nazar_ab/E+ via Getty Images

Investment Thesis

As of December 26, 2021, First Watch had 435 system-wide restaurants in 28 states, 341 of which were company-owned while 94 were franchised. The company is opening new restaurants and its revenue and operating performance is improving.

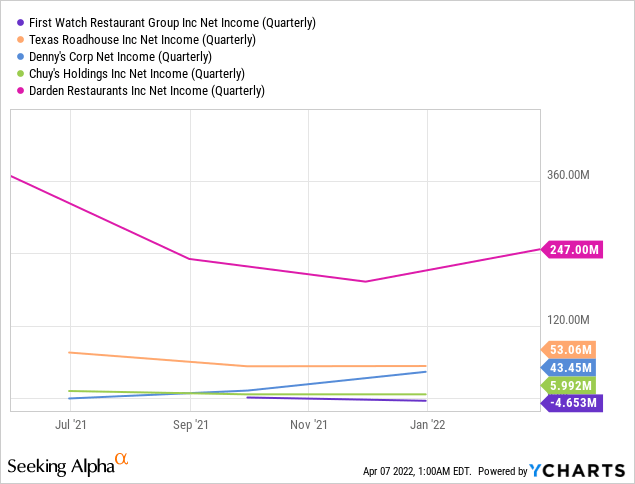

Its 2021 revenue is higher by 37.8% from the pre-covid level in the year 2019. However, generating profits for shareholders still seems challenging and the company reported net loss of -$4.7 million in Q4 2021 when several peers reported profits. Investors would find better options elsewhere in the restaurant industry.

An Overview Of The Company

Bradenton, Florida based First Watch Restaurant Group (NASDAQ:FWRG) was founded in the year 1983. First Watch is a restaurant concept that serves made-to-order breakfast, brunch, and lunch from scratch using fresh ingredients. The company operates for limited hours from 7:00 a.m. to 2:30 p.m. The Company does not have operations outside the United States.

As of December 26, 2021, the company had 435 system-wide restaurants in 28 states, 341 of which were company-owned while 94 were franchised. Advent, one of the private equity firms, owns a majority stake in the company. The company has around 10,000 employees. First Watch Restaurant went public in October 2021.

Service Overview

The restaurant serves made-to-order breakfast, brunch, and lunch. Its menu features items such as Avocado Toast, Smoked Salmon Eggs Benedict, Farm Stand Breakfast Tacos, and Lemon Ricotta Pancakes, as well as rotating seasonal items such as the Trailblazer Bowl, Carnitas Breakfast Tacos, Superseed Protein Pancakes, and a rotating fresh, seasonal juice.

Source: Company’s website

The rise of the gig economy, flexible work hours, and expansion of remote work – trends that got further supported by the covid-19 pandemic – are increasing demand for fast and flexible daytime dining, which traditional rigid breakfast and lunch dayparts were not designed for.

Competitive Environment

First Watch Restaurant operates in a highly competitive and fragmented industry where it competes directly and indirectly in terms of dining experience, food quality, service, price, and location. Its competitors also include grocery store chains and meal subscription services. Marketing and brand reputation can be key to the company’s growth.

First Watch Restaurant believes that it is well-positioned to compete with national, regional, and local establishments that operate during its hours of operation. Consumers increasingly seek higher-quality breakfast, brunch, and lunch experiences and First Watch believes there is no comparable offering in the segment that operates at scale. It sees its primary competition as a network of independent restaurants that serve breakfast and lunch in neighborhoods across the United States.

Competitive Advantages

As the company focuses on one daytime shift, it can optimize restaurant operations. It generated average annual sales volumes of $1.8 million per restaurant in 2021 serving only 7.5 hours per day. This daytime focus also helps First Watch attract and retain employees who are passionate about hospitality and are attracted to the company’s “No Night Shifts Ever” philosophy.

First Watch Restaurant Group

“Follow the Sun” is the company’s guiding principle when it comes to sourcing. This means it incorporates ingredients harvested at the peak flavor and freshness into each season’s menu.

The company’s menu is constantly evolving to keep it fresh and exciting while remaining operationally efficient. Its five highly anticipated seasonal menus, as well as the introduction of new platforms, encourage customers to return and spend more money.

According to First Watch, the company’s integrated technology has improved the convenience of its customers when ordering directly from First Watch and its third-party delivery partners.

The alcohol platform reflects the company’s culinary philosophy by combining fresh juices and ingredients with a variety of liquors to create craft cocktails. Craft cocktails were available in 305 restaurants as of December 26, 2021, including company-owned and franchise-owned restaurants, with clear plans to expand to all restaurants where possible.

For nearly four decades, First Watch has grown primarily through word-of-mouth, with loyal customers attracted by its service, menu, and atmosphere. While the company believes that organic awareness growth contributes to a local feel, it also recognizes the value of strategically marketing its brand through appropriate channels to increase brand awareness.

