Evgeny Gromov

Earnings of First Interstate BancSystem, Inc. (NASDAQ:FIBK) will most probably surge next year on the back of moderate loan growth. Further, slight margin expansion will help the bottom line. Overall, I’m expecting First Interstate BancSystem to report adjusted earnings of $2.72 per share for 2022 and $4.28 per share for 2023. Compared to my last report on the company, I’ve raised my earnings estimate for next year mostly because I’ve increased the margin estimate. Next year’s target price suggests a high upside from the current market price. Therefore, I’m upgrading First Interstate BancSystem to a buy rating.

Large Securities Portfolio is One of FIBK’s Biggest Weaknesses

First Interstate BancSystem has a large securities portfolio, which is quite unfortunate in the current rate scenario. Securities made up a hefty 36.6% of total earning assets at the end of September 2022. The large securities portfolio will hurt First Interstate BancSystem in the following two ways.

- Securities will hold back the average earning asset yield. Most securities are based on fixed rates; therefore, they won’t reprice as market interest rates rise. They will only provide a repricing opportunity when they mature. The portfolio’s duration at the end of the third quarter was quite long, at around 3.86 years, as mentioned in the earnings presentation. Therefore, it’s safe to assume that a large part of the portfolio will not mature in the next twelve months.

- Securities will lead to equity book value attrition. Available-for-sale securities made up around 66% of total securities at the end of September 2022. As interest rates rise, the market value of these securities will fall, resulting in unrealized mark-to-market losses. As these losses are unrealized, they will bypass the income statement and directly erode the equity book value. The book value per share has already dropped from around $21 at the end of December 2021 to $17 at the end of September 2022.

Loan Growth Outlook is the Major Reason for Hope

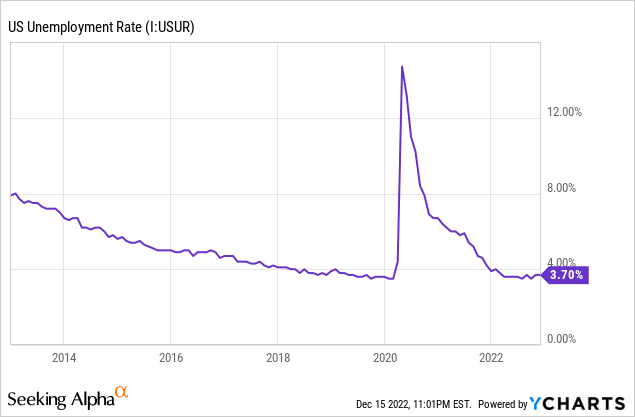

Loan growth remained at a high level for the third quarter at around 2.6%, or 10.6% annualized. Growth will decelerate in future quarters due to high borrowing costs. However, it won’t dip too low because of robust job markets. First Interstate BancSystem’s loan portfolio is geographically well diversified; therefore, it’s appropriate to consider the national average when ascertaining the credit product demand. As shown below, the unemployment rate for the country has persisted at a record low level throughout this year.

Considering these factors, I am expecting the portfolio to grow by 1% in the fourth quarter of 2022, leading to full-year loan growth of 91%. (Side note: FIBK completed the acquisition of Great Western Bancorp in the first quarter of 2022, which increased the loan portfolio size by around 80%.) For 2023, I’m expecting the portfolio to grow by 4%. I’m expecting deposits to grow in line with loans. However, the growth of securities and equity book value will trail loan growth, as discussed above. The following table shows my balance sheet estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net Loans | 8,431 | 8,858 | 9,663 | 9,209 | 17,564 | 18,278 |

| Growth of Net Loans | 11.8% | 5.1% | 9.1% | (4.7)% | 90.7% | 4.1% |

| Other Earning Assets | 3,255 | 3,988 | 6,150 | 8,714 | 10,803 | 11,242 |

| Deposits | 10,681 | 11,664 | 14,217 | 16,270 | 26,144 | 27,205 |

| Borrowings and Sub-Debt | 815 | 798 | 1,291 | 1,251 | 2,004 | 2,086 |

| Common equity | 1,694 | 2,014 | 1,960 | 1,987 | 2,869 | 2,925 |

| Book Value Per Share ($) | 29.1 | 31.5 | 30.8 | 32.2 | 26.9 | 27.4 |

| Tangible BVPS ($) | 18.7 | 21.8 | 21.0 | 21.0 | 15.6 | 16.2 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Margin to Continue Expanding Despite the Unfavorable Asset Mix

The average earning-asset yield is only slightly rate-sensitive because of the large securities portfolio discussed above and the substantial number of fixed-rate loans. Around 56% of the loan portfolio is based on fixed rates, as mentioned in the earnings presentation.

On the deposit side, the non-interest-bearing deposits, which make up 31.5% of total deposits, will weigh down the deposit cost as market interest rates rise. The management mentioned in the conference call that it expects the deposit beta to be below 27%, which isn’t too bad.

The results of the management’s interest-rate sensitivity analysis given in the 10-Q filing show that a 200-basis points hike in interest rates could boost the net interest income by only 2.43% over twelve months. Considering these factors, I’m expecting the margin to increase by ten basis points in the last quarter of 2022 and a further ten basis points in 2023. Compared to my last report on FIBK, which was issued back in August, I’ve raised my margin estimates for 2023 because the Federal Reserve has already increased the fed funds rate beyond my previous expectation.

