Kondor83/iStock via Getty Images

Three months ago, I wrote about the incredible number of brands FAT Brands, Inc (NASDAQ:FAT) has acquired since 2021. In 2022 we can see that its multi-brand offerings are delivering serious growth opportunities within the United States, where many stores have been opening throughout the year. It is the 25th largest restaurant company in the country. However, equally noteworthy has been the introduction of some of its brands into international markets. We saw it open its first stores in Mexico last month, in Morocco, and most recently, the company announced stores opening in the Republic of Congo. While the stock is trending downwards, since my article, the stock price has increased by 5.28%. The company has a 1-year target price of $25, more than three times its current value. Although we have to remain very cautious that this is an unprofitable company with a severely high debt level, it has used its high-yield preferred stocks to pay for acquisitions, thus partially downplaying the debt on the balance sheet. On top of that, there is general market uncertainty as a recession looms ahead.

Nonetheless, the upside potential for this very affordable stock seems inevitable, with a strong brand repertoire to take on market expansion opportunities and a consecutive upward trend in sales and stores opening. If we compare it to the top franchise restaurant companies in the United States, it appears to be incredibly undervalued and growing well above industry standards. For this reason, I suggest investors take a bullish stance on this very cheap restaurant franchisor stock.

The Restaurant industry

Although cautious of the impact of inflation on numbers, the US restaurant industry is projected to surpass pre-Covid numbers to reach an expected $898 billion for the first time since 2019. The restaurant industry in the United States is diverse and hugely fragmented, and most businesses are privately owned. It employs over 15.6 million people. The industry is harsh, with 60% of companies failing within the first year. However, there is a reason to be cautious about the looming recession, inflation and rising costs. If we look at the Dow Jones Index for US restaurants and bars, it has outperformed the overall market over the last 12 months by 5.8%.

When looking at the industry, it is crucial to recognize the business model you are evaluating and some key metrics. FAT is predominantly a franchise model; it also has wholly-owned businesses. Thus we look at system sales to understand the complete restaurant chain. FAT has a total of 17 restaurant brands. It works with 760 different franchisees who operate a total of 2,227 restaurants. It also has 127 of its stores and a total of 2,350 open restaurants. According to unit count, FAT is the 25th largest restaurant company in the United States.

Financials and Valuation

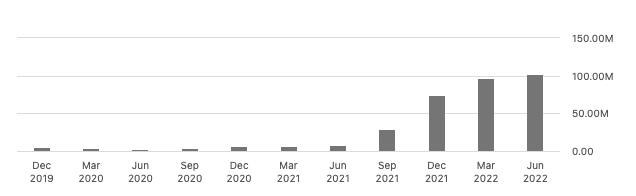

There is much to get excited about if we look at restaurant unit growth and sales revenue increases. The company has opened 60 units year to date and is set to achieve approximately 120 new restaurants by year-end. Over the last four quarters, FAT has reported consecutively higher revenue numbers, as seen below. Total revenue for Q2 2022 was $102.8 million. It is a massive jump from $8.3 million in Q2 2021. The growth is directly connected to the acquisition of other brands the company can now offer.

Total Revenue Per Quarter (SeekingAlpha.com)

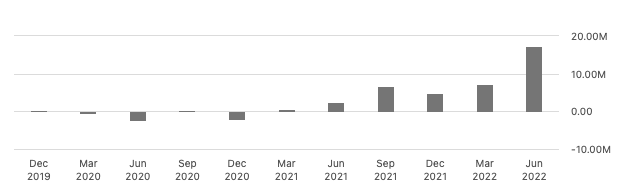

System sales increased by 284% from the previous second quarter results of 2021. Again the majority of sales came from the newly acquired brands. The legacy brands accounted for a 7.5% increase. In the graph below, we can also see the upward trend in earnings before interest, taxes, depreciation and amortization.

EBITDA per Quarter (SeekingAlpha.com)

However, we are seeing the impact of increased costs this year. In Q2 2022, the company made a net loss of $8.2 million. It was an increase of $2.3 million year on year, mainly due to the supply chain disruption costs, inflation and worker wages that have had an industry-wide impact.

