frankpeters

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on November 4th.

Real Estate Weekly Outlook

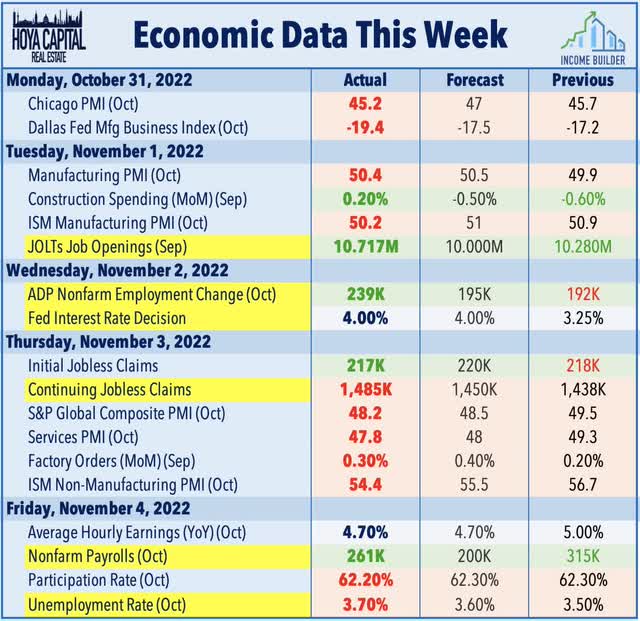

U.S. equity markets slumped this week after the Federal Reserve approved another “jumbo” 75-basis point interest rate hike while lukewarm employment data pushed back the timeline for a potential “pivot” towards less-aggressive tightening. After delivering a third-straight 75-basis point hike – a level of tightening that would be almost unimaginable several years ago in the “zero rate” environment – Fed Chair Powell commented that its tightening course still has “some ways to go” while noting that the “the ultimate level of interest rates will be higher than previously expected” following inflation data showing persistence in price pressures in the face of a broader economic slowdown.

