Althom/iStock Editorial via Getty Images

Earnings of First Commonwealth Financial Corporation (NYSE:FCF) will most likely slightly dip this year as provisions expenses will return to a normal level. On the other hand, margin expansion amid a rising interest-rate environment will support the bottom line. Further, economic recovery will drive loan growth, which will, in turn, support earnings. Overall, I’m expecting First Commonwealth Financial to report earnings of $1.34 per share in 2022, down 7% year-over-year. The year-end target price suggests a decent upside from the current market price. As a result, I’m maintaining a buy rating on First Commonwealth Financial.

High-Single-Digit Loan Growth on the Cards

First Commonwealth Financial Corporation’s loan growth decelerated last year, partly because of Paycheck Protection Program (“PPP”) loan forgiveness. The remaining PPP loans outstanding made up only 1.0% of total loans at the end of December 2021, according to details given in the 10-K filing. As a result, PPP forgiveness will put lower pressure on the total loan portfolio size this year relative to last year.

The management mentioned in the conference call that it expects organic loan growth to be in the mid-to-high-single-digit range for 2022. This target excludes growth through the recently launched equipment finance division. The management’s loan growth target appears easily achievable as the portfolio has grown at a similar level in the past.

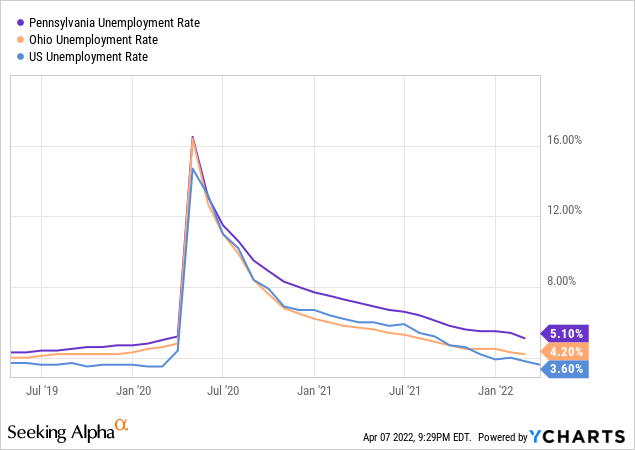

First Commonwealth Financial operates in the states of Pennsylvania and Ohio. Economic metrics for these states, including the unemployment rate and GDP, are trailing the rest of the country. However, these metrics show a much brighter picture than a year-ago period. As a result, I’m expecting the economic recovery in First Commonwealth’s markets to benefit loan growth in 2022.

Considering these factors, I’m expecting the loan portfolio to increase by 8% by the end of December 2022 from the end of 2021. In my previous report on First Commonwealth Financial, I was expecting lower loan growth for this year. I have revised upwards my growth estimate because of an improvement in the economic outlook.

Meanwhile, I’m expecting deposits to grow mostly in line with loans. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||

| Financial Position | |||||||

| Total Loans | 5,407 | 5,774 | 6,189 | 6,761 | 6,839 | 7,403 | |

| Growth of Total Loans | 11.0% | 6.9% | 7.2% | 8.5% | 1.3% | 8.2% | |

| Other Earning Assets | 1,207 | 1,350 | 1,292 | 1,495 | 2,443 | 2,492 | |

| Deposits | 5,581 | 5,898 | 6,678 | 7,439 | 7,982 | 8,556 | |

| Borrowings and Sub-Debt | 795 | 907 | 436 | 351 | 321 | 327 | |

| Common equity | 888 | 975 | 1,056 | 1,069 | 1,109 | 1,194 | |

| Book Value Per Share ($) | 9.3 | 9.8 | 10.7 | 10.9 | 11.6 | 12.5 | |

| Tangible BVPS ($) | 6.5 | 6.9 | 7.5 | 7.7 | 8.3 | 9.2 | |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||

Revising Upwards the Margin Estimate

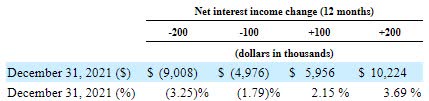

Around 51% of the total loan portfolio is variable, as mentioned in the earnings presentation. Nevertheless, more liabilities than assets will reprice within a one-year time frame, as mentioned in the 10-K filing. The asset-liability gap for this year is negative $869 million, or a negative 9.1% of total assets. Nevertheless, due to the magnitude of yield and cost changes, the repricing of assets will outweigh the repricing of liabilities. The management’s interest-rate sensitivity analysis given in the 10-K filing shows that a 200-basis points increase in interest rates can boost the net interest income by 3.69% over twelve months.

2021 10-K Filing

Despite the results given by the interest-rate sensitivity model above, the management appeared highly optimistic in the conference call. The management estimates every 25-basis points interest rate hike to result in a 5 to 7 basis point improvement in the margin. It seems like the management is hoping to quickly shift its balance sheet positioning after a rate hike to increase its rate sensitivity. I have decided to take the management’s guidance given in the conference call with a pinch of salt. Overall, I’m expecting the margin to increase by eight basis points in 2022.

In my last report on First Commonwealth Financial, I estimated the margin to increase by four basis points this year. Since the issuance of my last report, the Federal Reserve has substantially increased its rate projections for 2022. As a result, I have revised upwards my margin estimate for 2022.

Loan Growth to be the Chief Driver of Provision Expense this Year

The anticipated loan growth mentioned above will likely drive provisioning for expected loan losses this year. I’m expecting barely any pressure from economic factors as my outlook on the economy is stable. Further, the existing portfolio’s credit risk appears well provided for. Non-performing loans made up 0.80% of total loans at the end of December 2021, while allowances for loan losses made up 1.35% of total loans at the end of last year, as mentioned in the earnings release.

Overall, I’m expecting provisions expense to make up around 0.18% of total loans in 2022, which is the same as the average provision-expense-to-total-loan ratio for 2017 to 2019. In my previous report on First Commonwealth Financial, I was expecting lower provision expenses for this year. I have revised upwards my provision expense estimate mostly due to my loan growth estimate revision.

Expecting Earnings to Dip by 7% Year-Over-Year

Earnings will likely dip in 2022 on a year-over-year basis mostly because of provision normalization. On the other hand, strong loan growth and margin expansion will likely support earnings. Overall, I’m expecting the company to report earnings of $1.34 per share in 2022, down 7% year-over-year. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||

| Income Statement | |||||||

| Net interest income | 229 | 252 | 270 | 268 | 279 | 303 | |

| Provision for loan losses | 5 | 13 | 15 | 57 | (1) | 13 | |

| Non-interest income | 80 | 89 | 85 | 94 | 107 | 106 | |

| Non-interest expense | 200 | 196 | 210 | 216 | 214 | 234 | |

| Net income – Common Sh. | 55 | 107 | 105 | 73 | 138 | 128 | |

| EPS – Diluted ($) | 0.58 | 1.08 | 1.07 | 0.75 | 1.44 | 1.34 | |

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

|||||||

In my last report on First Commonwealth Financial, I estimated earnings of $1.33 per share for 2022. My earnings estimate is barely changed as the upward revision in provision expense and non-interest expenses cancel out the upward revision in loan growth and margin.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to the COVID-19 pandemic and the timing and magnitude of interest rate hikes.

Decent Total Expected Return Justifies a Buy Rating

First Commonwealth Financial is offering a dividend yield of 3.2% at the current quarterly dividend rate of $0.115 per share. The earnings and dividend estimates suggest a payout ratio of 34% for 2022, which is below the five-year average of 43%. Therefore, the earnings outlook poses no threat to the dividend payout in my opinion.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value First Commonwealth Financial. The stock has traded at an average P/TB ratio of 1.7 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 6.9 | 7.5 | 7.7 | 8.3 | ||

| Average Market Price ($) | 15.0 | 13.4 | 9.6 | 14.1 | ||

| Historical P/TB | 2.2x | 1.8x | 1.2x | 1.7x | 1.7x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $9.2 gives a target price of $15.8 for the end of 2022. This price target implies an 8.8% upside from the April 7 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.5x | 1.6x | 1.7x | 1.8x | 1.9x |

| TBVPS – Dec 2022 ($) | 9.2 | 9.2 | 9.2 | 9.2 | 9.2 |

| Target Price ($) | 14.0 | 14.9 | 15.8 | 16.8 | 17.7 |

| Market Price ($) | 14.6 | 14.6 | 14.6 | 14.6 | 14.6 |

| Upside/(Downside) | (3.8)% | 2.5% | 8.8% | 15.1% | 21.4% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 12.2x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 1.08 | 1.07 | 0.75 | 1.44 | ||

| Average Market Price ($) | 15.0 | 13.4 | 9.6 | 14.1 | ||

| Historical P/E | 13.9x | 12.5x | 12.7x | 9.8x | 12.2x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $1.34 gives a target price of $16.4 for the end of 2022. This price target implies a 12.5% upside from the April 7 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 10.2x | 11.2x | 12.2x | 13.2x | 14.2x |

| EPS – 2022 ($) | 1.34 | 1.34 | 1.34 | 1.34 | 1.34 |

| Target Price ($) | 13.7 | 15.1 | 16.4 | 17.7 | 19.1 |

| Market Price ($) | 14.6 | 14.6 | 14.6 | 14.6 | 14.6 |

| Upside/(Downside) | (5.9)% | 3.3% | 12.5% | 21.7% | 30.9% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $16.1, which implies a 10.6% upside from the current market price. Adding the forward dividend yield gives a total expected return of 13.8%. Hence, I’m maintaining a buy rating on First Commonwealth Financial.

Be the first to comment