SimonSkafar

According to Investment Advisor First Trust Advisors L.P., the First Trust Energy Infrastructure Fund (NYSE:NYSE:FIF) (the “Fund”) is:

A non-diversified, closed-end management investment company. The Investment Objective/Strategy of the Fund is to seek a high level of total return with an emphasis on current distributions paid to shareholders.

The Fund pursues its objective by investing primarily in securities of companies engaged in the energy infrastructure sector. These companies principally include publicly-traded master limited partnerships (“MLPs”) and limited liability companies taxed as partnerships, MLP affiliates, YieldCos, pipeline companies, utilities and other infrastructure-related companies that derive at least 50% of their revenues from operating, or providing services in support of, infrastructure assets such as pipelines, power transmission and petroleum and natural gas storage in the petroleum, natural gas and power generation industries (collectively, “Energy Infrastructure Companies”).

For purposes of the Fund’s investment objective, total return includes capital appreciation of, and all distributions received from, securities in which the Fund invests, taking into account the varying tax characteristics of such securities.

Under normal market conditions, the Fund invests at least 80% of its managed assets (total asset value of the Fund minus the sum of the Fund’s liabilities other than the principal amount of borrowings) in securities of Energy Infrastructure Companies.

First Trust Energy Infrastructure Fund

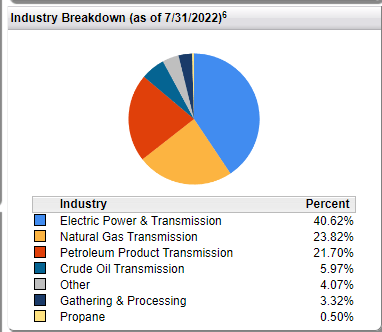

The Fund’s primary holdings by far are in Electric Power and Transmission industry (40.52%). Secondarily, the Fund is invested in Natural Gas Transmission (23.82%), Petroleum Product Transmission (21.70%) and Crude Oil Transmission (5.97%).

First Trust Advisors L.P.

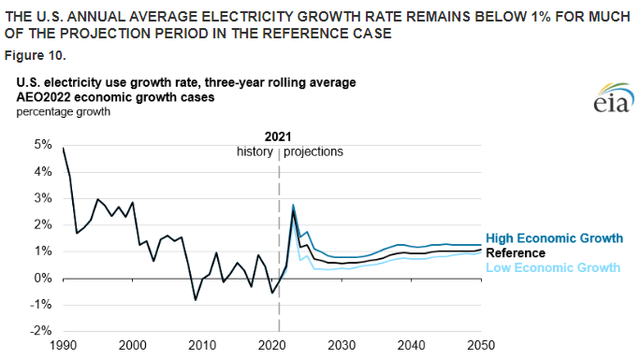

U.S. electricity growth is projected to grow slowly by the Energy Information and Administration (“EIA”).

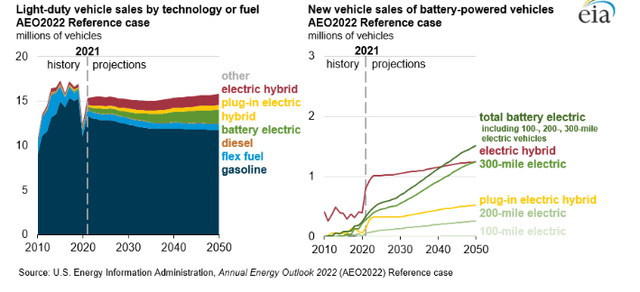

Gasoline consumption, the largest sector of petroleum products, is not expected to return to its pre-pandemic level through 2050.

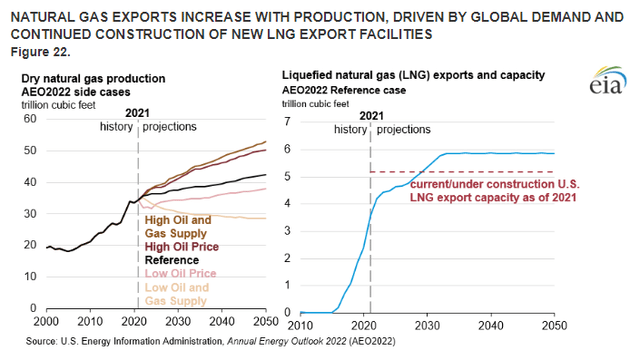

Natural gas production is projected to rise but much of the increase will be dedicated to exports, not increased domestic use and transmission.

Holdings

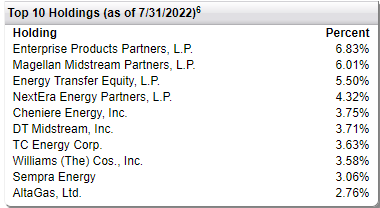

The largest corporate holdings of FIF appear to be mainly in the area of petroleum product midstream companies, such as Enterprise Products Partners (EPD), Magellan Midstream Partners (MMP) and Energy Transfer (ET).

First Trust Advisors L.P.

