gchapel/iStock via Getty Images

The Q4 Earnings Season for the Silver Miners Index (SIL) has come to a close, which means that many producers are busy reporting their year-end Reserve & Resource estimates. One of the most recent companies to report was First Majestic Silver (NYSE:AG), and while we did see reserve growth, metals price assumptions were pulled higher for a second consecutive year to levels well above the industry average. In precious metals bull markets, First Majestic can outperform massively, as it did in Q1-Q3 2016. Still, at more than 3.0x estimated P/NAV, I see no margin of safety at current levels for new investors.

First Majestic Silver Operations (Company Presentation)

Last month, First Majestic Silver released its FY2021 Reserve & Resource update, reporting company-wide mineral reserves of ~63.0 million ounces of silver and ~1.32 million ounces of gold. This translated to a 1% and 118% increase in reserves, respectively. The significant growth in gold reserves was helped by the inclusion of Ermitano into reserves and the acquisition of the Jerritt Canyon Mine in Nevada. However, while reserves did increase, First Majestic continues to have relatively short mine lives (based on reserves), so the key will be reserve replacement in 2022 without the benefit of a major acquisition. Let’s take a look at the update below:

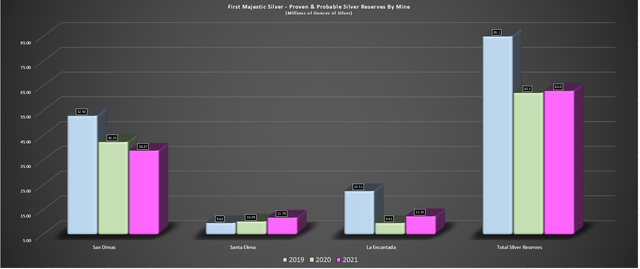

First Majestic Silver – Silver Reserves (Company Filings, Author’s Chart)

As the chart above shows, First Majestic saw a slight uptick in its total mineral reserves in FY2021, with silver reserves increasing just over 1% to 63.0 million ounces, up from 62.2 million ounces in FY2020. This was driven by an increase in reserves at its two smaller assets (La Encantada and Santa Elena) but offset by another decline in reserves at its lowest-cost producing asset: San Dimas. This marked the third consecutive year of declining reserves at this key asset in Mexico, with silver reserves now down 27% vs. 2018 levels (~38.9 million ounces vs. ~53.9 million ounces).

Assuming a throughput rate of ~950,000 tonnes per annum, San Dimas is now down to just ~4.1 years of mine life, which is not alarming for an underground operation but is not ideal either. This compares unfavorably to an 8-year mine life to start 2019 with an annual throughput rate of ~690,000 tonnes and ~5.4 million tonnes of material. Inferred resources have also fallen considerably in the same period, down from ~5.7 million tonnes to ~4.07 million tonnes. Given that this is a key asset to help pull down consolidated costs from its higher-cost operations, investors will want to see reserve replacement in FY2022 following the planned $45 exploration budget.

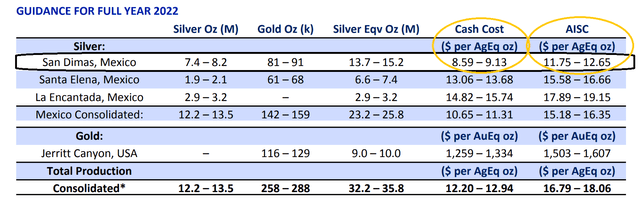

2022 Cost Guidance (Company Filings)

Moving to Santa Elena, we saw meaningful reserve growth, helped by moving the higher-grade Ermitano deposit into reserves. As shown above, reserves at this asset increased from ~10.2 million ounces to ~11.8 million ounces, and grades improved to ~221 grams per tonne silver-equivalent to ~371 grams per tonne silver-equivalent. This was a positive development, with the current mine life extended to 2027, and the company benefits from not having to sell gold under a stream to Sandstorm (SAND) at this asset.