Furthermore, the company has a very high debt level, which is not expected to reduce or be paid off before Q1 2023. Due to the significant acquisitions, cash from operations has been negative for the last three consecutive quarters. It has a very high negative leveraged free cash flow of $15.9 million, which is a big issue, especially for companies in the restaurant business, which are asset-heavy and require investment throughout the business cycle. Can sales and new restaurant growth create cash flow and debt level improvements soon enough for investors to gain trust in the company?

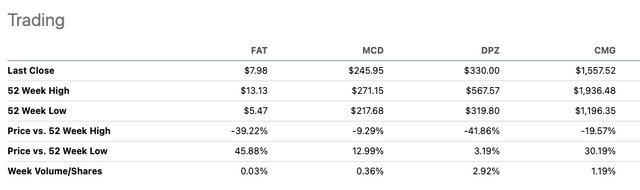

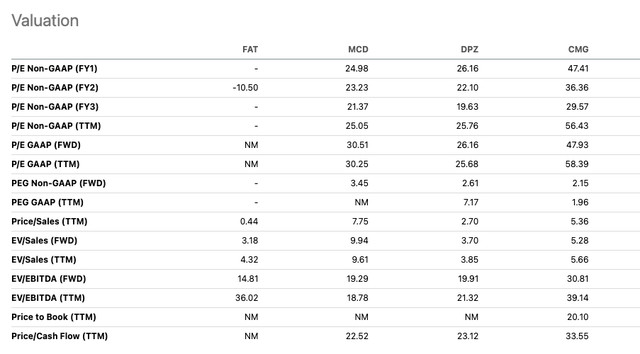

If we look at the valuation of this company, I believe there is a potentially big reward for taking a leap of faith with FAT. It has a small market cap of $131.43 million. This is well below the top leading franchisor restaurant stocks available on the market. Furthermore, the brands the company has acquired cover a wide range of consumer food demands, and the company can use synergies to boost sales between certain brands. I have compared FAT with some of the tops in the league, namely McDonald’s (MCD), Domino’s Pizza (DPZ) and Chipotle Mexican Grill (CMG). Below we can see what prices these stocks are trading at.

Trading Comparison (SeekingAlpha.com)

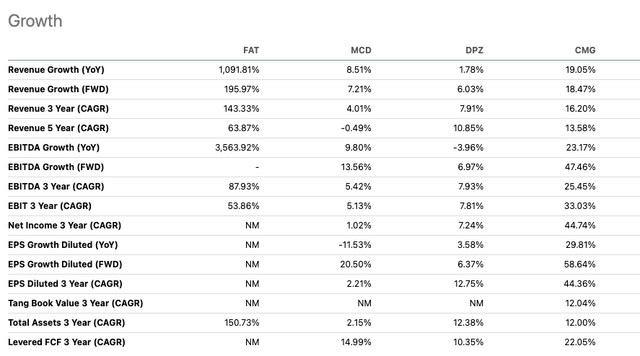

Although we cannot ignore the negative earnings, the company is in a severe growth phase. If we compare it to the three market-leading stocks, the company is well above average for its growth performance across the board, with revenue growth at 1091.81% year on year.

Growth Comparison (SeekingAlpha.com)

If we look at the price-to-sales ratio, comparing the stock price to revenue, an investor is investing less than a dollar for every dollar earned. This is well below the valuation of the three other stocks and may indicate that the company is undervalued. If we look at the forward-looking EV to EBITDA ratio, it is lower than its peers, suggesting that it may be a good investment for the future.

Relative Valuation (SeekingAlpha.com)

Final Thoughts

FAT is a company that has made some big moves in the restaurant business. In an industry where most companies are private and small, FAT is the 25th largest restaurant chain in the States. It has entered a new chapter of growth. Although we have to be cautious of the enormous debt the company has taken on to make these big moves, according to the financials, we are seeing some consistent and consecutive growth on the top and bottom lines. With a vast repertoire of brands that meets various food and drink needs, this company has a lot more upside potential and is very cheaply evaluated compared to its larger competitors. For this reason, I believe investors may want to take a bullish stance on this growing franchise restaurant stock.

Be the first to comment