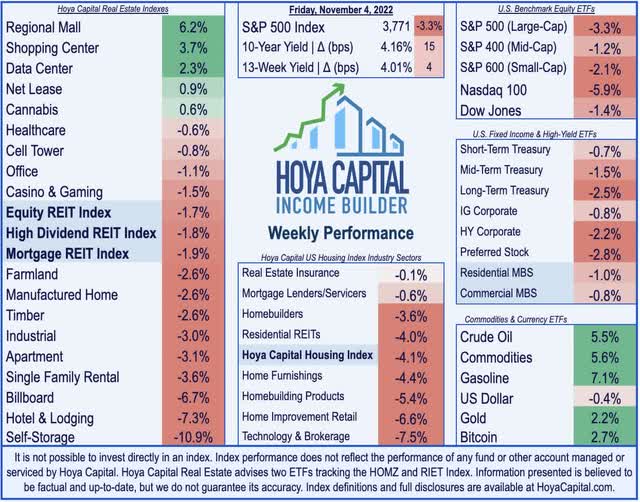

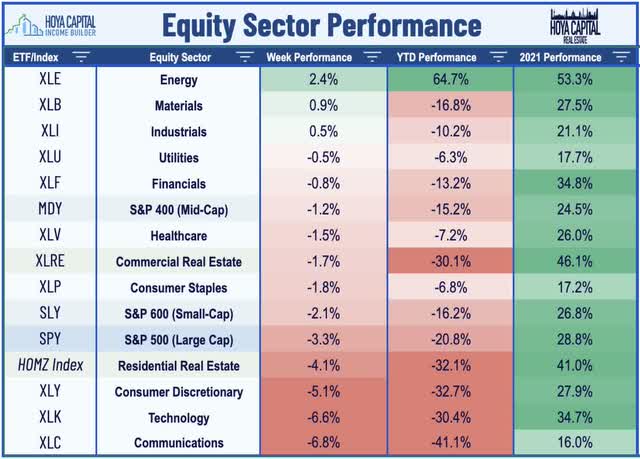

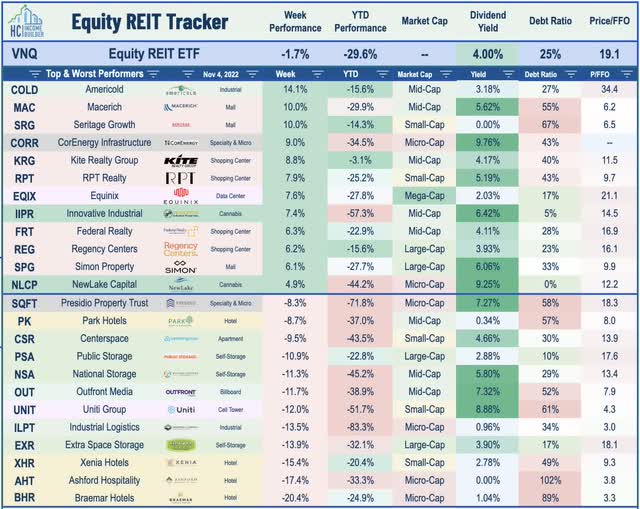

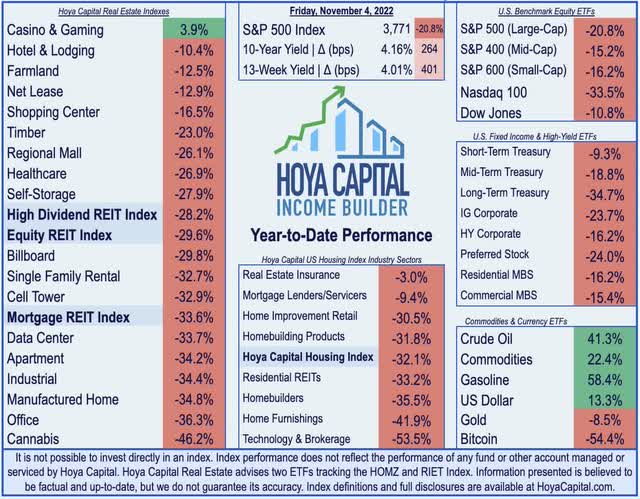

Retreating following its best week since November 2020, the S&P 500 dipped 3.3% on the week – pushing its drawdown back below the 20% “bear market” threshold – while the tech-heavy Nasdaq 100 dipped nearly 6%. The more domestic-focused Mid-Cap 400 and Small-Cap 600 posted more muted declines of 1.2% and 2.1%, respectively. Powered by another strong slate of earnings reports and a wave of dividend hikes, real estate equities were outperformers for a second-straight week. Led on the upside by retail and technology REITs, the Equity REIT Index finished lower by 1.7% this week with 5-of-18 property sectors in positive territory while the Mortgage REIT Index declined 1.9% and Homebuilders pulled back by 3.6%.

After pulling back sharply last week, the 10-Year Treasury Yield rebounded to 4.16% – up 15 basis points on the week – following a busy slate of employment data showing that while hiring has certainly cooled in recent months, labor markets still remain historically tight amid a broader shortage of skilled and available workers. Crude Oil prices surged more than 5% while Gasoline futures jumped 7% as the already-messy global geopolitical dynamics seemingly deteriorated further amid threats of an Iranian attack on Saudi Arabia. Energy (XLE) stocks were the top-performing GICS sector this week despite President Biden’s plans to ask Congress to pursue “windfall” tax penalties for oil and gas companies while Communications (XLC) and Technology (XLK) stocks were laggards following a handful of announced layoffs or hiring freezes including from Amazon (AMZN), Apple (AAPL), Lyft (LYFT), and recently-privatized Twitter, which has reportedly seen a “massive” decline in revenues amid an industry-wide pullback in spending.