Finally, at La Encantada, First Majestic saw a 29% increase in silver reserves, driven by successful drilling at the Ojuelas and Milagros Breccia deposits. While this has pushed reserves above the 12 million ounce mark, grades fell considerably, down from 201 grams per tonne silver to 170 grams per tonne silver. Besides, even though silver reserves did increase, the key will be continued reserve growth. This is because the mine life here sits at just over two years, assuming a similar throughput rate to FY2021 of ~1.0 million tonnes per annum.

La Encantada Operations (Company Website)

Gold Reserves

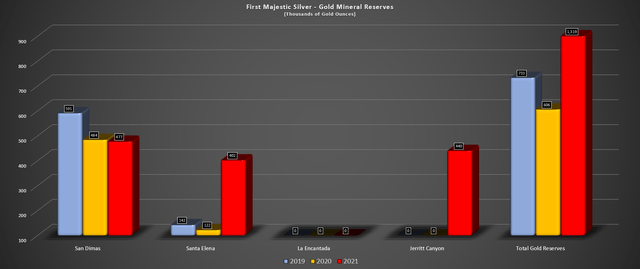

Taking a look at gold reserves, First Majestic saw significant growth, with total reserves increasing from ~606,000 ounces to more than 1.30 million ounces. If we adjust for the 440,000 ounces of reserves at Jerritt Canyon, this translated to an increase of ~280,000 ounces of gold, or nearly 50% growth year-over-year. As noted earlier, this was helped by the inclusion of the Ermitano deposit, which lies just 4 kilometers from the Santa Elena processing plant. At San Dimas, gold reserves were roughly flat year-over-year, albeit at slightly higher grades (3.87 grams per tonne of gold).

First Majestic Silver – Gold Reserves (Company Filings, Author’s Chart)

Finally, at the company’s newest Jerritt Canyon Mine, reserves sit at just shy of 500,000 ounces, representing a relatively short mine life. However, as discussed, First Majestic is spending aggressively this year to grow reserves and resources. Besides, this asset has been neglected in the past from an exploration standpoint, suggesting that it isn’t fair to judge the asset just yet until we give First Majestic at last two years’ worth of exploration to see if it can improve this mine plan. So, while Jerritt Canyon is yet another asset with a sub-5-year mine life based solely on reserves, I don’t see this as a deal-breaker.

Metals Prices Used to Calculate Reserves

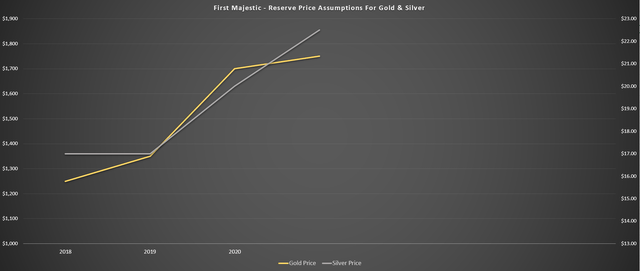

On the surface, this wasn’t a bad Reserve update by any means, but there is one key point worth pointing out. Looking at the chart below, we have seen only slight growth in gold reserves on a two-year basis (Q4 2021 vs. Q4 2019), excluding Jerritt Canyon, even though its metals price assumptions have increased considerably. In fact, silver reserves have actually declined by more than 25% even though the company’s silver price to calculate reserves has increased from $1,250/oz to $1,750/oz for gold and $17.00/oz to $22.50 for silver.

First Majestic Silver – Metals Priced Used to Calculate Reserves (Company Filings, Author’s Chart)

This is a negative trend relative to what we’ve seen from many other producers. In fact, some gold producers like Barrick (GOLD) have seen only a marginal decline in reserves (Q4 2021 vs. Q4 2019) despite maintaining a conservative gold price of $1,200/oz. Meanwhile, in the silver sector, Hecla has grown silver reserves from 177 million ounces to 200 million ounces (2021 vs. 2018) despite only seeing a slight increase in its metal price assumptions ($17.00 vs. $14.50/oz) and assuming a much more conservative silver price assumption than First Majestic ($22.50/oz).