Expecting Earnings to Surge Next Year

Earnings will likely surge in 2023 thanks to moderate loan growth and margin expansion. Further, the provisioning and operating expenses will return to a normal level after the merger-related effects witnessed in 2022. Overall, I’m expecting First Interstate BancSystem to report earnings of $4.28 per share for 2023, up 57.7% from the adjusted estimated earnings for 2022. The following table shows my income statement estimates.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net interest income | 433 | 495 | 497 | 488 | 955 | 1,144 |

| Provision for loan losses | 9 | 14 | 57 | (15) | 76 | 32 |

| Non-interest income | 139 | 143 | 157 | 151 | 169 | 186 |

| Non-interest expense | 356 | 389 | 388 | 406 | 755 | 712 |

| Net income – Common Sh. | 160 | 181 | 161 | 192 | 230 | 457 |

| EPS – Diluted ($) | 2.75 | 2.83 | 2.53 | 3.11 | 2.15 | 4.28 |

| Normalized EPS – Diluted ($) | 2.35 | 2.50 | 2.15 | 2.56 | 2.72 | 4.28 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates, Seeking Alpha for Historical Normalized EPS(In USD million unless otherwise specified) | ||||||

In my last report on First Interstate BancSystem, I estimated earnings of $2.72 per share (adjusted) for 2022 and $4.12 per share for 2023. I haven’t changed my earnings estimate much for 2022. However, for 2023, I’ve increased my earnings estimate mostly because I’ve raised my margin estimate for next year.

My estimates are based on certain macroeconomic assumptions that may not come to pass. Therefore, actual earnings can differ materially from my estimates.

Upgrading to a Buy Rating

First Interstate BancSystem is offering a dividend yield of 4.9% at the current quarterly dividend rate of $0.47 per share. The earnings and dividend estimates suggest a payout ratio of 44% for 2023, which is close to the last five-year average of 48%. Therefore, I’m not expecting a dividend hike next year.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value First Interstate BancSystem. The stock has traded at an average P/TB ratio of 1.83 in the past, as shown below.

| FY19 | FY20 | FY21 | Average | |||

| T. Book Value per Share ($) | 21.8 | 21.6 | 21.0 | |||

| Average Market Price ($) | 40.3 | 33.8 | 43.6 | |||

| Historical P/TB | 1.85x | 1.57x | 2.08x | 1.83x | ||

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $16.2 gives a target price of $29.6 for the end of 2023. This price target implies a 22.4% downside from the December 15 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.63x | 1.73x | 1.83x | 1.93x | 2.03x |

| TBVPS – Dec 2023 ($) | 16.2 | 16.2 | 16.2 | 16.2 | 16.2 |

| Target Price ($) | 26.4 | 28.0 | 29.6 | 31.2 | 32.9 |

| Market Price ($) | 38.2 | 38.2 | 38.2 | 38.2 | 38.2 |

| Upside/(Downside) | (30.9)% | (26.6)% | (22.4)% | (18.2)% | (13.9)% |

| Source: Author’s Estimates |

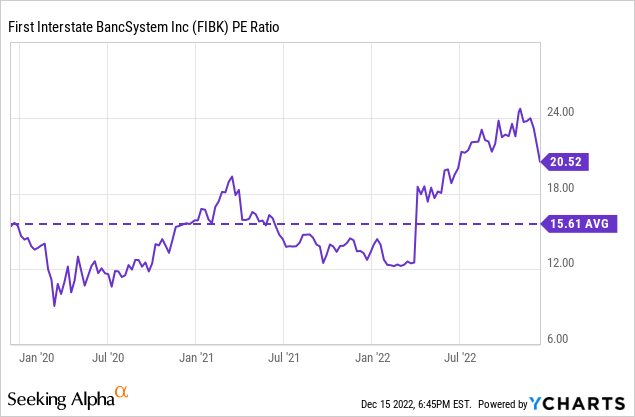

The stock has traded at an average P/E ratio of around 15.6x in the past, as shown below.

Multiplying the average P/E multiple with the forecast earnings per share of $4.28 gives a target price of $66.9 for the end of 2023. This price target implies a 75.2% upside from the December 15 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 13.6x | 14.6x | 15.6x | 16.6x | 17.6x |

| EPS 2023 ($) | 4.28 | 4.28 | 4.28 | 4.28 | 4.28 |

| Target Price ($) | 58.3 | 62.6 | 66.9 | 71.1 | 75.4 |

| Market Price ($) | 38.2 | 38.2 | 38.2 | 38.2 | 38.2 |

| Upside/(Downside) | 52.7% | 63.9% | 75.2% | 86.4% | 97.6% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $48.2, which implies a 26.4% upside from the current market price. Adding the forward dividend yield gives a total expected return of 30.7%.

In my last report on First Interstate BancSystem, I adopted a hold rating with a target price of $40.1 for December 2022. My target price for 2023 is much higher than the 2022 target price because of the large difference between the projected earnings for 2022 and 2023. Based on the total expected return for the next twelve months, I’m upgrading First Interstate BancSystem to a buy rating.

Be the first to comment