christiannafzger/iStock via Getty Images

Earnings of First National Bank Alaska (OTCQX:FBAK) will likely remain flattish this year as moderate loan growth will counter lower Paycheck Protection Program fees. However, earnings will likely trend upwards next year thanks to moderate loan growth. Meanwhile, the margin will likely expand slightly in the remainder of 2022 before stabilizing in 2023. Overall, I’m expecting First National Bank Alaska to report earnings of $18.35 per share for 2022, down 0.5% year-over-year, and $19.20 per share for 2023, up 4.6% year-over-year. The company is offering a high dividend yield but also a substantial price downside. Therefore, I’m adopting a hold rating on First National Bank Alaska.

Alaskan Economy Presents a Mixed Picture

After declining by 7% from March 2021 to March 2022, the loan book grew by 3.2% in the second quarter of this year. The second quarter’s performance will most probably not be repeated in the second half of this year partly due to high interest rates that will discourage borrowers. Regional economic factors will also result in lower loan growth for the remainder of this year.

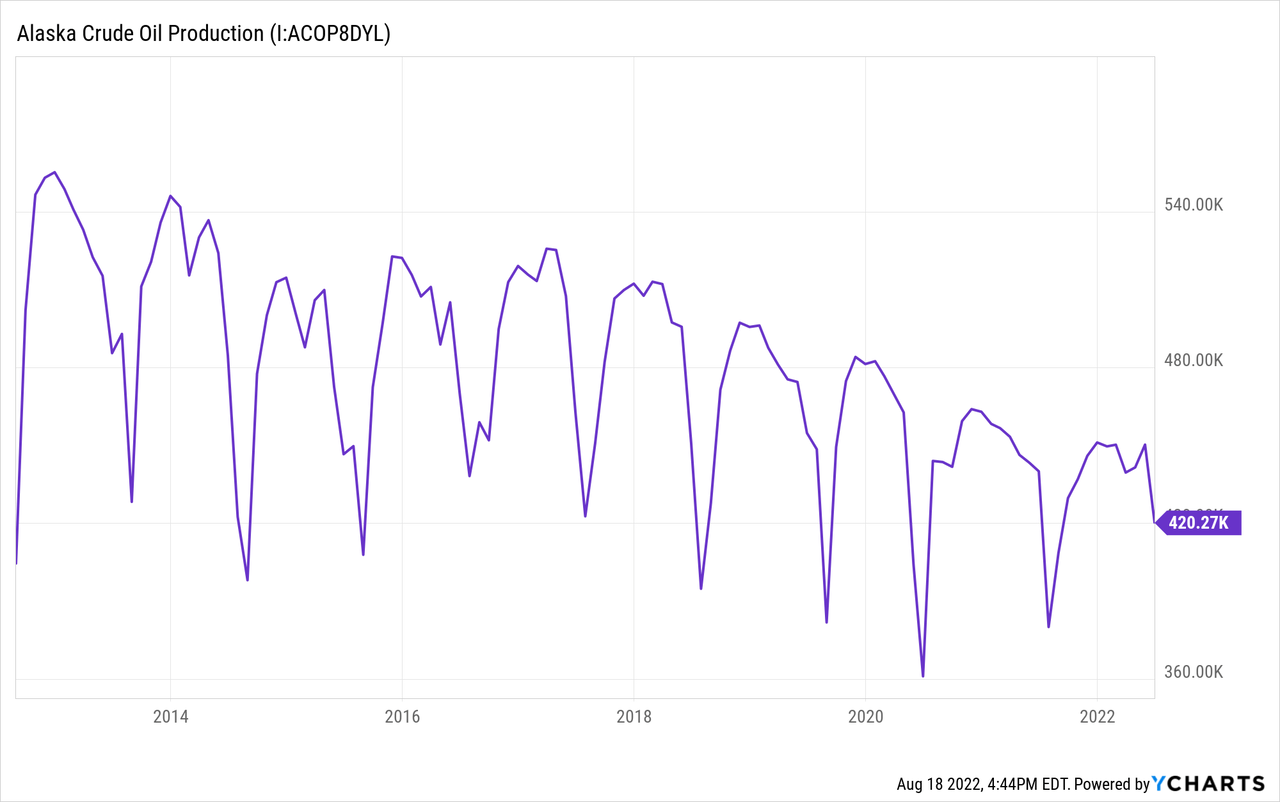

An important indicator of economic growth in Alaska is crude oil production. As shown below, production continued to make lower seasonal highs this year. However, the rate of decline does not seem to have changed much.

