MF3d/iStock via Getty Images

Investment thesis

Fastly, Inc.’s (NYSE:FSLY) shares have dropped by more than 90% from their highs. The company has solid retention rates for its services, but growth has been declining over the past two years. The company is also consistently unprofitable.

I believe the company may be able to recover with new management and a focus on some of its new services. But I have concluded that Fastly is likely to underperform over the long term.

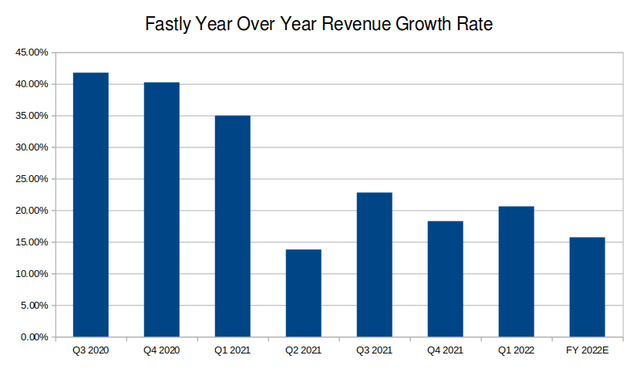

Growth is decelerating

One of the reasons I think Fastly’s stock is so risky is its decelerating growth. In early 2020, the company’s year-over-year growth rate was higher than 40%. This has dropped to about 20% in the past two quarters. On its last earnings call, the company guided for about $410 million in revenue this year. That’s just above a 15% annual growth rate.

Created by author using data from 10-K and 10-Q filings

Within the past year, the company guided for $1 billion in revenue by 2025. This would require a 35% CAGR from their 2022 guidance. The company’s leadership emphasized it multiple times in their Q3 2021 shareholder letter. Since then, this guidance hasn’t even been discussed in any of management’s prepared comments. This gives me doubts about future projections. I don’t know if management is able to accurately forecast their own results.

I also believe Fastly’s revenue is more volatile than many of its peers. Their business model is primarily usage-based. This makes it less reliable and predictable than a subscription service. We are seeing a pullback in spending and headwinds in the technology sector. This may further hurt Fastly’s revenue growth.

Management pushed back on this on its last earnings call. According to the company’s CEO, Fastly doesn’t have a lot of exposure to the industries seeing the highest declines. Some industries are even seeing an uptick, such as travel. The company also has a revenue churn rate of under 1%. This may help make Fastly’s revenues more consistent. However, I still think growth will be disappointing.

Consistently unprofitable results

Fastly’s profitability is poor. The business has been losing money for as long as it has been public. Even though revenue is growing, gross profit has been flat since early 2020. Over the same period, the company’s operating costs increased by over 30%.

Stock-based compensation is a significant part of these operating costs. Fastly pays out about $40 million each quarter in equity. This is contributing to the dilution of Fastly’s shares, which is about 5% year-over-year.

The company explained some of these headwinds on their last earnings call. I understand that new architecture upgrades are putting pressure on gross margins. This is expected to normalize over the next year. Growth in operating expenses is attributed to increased hiring. Management expects these operating costs to moderate over the rest of the year.

But the company has a profit margin of -60%. Fastly doesn’t have an easy path to profitability. Sustainability will require significant changes in the company’s current operations.

The valuation is still expensive

Even after falling over 90% from its highs, I think Fastly’s stock is still expensive.

The company is trading at almost four times price to sales. I believe this is too expensive for an unprofitable company with a projected revenue growth of less than 20%. Fastly also doesn’t have clear operating leverage to become profitable. I would not pay more than one times price to sales for this company.

Fastly is also diluting its shares significantly. The stock would have to drop by 80% or more before I’d consider buying it. This is a conservative valuation, but I think there is a high risk of underperforming even if Fastly becomes profitable.

Is a turnaround possible?

While I am bearish on Fastly, I do think the company may be able to execute a turnaround. In its last conference call, the company’s CEO announced his departure. I think new leadership is important for the company to reach profitability. The company has solid infrastructure in place. Their security services segment is growing at over 50% year-over-year.

I don’t think the company’s financial situation is dire. Fastly is only burning about $15 million per quarter. Currently, the company has over a billion dollars in cash and liquid investments. The company should easily be able to pay its operating costs until its 0% convertible notes are due in early 2026.

The company has even been buying back some of its debt at a significant discount. This could further extend the business’s runway. While I believe Fastly’s business model has major flaws, shorting the stock is also risky.

Final Verdict

Fastly has a solid product, but revenue growth is slowing down. The company isn’t profitable. I see the potential for significant downside in their shares. I think the company’s stock price may stagnate for a while, so I wouldn’t short the company either.

I think the safest option is to avoid taking any position in this company’s stock. A turnaround may be possible, but it’ll take multiple quarters of strong results before I’d consider buying or holding.

Be the first to comment