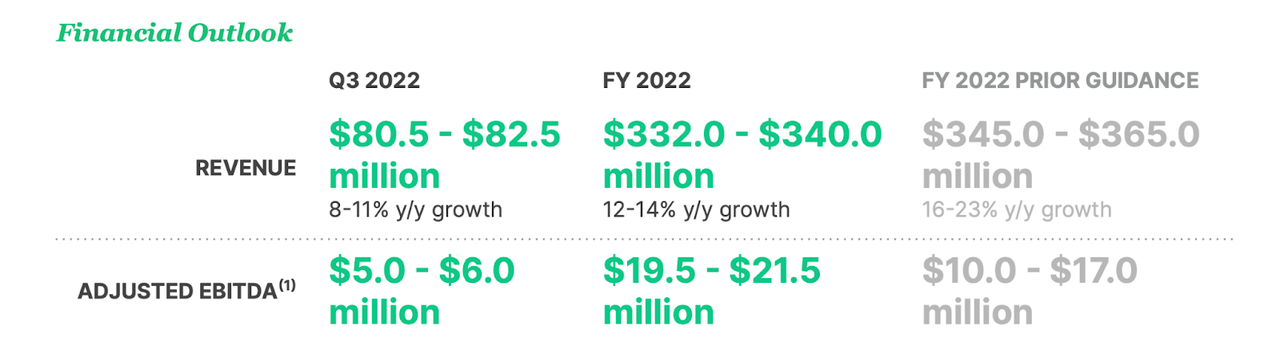

Looking forward, FVRR expects to see up to 11% growth in the next quarter. The company did bring its full-year guidance lower to $340 million versus $365 million previously (this is the second time the company has reduced guidance this year).

2022 Q2 Shareholder Letter

FVRR ended the quarter with $528.3 million of cash versus $451.5 million of convertible notes. Those convertible notes carry a 0% interest rate, mature in 2025, and have a conversion price of $305.10 per share (net of capped call transactions).

Is FVRR Stock A Buy, Sell, or Hold?