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

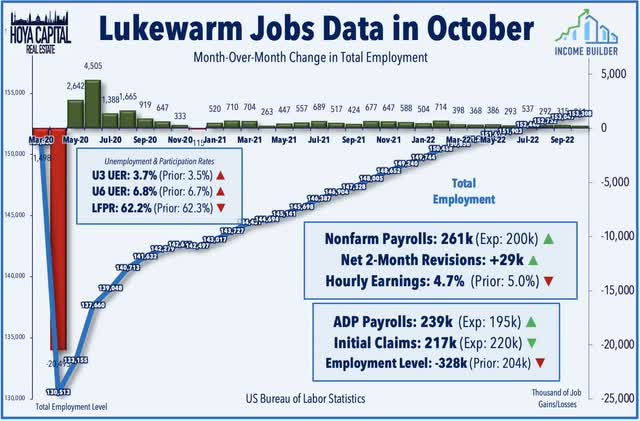

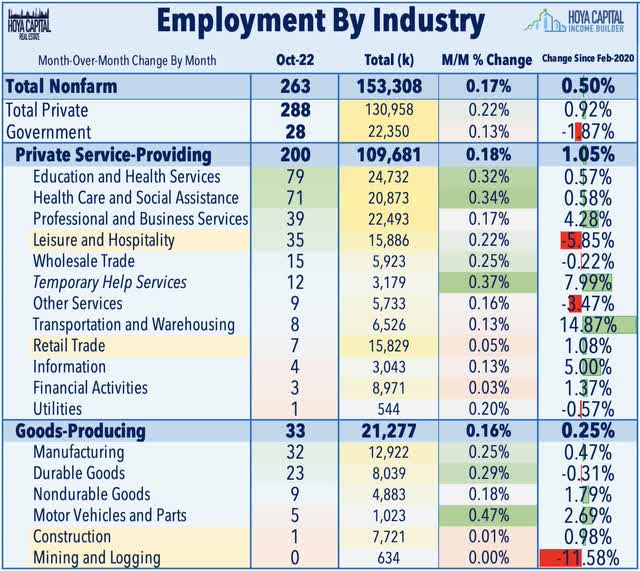

Soft, but not soft enough. The Bureau of Labor Statistics reported this week that the U.S. economy added 261k jobs in October – the slowest pace of hiring since December 2020 but still above expectations of roughly 200k – a relatively solid report following the handful of announced corporate layoffs and hiring freezes earlier in the week. Strong job gains seen in the establishment survey, however, were at odds with the household survey in the same report – which is used to calculate the unemployment and labor force participation figures – which showed net job losses of 328k in October. As a result, the headline U-3 unemployment rate and broader U-6 unemployment rate each ticked higher while the labor force participation rate declined to 62.2% – still 1.2 percentage points below its pre-pandemic level.

Employment gains were still relatively broad-based in October with notable job gains seen in health care, professional and technical services, and manufacturing. Notably, while the leisure and hospitality sector gained 35k jobs in October, the industry is still down by 1.1 million jobs, or 5.8%, since February 2020. Of note, the category with the strongest relative increase in hiring was Temporary Help Services – a category that has recorded total job growth of nearly 8% since February 2020 – the second-highest increase behind the Transportation and Warehousing category during that time, which has seen cumulative job growth of 15%. Ahead of the critical holiday season, retail hiring was fairly disappointing with just 7k jobs added in October.

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

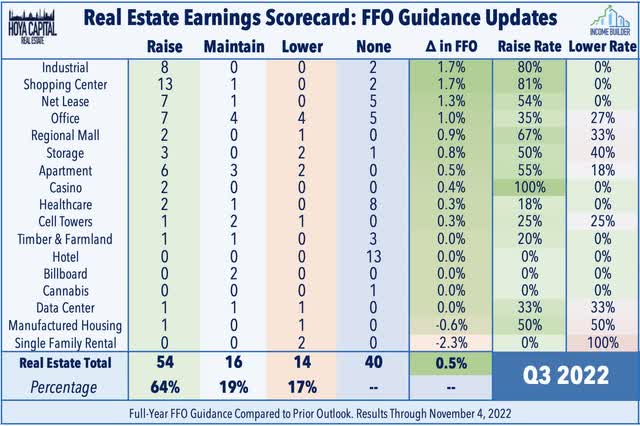

We’ve now heard results from 80% of the REIT sector, and the real estate sector remains an upside standout across the broader equity market. As we’ll discuss in more detail in our REIT Earnings Recap report published early next week, of the 85 equity REITs that provide full-year guidance, 54 (64%) have raised their outlook while 14 (17%) have lowered their outlook. Solid results from REITs come amid an otherwise disappointing earnings season for the broader equity market as, per FactSet, just 48% of S&P 500 companies have boosted their outlook. Upside standouts this earnings season include industrial, shopping center, and net lease REITs, while results from residential, healthcare, and technology REITs have been more “hit and miss.” Below we discuss some of the notable reports over the past week.

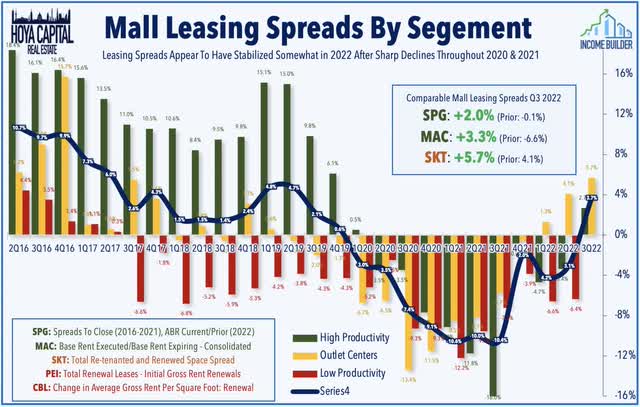

Mall: Results from mall REITs have shown that downward pressure on rents and occupancy rates may finally be subsidizing. Simon Property (SPG) rallied more than 6% this week after hiking its full-year guidance along with its quarterly dividend. Driven by an uptick in occupancy rates and a stabilization in rents, SPG now sees its FFO/share roughly matching that of the prior year driven by comparable leasing spreads are “wildly positive”. Tanger Factory Outlet (SKT) rallied more than 4% after reporting better-than-expected results and raising its full-year outlook, driven by its strongest quarter for rental rate spreads in a half-decade at 5.7% – its third straight quarter of positive spreads following a streak of eight straight quarters of negative growth. Macerich (MAC) gained about 10% after reporting similar strength in occupancy rates and rental rate spreads, which offset a downward revision to its full-year FFO target. Encouragingly, MAC reported positive spreads of 3.3% – up from -6.6% in the prior quarter – its best quarter of leasing since the pandemic began.