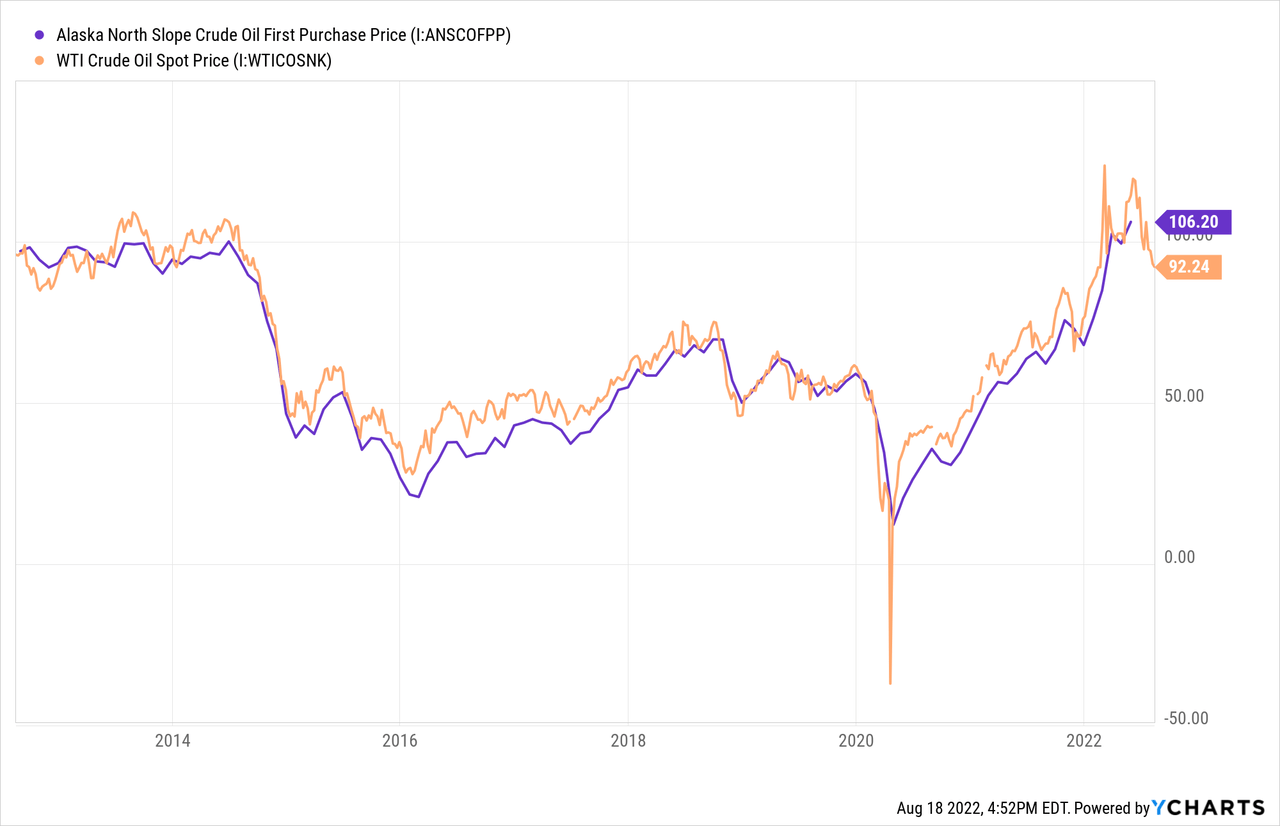

Crude oil prices are another big indicator of the health of the regional economy. Oil prices have recently trended downwards, but they’re still quite high from a historical perspective.