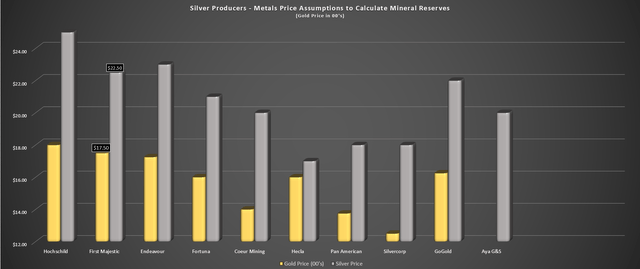

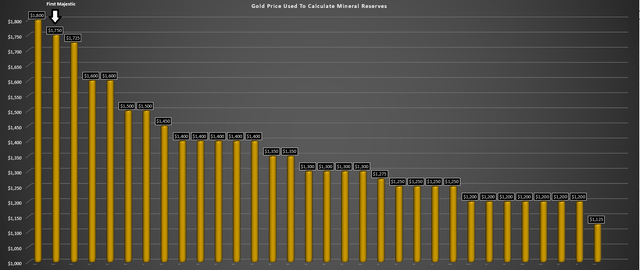

Metals Prices Used to Calculate Reserves – Silver Producers (Company Filings, Author’s Chart) Gold/Silver Producers – Metals Priced Used to Calculate Reserves (Company Fillings, Author’s Chart)

In fact, if we compare First Majestic’s metals prices used to calculate reserves with gold producers (gold price) and silver producers (silver/gold price), we can see that First Majestic has some of the highest prices sector-wide. This is not ideal, given that the highest-quality reserve growth is growth while maintaining conservative metal price assumptions. If metals prices head higher, this won’t be a problem, but this doesn’t leave much room for error when it comes to mine plans when reserve bases are built at levels slightly above spot prices. In contrast, most senior gold producers would need a $700/oz decline in the gold price to worry about their reserve assumptions ($1,250/oz vs. $1,950/oz gold price).

Inferred Resources

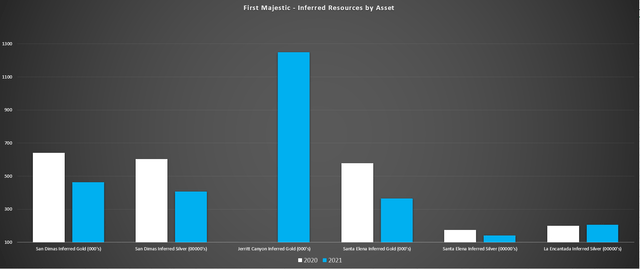

Finally, looking at inferred resources that back up reserves, the trend was not great here. As shown below, inferred ounces declined at San Dimas and Santa Elena and only increased slightly at La Encantada. The good news is that there is a large, inferred resource back at Jerritt Canyon to back up its short mine life. Usually, I wouldn’t be overly critical of sub-5-year mine lives at underground operations (San Dimas, La Encantada), but in the case of First Majestic, its metals price assumptions are not conservative in the slightest.

First Majestic – Inferred Resources by Asset (Company Filings, Author’s Chart)

This means that it will not be able to rely on pulling metals prices higher to convert additional material into reserves unless it wants to use prices that are similar to spot levels. Hence, the company will need to rely on exploration success to build reserves, so it’s good to see the company has a more aggressive budget this year. Some investors will argue that while reserves are low, a large portion of resources will be converted, and this is possible.

However, with resources being calculated at $25.00/oz silver (spot prices) and $1,800/oz gold (just below spot prices), the company will not have much margin for error when it comes to metals price volatility if it chooses to move these ounces into mine plans. To summarize, while First Majestic did increase reserves year-over-year, I would call the growth low-quality because it has some of the highest metals price assumptions sector-wide, and much of the growth was inorganic (Jerritt Canyon). Therefore, for long-term investors in First Majestic, monitoring reserves is critical going forward.