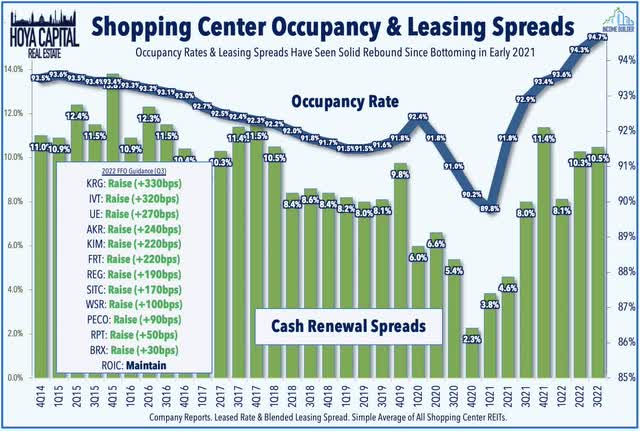

Shopping Center: The strong earnings season for shopping center REITs continued with a slate of very upbeat reports. Kite Realty (KRG) – which we recently identified as one of our three “Best Ideas in Real Estate” on the Income Builder Marketplace – advanced more than 8% after reporting very strong results and raising its full-year outlook. Driven by record leasing volume, KRG raised its full-year FFO growth outlook to 25.3% – up 330 basis points from last quarter. Regency Centers (REG) – which we own in the REIT Dividend Growth Portfolio – rallied nearly 6% after reporting better-than-expected results and raising its full-year FFO and NOI outlook while raising its dividend by 4%. Lifted by another strong quarter of leasing demand, Regency lifted its full-year FFO growth outlook by 190 basis points. Federal Realty (FRT) also rallied 6% after reporting similarly strong results and raising its full-year FFO outlook by 220 basis points. RPT Realty (RPT) rallied 8% after reporting similarly strong results and raising its full-year FFO and NOI outlook.

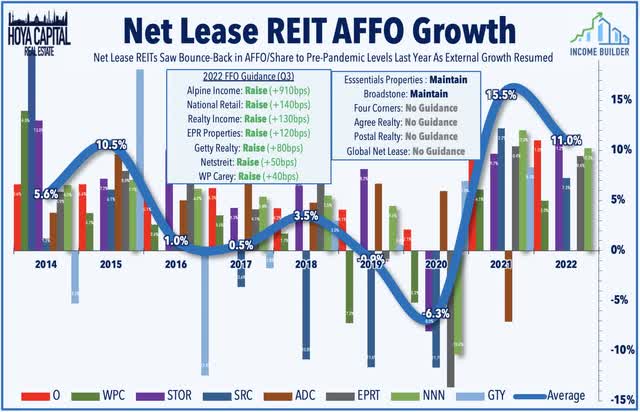

Net Lease: The strong earnings season for net lease REITs continued as well this week. W.P. Carey (WPC) – which we own in the REIT Focused Income Portfolio – rallied 2% on the week after raising its full-year FFO outlook driven by record-high rent growth driven by CPI adjustments. WPC now expects FFO growth of 5.0% this year – up 40 basis points from its prior outlook – and is one of seven net lease REITs to raise its full-year outlook this quarter despite the headwind from higher rates. National Retail (NNN) gained nearly 3% after it raised its full-year FFO growth outlook to 9.4% – up 120 basis points from its prior outlook. Of note, while NNN continued to plow ahead with acquisitions, it noted some upward “velocity” in cap rate since the last Fed rate hike remaking that cap rates have risen about 25-40 basis points “in the last month or so.” Realty Income (O) – the largest net lease REIT – finished higher by 1% after reporting solid results and raising its full-year FFO growth target by 12.3% – up 130 basis points from the prior quarter. EPR Properties (EPR) advanced about 1% after reporting continued progress in rent collection on deferred rent payments and raising its full-year FFO target.