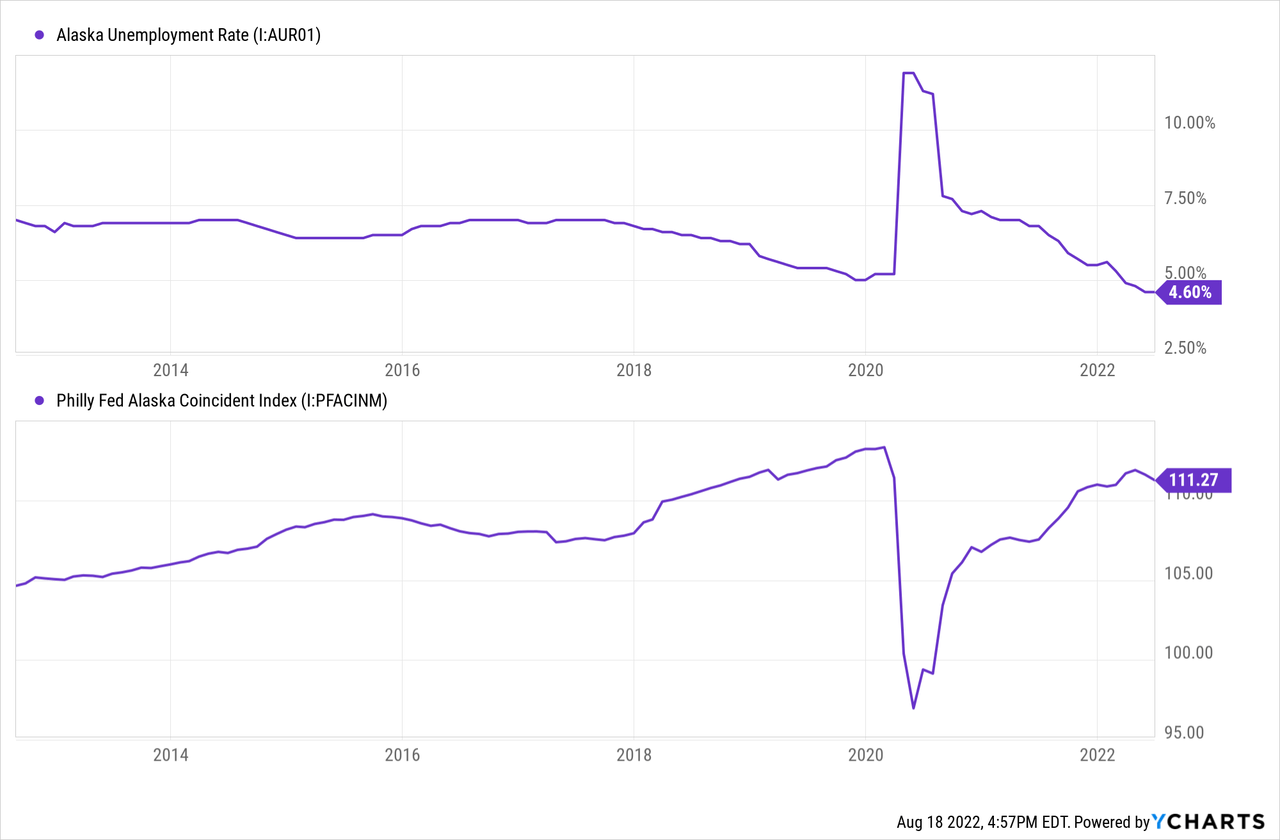

Alaska’s macroeconomic indicators also give a mixed picture. The unemployment rate is now at record lows and much better than the pre-pandemic level. However, the coincident index, which includes the unemployment rate among other metrics, shows that the economy has still not recovered to the pre-pandemic level.

Considering these factors, I’m expecting the loan portfolio to grow at a moderate rate of 0.75% in each quarter till the end of 2023, which is at the lower side of the historical trend.

Equity Book Value to Slip Further

First National Bank Alaska’s book value per share has plunged by 20% in the first half of 2022 due to the large available-for-sale debt securities portfolio. These securities made up 52% of total assets at the end of June 2022, according to details given in the FDIC report for the second quarter. The market value of the securities portfolio dropped in the first half as interest rates rose, leading to heightened unrealized losses. As per the relevant accounting standards, these losses skipped the income statement and went directly to the equity account through other comprehensive income.

