Jonathan Ross

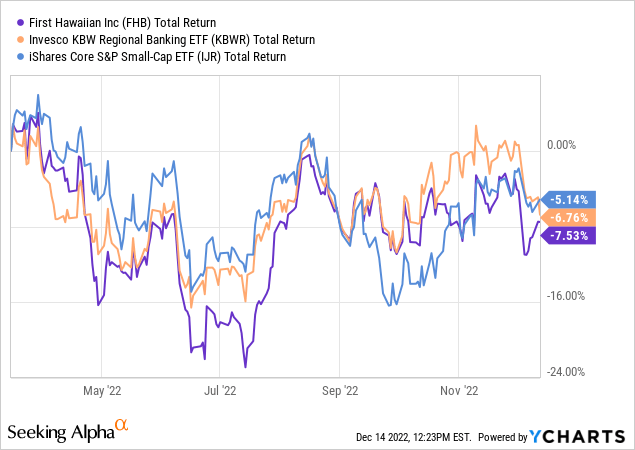

First Hawaiian (NASDAQ:FHB) stock has been fairly unremarkable since I last covered the lender in Q1, falling by high single-digits (with dividends) in that time albeit with that performance broadly in line with both its regional bank peer group and the broader S&P 600 Small Cap Index.

To recap, I initiated coverage on the bank with a ‘hold’ rating back in Q3 2021. That was upgraded to ‘buy’ in Q1 2022, chiefly on account of a then-dividend yield of circa 3.7% – which was 1,000bps higher than the peer-group average but backed up by a more conservative and higher quality earnings profile. With the bank also very asset sensitive, it looked like a sound way for conservative-oriented investors to play the rate hike cycle.

First Hawaiian has by-and-large behaved as it should have in that time. Its interest rate sensitivity has indeed delivered higher margins, revenue and pre-provision operating profit, while credit quality remains in top shape as we head into a potential downturn.

The moderate share price decline in the intervening period also makes these shares a little bit more attractive now. I haven’t been thrilled with the valuation here previously – seeing it more as a solid dividend growth stock than anything – and while it would be a push to say that this bank is now deeply undervalued, an 11x forward earnings multiple and 4%-plus dividend yield does at least make for a better returns profile. Buy.

Interest Rate Hikes A Nice Tailwind

Lower deposit betas and a general funding cost advantage vis-a-vis comparable mainland banks will always form the crux of the bullish case here. That’s just the nature of the banking market in Hawaii. Throw in a reasonable share of floating-rate loans, and First Hawaiian was one the most asset sensitive banks I follow.

As expected, the Fed embarking on a particularly aggressive tightening cycle has indeed been very good for the income statement here. Year-to-date net interest income is up around 12% (to $441.8m) versus the equivalent period last year, with the net interest margin (“NIM”) up 20bps to 265bps in the same timeframe. In Q3 specifically, net interest income was up over 20% year-on-year and 12% sequentially on slightly declining earning asset balances. That, in turn, helped push third quarter pre-provision operating profit around 18% higher year-on-year and roughly the same sequentially.

Funding costs and deposit betas have understandably been getting a lot of attention recently. With the Hawaiian banks, the advent of internet banking technology could conceivably threaten the cosy oligopoly in place on the islands (after all it’s never been easier to shop around for better rates).