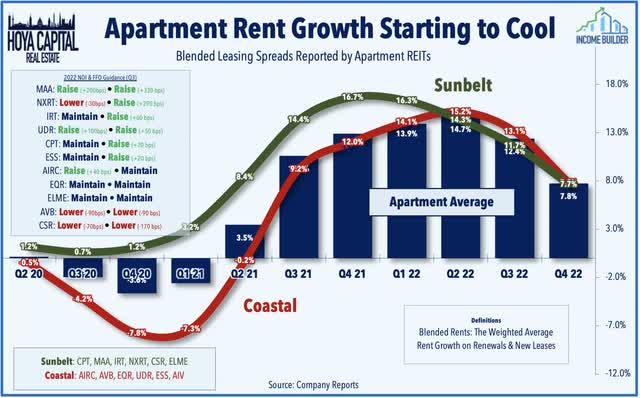

Apartment: Results were more hit-and-miss in the residential sectors following a strong start to earnings season last week. Apartment Income (AIRC) was the best performer in the sector this week after raising its full-year NOI growth outlook while reiterating its FFO target. Leasing results from AIRC were notably stronger than its coastal-focused peers, reporting 14.0% blended spreads in Q3 and 12.9% in October while recording an impressive 640 basis point decline in turnover rates. AvalonBay (AVB) slipped nearly 5% after reporting relatively weaker results and revising lower its full-year FFO and NOI growth outlook. Of note, AVB was the lone apartment REIT this earnings season to downward revise its full-year outlook lower across FFO and same-store revenues, expenses, and NOI. Centerspace (CSR) dipped nearly 10% after lowering its full-year NOI and FFO growth outlook, citing “persistent cost pressures” and a “higher than usual volume of non-controllable unreimbursable losses” in its non-same-store portfolio. Driving the higher expenses, in part, was an uptick in turnover rates, something we’ve seen across several multifamily REITs in Q3 after hitting record-low levels earlier this year.

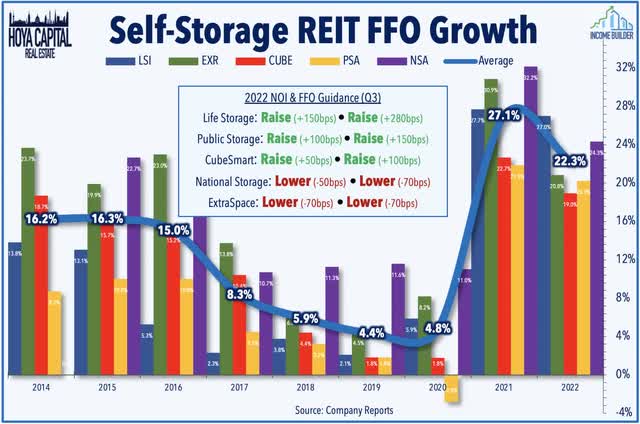

Storage: “Hit and miss” was certainly the theme of storage REIT reports with a trio of strong reports offset by a pair of downbeat outlooks. Extra Space (EXR) dipped more than 13% after lowering its full-year FFO and NOI growth outlook by 70 basis points each, citing a combination of expense pressures and slower demand. Public Storage (PSA) also dipped more than 10% despite reporting strong results and raising its full-year growth outlook. PSA now sees FFO growth of 20.5% this year – up 150 basis points from its prior outlook. Life Storage (LSI) declined 7% after reporting strong results and boosting its full-year FFO growth target by 280 basis points to 27.0%, commenting that “fundamentals are very strong with occupancy remaining elevated from pre-pandemic seasonal levels.“ National Storage (NSA) declined about 11% after lowering its full-year FFO growth outlook by 70 basis points to 24.3%, noting that self-storage fundamentals “remain healthy” but “are moderating toward historical norms.”

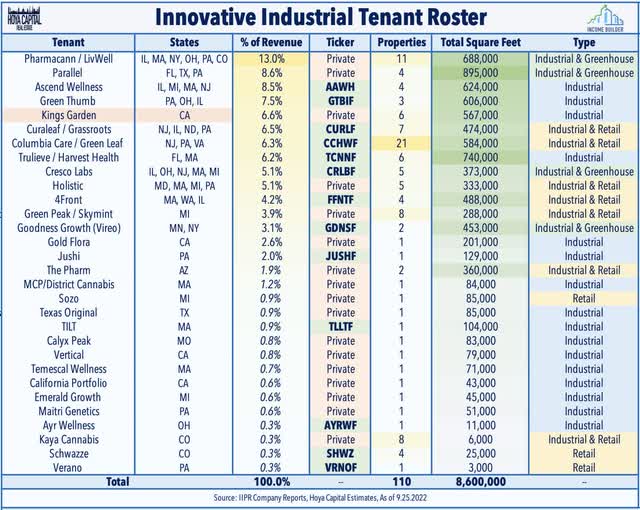

Cannabis: Innovative Industrial (IIPR) – a perennial outperform that has been slammed this year on concerns over tenant health – rallied more than 7% this week after reporting better-than-expected results and noting that rent collection issues remain limited to two troubled tenants – Kings Garden and Vertical. IIPR noted that it has collected 97% of its rent so far this year with the Kings Garden defaults in July responsible for the majority of that 3% of uncollected rent. Encouragingly, IIPR reported that it signed a Letter of Intent for a long-term lease at one of the properties that was formerly leased to Kings Garden in “just over a month of marketing the property.”

