apomares/E+ via Getty Images

The image of a rising sun over the horizon has come to symbolize hope, optimism, and progress. And now energy from the sun, previously uneconomical for much of the start of the new millennium, now stands at the cusp of runaway growth that will change the world energy markets forever. The implications are material for the economy, environment, geopolitics, and ultimately the global drive toward net-zero.

Net-zero has long been thought of as an unrealistic dream of bureaucrats, it very well may be, but the Inflation Reduction Act represents the most unprecedented intervention by a government anywhere in the world to influence this drive. The underlying thesis is that the wholesale architecture of energy systems has to change to reduce dependency on fossil fuels and limit the extent of observed anthropogenic climate change. Hence, every relevant part of the economy has to rise to the challenge to help restrict the rise in mean global temperature to well below 3.6 °F above pre-industrial levels.

The Act will allocate $370 billion over 10 years to decarbonization initiatives and is set to be the largest climate and clean energy investment in US history. It will form a crucial part of the US effort to reduce greenhouse gas emissions to the White House target of 50% below 2005 levels by 2030. Boston Consulting Group forecasts that it could increase the deployment of carbon-free energy to up to 80% of electricity production by the end of the decade, up from around 20% of production currently. The Act is also set to offer investment tax credits to domestic solar manufacturers and has the potential to see First Solar (NASDAQ:FSLR) realize an incremental $8 to $10 per share in annual earnings from these credits.

Tempe-based First Solar is a $14 billion dollar solar panel manufacturer and provider of utility-scale PV power plants. The company also provides finance, construction, maintenance and end-of-life panel recycling as supporting services to customers.

Supercharging The Ramping Rollout Of Solar Energy

Solar power accounted for just 3% of U.S. electricity generation from all sources in 2020. This was set to increase to around 5% this year and then 14% by the middle of the next decade.

U.S. Energy Information Administration

The Act is set to bring forward this date materially, with the five-year outlook for the US solar industry dramatically changed. Analysts now expect solar deployment to increase by 40%, around 62 GWDC, over pre-IRA projections through 2027. However, it is important to note that the extent to which First Solar will be able to expand production to fully realize the revenue opportunities will depend on how quickly and effectively the company is able to expand capacity. Management has already stated that they were almost already sold out through 2026. Hence, capacity will have to be extended.

The company recently announced plans to invest up to $1 billion in a new 3.5 GWDC manufacturing facility in the Southeast. The existing Northwest Ohio factory will be expanded by 0.9 GWDC through a $185 million investment. The Southeast facility will become the company’s fourth domestic factory and is expected to commence operations in 2025. This will see First Solar’s total panel-making capacity in the US rise to 10.6 GWDC by 2025, up from an expected 6 GWDC next year.

The demand is expected to be rapacious, with First Solar recently announcing several new customers from around the world. As such, there is a likelihood of a follow-up capacity expansion investment in another US-based factory within the next 6 to 12 months.

