Editor’s note: Seeking Alpha is proud to welcome Bavarian Value as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Ilya S. Savenok/Getty Images Entertainment

Investment Thesis

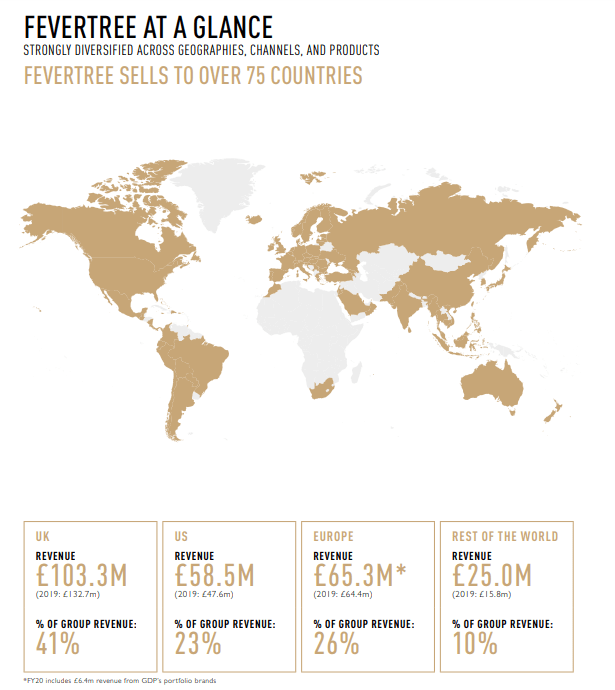

The biggest growth opportunity in the alcoholic beverages market comes with the premiumization trend. People care much more about the quality of their drinks and this factor is already recognized by alcoholic beverage companies. However, because of the fact that many good spirits are often mixed for long drinks and cocktails, the producers of high-quality mixers will also participate in this trend. Fevertree Drinks (OTCPK:FQVTF), which distributes its products in over 75 countries, is following this trend of premiumization of alcoholic beverages. Like Diageo (DEO) and Pernod Ricard (OTCPK:PDRDF), this is exactly where Fevertree anticipates the growth of the alcoholic beverages market – only that the company is responsible for the mixer part. According to its own statements, the company is the world-leading brand for premium mixers. There’s a lot that we like about Fevertree – for instance, its quality standards as well as its clear positioning in the premium sector – but for now, we assign a Hold rating on the stock as we believe the current share price is not a good starting point. The company, nevertheless, is high up on our watch list for a few reasons, including its growth opportunities.

Fevertree at a Glance (Fevertree)

Financials by Recent Fiscals

In September, Fevertree published its interim results for the fiscal year 2021. Compared to the previous year, sales could be increased by a solid 36% to £141.8 million. EBIT also developed excellently with an increase of over 18% to £25.3 million. This translates into an EBIT margin of just under 18%. While this development makes for excellent reading, we should put the figures into perspective. For obvious reasons, 2020 was a tough year for any business related to the gastronomy sector (such as suppliers of mixers to bars and restaurants). As a result, the results could be somewhat “distorted”, with the development appearing to be more positive than it actually is. So, how did 2020 go for the British company? The annual revenue decreased slightly by £8.4 million, or 3% in 2020. EBIT slumped more significantly by £20.9 million, or 29%. The pandemic had a particular impact on the company’s profitability, as the on-trade market (bars, restaurants, hotels, etc.) collapsed. This is why we think it’s a good idea to compare the revenue and EBIT of the first half of 2021 with the first half of 2020 and 2019 again at this point.

