anutr tosirikul/iStock Editorial via Getty Images

Ferrari (NYSE:RACE) just presented its capital markets day. Even if we are Ferrari fans here at the Lab, we think that there is more negative news than positive ones. Having said that, any negative implications will be short-lived for a company that’s built for the long horizon.

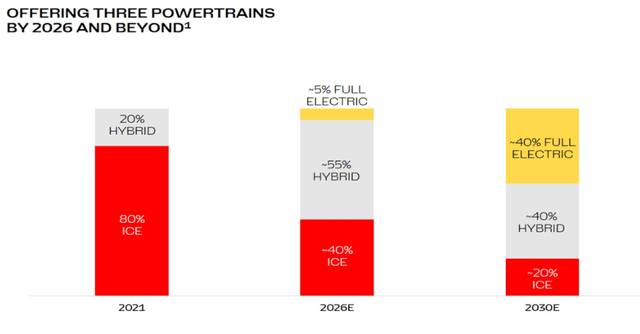

Starting with the negative comments, Wall Street analysts are worried about lower return on investment versus historical levels. This is due to higher investment assumptions ahead of the launch of an all-electric Ferrari in 2025. Investors expect structurally higher investments that will drag returns, which are likely to remain below 40% at the ROIC level. Capitalizing on more research and development costs, Rossa’s balance sheet has so far been protected from the impact, but the increase in depreciation will inhibit operating leverage and could mean disappointing results in the medium-term objectives. The Maranello house ROIC fell to 35% from 53% in 2017 following greater investments to finance new models and electric technology. In addition, investor attention is focusing on the medium-term free cash flow objective with higher R&D capitalization (39% today versus the historic 25%), which has cumulatively added 200 basis points to the group’s margins since 2017. To also add criticism, Ferrari stock is trading at 25x EV/EBIT, in line with the luxury companies, but Ferrari’s profits fell more in 2009 than its luxury competitors.

Our View

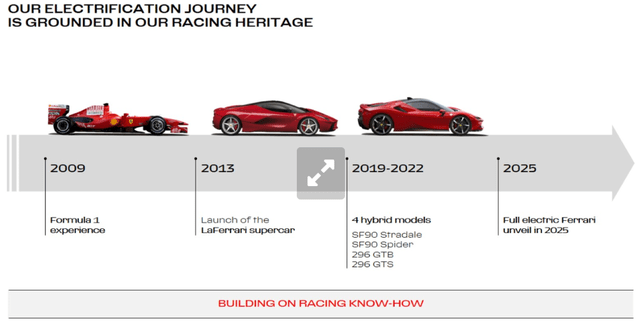

Ferrari has a strong track record and achieved great results since the last capital market day. As always, the Maranello house is building and is transferring know-how from Formula 1 to sports cars. The company also has made the necessary steps toward electrification in terms of human capital thanks to the new CEO coming directly to STMicroelectronics (STM) (OTCPK:STMEF), the 11th largest semiconductor company with a holding market-leading position in MEMS.

EV journey EV/ICE split (Ferrari CMD)

Ferrari’s ultra-luxury business model depends on limited supply, exclusivity, and long waiting lists. Compared to the 2009 results, Ferrari is a different company – more profitable and better managed. As a result, demand should hold up even in the event of a downturn economic scenario. Having participated in the CMD, businesswise here below our main key takeaway:

- Different Ferrari for different Ferraristi: more product offerings;

- Enhance profitability thanks to its uniqueness and more personalization.

Conclusion

According to Bloomberg, Ferrari has concluded an acquisition to buy the property next to its Maranello facility aiming to build a third production site dedicated to hybrid/EVs (5k cars per year). Rising CAPEX to hybrid/EV productions has been the major investor’s concern in the past years. No step-up in CAPEX was confirmed in the CMD call. Ferrari is currently producing 12k cars per year but has an additional capacity to produce 15k cars per year with no incremental CAPEX needed. FCF target was also confirmed, we do not see right the downward revision of about 10% of the EBIT and free cash flow currently estimated by the 2023 consensus. Therefore, we reiterate our buy rating confirming a €2 billion EBITDA in our 2023 forecast with a 23x multiple.

Be the first to comment