vitranc

Editor’s Note: The author recently rebranded the name from Stock Metal Investment to Heavy Moat Investments. The article’s content remains unchanged.

Thesis

Ferguson (NYSE:FERG) is a leading value-added distributor in a wide array of industries, in many of which they are the market leader. The company has recently been listed on the NYSE as its primary listing after the company disposed of its operations outside of the US. The company is currently fairly cheap with looming fears of a recession, which would affect the company that is reliant on housing.

Throughout this article, I’ll also refer to Ferguson as its ticker FERG.

Industries

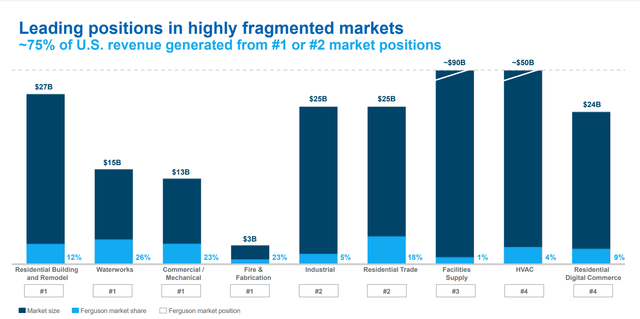

Ferguson has a very wide diversification being a distributor in 9 different markets, which are all highly fragmented. The company is:

- The leader in 4 markets, accounting for roughly $10.82 billion in revenues

- The second biggest player in 2 markets, accounting for roughly $5.75 billion in revenues

- The third/fourth biggest player in 3 markets, accounting for roughly $5,06 billion in revenues

Ferguson market shares (Ferguson market shares (FERG Investor day))

We can observe that all of these markets are fragmented because even as the market leader Ferguson never has more than 26% of the market share in a given market. This leaves a lot of opportunity for consolidation for a skilled acquirer. I find the HVAC industry in particular interesting and am invested in the market leader in that segment, Watsco (WSO). In my recent article about Watsco, I go more into detail about the HVAC industry and its tailwinds.

Sales Mix

Ferguson further splits up its sales mix by customer type and sales type :

- Residential housing accounts for 56% of revenues and Non-residential housing accounts for the remaining 44%.

- New Construction accounts for 40% of revenues and is the more cyclical sales type. The housing cycle is a big risk for Ferguson right now and a reason why the stock is down significantly. The market expects a recession and that normally is not good for new construction of housing. In its investor presentation Ferguson shares that the US currently has over 3.5 million underbuilt in Housing, but on the other hand mortgage rates are going up fast due to interest rates increasing (page 53).

- Repair, Maintenance and Improvement (RMI) accounts for 60% of revenues and is much less cyclical. Homes always need RMI services, even in recessions. Ferguson learned its last lesson in the GFC and increased its sales in RMI from 31% to 60% of revenues, making the business a lot more resilient now.

Serial Bolt-on Acquirer

Ferguson is a Serial Acquirer focused on bolt-on acquisitions, so small purchases in its current or adjacent niches. Due to being active in 9 highly fragmented markets, there is no shortage of small companies to purchase.

The goal of these acquisitions is to:

- Expand the product and solution portfolio

- Acquire and keep talented people in the company

- Acquire new customers

- Expand into new geographies

After a company is acquired, they are mostly left to continue operating as it did before with an integration to the Ferguson backend and software (significant cost-saving potential), cross-selling through all Ferguson sales channels and best practices on how to run the company more efficiently.

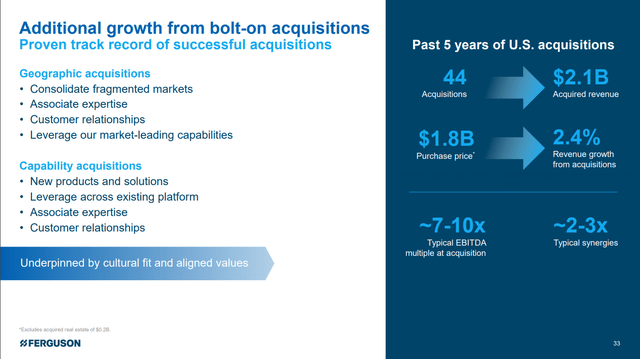

Over the last 5 years the company purchased 44 companies for a total of $1.8 billion and added $2.1 billion of revenue. These acquisitions contributed 2.4% per year to the growth of the company.

Ferguson acquires typically between 7-10 times EBITDA, leaving a slight multiple arbitrage on these acquisitions: The median EV/EBITDA LTM multiple for FERG is 11.7x which is above the 7-10 times they pay. This raises the valuation the market gives on the acquired companies inside of Ferguson. Right now this is not the case though with FERG trading at a low 7.4x EBITDA, last seen during the COVID crash.

Acquisition strategy (Acquisition strategy (Ferguson Investor Day))

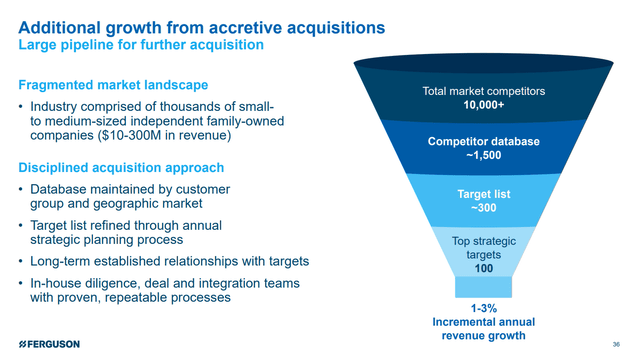

Ferguson seems to be a disciplined buyer, which is very important for a serial acquirer to make sure that acquisitions don’t destroy value. In the picture below you can see their acquisition funnel that filters narrow their total market opportunity down to targets to acquire. They maintain a database with thousands of small companies and update them on a regular basis. Often there are long-term relationships with potential targets, greatly improving the chances to get the deal once they decide to sell. This reminds me a lot of the approach Constellation Software (OTCPK:CNSWF) takes, read my latest article on the company here.

Acquisition funnel (Acquisition funnel (Ferguson Investor Day))

Sensible returns to shareholders

Valuation

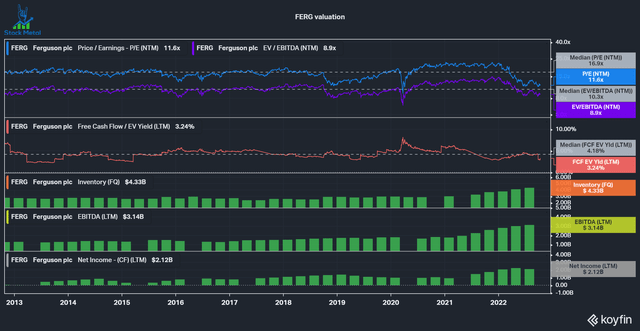

I look at the valuation on two levels: Historic multiples and an Inverse DCF. In the chart below you can see the last 10-year historic multiples for FERG. We can see that on a PE and EV/EBITDA basis FERG is trading much below its average. We also have to take into account that EBITDA and Net income saw phenomenal increases over the last 2 years, with EBITDA growing from $1.6b (2020) to $3.1 billion (2022) and net income from $0.9b (2020) to $2.12b (2022). On the other hands inventories also started to increase fast, growing from $3b (2020) to $4.3b (2022). These increases in Inventory also suppressed Free Cash Flows, resulting in an FCF yield below the 10 year average.

FERG valuation (FERG valuation (Koyfin))

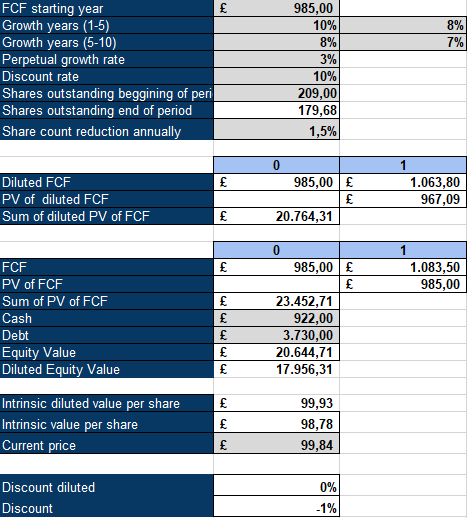

For my inverse DCF, I used a discount rate(my required rate of return) of 10%, a perpetual growth rate of 3% and I assumed a 1.5% annual reduction in shares outstanding based on the past buybacks of the company and no change in capital allocation strategy. Based on these assumptions the market is assuming between 7-8% FCF growth per year to justify the current stock price. On its investor day, the company projected annual revenue growth between 7-12% (page 45) based on the growth of the overall market, Fergusons outperformance over its market and its bolt-on acquisitions. If revenues grow at 7-12% we can assume that FCF grows in line or faster, if we continue the long upwards trend in FERGs margins. The growth assumptions seem to be in line with management’s expectations and even have some upside potential if they grow at the upper end of the spectrum.

FERG inverse DCF (FERG inverse DCF (Authors model))

Conclusion

Ferguson is a high-quality consolidator in the distributor space with a sound acquisition strategy. The looming fears over a recession make the shares attractive, even if earnings go back to the mean. Based on my inverse DCF shares are fairly priced, maybe even slightly undervalued. Even though Ferguson is a great company, I am not buying shares. I prefer to own Watsco, the leading distributor in the HVAC space, due to a clear focus on one industry and large insider ownership and great management alignment with shareholders. Ferguson sadly does not have significant insider ownership.

Be the first to comment