The market value of securities will fall further in the second half of 2022 because the Fed raised the fed funds rate by 75 basis points in July. Further, I’m expecting another 75 basis points hike in the remainder of the year. Therefore, the book value of equity is likely to continue to slip in the year ahead. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Financial Position | ||||||||||

| Net Loans | 1,935 | 1,992 | 2,190 | 2,104 | 2,185 | 2,251 | ||||

| Growth of Net Loans | 7.7% | 2.9% | 9.9% | (3.9)% | 3.8% | 3.0% | ||||

| Other Earning Assets | 1,598 | 1,589 | 2,391 | 3,356 | 3,083 | 3,176 | ||||

| Deposits | 2,420 | 2,388 | 3,113 | 4,217 | 4,224 | 4,352 | ||||

| Total Liabilities | 3,247 | 3,261 | 4,109 | 5,027 | 5,003 | 5,154 | ||||

| Common equity | 507 | 548 | 587 | 555 | 414 | 424 | ||||

| Book Value Per Share ($) | 159.9 | 172.8 | 185.2 | 175.1 | 130.7 | 133.9 | ||||

| Tangible BVPS ($) | 159.9 | 172.8 | 185.2 | 174.1 | 129.7 | 132.9 | ||||

|

Source: FDIC Call Reports, Annual Financial Reports, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

PPP Fees, Security Portfolio to Restrict Margin Expansion

The rising-rate environment is unlikely to have much of an impact on the net interest margin in the short term. Firstly, the average earning-asset yield is kind of sticky as First National Bank Alaska has more fixed-rate debt securities than loans. Fortunately, around 47% of the securities are U.S. treasuries (source: financial review), so they will mature soon.

Non-interest-bearing deposits made up a hefty 57.6% of total deposits at the end of June 2022. Therefore, the average deposit cost will remain mostly upward sticky amid a rising-rate environment.

First National Bank Alaska’s asset mix is far from optimal. More than half the earning assets are debt securities, which carry an average yield of only 1.29%. In comparison, the average yield on loans is 4.97%. The following chart shows how the mix has worsened over the last two years.

FDIC Call Reports

If First National Bank Alaska could only slightly tilt its loan mix towards loans, then the margin could improve significantly. Unfortunately, the task seems too difficult to complete due to the economic factors given above.

Considering these factors, I’m expecting the margin to grow by 14 basis points in the second half of 2022 before stabilizing in 2023. Despite the expansion, the average margin for 2022 will be below the average margin for 2021 because of lower accelerated fees from the Paycheck Protection Program (“PPP”).

Above Normal Provisioning Likely for the Remainder of this Year

Non-current loans made up just 0.3% of total loans, while allowances made up 0.9% of total loans at the end of June 2022. A 3x coverage appears reasonable in ordinary times. However, I’m expecting more than usual financial stress for borrowers in the second half of this year. This stress will be driven by high inflation and the possibility of a recession. For borrowers on variable-rate loans, heightened rates will also add to the financial stress.

As a result, I’m expecting provisioning to remain above normal in the second half of 2022 and then return to a normal level in 2023. I’m expecting provisioning to make up 0.12% of total loans (annualized) in the second half of 2022 and 0.09% of total loans in 2023. In comparison, the net provision expense averaged 0.09% from 2017 to 2019.

Please note that despite above-normal provisioning for the second half of 2022, the full-year provisioning will be below normal due to the large provision reversals in the first quarter of this year.

Flattish Earnings Likely for 2022

Earnings will likely be flattish this year as lower PPP fees will undermine the effects of moderate loan growth. Further, the provision will likely be lower this year thanks to large provision reversals in the first quarter. Overall, I’m expecting First National Bank Alaska to report earnings of $18.35 per share for 2022, down by just 0.5% year-over-year.

For 2023, I’m expecting moderate loan growth to be the chief driver of earnings. I’m expecting the company to report earnings of $19.20 per share for next year, up by 4.6% year-over-year. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Income Statement | ||||||||||

| Net interest income | 132 | 137 | 145 | 146 | 145 | 154 | ||||

| Provision for loan losses | 2 | 0 | 2 | 2 | 1 | 2 | ||||

| Non-interest income | 26 | 23 | 26 | 27 | 26 | 28 | ||||

| Non-interest expense | 86 | 86 | 91 | 92 | 92 | 98 | ||||

| Net income – Common Sh. | 54 | 56 | 58 | 58 | 58 | 61 | ||||

| EPS – Diluted ($) | 17.07 | 17.56 | 18.17 | 18.45 | 18.35 | 19.20 | ||||

|

Source: FDIC Call Reports, Annual Financial Reports, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Significant Price Downside Tarnishes the High Dividend Yield

First National Bank Alaska currently pays a quarterly dividend of $3.20 per share and an annual special dividend of around $3.20 per share as well. If the company maintains this dividend, then the implied dividend payout ratio for 2023 will be very high at around 83%. Nevertheless, I’m not expecting a dividend cut because First National has endured a higher payout ratio in the past. Moreover, the company’s capital appears more than adequate with a tier I ratio of 19.5%, as opposed to the minimum regulatory requirement of 8.5%. The current dividend (including the special dividend) implies a dividend yield of 6.2%.