Revenue H1 2021: +36% compared to H1 2020 / +21% compared to H1 2019

EBIT H1 2021: +18% compared to H1 2020 / -27% compared to H1 2019

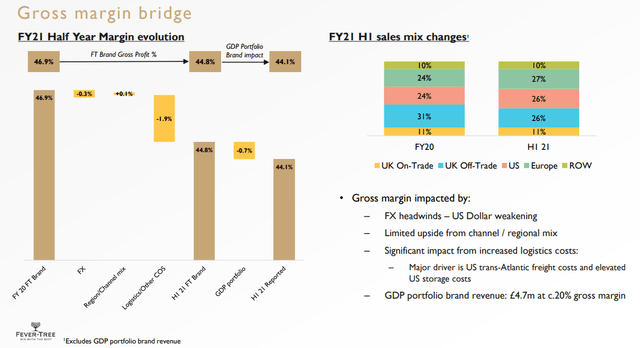

While revenue is looking excellent, the profitability level of 2019 couldn’t be reached yet. The fact that profitability has not yet returned to pre-pandemic levels is not directly attributable to the coronavirus pandemic – but indirectly. Fevertree is struggling with disrupted supply chains due to several lockdowns, which have led to sky-rocketing transport costs. Furthermore, the acquisition of the German distribution partner Global Drinks Partnership in 2020 is negatively impacting margins. This acquisition has served to strengthen the company’s presence, particularly in Germany. However, Global Drinks Partnership’s margins are significantly lower and therefore depress Fevertree’s overall profitability. Nevertheless, Fevertree is doing quite well in these difficult times with an EBIT margin of just under 18% currently.

Gross margin bridge (Fevertree)

A number of successes were achieved in the various markets in the first half of the year. Fevertree became the No. 2 retail tonic brand in the United States, the No. 1 tonic brand in Canada with a market share of 30%, and also expanded into South Korea. In the domestic market of Great Britain, the company was also able to extend its market leadership over the competition. In general, the strong first half of the year can be explained by the fact that on-trade sales have slowly recovered as a result of various easing measures, while off-trade revenues have remained consistently high. And obviously, Fevertree benefits from the premiumization of alcoholic drinks and the subsequent increase in demand for high-quality mixers that complement spirits rather than spoiling them. At the end of January, the British company delivered its preliminary results for fiscal year 2021.

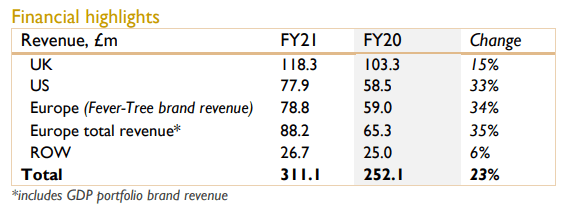

Financial Highlights (Fevertree)

In total, a sales growth of more than 23% was achieved compared to 2020. The main drivers behind this were Europe and the United States. In general, this shows a growing independence from Great Britain. It was therefore possible to continue the trend of the first half of the year. Off-trade sales remained above pre-pandemic levels, while on-trade sales continued to recover due to a generally more relaxed situation regarding the pandemic. According to management, there was another highlight for Fevertree as they became the No. 1 Tonic brand at retail in the United States, overtaking Schweppes for the first time. Fevertree also anticipates a two-figure sales growth for 2022; however, margins will remain under pressure due to rising costs (inflation), which is why management is not expecting a profitability increase. But nevertheless, the company gains more and more market share with its high-quality products and upcoming brands, and even managed to overtake Schweppes.

Qualitative Analysis

Fevertree’s business model is really easy to understand. The company sells premium mixers such as tonic water or ginger beer, primarily for mixing with spirits, but also for consumption as soft drinks. With a catchy slogan that reads “If ¾ of your drink is the mixer, mix with the best”, this British producer of drink mixers, founded by Charles Rolls and current CEO Tim Warrillow, who still (as of December 31, 2020) hold a significant proportion of the shares (Tim with a 4.70% stake and Charles 5.12%), the company underlies its high-quality approach. Fevertree places a special emphasis on the quality of its ingredients. The two founders themselves were among the team that travelled across the globe in search of the best ingredients. The product range of the British company includes:

- Premium Indian Tonic Water: The first tonic by Fevertree

- Ginger Ales, Ginger Beers & Cola: Mixers for dark spirits such as whisky, bourbon and rum, as well as for Mule cocktails

- Flavored Tonics: Selection of tonics to cover the growing variety of gins, such as the Mediterranean Tonic Water

- Lemonades: For mixing with vodka or drinking by itself

- Sodas: For a wide range of spirits such as vodka, gin, vermouth or Italian liqueur

- Refreshingly Light: Light versions of existing mixers for health-conscious consumers

Fevertree Overview (Fevertree)