Data Center: Equinix (EQIX) – which we own in the REIT Dividend Growth Portfolio – rallied nearly 8% on the week after reporting strong results and raising its full-year 2022 outlook driven by a sixth consecutive quarter of record leasing activity and strong pricing trends. Of note, EQIX reported same-store revenue growth of 7% in Q3, continuing an acceleration in rent growth since early 2021. EQIX now sees full-year FFO growth of 7.7% (10.5% on a constant-currency basis) – up 100 basis points from last quarter. Specialty REIT Iron Mountain (IRM) finished roughly flat after reporting that it expects to exceed its previous projection of 130 megawatts for new data center leases for the year while maintaining its full-year outlook. While no longer a REIT, DigitalBridge (DBRG) dipped another 7% on the week after reporting mixed third-quarter results with higher interest expenses taking a tool on its more-highly-levered balance sheet following a frenzy of acquisitions in the past two years, extending its year-to-date decline to over 60%.

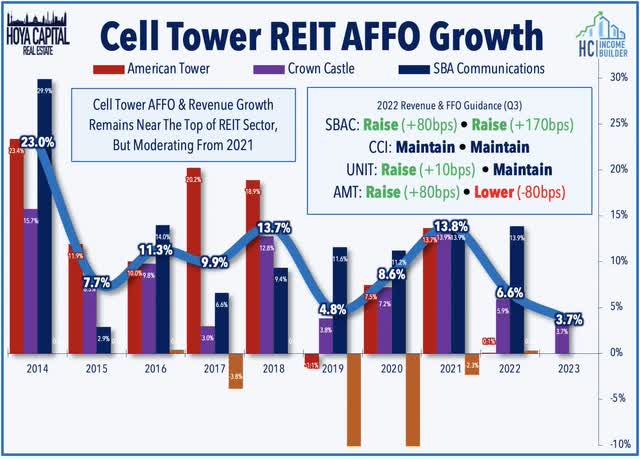

Cell Tower: SBA Communications (SBAC) gained 1% on the week after reporting better-than-expected results and raising its full-year outlook, noting that “wireless carrier activity remains robust across most of our markets. We believe activity will remain strong into 2023 and perhaps beyond, given the size and scope of our customers’ 5G deployment plans.” SBAC boosted its full-year revenue growth outlook by 80 basis points and its FFO growth outlook higher by 170 basis points to 13.9%. The company also announced that it closed on its previously-announced acquisition of 2,632 towers in Brazil, which is expected to grow its portfolio of owned tower sites by 15%, which some analysts have flagged as a potential risk given the leftward shift in Latin America electoral politics over the past several years. Uniti Group (UNIT) – which owns fiber networks – dipped 12% on the week despite reporting decent results and maintaining its full-year outlook as weak results from its non-REIT peer Lumen (LUMN) weighed on UNIT’s outlook.

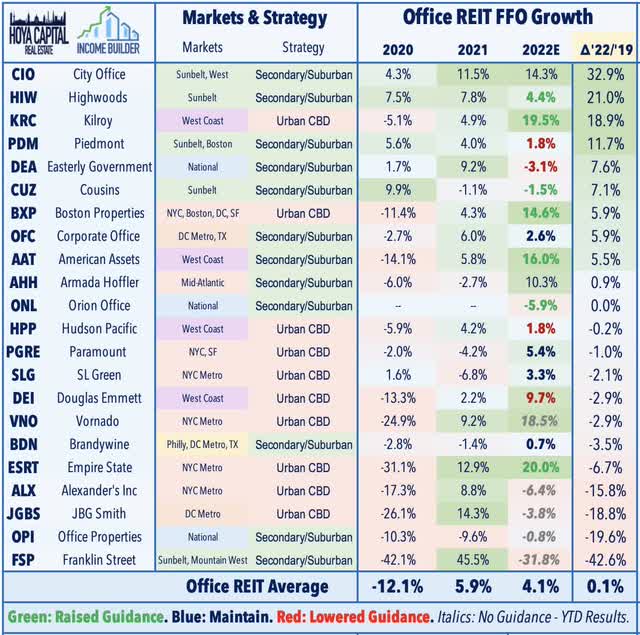

Office: This week, we published Office REITs: Work from Home Reckoning? Pressured by the painfully slow “return to the office” with daily utilization rates still 50% below pre-pandemic norms, Office REITs are the among worst-performing property sectors this year even as leasing activity and REIT earnings results have been surprisingly resilient. With labor markets still historically tight, employees are still dictating the terms of the “Work from Home” dynamic, especially in coastal markets with long commutes where WFH benefits outweigh costs. Counterintuitively, a recession could be a net positive for the typically pro-cyclical office sector as firms increasingly utilize office mandates as part of a workforce reduction strategy, driving utilization rates closer to pre-pandemic levels. Of note, Easterly Government (DEA) slumped nearly 7% on the week after lowering its full-year FFO growth outlook – a revision primarily attributable to a newly-announced deal to sell 10 properties.