Expense Ratio and AUM

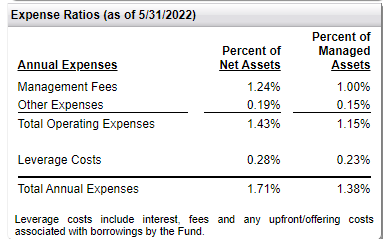

FIF’s annual expenses are 1.71%, including a 1.24 % management fee.

First Trust Advisors L.P.

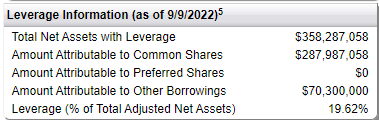

Its Assets Under Management (“AUM”) is about $360 million with leverage.

First Trust Advisors L.P.

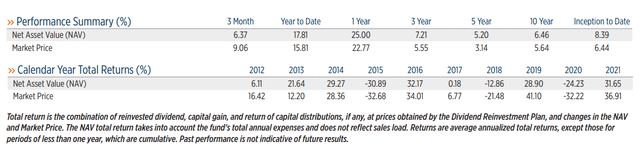

Performance

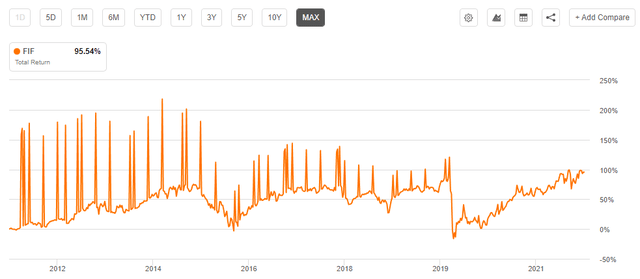

Since inception in September 2011, FIF has returned 95.54% to investors.

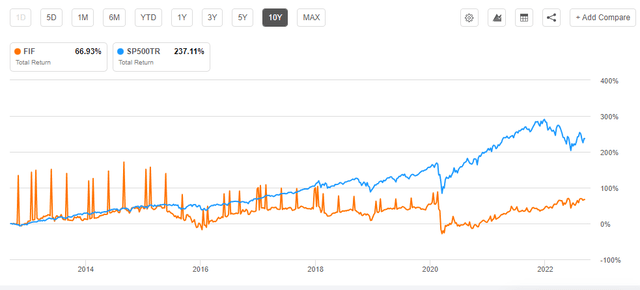

Over the past ten years, the return has been 66.93%, far below the total of the SP500TR, 237.11 %.

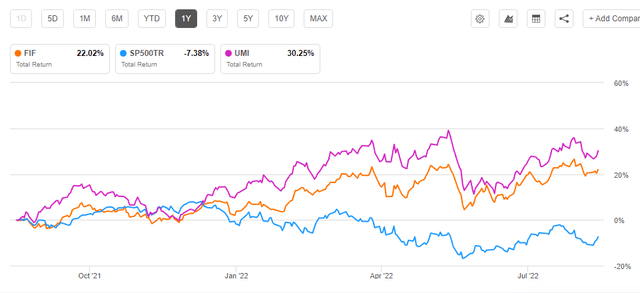

But over the past year, when energy markets have been strong, FIF returned 22.02%, as opposed to a loss of 7.38% for SP500TR. The return for the USCF Midstream Energy Income Fund ETF (UMI) was 30.25%.

I recently published an article, UMI: Midstream Energy Fund With NGL Tilt Outperforms, which explained how its NGL focus has made it a stronger performer in the energy infrastructure space.

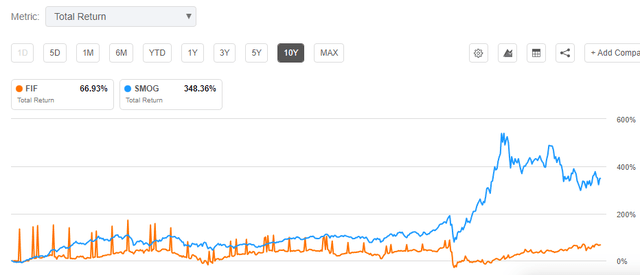

The electric power industry is expected to shift its supply sources away from fossil fuels and toward renewables. So if investors are most interested in that thesis, the VanEck Vectors Low Carbon Energy ETF (SMOG) may be a better investment vehicle. Over the past ten years, SMOG has returned +348.36 %, compared to 66.93 % for FIF.

I recently wrote an article, SMOG: A Well-Diversified Bet On The Energy Transition, explaining my views on that low-carbon ETF.

Conclusions

Generally speaking, investors are attracted to investments in the utility sector during periods of recession or weak economic growth because they provide regular dividends that are higher than those paid by other companies. And a recession may be coming due to high energy prices and high inflation.

If investors are interested in energy infrastructure investments, UMI deserves a closer look due to it NGL allocations. If investors are more interested in investing in the coming energy transition, SMOG may offer a more diverse approach.

As always, investors must perform their own due diligence and seek the advice of an investment advisor who understands their goals and objectives, as well as their risk tolerance and tax considerations.

Be the first to comment