What’s interesting about Fevertree’s business model is the large degree of outsourcing. Instead of producing the drinks themselves, the company merely supplies the ingredients to its bottlers, while logistics are run by external service providers. This offers Fevertree the advantage of not having to build its own capital-intensive production and distribution network. On the other hand, this obviously makes the company strongly dependent on its partners. The company’s main tasks include selecting suitable ingredients, creating new mixers, and marketing its products. The competitive advantage is difficult to evaluate. What is clear, however, is the success of the brand. In December 2021, Fevertree took over market leadership from competitor Schweppes in the United States, albeit by a close call – 26% for Fevertree vs. 25% for Schweppes. Fevertree is a pioneer in the premium mixer segment and has built an unique image with a clear focus from the very beginning. It’s the combination of different aspects that sets Fevertree apart. The company uses high-quality ingredients and skillfully promotes its sustainable, premium-oriented focus – through TV adverts, events, or pop-up bars. Yes, it would be possible to replicate the drinks with the right ingredients. However, we believe Fevertree is successful because it is creating its own image. The product is more than just a drink: much like Red Bull or early-day Coca-Cola, it represents a way of life. This is why we would not yet use the term economic moat with regard to Fevertree, although a small competitive advantage certainly appears to exist. Perhaps, we should also mention that we are gin aficionados ourselves and believe that Fevertree has by far the best taste among tonics. As two Bavarians born and raised in the land of beer, we know a good taste when we drink it. According to Fevertree, it looks like spirits are increasingly taking market shares from beer. The annual market growth of beer from 2014 to 2019 was -1%, while that for spirits increased by at least 1% over the same period. What’s particularly interesting is that the share of premium spirits is growing significantly more, as we mentioned earlier.

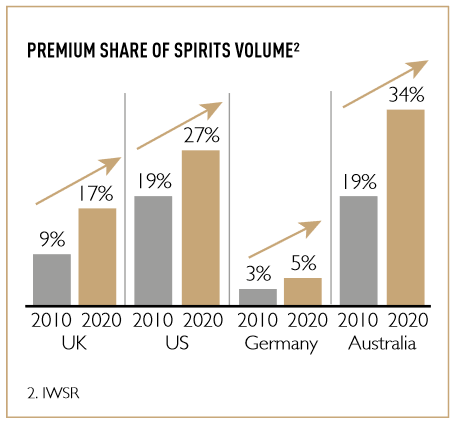

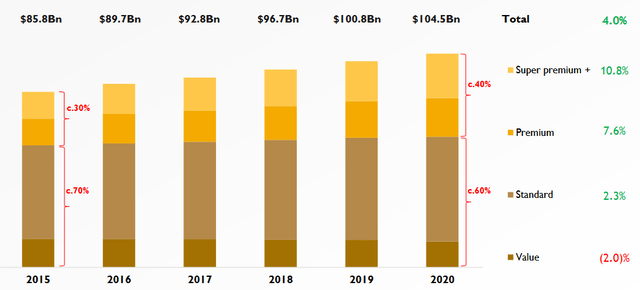

Premium Share of Spirits (Fevertree)

We can see that premiumization has progressed further in the past 10 years. The Premium and Super Premium+ spirits segments, which Fevertree belongs to, have shown the strongest growth.

The Super Premium + segment increased by 10.8% in 2020 and the Premium segment by 7.6%, with a clear tendency to grow. The development of the gin sector is of particular interest to Fevertree. While, according to Statista, the total market for gin amounted to $13 billion in 2021, over $19 billion are expected for 2025, which corresponds to an annual growth of around 8%. This makes gin one of the strongest-growing segments in the spirits sector. And if you still want more, go ahead and take a look at the growth of mixers:

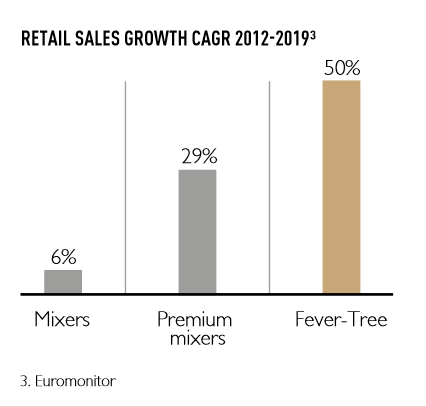

Retail Saltes Growth (Fevertree)

Premium mixers have seen an above-average growth, and Fevertree has grown even more strongly.