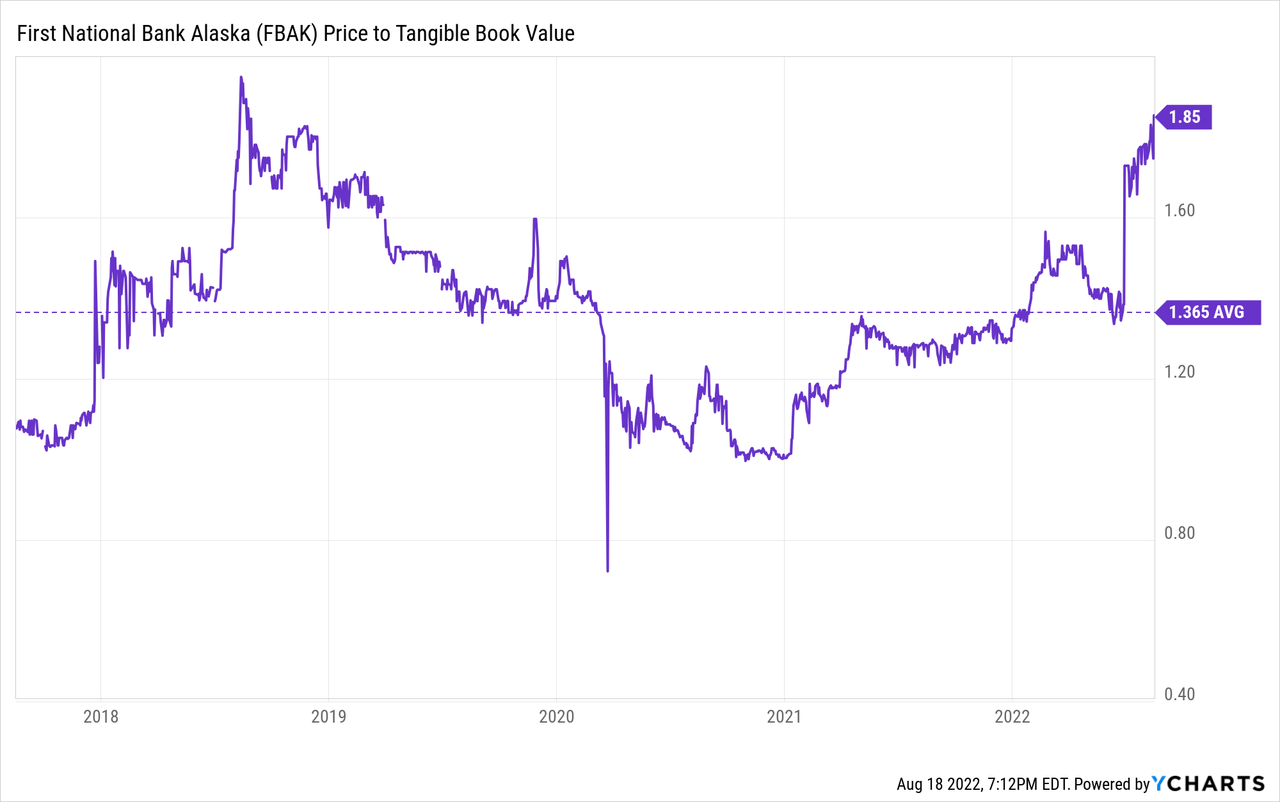

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value First National Bank Alaska. The stock has traded at an average P/TB ratio of 1.37 in the past, as shown below.

Multiplying the average P/TB multiple with the forecast tangible book value per share of $129.7 gives a target price of $177.0 for the end of 2022. This price target implies a 31.8% downside from the August 18 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.27x | 1.32x | 1.37x | 1.42x | 1.47x |