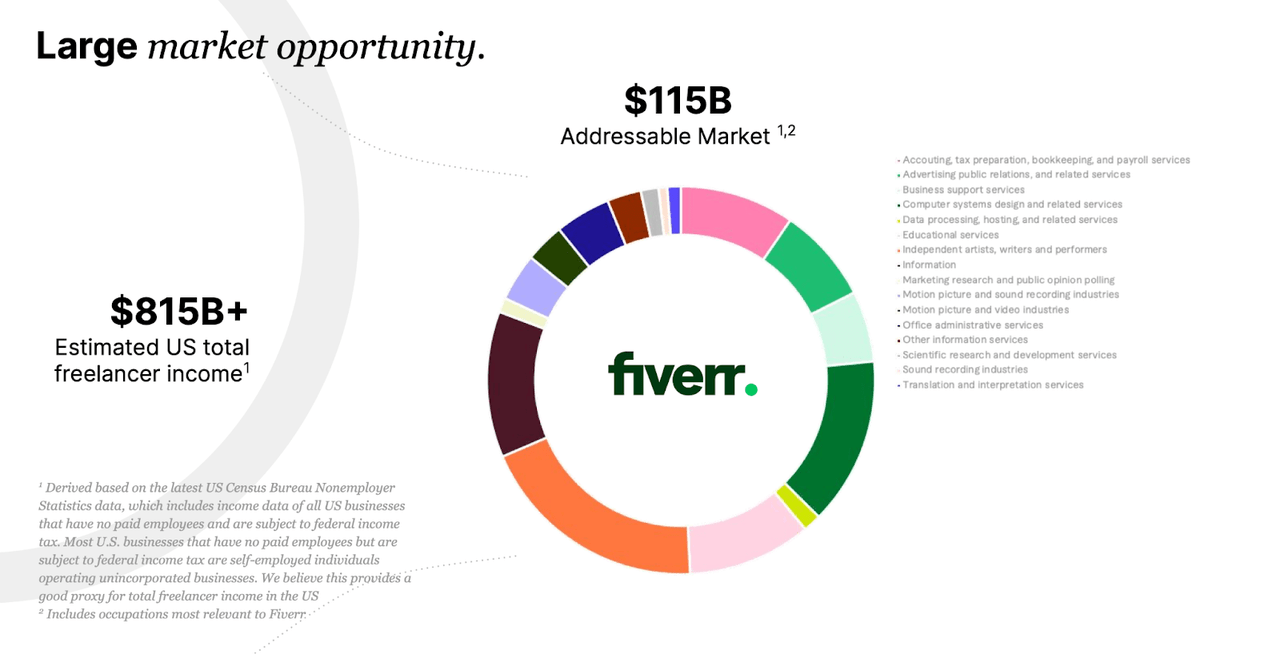

I would not be surprised if FVRR misses even on their reduced guidance due to the ongoing market volatility. But longer term, the freelancing market opportunity remains very large.