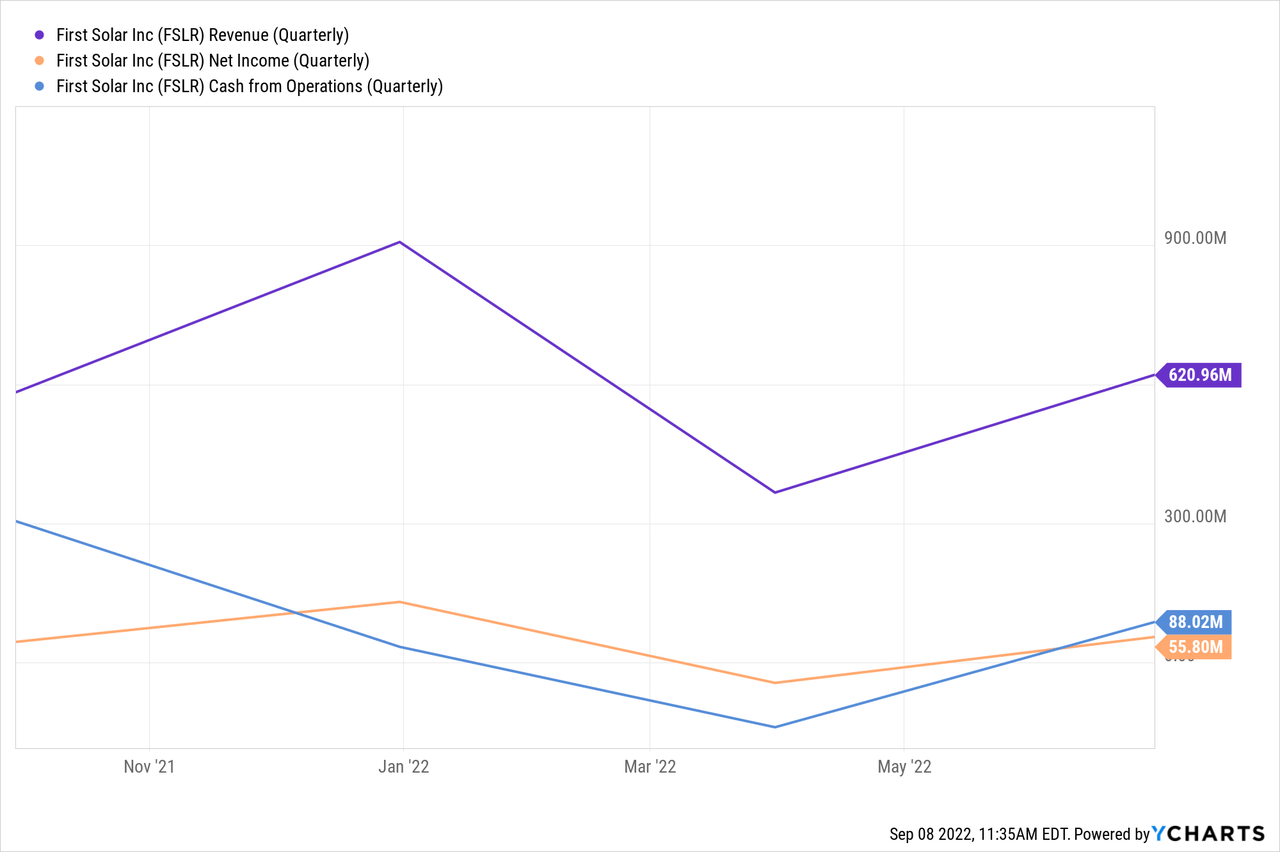

The company last reported earnings for its fiscal 2022 second quarter, which saw revenue come in at $620.96 million, a 1.3% decline from its year-ago quarter but a beat of $14.51 million on consensus estimates. The key takeaway was the raised revenue guidance for fiscal 2022 to between $2.55 billion and $2.8 billion, up from a prior outlook of $2.4 billion to $2.6 billion.

First Solar also generated healthy cash from operations during the quarter of $88 million, which helped push total cash and equivalents to $1.84 billion. Valuation remains stretched, with the upwardly revised revenue guidance still leaving the company with a price to forward sales of 5.51x. This is almost double the 2.77x sector average.

At The Cusp Of A Boom

US solar energy now stands at the cusp of a solar energy boom. Indeed, the rollout of solar farms was already ramping up, but the IRA represents a high-octane boost that will usher in a golden age of renewable energy and guarantee Made In America extends to the drive to net-zero. First Solar is at the heart of this revolution in the US. This has been compounded by the current stratospheric prices for natural gas that has driven an energy crisis like no other. The medium to long-term impact of this will be greater adoption of solar by both commercial and residential customers across the world.

First Solar should be heavily considered for those looking to gain exposure to the rollout of renewable energy in the United States, a runaway adoption that will change humanity forever.

Be the first to comment