manassanant pamai

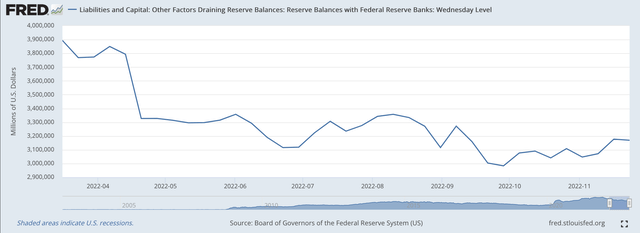

Reserve Balances with Federal Reserve Banks have declined by $725.0 billion since March 16, 2022.

Reserve Balances with Federal Reserve Banks (Federal Reserve)

These reserve balances show the “cash” assets on the balance sheets of commercial banks.

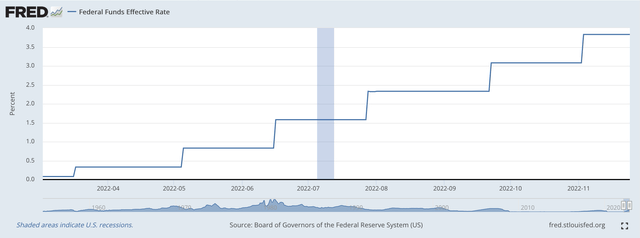

The effective Federal Funds rate has risen from 0.08 percent to 3.83 percent during this time period.

Effective Federal Funds Rate (Federal Reserve)

This is the Fed’s policy rate of interest. The Federal Reserve is expected to raise this rate by another 50 basis points at its meeting of the Federal Open Market Committee in the middle of December.

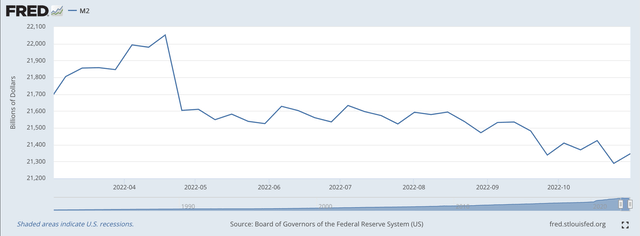

The M2 money stock reached a peak in the week of April 18, 2022, at $22,052.1 billion and has declined ever since.

M2 Money Stock (Federal Reserve)

The M2 money stock was at $21,346.7 billion in the week of October 31, a 3.2 percent drop from the April figure.

Note that the rate of growth of the money stock from December 2020 to December 2021 was 12.4 percent.

The rate of growth of the M2 money stock from October 2021 to October 2022 was 1.2 percent.

The Federal Reserve’s efforts to tighten up on the monetary system really seem to be working.

And, although Federal Reserve officials seem to be signaling that the next move in their policy rate of interest will be more modest than the four that went before, there is no indication that the Fed will be reducing or ending the rate at which the securities portfolio is being reduced.

The implication from this is that the year-over-year rate of growth of the M2 money stock will drop into negative territory.

And, it appears as if the M2 money stock may decline for some time after this date.

Historically, an economic recession follows a declining money stock…but with a lag.

This is another sign that the U.S. economy will be facing an economic recession in 2023.

How long this recession will go will depend upon how long Federal Reserve officials continue to let the securities portfolio decline and how long the Federal Reserve lets the year-over-year stock of money fall.

Money Stock Concern

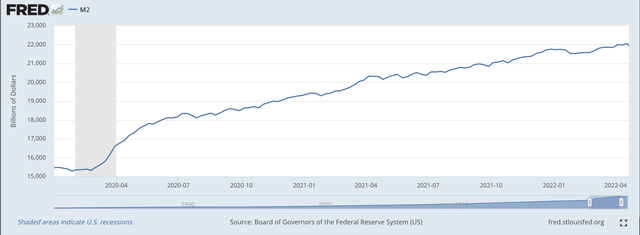

Behind this all is the fact that the Federal Reserve let the money stock grow so rapidly in 2020 and 2021.

I just mentioned that the M2 money stock grew in excess of 12 percent, year-over-year, in 2021.

Well, the M2 money stock grew by more than 24 percent, year-over-year, in 2020.

In other words, the Federal Reserve pumped lots and lots of money into the financial system in 2020 and 2021.

M2 Money Stock: 2020 to 2022 (Federal Reserve)

The problem that the Federal Reserve faces is the fact that there is still lots and lots of money floating around in the economy.

How much money is the Federal Reserve going to have to take “out of the financial system” before economic stability can be achieved?

The Federal Reserve is going to be facing some interesting issues in the next year or so. Most of the decisions they will have to make will be very pleasant ones.

Right now, they are on the path to put down inflation. They seem committed to doing so.

In my view, it is going to be more important to see what the Fed does to its securities portfolio and what these actions do to the M2 money stock than it is to dwell on just how much the Fed is going to change its policy rate of interest.

We are now moving, I believe, into a very crucial time.

And, we must keep our eyes on what the Federal Reserve is doing, especially to its balance sheet.

Be the first to comment