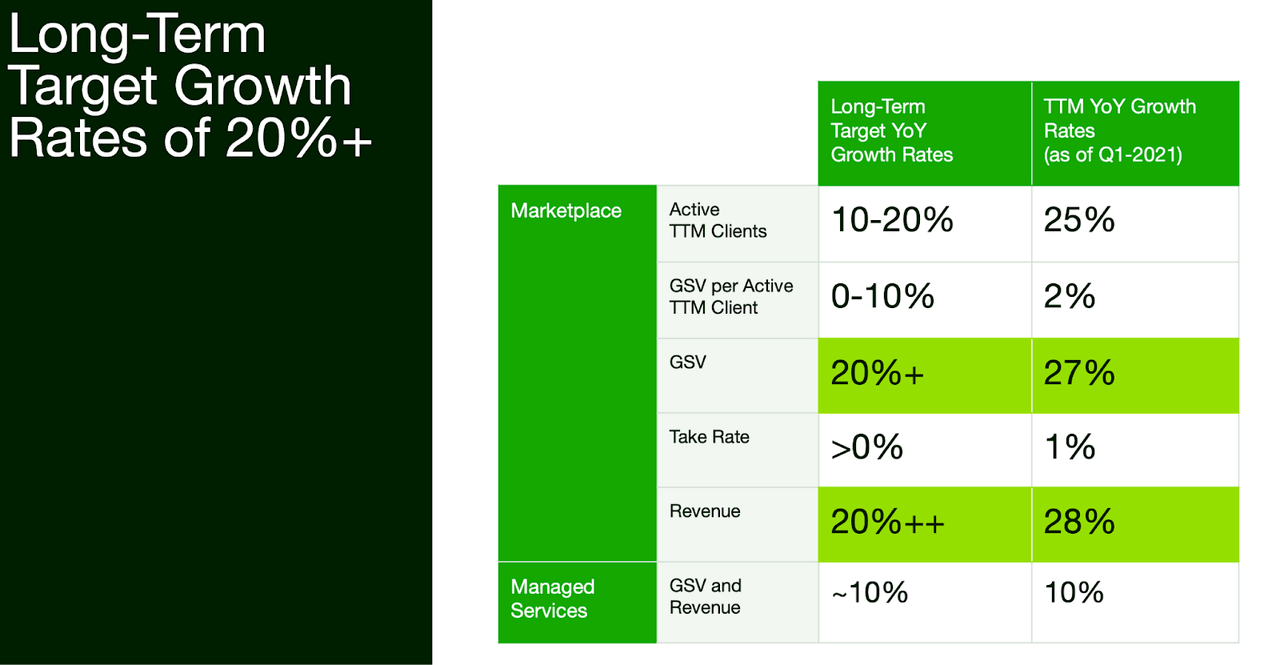

May 2022 Investor Presentation

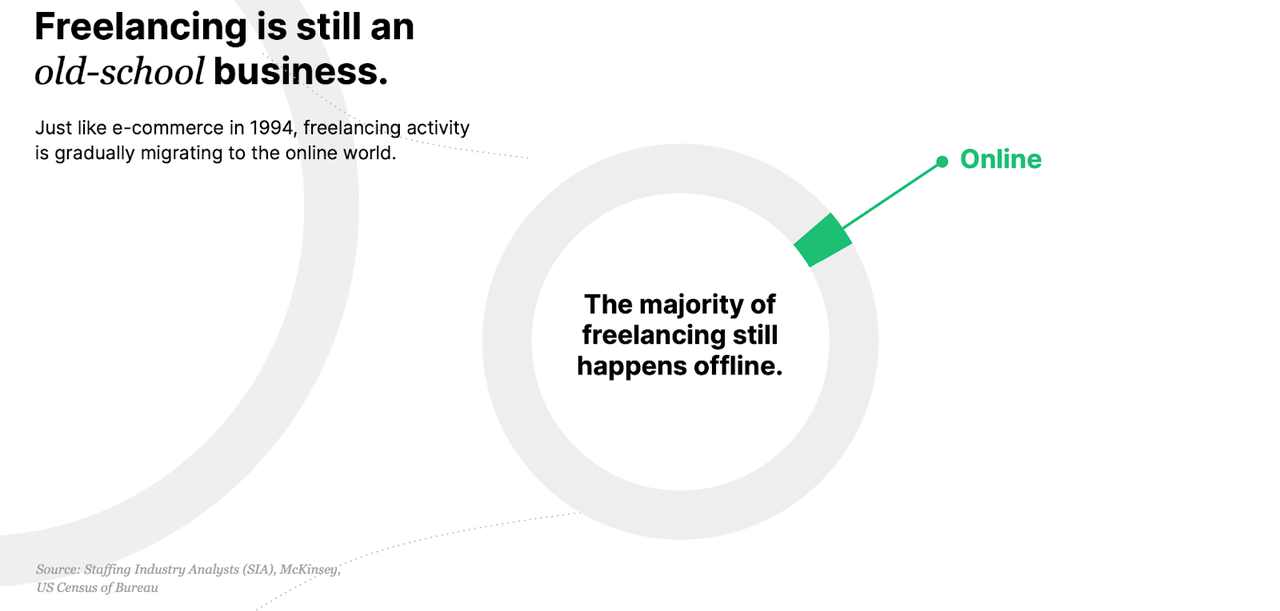

Put more specifically, I view FVRR to be similar to e-commerce operators in that it is helping to bring freelancing online.

May 2022 Investor Presentation

This means that FVRR, as an online freelancer marketplace, will benefit both from the growth of the freelancer economy as well as from gaining market share within it. FVRR has not given long term guidance, but its peer UPWK has guided for long term revenue growth north of 20%.

Upwork 2022 Investor Presentation

FVRR is guiding for slower growth than that this year, but I expect growth rates to rebound when the economy eventually stabilizes. FVRR is currently trading at only 4x forward sales. If the company can sustain 20% growth rates then the stock has considerable upside from here. I assume that the company can sustain 30% net margins over the long term and that the stock trades at a conservative 1.5x price to earnings growth ratio (‘PEG ratio’). This would place the stock at 9x sales – representing a stock price of $85 per share and potential upside north of 100%. There are some important risks. FVRR is not yet profitable on a GAAP basis and even on a non-GAAP basis its margins are slim. The company does have a cash-rich balance sheet which should support liquidity over the near term, but dilution may persist for many years and the company may find itself with a sizable debt load in an economic downturn. Another risk is that of what the freelancing market looks like over the long term. Will there be multiple market leaders, or will there only be one winner? If it is the latter, will that winner be FVRR? FVRR has outperformed UPWK in the past, but that may not continue moving forward. It may make sense to invest in both FVRR and UPWK to diversify that risk – UPWK also looks compelling at current levels (both are included in the 2022 Tech Stock Crash List provided for subscribers). I rate FVRR a buy due to the deep undervaluation and have purchased a small position myself.

Be the first to comment