Valuation

Based on ~266 million fully diluted shares and a share price of US$13.60, First Majestic trades at a market cap of ~$3.62 billion at a share price. This figure dwarfs my estimate of the company’s combined Project After-Tax NPV (5%) of ~$1.0 billion. It’s worth noting that this does not include any potential impacts from the tax dispute with the Servicio de Administracion Tributaria [SAT], the revenue service of the Mexican Government. Hence, even without factoring in any potential negative impacts from this dispute, the stock trades at over 3x P/NAV. For those unfamiliar, the SAT has issued reassessments of ~$260 million.

If we compare this valuation with more diversified precious metals producers like Agnico Eagle (AEM) or Northern Star (OTCPK:NESRF), First Majestic trades at triple their average P/NAV multiple (1.15x). This is although both companies have more attractive jurisdictional profiles, with 90% or more of production from Tier-1 jurisdictions). In contrast, First Majestic has less than 40% of production coming from Tier-1 jurisdictions and weaker margins. Hence, it’s difficult to justify paying up for First Majestic at current prices from solely a valuation standpoint, with the stock trading above $13.60.

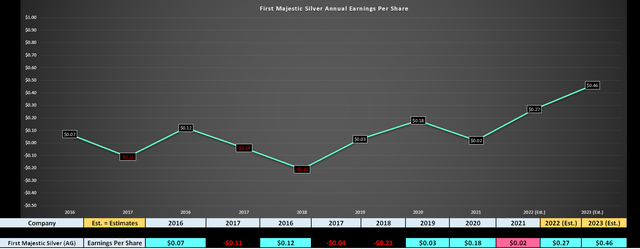

First Majestic Silver – Earnings Trend & Earnings Estimates (YCharts.com, Author’s Chart)

If we look at the stock from a price-to-earnings standpoint, the valuation isn’t any more attractive, with First Majestic trading at ~29x FY2023 earnings estimates, a very steep valuation for a cyclical stock. So, while First Majestic ranks well from an earnings growth standpoint compared to peers following its recent acquisition, I continue to see First Majestic as an example of growth at an unreasonable price. This doesn’t mean that the stock can’t go higher, but I would never pay more than 3.0x P/NAV for a gold or silver miner, nor 2.0x for that matter, and First Majestic trades at a premium to both figures currently.

First Majestic Silver Operations (Company Presentation)

First Majestic Silver’s Reserve & Resource update was satisfactory at best, with minimal growth in reserves/resources (ex-Jerritt Canyon), despite higher metals price assumptions. Meanwhile, the stock trades at a massive premium to other precious metals names. This makes the stock unattractive from a valuation standpoint, and I continue to see a conservative fair value for the stock below $9.00. A fair value well below market prices doesn’t mean the stock has to drop this low; it simply means that the stock would need to decline significantly to offer any margin of safety.

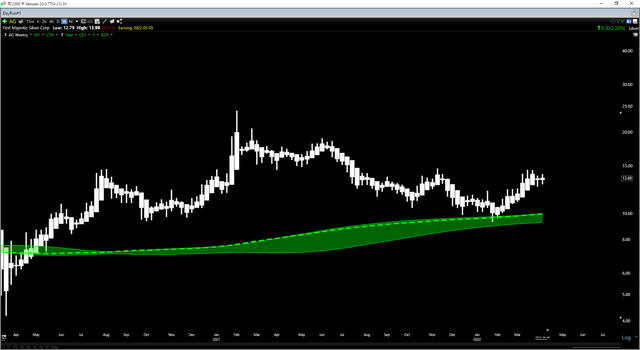

First Majestic Silver – Daily Chart (TC2000.com)

Having said that, First Majestic has proven it can outperform its peers in bull markets, and it does have one of the best earnings growth rates sector-wide (FY2020-FY2023 estimates). So, while the stock does not appeal to me from a valuation standpoint, one can make a case for buying any pullbacks below $10.50 from a technical standpoint, where the stock has strong support. To summarize, I continue to see several more attractive opportunities elsewhere, like Nomad Royalty (NSR), but I would view pullbacks on First Majestic below $10.50 as buying opportunities.

Be the first to comment