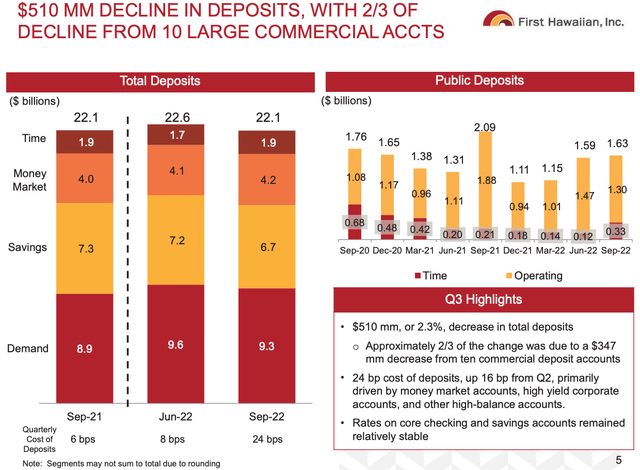

Source: First Hawaiian Q3 2022 Results Presentation

So far, though, there is scant evidence of that theme playing out. Deposit costs did increase 16bps sequentially (to 24bps), and total deposits fell 2.5% on the same basis, but this was down to a relatively small number of large accounts. Management noted that non-interest-bearing deposits (~40% of total deposits) were actually up $200m a week after period end, which would imply circa 1% sequential decline – a solid performance all things considered. After incorporating an acceleration of deposit cost increases in Q4 management expects deposit beta to come in around 10%, which is low. The loan-to-deposit ratio also remains low here at ~62% affording the bank a fair bit of flexibility.

Good Loan Growth And Pristine Credit Quality

Loan growth was solid in Q3, increasing 3.3% sequentially. C&I was a particular bright spot (up over 6% sequentially ex. PPP) as floor plan financing continued its recovery, though category lending was strong even without this, with dealer flooring contributing about half of C&I growth.

Commercial real estate was also strong, increasing 3.7% sequentially. Tourism remains buoyant – visitor spend was up by a fifth in September versus pre-COVID 2019 levels even with visitor numbers still below pre-pandemic levels – and that is supporting the commercial portfolio. Residential is understandably softer in light of the interest rate hikes, and that is something that is going to weigh here heading into 2023 given its ~30% share of the loan book.

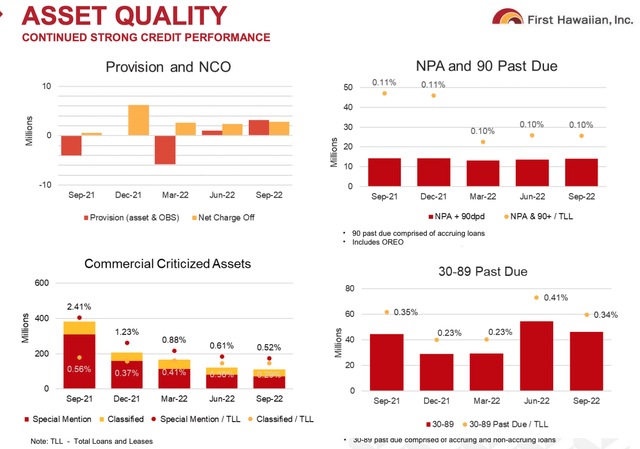

Source: First Hawaiian Q3 2022 Earnings Call Presentation

Asset quality remains very strong. Non-performing assets and accruing loans past due 90-plus days remains at just 0.1% of total loans and leases, unchanged sequentially and down a touch on the start of the year. The bank remains well provisioned for a downturn, with its credit loss allowance at 1.08% of total loans.

Valuation Now A Bit More Attractive

Looking ahead, First Hawaiian is now understandably quite a bit less asset sensitive than it was when I first covered it. Management expects another 10 – 15bps in margin expansion in Q4 depending on deposit flows and a 450bps Q4 Fed borrowing rate, so the high-end of that range seems unlikely to me. Still, FY23 comps will benefit from a full-year of higher interest rates, while a lower level of rate hikes next year will also contribute a little to growth. All told, that should add up to double-digit NII and PPOP growth in FY23, which, in terms of the bottom line, should offset the inevitable tick up in provisioning.

With that, these shares now look a tad more attractive in terms of valuation than they did previously, particularly for dividend investors. First Hawaiian shares change hands for $25.15 at time of writing, putting them at around 11x the consensus FY23 EPS estimate. The current dividend yield is over 4% based on the ¢26 per share quarterly payout.

At under 50%, the payout ratio looks a little on the low side to me. Management wants to get to a CET1 of 12%, and that will limit additional capital returns to stockholders over the next couple of quarters, but given the bank’s superior profitability and lower requirement for retained earnings I do think there is a fair bit of scope for upping the payout ratio beyond that (whether directly through higher cash dividends or via buyback-fueled growth). With a 4%-plus base yield, that would add up to a reasonable outlook for dividend growth investors even if long-term earnings growth only lands in the 3-4% per annum area. Buy.

Be the first to comment