Competitive Analysis

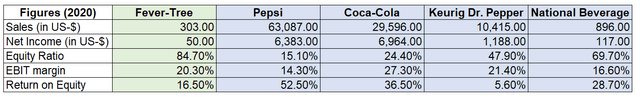

Competitive analysis (own calculations based on annual report)

(Own calculations)

It can be generally observed that while Fevertree belongs to the soft drinks sector, its competitors are mainly in the mixer drinks niche. PepsiCo (PEP) is the largest company we are looking at here, with brands including Pepsi, Lipton, SodaStream, and 7Up. Another giant is Coca-Cola (KO) with its key brands Coca-Cola, Fanta, Schweppes (at least in large proportions, we’ll get to this later), and Sprite. An equally long-established competitor is Keurig Dr. Pepper (KDP) with brands including Dr. Pepper, Schweppes (hang on, we’ll cover this later), Snapple, and Evian. Finally, there is also National Beverage (FIZZ) with LaCroix or Everfresh. Several brands in the tonic water segment belong to private unlisted companies. These include Fentimans and Thomas Henry, among others. However, Schweppes is certainly the biggest competitor. Schweppes’ distribution rights are quite complex. Coca-Cola owns a large proportion of these rights, which includes parts of Europe (e.g., Great Britain, Slovenia and Croatia). The distribution in France, Spain and Portugal is handled by the Japanese company Suntory. Krombacher is in charge in Germany, while it is Keurig Dr. Pepper in the United States. In any case, Fevertree remains the undisputed leader in its home country.

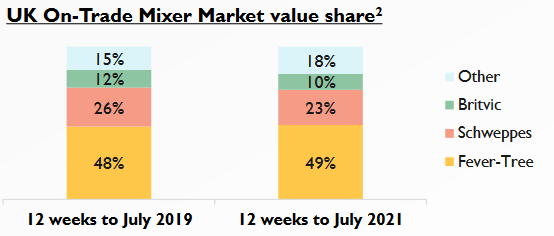

UK Market value share (Fevertree)

In the first half of 2021, the company was able to win 49% of the market, followed by Schweppes (23%), Britvic (10%) and the rest (18%). The British company also has an interesting graphic in store for Europe.

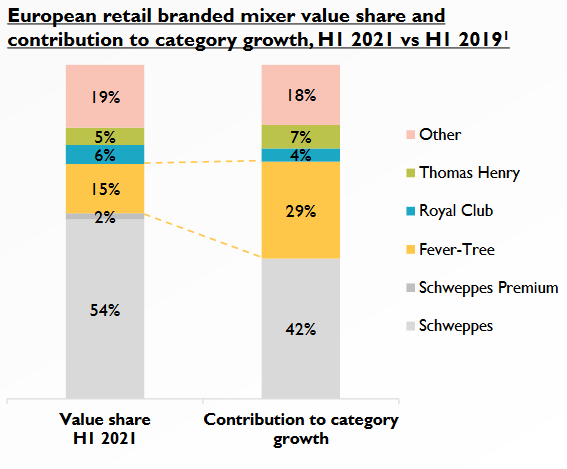

Retail mixer value share (Fevertree)

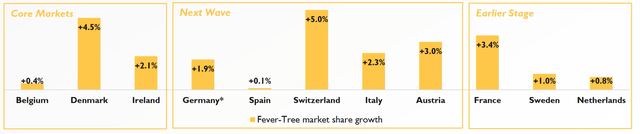

In Europe excluding Great Britain, Fevertree has a market share of around 15% (the graph on the top left). On the right-hand side, you can see that 29% of the market growth from 2019 to 2021 can be attributed to Fevertree alone. In addition, Fevertree is gaining significant market shares in several European markets.

Market share Europe (Fevertree)

And in the United States, as mentioned earlier, Fevertree has surpassed Schweppes for the first time.

Risks

Macro-level risks

Firstly, Fevertree is subject to the same risks as producers of alcoholic drinks, such as Diageo and Pernod Ricard. This should not come as a big surprise, since the company’s success strongly depends on the trend of premiumization of alcoholic drinks – no gin, no tonic. Apparently, you can drink tonic by itself, but why would you do that? So let’s get back to the basics:

- Risk #1: The future development of the pandemic may possibly have negative effects on the on-trade business (bars, restaurants, etc.).

- Risk #2: There is fierce competition for shelf placement in the food retail industry. If the Fevertree brand loses importance or popularity or new competitors appear – which is not unusual in a growing market – this competition could intensify and may put pressure on margins. But Fevertree obviously handles this issue quite well. For example, if you look at the development in German supermarkets, you could see that Fevertree is getting more and more shelf space. A few years ago, the tonic was only available in a few specialized beverage stores, but now the company’s various types of beverages are placed in many supermarkets.

