hapabapa/iStock Editorial via Getty Images

Investment Thesis

Fidelity National Financial (NYSE:FNF) has a current dividend yield of 3.3%, seven consecutive years of dividend growth, and 16 years of consecutive dividend payments. and 45 years of uninterrupted dividend growth. The dividend is well covered by earnings, and with a dividend over 3% there’s a lesser need for share price growth to get up into high single-digit total returns. But the story for FNF is far more than dividend yield. FNF’s title insurance business is one of the largest in the United States. Low interest rates have increased refinancing and real estate sales leading to bumper results for this segment. While refinancing is expected to reduce with increases in interest rates, this is the lower value side of the business and the higher value real estate business is expected not to be affected as much. This is reflected in analysts’ EPS estimates showing ~20% lower EPS of $6.30 for 2022 compared to actual $7.90 for 2021. FNF’s 2020 acquisition of FGL holdings (F&G) has provided both diversification and strong EPS growth (see additional detail under FNF: Business below). So, while analysts’ consensus EPS estimate for 2022 of $6.30 is well down from the actual non-GAAP EPS of $7.90 for 2021, it’s well up on the actual non-GAAP EPS results of $5.30 for 2020, and $3.90 for 2019. My detailed analyses indicate these improvements in EPS are not fully reflected in share price growth, providing the opportunity for outsized returns buying at current share price. The current P/E multiple is 6.28. Based on buying at current share price, analysts’ consensus EPS estimates being met, and the P/E multiple increasing to the historical multiple of 10.53, total return of 21% per year is indicated through end of 2023. Even if the P/E multiple increased to 8.50, only halfway to the historical average, yearly return of 10.6% per year is indicated. FNF is one of three stocks covered by Seeking Alpha’s Quant specialist, Steven Cress, with a Strong Buy recommendation, in his article “3 Dividend Stocks For a Bear Grip Or Bull Run.” Wall Street’s rating is Buy. At least, the last nine articles by SA authors rate FNF a Strong Buy. I am not about to the spoil the party – I will make it ten in a row and rate FNF a Strong Buy.

FNF: Business

From the company’s 2021 10-K filing,

As of Dec. 31, 2021, we had the following reporting segments:

•Title. This segment consists of the operations of our title insurance underwriters and related businesses, which provide title insurance and escrow and other title-related services including trust activities, trustee sales guarantees, and home warranty products. This segment also includes our transaction services business, which includes other title-related services used in the production and management of mortgage loans, including mortgage loans that experience default.

•F&G. This segment primarily consists of operations of our annuities and life insurance related businesses. This segment issues a broad portfolio of annuity and life insurance products, including deferred annuities (fixed indexed and fixed rate annuities), immediate annuities, and indexed universal life (“IUL”) insurance, through its retail distribution channels. This segment also provides funding agreements and pension risk transfer (“PRT”) solutions through its institutional channels.

•Corporate and Other. This segment consists of the operations of the parent holding company, our real estate technology subsidiaries, other smaller, non-title businesses and certain unallocated corporate overhead expenses and eliminations of revenues and expenses between it and our Title segment.

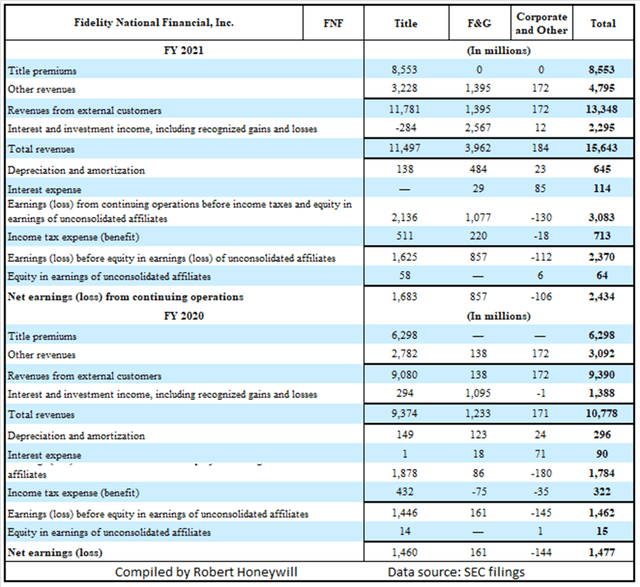

Segment results for 2021 and 2020 are shown in Table A below:

Table A

Source: SEC filings

Table A illustrates what an excellent acquisition F&G has been. F&G’s growth has been able to be leveraged through the financial strength of FNF, truly a synergistic acquisition. From SA Premium transcript of FNF’s Q4 2020 earnings call:

Turning to our acquisition of FGL Holdings. F&G continues to execute on its growth strategy, generating retail sales growth of over 40% in the fourth quarter. The credit rating upgrade that F&G has enjoyed as a result of the acquisition by FNF has opened additional large market opportunities. F&G is gaining momentum in the newly entered bank and broker-dealer channel, generating $500 million of channel sales since our launch on July 1. Additional distribution channels, including institutional products, will continue to be a strategic area of focus for F&G in 2021, including the pension risk transfer marketing.

And, from SA Premium transcript of FNF’s Q4 2021 earnings call:

F&G sales growth remains impressive and above expectation as they continue to expand in the new channels and grow their addressable market opportunity while continuing to a strong success in existing markets. For the quarter, F&G delivered total sales of $2.2 billion representing a 50% increase over the fourth quarter of 2020… Importantly total assets under management were $36.5 billion at December 31, 2021, which is well ahead of our goal of doubling assets under management over five years as we outlined at the time of our acquisition.

My usual detailed structured financial analysis follows.

Looking for share market mispricing of stocks

What I’m primarily looking for here are instances of share market mispricing of stocks due to distortions to many of the usual statistics used for screening stocks for buy/hold/sell decisions. The usual metrics do not work when the “E” in P/E is distorted by the impact of COVID-19. And if the P/E ratio is suspect, so too, then, is the PEG ratio similarly affected. I believe the answer is to start with data at the end of 2019, early 2020, pre-COVID-19 and compare to projections out to the end of 2022 or later, when hopefully the impacts of COVID-19 will have largely dissipated. Summarized in Tables 1, 2, and 3 below are the results of compiling and analyzing the data on this basis.