REIT earnings season will wrap-up in the week ahead with reports from two dozen REITs with a few “big names” still left to report including Apple Hospitality (APLE), Welltower (WELL), and Sabra Health Care (SBRA) on Monday, Spirit Realty (SRC), UMH Properties (UMH), and National Health Investors (NHI) on Tuesday, Healthcare Realty (HR) and Tricon Residential (TCN) on Wednesday, and NewLake Capital (OTCQX:NLCP) and Sotherly Hotels (SOHO) on Thursday. As always, we’ll provide real-time commentary throughout earnings season for Income Builder members.

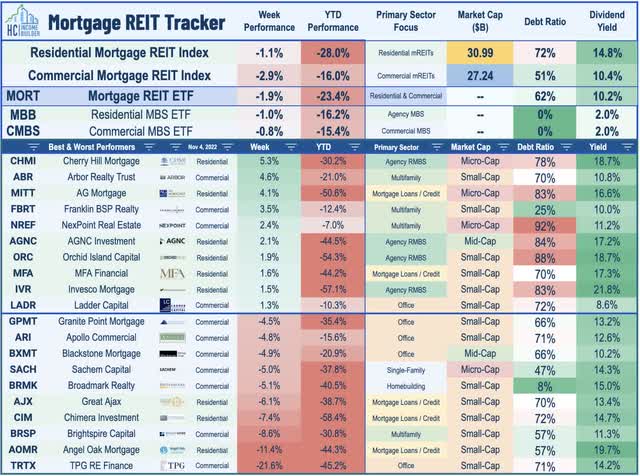

Mortgage REIT Week In Review

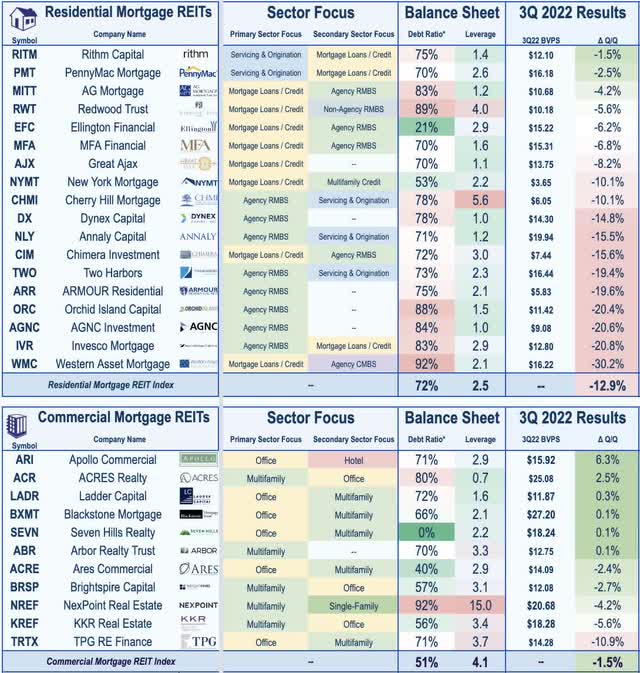

Following double-digit gains in the prior week, Mortgage REITs were mixed on the week amid a busy earnings slate with 18 report which, as a whole, have been significantly better than expected amid a historically brutal quarter for lending markets. On the upside this week, Arbor Realty (ABR) – which we own in the REIT Focused Income Portfolio – rallied more than 4% on the week after reporting strong Q3 results and raising its dividend for the fourth time this year. Cherry Hill Mortgage (CHMI) rallied 5% after reporting that its Book Value Per Share (“BVPS”) declined 10% in Q3 to $6.05 – less steep than its agency-focused peers. Rithm Capital (RITM) finished roughly flat after noting that its Book Value Per Share (“BVPS”) declined just 1% to $12.10 – the most muted decline among residential mREITs so far this earnings season.