Financial Performance

First Watch’s total revenues increased by 48.6% to $162.6 million in Q4 2021, up from $109.4 million in Q4 2020. The company reported a net loss of -$4.7 million in Q4 2021, compared to -$7.1 million in Q4 2020.

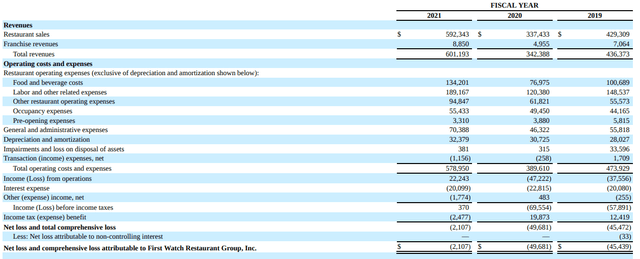

Source: 10-K

For the year 2021 the revenues increased by 75.6% to $601.2 million from $342.4 million in the year 2020. The company’s 2021 revenue was higher by 37.8% from pre-covid level of $436.4 million in 2019. The company reported net loss of $2.1 million for 2021, compared to $49.7 million in 2020. The restaurant level operating profit margin reached to 19.5% in 2021, which was higher than 17.4% in the pre-Covid 2019 period.

The company had $51.9 million in cash and cash equivalents and $100.0 million in outstanding borrowings as of December 26, 2021. It had $75.0 million in unused borrowing capacity under its new revolving credit facility as of December 26, 2021.

Growth Prospects

In Q4 2021, First Watch opened five company-owned and three franchise-owned restaurants, bringing the total number of system-wide restaurants to 435 (341 company-owned and 94 franchise-owned) across 28 states as of December 26, 2021.

Chris Tomasso, Chief Executive Officer and President of First Watch noted:

Q4 2021 represented one of our strongest quarters of same-restaurant traffic growth yet, increasing 31.9% versus Q4 2020 and 6.1% versus Q4 2019.

2022 Outlook:

- The company expects total revenue to increase by more than 15% from 2021

- It expects to open 30 to 35 new company-owned restaurants and 8 to 13 franchise-owned restaurants.

- Anticipates $60.0 million to $70.0 million in capital expenditures on new restaurant projects, planned remodels, and new in-restaurant technology.

Valuation

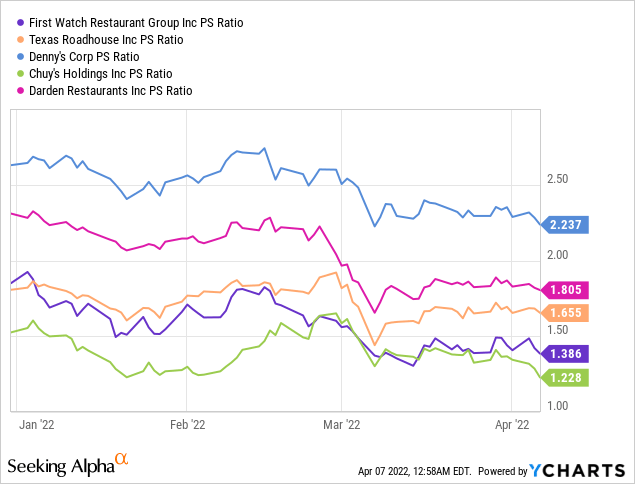

Based on price-to-sales ratio, First Watch’s valuation looks attractive compared to its peers.

However, the company is incurring losses, even though its sales are growing. First Watch believes that it has some pricing power and can offset the impacts of inflation on its margins.

As the pandemic-related restrictions got lifted, most of First Watch’s peers reported profits. First Watch Restaurant Group’s losses explain its relatively cheaper valuation.

Risk Factors

- Food and beverage prices are increasing and inflation concerns put First Watch at risk. The ability to anticipate and react to changes in these costs is crucial to the company’s profitability. Increases in fuel prices may also lead to increased distribution costs.

- The company relies on just one distributor to provide virtually all its food distribution services in the U.S. Likewise, it relies on very limited suppliers for its pork, egg, and avocado needs. That increases risk of supply disruption if the suppliers or distributors aren’t able to meet their obligations.

Conclusion

The demand for fresh and healthy food is increasing, which benefits the company because it focuses on providing freshly prepared food made with quality ingredients. The company’s off-premises offering has become more convenient and accessible to customers because of its integrated technology and improvements. On the other hand, the company faces risks of inflation, which may continue to hurt its profit margin.

First Watch is expanding restaurants rapidly. Its same-restaurant sales are growing, and losses are narrowing. It believes it has some pricing power to offset effects of rising inflation. However, it might be best to watch this stock from the sidelines until the company becomes profitable.

Be the first to comment