guvendemir

When the US Senate passed the “Inflation Reduction Act” this weekend, First Solar (NASDAQ:FSLR) seems to have reached the tipping point discussed in recent articles about the Company: “First Solar To Have A Tough 2022 Without US Subsidies” and “FSLR Near Term Prospects Tied To Reconciliation Bill”. With the long-anticipated solar manufacturing credits set to pass congress and signed by the President in a matter of days, it is time to review recent First Solar Q2 2022 results and where the Company could go from here.

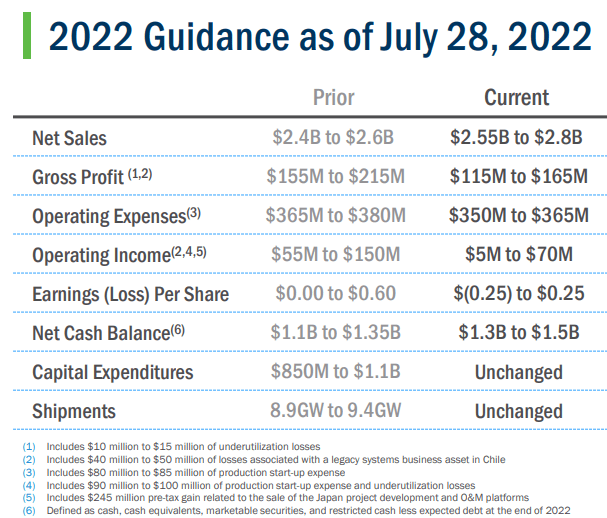

The Company delivered a Q2 revenue and earnings beat but, due to ongoing logistics turbulence and project dynamics, the Company guided up revenues and simultaneously guided down EPS (image below).

First Solar Q2 Earnings Presentation

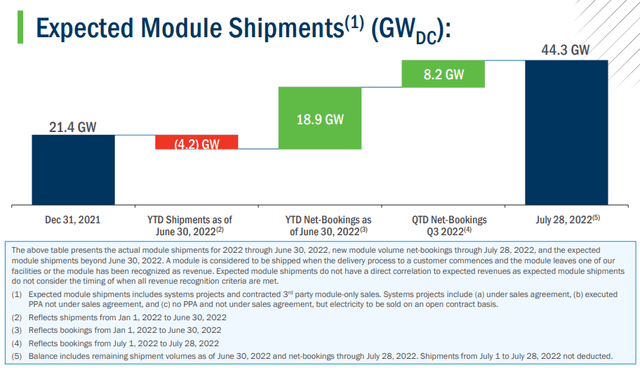

In many ways, the Company is continuing to struggle in an environment driven by COVID-related logistics issues and cost increases. Given these short-term challenges, there is not much reason to be excited by the Company’s near-term business prospects. However, looking further out in time, the Company is continuing to see tremendous prospects as evidenced by the strength in bookings (image below). In the first six months of 2021, the Company has more than doubled its year-end 2021 bookings and is now booking projects into 2026 and 2027. Management noted that interest is increasing worldwide, especially in Europe, for First Solar products.

First Solar Q2 Earnings Presentation

Excluding the output of the new India manufacturing facility, the Company is now sold out for 2024. Excluding India, the Company has 12GW of planned deliveries in 2025 and 2.6GW of planned deliveries in 2026 and beyond. Not only is First Solar booking a lot of new business, but in an industry used to consistent price decreases, the company is booking the business at almost unheard-of flat pricing and with contract terms where the customers increasingly share or take on logistics risks. Management communicated that 2022 to 2025 pricing is about 30.1 cents per watt excluding adjusters which are likely to push the prices further up.

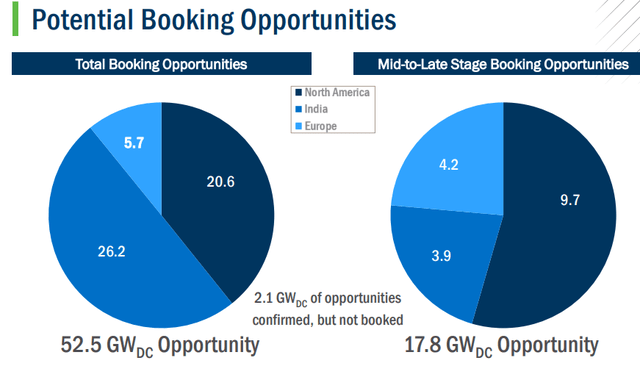

Despite such strong bookings, the new business opportunity pipeline continues to be strong – indicating that there is likely to be ongoing strength in bookings (image below).