Another risk is the current favorite subject of the financial press: inflation. This may also negatively impact the margins of the British company, if it is unable to pass on the price increases to its clients, or can only do so partially. Fevertree previously announced in its release of preliminary results for fiscal year 2021 that it does not expect margins to increase due to rising prices. However, it may even lead to a decrease in profitability. It would definitely make sense to keep an eye on this development. One additional macro-level risk is actually quite obvious: if the trend of premiumization of alcoholic drinks gets discontinued for whatever reason, Fevertree will be in big trouble. Although there are no indications of this at present, it should be kept in mind.

Company-specific risks

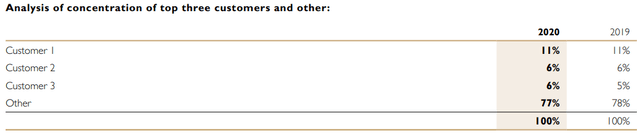

Apart from that, we like a certain level of diversification in a company’s sales. Fevertree is rather moderately positioned in this respect. On the one hand, with a sales share of the domestic market of just under 40%, the geographic focus is still quite strongly on Great Britain but due to the strong growth in the United States and Europe, the company is on the right track here. On the other hand, Fevertree’s three main clients account for around 23% of sales.

Concentration of top three customers (Fevertree)

While this is not as extreme as the case of Brown-Forman (BF.B), for instance (with the two largest customers accounting for 32% of net sales), Fevertree could still improve in this area. A strong dependence on one or few customers means a relatively lesser room to negotiate, which can in turn negatively impact profitability.

Fevertree Valuation

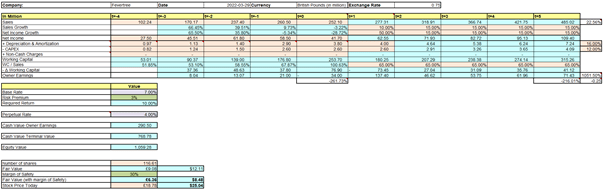

Discounted Cash flow Valuation (own calculations based on annual report)

(Owner Earnings Discounted Cashflow Valuation)

For our valuation, we use a discounted cashflow model with Warren Buffett’s Owner Earnings. We believe that Owner Earnings are a better representation of a company’s true earnings. It is the money a company generates by selling its products or services minus the money it needs to maintain its business operations. Therefore, Owner Earnings paint a more accurate picture. For 2020 our calculation for Fevertree goes as follows:

Net Income ($54.80 million)

+ Depreciation & Amortization ($5.00 million)

– CAPEX ($ 3,40 million)+ other non-cash items ($0 million)

– Change in Working Capital ($101.00 million)

= Owner Earnings ($ -44.7 million)

We assume a long-term growth rate in owner earnings of 4.0%. This comprises an inflation rate of 2.0% and an assumed organic growth of 2.0%. Based on current Owner Earnings of $ -44.7 million (2020), the following values are obtained:

Fair value: $12

10% margin of safety: $11

20% margin of safety: $10

30% margin of safety: $9

40% margin of safety: $7

Book value: $3

Current share price (March 29, 2022): $25

That means that Fevertree is currently overvalued. We prefer to buy high-quality companies at fair value, so if Fevertree reaches the $12 mark we would consider buying the stock.

Conclusion

We deeply appreciate high-quality spirits, especially scotch and gin. It is no coincidence that we have already analyzed various spirits producers. And Fevertree is our preferred choice for a proper gin and tonic. We are quite confident in our estimation that the British company has a really good product. Others seem to be noticing that too, as the company’s market share is rising steadily. And due to the continuous trend of premiumization in the alcoholic drinks sector, we believe that the growth will continue for some time to come. Fevertree shows that besides the much-discussed tech stocks, there are other companies with very positive growth prospects. The fact that the two founders are still significant shareholders and one of them is the CEO is another plus. Of course, Fevertree also has industry- and company-specific risks, such as the future development of the pandemic (industry-specific) or the fact that three clients account for around 23% of sales (company-specific). Nevertheless, we really like company’s risk/reward profile, which is why the British company is high up on our watch list. All that’s needed is a good price.

Be the first to comment