| TBVPS – Dec 2022 ($) | 129.7 | 129.7 | 129.7 | 129.7 | 129.7 |

| Target Price ($) | 164.1 | 170.6 | 177.0 | 183.5 | 190.0 |

| Market Price ($) | 259.5 | 259.5 | 259.5 | 259.5 | 259.5 |

| Upside/(Downside) | (36.8)% | (34.3)% | (31.8)% | (29.3)% | (26.8)% |

| Source: Author’s Estimates |

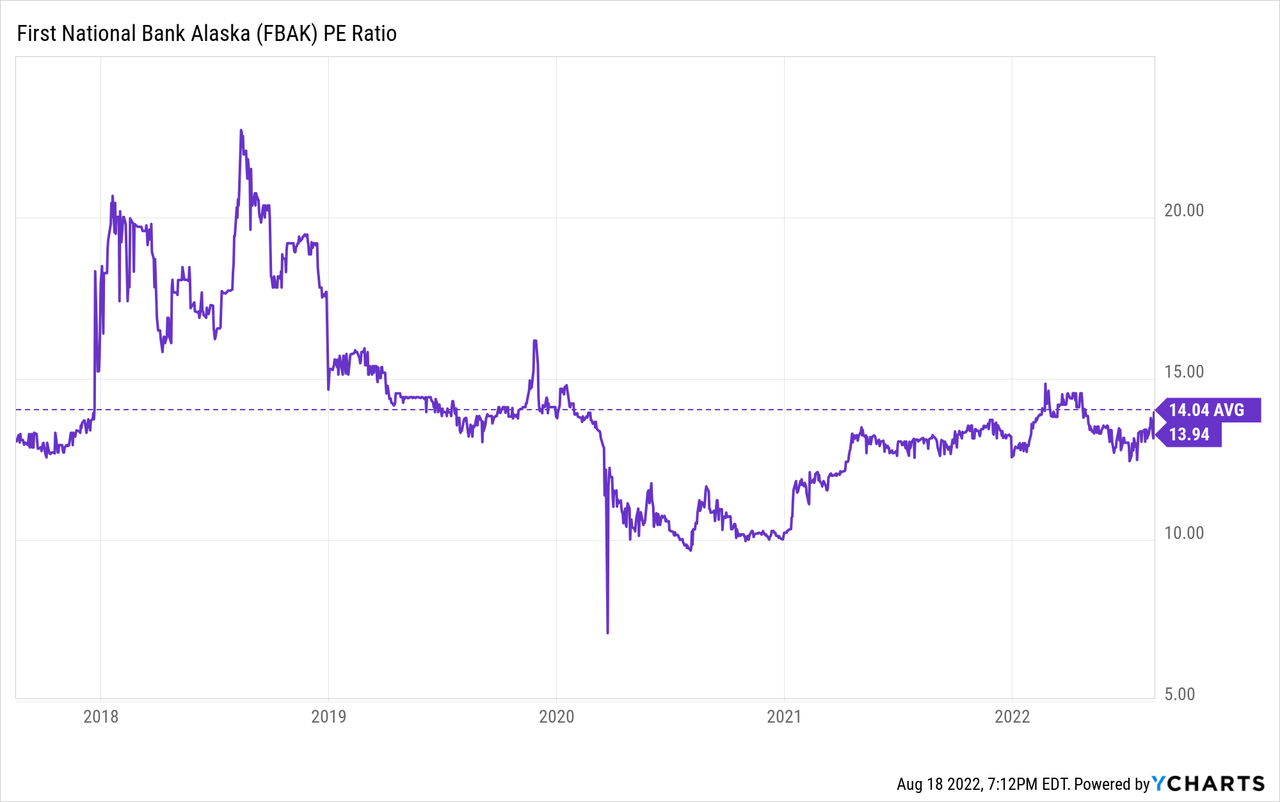

The stock has traded at an average P/E ratio of around 14.04x in the past, as shown below.

Multiplying the average P/E multiple with the forecast earnings per share of $18.4 gives a target price of $257.6 for the end of 2022. This price target implies a 0.7% downside from the August 18 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 13.94x | 13.99x | 14.04x | 14.09x | 14.14x |

| EPS 2022 ($) | 18.4 | 18.4 | 18.4 | 18.4 | 18.4 |

| Target Price ($) | 255.8 | 256.7 | 257.6 | 258.6 | 259.5 |

| Market Price ($) | 259.5 | 259.5 | 259.5 | 259.5 | 259.5 |

| Upside/(Downside) | (1.4)% | (1.1)% | (0.7)% | (0.4)% | (0.0)% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $217.3, which implies a 16.2% downside from the current market price. Adding the forward dividend yield gives a total expected return of negative 10.1%. Hence, I’m adopting a hold rating on First National Bank Alaska.

Be the first to comment