First Solar Q2 Earnings Presentation

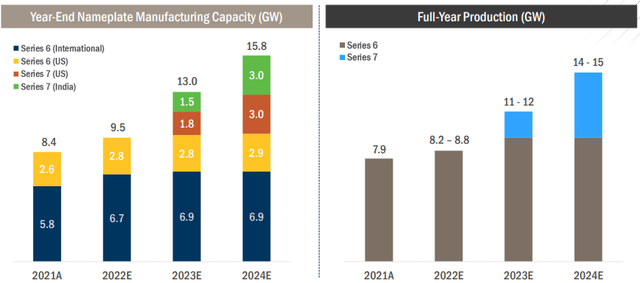

As discussed below, the Company’s planned production capacity is woefully short of demand. The company’s capacity plan from earlier this year, prior to the new manufacturing credits and prior to the recent steep uptick in bookings, can be seen in the images below:

First Solar Q4 2021 Earnings Presentation

Given this capacity plan, the company is not able to take additional bookings through 2024. With 12 GW of bookings for 2025, unless there is significant capacity growth in 2025 from 2024 levels, the company is pretty much sold out of 2025 capacity too (excluding India). In effect, First Solar, with the current plan, is unable to take on much new business until 2026! Even for a conservative company like First Solar, this is a ridiculous situation to be in. (Note: The situation is not a sign of management incompetence but being driven by the sudden and large uptick in bookings – in part precipitated by strategic concerns about China and Russia/Ukraine war-driven energy challenges. Of course, management conservatism has worsened the impact).

It is with this constrained capacity and strong demand backdrop that Congress is about to pass the Inflation Reduction Act. If this bill passes, First Solar will get lucrative solar manufacturing credits as follows:

- $0.04 per watt thin-film credit. This credit is specific to thin-film solar and outside of First Solar, no other module manufacturer has meaningful thin-film production volumes today. Even if Chinese or other solar module manufacturers start production in the US to benefit from the new bill, they are unlikely to benefit from this credit for the foreseeable future.

- $12 per square meter of wafer credit: This less well-known credit, which appears to have been initially written originally for crystalline silicon modules, as an equivalent to the thin film credit above, is vague enough that First Solar can now access this credit. This is additive to the thin film and is based not on a per watt basis but on “wafer” size. For a 2.5 m2 Series 6 module, this credit amounts to $30 or about 6.5 cents per watt at current module efficiency. For the next generation Series 7 module, which is larger, this credit would be about $34. Assuming bifacial or tandem functionality, this credit could drop to about 5 cents per watt for next-generation modules.

- $0.07 per watt module credit. This is a credit that all manufacturers including Chinese companies could access if they produce solar modules in the US. Over time, we can expect manufacturers like JinkoSolar (JKS), Canadian Solar (CSIQ), and others to access this credit. In other words, this will help First Solar on a relative basis in the near term but only until competitors start producing their own modules in the US.

Over time, as competition absorbs these credits and drives down prices, the benefit of these credits will fade away compared to peers with production in the US.

Anything that the Company produces in the US, regardless of where it ships to, would be entitled to this credit. Given these generous incentives, it is likely that First Solar will step up its capacity ramp and exit 2022 with about 3 GW of US capacity. Similarly, First Solar is likely to be more aggressive in 2023 and deliver about 2 GW of Series 7 modules in 2023 compared to the current plan of 1.8GW. With a total of about 5 GW US capacity in 2023, First Solar should be getting credits of about $875M. This should flow directly to the operating profit line. If First Solar’s international capacity and project business contribute at the current level, the total 2023 EPS would be in excess of $8 per share (15% tax rate assumed – actual EPS could be higher depending on the tax treatment of the manufacturing credits).

It may be a quarter or two before First Solar decides where and how much capacity it will add, but it seems likely that the company will add, at the minimum, 3 GW to 6 GW of new capacity on top of the existing plan. How much this capacity will contribute to shareholders is a matter of when the new capacity comes online and the markets that First Solar serves.

Prognosis

To be sure First Solar stock has moved up nicely since the bill started moving through Congress and one may wonder what part of the upside from the bill is already built into the stock. As discussed below, the upside for First Solar is significant and ongoing. While the stock has already moved up nicely, it still has a long way to go as the company exploits the subsidies in the Inflation Reduction Act.

First Solar is likely to add a large amount of new capacity over the coming years to benefit from the Inflation Reduction Act. Existing capacity and any new First Solar capacity coming online by 2025 could garner as much as 17 cents per watt in subsidies. With aggressive capacity expansion, the company could supply to countries other than the US, but the profitability on those shipments will be a bit less than shipping the modules locally.

On the flip side, crystalline silicon competitors could use the subsidy regime and should start pumping out competitive products by 2025 and driving down ASPs. As competition sets in, the relative cost/subsidy benefit for First Solar should steadily drop over a period of time. Given the variables at play, it is extremely difficult to forecast how exactly First Solar’s advantage peters out over time.

These dynamics, especially not knowing the capacity ramp and not knowing how the subsidy advantage will tail off, and not knowing which First Solar will choose to serve, make calculating First Solar’s long-term earnings power difficult. Assuming a fairly conservative ramp, as a first-order approximation, it appears that First Solar’s EPS will be $8+ in 2023, $11+ in 2024, and peak around the $15+/- range in 2025 or 2026. After 2026, the benefits of increases in capacity are likely to be offset by ASP drops as new competitive capacity comes on board.

As First Solar unveils its capacity plan and starts guiding for 2024, EPS expectations of $11+ could easily attract a 10x to 15x multiple on the stock. This could result in a $110 to $165 valuation for the Company over the next several quarters. Looking further out, a midpoint EPS of $15 in 2025 could easily attract a 10x to 15x multiple as the year 2024 progresses. This would indicate a potential $150 to $225 valuation in the 2024 time frame. The risk to this thesis, of course, is that the Inflation Reduction Act, does not make it through the house. This risk appears remote.

Be the first to comment