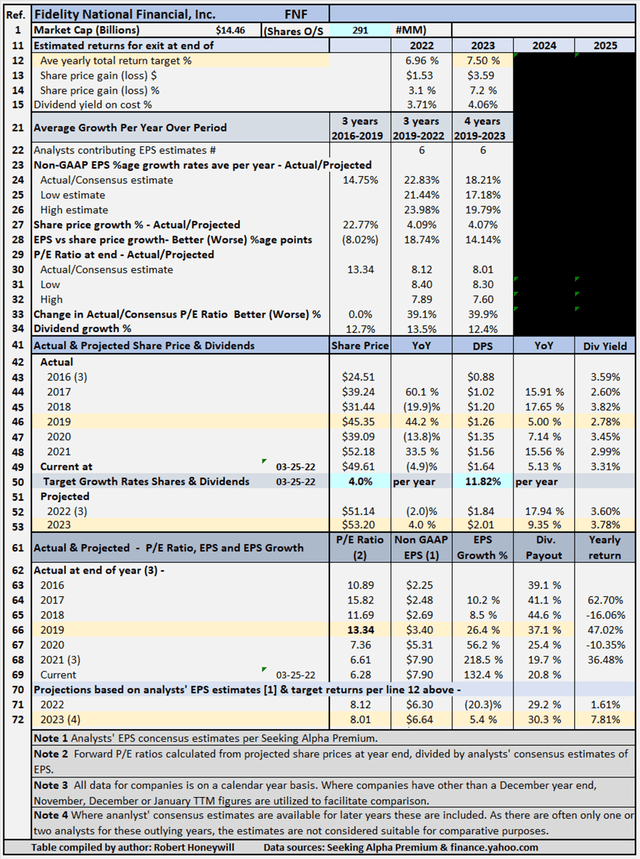

Table 1 – Detailed Financial History And Projections

Sources: Seeking Alpha Premium

Table 1 documents historical data from 2016 to 2019, including share prices, P/E ratios, EPS and DPS, and EPS and DPS growth rates. The table also includes estimates out to 2023 for share prices, P/E ratios, EPS and DPS, and EPS and DPS growth rates (note – while estimates are shown for analysts’ EPS estimates out to 2023, 2024 and 2025 where available, estimates do tend to become less reliable, the further out the estimates go. These estimates are generally only considered sufficiently reliable if there are at least three analysts’ contributing estimates for the year in question). Table 1 allows modeling for target total rates of return. In the case shown above, the target set for total rate of return is 7.5% per year through the end of 2023 (see line 12), based on buying at the March 25, 2022, closing share price level. As noted above, estimates become less reliable in the later years. In the case of FNF, I have decided to input a target return based on 2023 year, which has EPS estimates from six analysts, because that is as far out as analysts’ estimates extend. The table shows to achieve the 7.5% return, the required average yearly share price growth rate from Mar. 25, 2022, through Dec. 31, 2023, is 4.0% (line 50). Dividends, including estimated dividend increases, account for the balance of the target 7.5% total return. Table 2 below summarizes relevant data flowing from the assumption of a target 7.5% total return through the end of 2023.

Targeting A 7.5% Return

Table 2 – Targeting a 7.5% return

Sources: Seeking Alpha Premium

Table 2 provides comparative data for FNF, assuming share price grows at rates sufficient to provide total rate of return of 7.5%, from buying at closing share price on March 25, 2022, and holding through the end of 2023. All EPS estimates are based on analysts’ consensus estimates per SA Premium.

Comments on Table 2 are as follows

Part 1 – Consensus EPS (Case 1.1) (lines 1 to 12)

Part 1 shows the amounts the share price would need to increase to achieve a 7.5% rate of return through the end of 2023. The share price would need to increase by $3.59 from the present $49.61 to $53.20 at the end of 2023, for the 7.5% rate of return to be achieved.

Part 2 – Required change in P/E ratio to achieve target 7.5% return (lines 21 to 23)

Part 2 shows the amount the P/E ratio would need to increase or decrease by, from buy date to the end of 2023, to achieve the share price level at the end of 2023 necessary to achieve the targeted 7.5% return. For FNF, the P/E ratio at buy date needs to increase by 27.6% through the end of 2023 for the 7.5% return to be achieved. Being required to have an increase in the P/E ratio to achieve a targeted return would normally be regarded as a negative. However, due to the distortions in earnings and sentiment owing to the COVID-19 pandemic, it’s difficult to judge whether the change in P/E ratio is a negative or the result of a distorted starting point. To overcome this difficulty, in Part 3, I review the necessary change in P/E ratio from a different, pre-COVID-19 starting point.

Part 3 – Projected change in P/E ratios from 2019 to 2023 (lines 31 to 46)

In Part 3, I start with the share price at Dec. 31, 2019, before the impact of the COVID-19 pandemic on earnings and market sentiment. The end point is projected share price at the end of 2023, when it’s assumed the market and earnings are no longer materially impacted by the pandemic, and EPS growth has brought the P/E ratio back closer to historical levels. For FNF, the share price needs to increase by $7.85 from $45.35 at Dec. 31, 2019, to $53.20 at the end of 2023, and as detailed in Part 1, at $53.20, the targeted 7.5% rate of return would be achieved. For FNF, there are a number of givens in our assumptions. Using these givens, the change in the share price from Dec. 31, 2019, to the end of 2023, can be expressed as mathematical formulae as follows:

[A] Change in share price, due to the effect of EPS growth rate, equals share price at the beginning multiplied by (1 plus average yearly Consensus EPS growth rate) to the power of number of years invested.

= $45.35*(1+18.21%)^4 = $88.57 (that would be the result if the share price grew in line with EPS growth, and the P/E multiple remained constant)

[B] Change in share price due to change in P/E ratio equals share price adjusted for EPS growth rate multiplied by (1 plus/minus percentage change in P/E ratio).

= $88.57*(1- 39.9%) = $53.20 (price required at end of 2023 to provide 7.5% total return, buying at current share price).

The increase of $43.22 ($88.57 minus $45.35) due to the average yearly EPS growth rate is cumulative, and the share price will continue to increase the longer the shares are held, and the growth rate continues. The decrease of $35.37 due to a change in the P/E ratio ($88.57 minus $53.20) has a one-off effect. A continuing high or low P/E ratio has no impact on future share price growth, only a change in P/E ratio affects share price, not the level of P/E ratio.

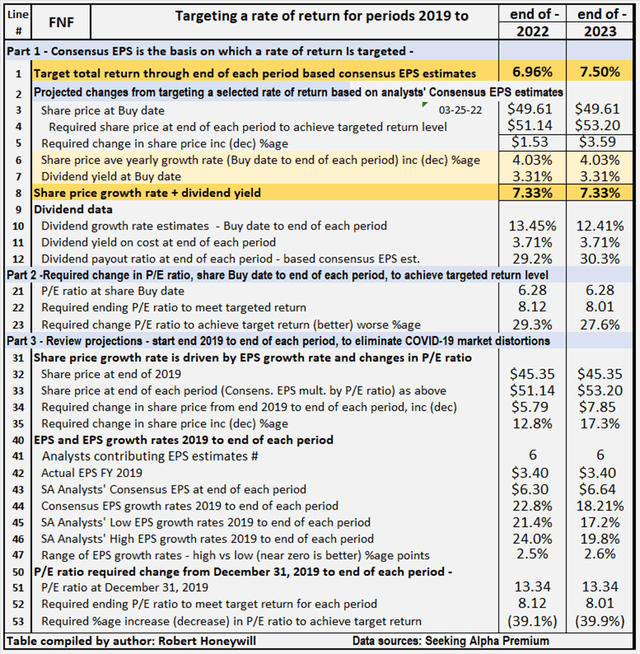

Next, rather than targeting a specific rate of return, I look at historical P/E ratios to see the potential impact on returns of a reversion to these levels of P/E ratio. First of all, I should explain a little about the Dividend Growth Income+ Club approach to financial analysis of stocks.

Understanding The Dividend Growth Income+ Club Approach

Copyright: Robert Honeywill 2020

Total return, dividends, share price

The only way an investor can achieve a positive return on an investment in shares is through receipt of dividends and/or an increase in the share price above the buy price. It follows what really matters in share value assessment is the expected price at which a buyer will be able to exit shares and expected cash flow from dividends.

Changes in share price

Changes in share price are driven by increases or decreases in EPS and changes in P/E ratio. Changes in P/E ratio are driven by investor sentiment toward the stock. Investor sentiment can be influenced by many factors, not necessarily stock-specific.

“Equity bucket”

Earnings are tipped into the “Equity Bucket” for the benefit of shareholders. It’s prudent to check whether distributions out of and other reductions in the “Equity Bucket” balance are benefiting shareholders.

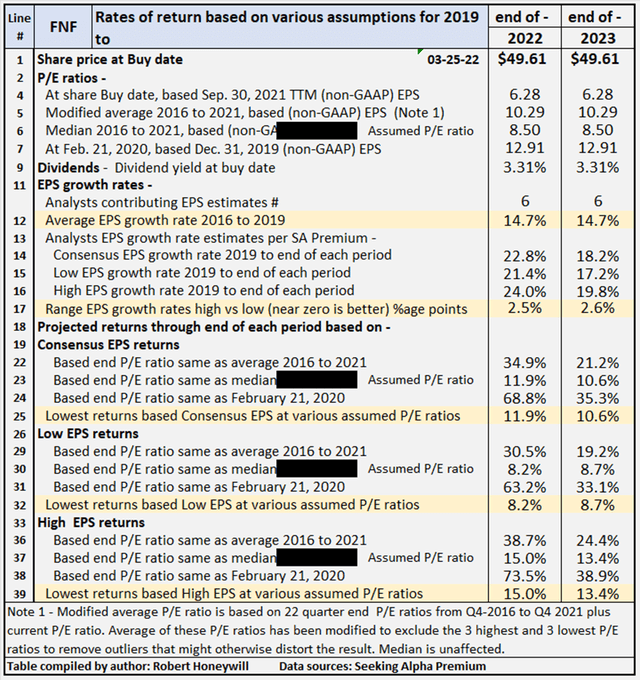

FNF’s Projected Returns Based On Selected Historical P/E Ratios Through End Of 2023

Table 3 below provides additional scenarios projecting potential returns based on select historical P/E ratios and analysts’ consensus, low, and high EPS estimates per Seeking Alpha Premium through the end of 2023.

Table 3 – Summary of relevant projections FNF

Sources: Seeking Alpha Premium

Table 3 provides comparative data for buying at closing share price on Mar. 25, 2022, and holding through the end of 2023. There’s a total of nine valuation scenarios for the year, comprised of three EPS estimates (SA Premium analysts’ consensus, low, and high) across three different P/E ratio estimates, based on historical data. FNF’s P/E ratio is presently 6.28. For many companies, their current P/E ratios are distorted by the impact of COVID-19. For FNF, the present P/E ratio is well below the range of historical P/E ratios. This likely reflects in part the high non-GAAP EPS for 2021 will not be maintained at that level in future years. Table 3 shows potential returns from an investment in shares of the company at a range of historical level P/E ratios. This analysis, from hereon, assumes an investor buying FNF shares today would be prepared to hold through end of 2023, if necessary, to achieve their return objectives. Comments on contents of Table 3, for the period to 2023 column follow.

Consensus, low, and high EPS estimates

All EPS estimates are based on analysts’ consensus, low, and high estimates per SA Premium. This is designed to provide a range of valuation estimates ranging from low to most likely to high based on analysts’ assessments. I could generate my own estimates, but these would likely fall within the same range and would not add to the value of the exercise. This is particularly so in respect of well-established businesses such as FNF. I believe the “low” estimates should be considered important. It’s prudent to manage risk by knowing the potential worst-case scenarios from whatever cause.

Alternative P/E ratios utilized in scenarios

- The actual P/E ratios at share buy date based on actual non-GAAP EPS for FYE 2021.

- A modified average P/E ratio based on 22 quarter-end P/E ratios from Q4 2016 to Q4 2021 plus current P/E ratio in Q1 2022. The average of these P/E ratios has been modified to exclude the three highest and three lowest P/E ratios to remove outliers that might otherwise distort the result.

- A median P/E ratio calculated using the same data set used for calculating the modified average P/E ratio. Of course, the median is the same whether or not the three highest and lowest P/E ratios are excluded. In the case of FNF I have replaced the median P/E ratio of 10.53 with a P/E ratio of 8.50. This is done to provide a test of effect of multiple remaining below the historical average.

- The actual P/E ratio at Feb. 21, 2020, share price, based on 2019 non-GAAP EPS. The logic here is the market peaked around Feb. 21, 2020, before any significant impact from COVID-19 became apparent. This makes the P/E ratios at Feb. 21, 2020, reflective of most recent data before the distortion of P/E ratios by the impact of the coronavirus pandemic.

Projected returns (lines 18 to 39)

Lines 22, 29 and 36 show if FNF P/E multiple were to expand from present level of 6.28 to around its historical average of 10.29, high returns ranging from 19.2% to 24.4% could be expected through end of 2023. The 19.2% return is based on analysts’ low EPS estimates and the 24.4% on their high EPS estimates, with a 21.2% return based on consensus estimates. Lines 25, 32 and 39 show lower indicative returns ranging from 8.7% to 13.4%, with consensus 10.6%. These returns are based on a P/E ratio of 8.5, around halfway between the present P/E ratio of 6.28 and the historic average of 10.29.