As expected, Book Value declines have been more significant for pure-play agency-focused mREITs but conditions are far less grim than feared several weeks ago. Agency-focused Invesco Mortgage (IVR) advanced 1.5% after reporting that its BVPS declined 20% in Q3 to $12.80 – essentially in line with estimates. AG Mortgage (MITT) gained 4% after reporting that its BVPS declined just 4% in Q3. Back on the commercial side, Hannon Armstrong (HASI) advanced 1% after reporting better-than-expected results and affirming its guidance that Distributable Earnings Per Share is expected to grow at a compound annual rate of 10% to 13% from 2021 to 2024, relative to the 2020 baseline of $1.55 per share. On the downside this week, TPG Real Estate (TRTX) slumped more than 20% after reporting that its BVPS dipped more than 10% in Q3, the steepest decline among commercial mREITs. Chimera (CIM) dipped nearly 9% after reporting that its BVPS declined 16% to $7.44 – the steepest among non-agency mREITs thus far while Great Ajax (AJX) slipped about 6% after reporting that its BVPS declined 8.2% to $13.75 in Q3 – a bit softer than expected.

Among the REITs that were little-changed after earnings reports, ACRES Commercial (ACR) slipped 1% despite reporting that its BVPS advanced 2% in Q3, among the best in the sector thus far. New York Mortgage (NYMT) finished lower by about 2.5% after reporting that its BVPS dipped 10% to $3.65. Western Asset (WMC) slipped roughly 2% after reporting a sector-worst 30% decline in its BVPS, but noted that it remains committed to “pay dividends that are supported by the long-term earnings power of the portfolio.” We’ll hear results from the final dozen mREITs in the week ahead including Two Harbors (TWO) and Broadmark (BRMK) on Tuesday and Starwood Property (STWD) on Wednesday.

2022 Performance Check-Up

With ten months of 2022 now in the books, Equity REITs are now lower by 29.6% on a price return basis for the year – still their second-worst YTD performance for the REIT Index on record through this date behind 2008 – while Mortgage REITs are lower by 33.6%. This compares with the 20.8% decline on the S&P 500 and the 15.2% decline on the S&P Mid-Cap 400. Within the real estate sector, just one property sector is in positive territory on the year – Casino REITs – while nine property sectors are lower by more than 30%. At 4.16%, the 10-Year Treasury Yield has surged 264 basis points since the start of the year, but is below its 2022 highs of 4.30%. As a result, the US bond market is on pace for its worst year in history with a loss of 16.0% on the Bloomberg US Aggregate Bond Index, which is 5x larger than the previous worst year back in 1994 (-2.9%).

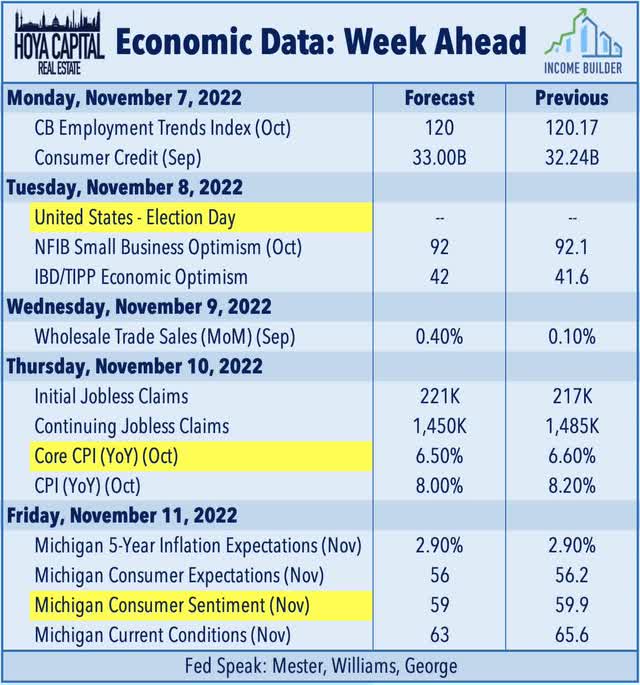

Economic Calendar In The Week Ahead

The economic data and earnings calendar slows down a bit in the week, headlined by the Consumer Price Index on Thursday which investors – and the Fed – are hoping to show that the fastest pace of year-over-year increases is finally behind us. The headline CPI is expected to moderate to an 8.0% year-over-year rate while the Core CPI is expected to decelerate slightly to 6.5%. Consumer gas prices were, on average, 3% higher in October compared to the prior month and 15.9% above the prior month. The other major market-moving event of the week comes on Tuesday with Election Day in the United States. Market pricing currently implies a roughly 75% probability that Republicans take control of the House and Senate, a state of “divided government” that would likely remove the potential for major fiscal spending over the next two years. On Friday, we’ll get our first look at Michigan Consumer Sentiment for September. The Fed is particularly interested in the 5-Year Inflation Expectations survey, looking for signs of a potential “wage-price inflation spiral” through elevated consumer wage expectations.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment