Nikada/iStock Unreleased via Getty Images

Investment Thesis

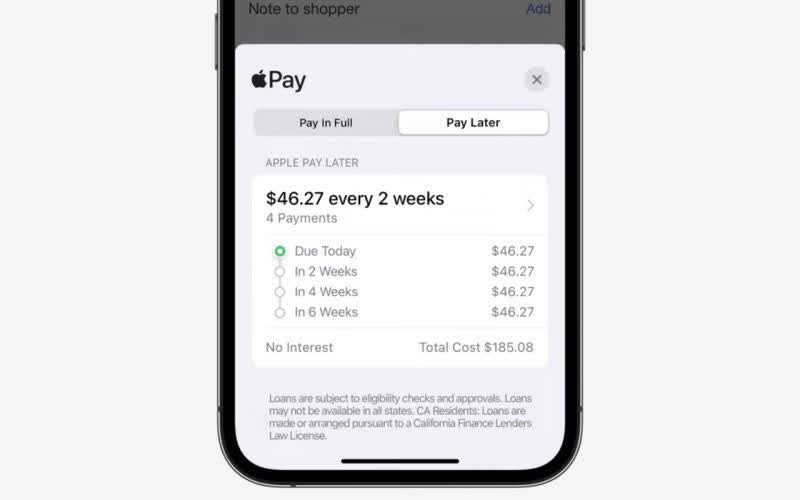

Last week, Apple Inc. (NASDAQ:AAPL) unveiled Apple Pay Later, letting Apple Pay users split purchases into four equal payments with 0% interest. Apple’s move into BNPL (“buy now pay later”) comes as no surprise, as Bloomberg reported in March that Apple is pursuing a long-term plan to bring more components of its financial services in-house. This comes after Apple announced that it acquired Credit Kudos, a U.K. credit reference agency that combines transactional data (enabled by open banking) with loan outcome data to make lending decisions.

Apple Press Release June 6th

Apple’s plan to offer BNPL with no late or hidden fees are ultimately better for consumers and merchants. However, Apple’s BNPL products don’t offer anything innovative and are offered on existing payment rails (Mastercard).

Apple’s entrance into BNPL is a validation of our thesis that this new payment mechanism is here to stay, but Apple’s entrance is not meant to reorient the consumer credit ecosystem. Rather, Apple wants to use its massive network effects to become another profit center within the payment rails. Apple has a massive network to offer its digital wallet and financial services, but Apple’s means to get there is no different than a traditional credit card swipe, as Apple abides by the same payment rails as traditional credit cards. Therefore, Apple’s at a disadvantage when it comes to offering a payment mechanism that includes consumers, merchants, and product manufacturers.

Apple Pay Later

Apple Pay Later provides users in the U.S. with a seamless and secure way to split the cost of an Apple Pay purchase into four equal payments spread over six weeks, with zero interest and no fees of any kind. Built into Apple Wallet and designed with users’ financial health in mind, Apple Pay Later makes it easy to view, track, and repay Apple Pay Later payments within Wallet.” – Apple Press Release

Apple strives to replace physical wallets with Apple Wallets. I explored Apple’s financial services in this recent note, for more on Apple’s current offerings. Apple Pay Later will allow consumers with Apple Pay to split payments over six weeks and will be accepted everywhere the Apple Card is accepted. Similar to the Apple Card, Apple has chosen to partner with Mastercard.

Apple Pay Later is available everywhere Apple Pay is accepted online or in-app, using the Mastercard network.” – Apple Press Release

Apple’s partnered with Goldman Sachs (GS) as the issuing bank and Mastercard (MA) as the card network. Apple will be using Mastercard Installments, which is Mastercard’s white-label BNPL offering, while Apple will use its own credit decisioning (now that Apple has acquired Credit Kudos) to power its underwriting models and authorize transactions within Mastercard’s network of merchants. Apple’s looking to bring more of its financial services in-house, in a project named “breakout” internally, according to Bloomberg. Apple Pay Later seems like this is most likely where it starts to “break away” from its current partners and start to build out its underwriting, but it will be notable if we see any new partnerships form with any banks or startup fintechs.

Apple is adding some unique features as well, but nothing that gives merchants or product manufacturers the ability to influence consumer behavior before they are at the checkout stage.

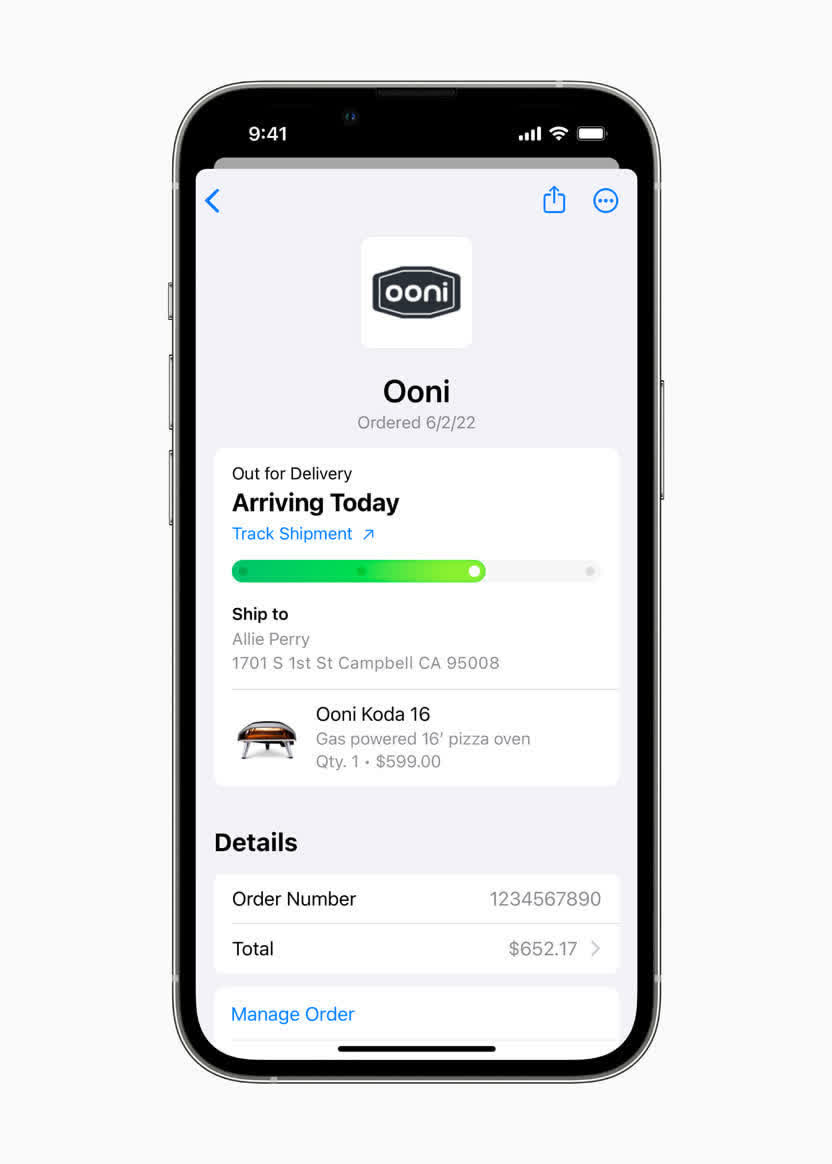

Additionally, with Apple Pay Order Tracking, users can receive detailed receipts and order tracking information in Wallet for Apple Pay purchases with participating merchants.” – Apple Press Release

Apple Press Release June 6th

Apple Pay Order Tracking enables consumers to easily track their online orders when they use Apple Pay at participating merchants. Shopify will be the first merchant to enable Apple Pay Order Tracking and could be an insightful way for Apple to engage with Apple Pay users and potentially encourage them to repeat their purchases or spend more leveraging Apple’s financial products.

Nothing New Here

What Apple is doing is nothing unique or fundamentally different.

For more on why Mastercard or Visa (V) can’t support a new payments network that it vertically integrated across many parties within a transaction, I explained why in my note, “Buy Now, Pay Later Is Disrupting The Consumer Credit Ecosystem.” Here’s an excerpt.

The card networks are responsible for decoding the messages between the banks and don’t break down messages into SKU-level data.

“There’s literally, technologically no way for Walmart to send back to First Data, to send back to Visa, to send back to Capital One, to put in my app, what items I bought at Walmart.” – Alex Rampell – Visa: The Original Protocol Business

Alex goes on to say this is due to legacy technology and that it’s extremely difficult for the largest companies to agree on new protocols. It is difficult for the card networks and banks to agree to change these protocols because the issuing banks are tied to the consumers.

If the card networks competed with the issuing banks, then they’d be out of business, so card networks are restricted and wouldn’t offer a product directly to consumers that competed with the banks. It will be interesting to see how Mastercard implements its BNPL solution, but I think it will be used as a marketing scheme to try and appeal to more banks.

Apple Pay Later isn’t a SKU-based payments network and can’t be preserved and integrated across Apple’s network because it is using the same payments rails as traditional credit cards, while data is siloed and not used in the current credit card paradigm. This puts Apple at a disadvantage compared to other BNPLs, specifically Affirm Holdings (AFRM), that have access to merchants’ SKUs, where Affirm uses data specific to the item Affirm is underwriting based on individual transactions as well as for fraud.

What differentiates Affirm’s network from Apple’s is Affirm’s ability to enable parties within a transaction to subsidize a promotion on specific items to drive new customers to the checkout page, thereby increasing a merchant’s sales, while preserving this data and information across its entire network.

What Apple’s doing is nothing different because it doesn’t enable merchants to include other parties in a transaction and it doesn’t ultimately give merchants or product manufacturers the ability to change or influence consumer behavior before they reach the checkout point.

BNPL is a *promotional tool used by manufacturers and merchants to sell more stuff* — eg, Toyota often offers and *advertises* 0% financing to induce you to buy (promotion!)…not ‘post payment planning’” – Alex Rampell

While Apple’s Order Tracking functionality will be a great feature for Apple Pay users when they pay with Apple Pay at participating online merchants, it doesn’t enable merchants to drive new sales. This is a great feature for consumers once they’ve already made a purchase and Apple’s likely partnered with its participating online merchants by tracking SKUs to track orders. This is something that Affirm could easily duplicate since its network is SKU-friendly. However, this feature speaks to Apple’s focus on offering appealing financial services to consumers, rather than merchants.

The Uphill Battle

Splitting payments over a few weeks is becoming commoditized.

However, there’s significant uplift when a company must implement.

Since Apple will offer no late fees, it will also need to be aligned with consumers when it comes to extending credit and underwriting quality assets. Underwriting consumer credit is a difficult task for any entity, while traditionally issuing banks have relied on the interest of cardholder debt and late fees to create highly profitable card programs. When card issuers rely on the late fees and deferred interest to operate profitable card programs, the issuers are not aligned with the best interest of consumers and their ability to pay for a purchase when the issuers extend credit. However, Apple is putting consumers first, as all financial institutions should, because it will depend on its underwriting models to accurately price its assets while not taking advantage of consumers.

Apple’s underwriting will be incredibly important because it takes years and years of building proprietary models and Apple’s already handcuffed because it abides by the card networks.

Something to keep in mind is that Apple doesn’t offer an ideal point-of-sale system for merchants to standardize on, which would enable a larger supply of potential customers to make a purchase. Apple doesn’t have the ability to integrate promotions to outbound messaging tied to specific items on a SKU basis. The data within each transaction of an Apple payment is siloed across from the issuer, the network, and the merchant. This puts Apple at a disadvantage compared to a SKU-based network when underwriting transactions on an item-by-item basis. Apple is partnering with online merchants to get access to this data so that it can offer Apple Pay Order Tracking, but this serves to benefit consumers after they’ve already made a purchase, rather than influencing consumer behavior to drive more sales for merchants.

Conclusion

Apple dominates when it comes to smartphones as there are over billions of users and Apple is known for offering friendly user experiences that are seamless. Apple’s entrance into BNPL comes as no surprise as Apple recognizes the opportunity to further engage its network of smartphone users as Apple looks to make its devices the future of sending and receiving payments.

I don’t put it past Apple to launch a moderately popular BNPL product, but ultimately Apple doesn’t offer merchants a 10x better product for them to stimulate more sales. Therefore, it will be difficult for Apple to take on the legacy card issuers because it is following a similar playbook, at least merchants will see it this way.

I rate Apple a hold at its current valuation, while its entrance into BNPL is a sign that embedded finance is here to stay.

Be the first to comment