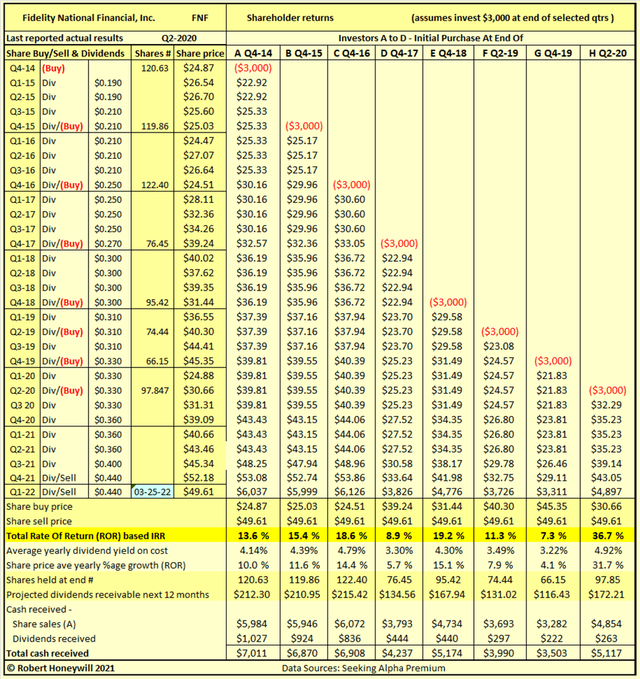

Review Of Historical Performance For FNF

FNF: Historical shareholder returns

In Table 4 below, I provide details of actual rates of return for FNF shareholders investing in the company over the last six years.

Table 4

Sources: Seeking Alpha Premium

For many stocks where I create a table similar to Table 4 above, I find a wide range of returns indicating a degree of volatility and risk. Table 4 above shows double-digit returns ranging from 11.3% to 36.7% for six of eight different investors, each investing $3,000 over the last seven years and holding to the present. A further two investors achieved single-digit returns of 7.3% and 8.9%. These rates of return, ranging from 7.3% to 36.7%, are not just hypothetical results. They are very real results for anyone who purchased shares on the various dates and held through to Mar. 25, 2022. In the above examples, the assumed share sale price is the same for all investors, illustrating the impact on returns of the price at which an investor buys shares, and the duration the shares are held.

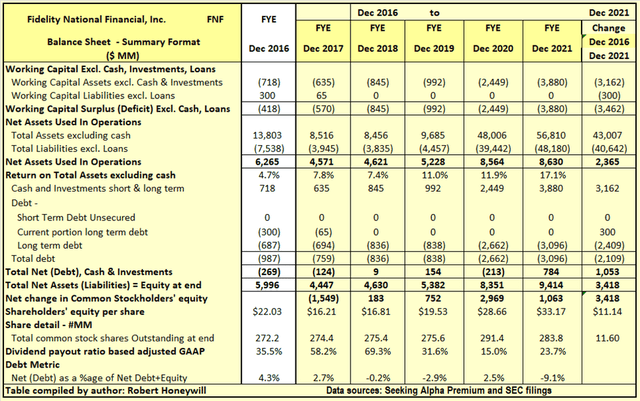

Checking FNF’s “Equity Bucket”

Table 5.1 FNF Balance Sheet – Summary Format

Sources: Seeking Alpha Premium and SEC filings

Table 5.1 shows FNF has increased net assets used in operations by $2,365 million and increased cash net of debt by $1,053 million over the last five years. These increases were funded by a $3,418 million increase in equity. Outstanding shares increased by 11.6 million from 272.2 million to 283.8 million, over the period. The increase in shares was comprised of 18.0 million shares related to the F&G acquisition,15.1 million shares for employee stock compensation, offset by 21.5 million shares repurchased. The $3,418 million increase in shareholders’ equity over the last 5 years is analyzed in Table 5.2 below.

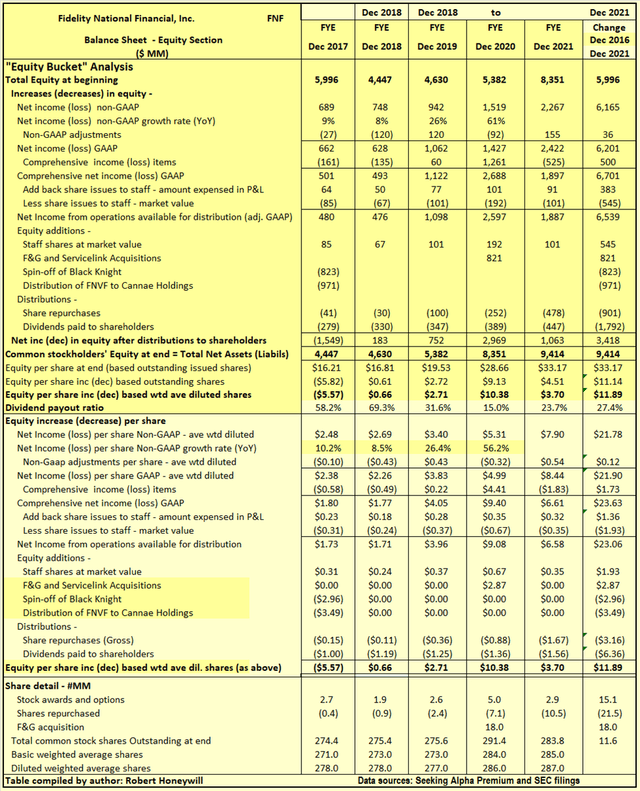

Table 5.2 FNF Balance Sheet – Equity Section

Sources: Seeking Alpha Premium and SEC filings

I often find companies report earnings that should flow into and increase shareholders’ equity. But often the increase in shareholders’ equity does not materialize. Also, there can be distributions out of equity that do not benefit shareholders. Hence, the term “leaky equity bucket.”

Explanatory comments on Table 5.2 for the period from end FY-2016 to end FY-2021.

- Reported net income (non-GAAP) over the five-year period totals $6,165 million, equivalent to diluted net income per share of $21.78.

- Over the five-year period, the non-GAAP net income excludes $36 million of GAAP income (EPS effect $0.12) of items regarded as unusual or of a non-recurring nature in order to better show the underlying profitability of FNF.

- Other comprehensive income includes such things as foreign exchange translation adjustments in respect to buildings, plant, and other facilities located overseas and changes in valuation of assets in the pension fund – these are not passed through net income as they fluctuate without affecting operations and can easily reverse in a following period. Nevertheless, they do impact on the value of shareholders’ equity at any point in time. For FNF, these items were $500 million additional income (EPS effect $1.73) over the five-year period.

- Amount taken up in equity to account for shares issued to staff over the five years is $383 million. This compares to an estimated market value of $545 million at the time of issue for these shares. The understatement of $162 million in employee stock compensation expense is not material in the context of reported earnings of $6,165 million.

- For most companies, by the time we take the above-mentioned items into account, we find the headline reported non-GAAP net income has considerably reduced, providing less funds from operations available for distribution to shareholders. For FNF we find the reported net income of $6,165 million for the 5-year period has increased to $6,539 million available for distribution to shareholders.

- Dividends of $1,792 million and share repurchases of $901 million were adequately covered by the $6,539 million generated from operations, leaving $3,846 million increase in equity.

- The $3,846 million increase in equity was further reduced to $2,052 million by additional distributions of equity through the spin off of Black Knight ($823 million) and distribution of FNVF to Cannae Holdings ($971 million).

- This $2,052 million was added to by the $545 million value of shares issued for employee stock compensation and $821 million shares issued for the F&G and Servicelink acquisitions. This brings the total increase to the $3,418 million increase in shareholders’ funds per Table 5.1 above.

Be the first to comment