Ekaterina79/iStock via Getty Images

Farmer Mac (NYSE:AGM), as a quick reminder, is a farm mortgage and rural infrastructure lender with a federal charter that allows it to fund its loans at below-market rates. Farmer Mac reported its financial results earlier this week. Operating EPS for the first half of the year was $5.20. A new record for the company, but up only 1% from the six months earlier. That is disappointing to me, since I believe is capable of 8%+ annual EPS and dividend growth. But Farmer Mac has de-levered over the past three years, which has reduced its EPS growth.

I will explain the deleveraging below, and why I believe it is ending. But first I’ll update Farmer Mac’s two main strengths – extremely low credit risk and a very stable interest margin.

The low credit risk

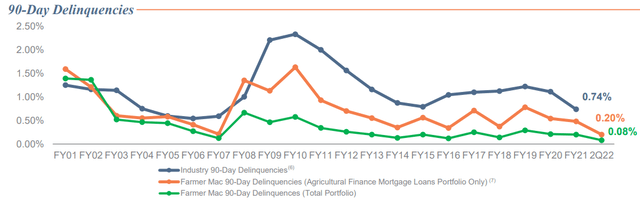

Farmer Mac has over $20 billion of loans and investments. Yet it had literally $0 in loan chargeoffs during Q2. Or, for that matter, during Q1. Or, for that matter, since 2017! Over the past 20 years Farmer Mac reports that its chargeoff rate is a ridiculously low 2 bp a year, compared to 22 bp a year for bank agricultural loans. And the total chargeoff rate for all bank loans over the past two decades was 88 bp a year, according to the Federal Reserve. I doubt that any lender has a lower loss history.

Adding to the good news, Farmer Mac’s loan delinquency rate during Q2 was low even for it, as this chart shows:

Source: Farmer Mac investor presentation

Recession looming? Bring it on. Actually U.S. farmers are currently in excellent shape because the unfortunate global food shortages have driven strong farm product price increases. But long-term, Farmer Mac has consistently limited defaults because of excellent lending standards and federal farm subsidies.

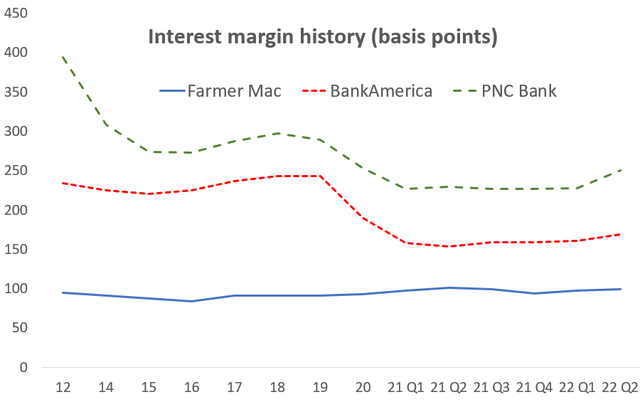

The stable interest margin

Farmer Mac’s main source of revenues is interest income, like banks. Bank interest margins are subject to the whims of the debt markets and Federal Reserve policy changes. But Farmer Mac uses part of its funding advantage to carefully hedge the interest rate risk of its loans and keep its interest margin remarkably stable, as this historical comparison to two banks shows:

Sources: Company financial reports

But you may be saying, “Sure Farmer Mac’s interest margin is more stable than banks, but it is also much lower. How is that good news?” Because Farmer Mac’s far lower interest rate and credit risks means that its regulator requires it to hold far less capital than banks. As a result, Farmer Mac’s 16% return on equity for the first half of ’22 compared favorably to Bank of America’s (BAC) 15%.

Farmer Mac’s deleveraging

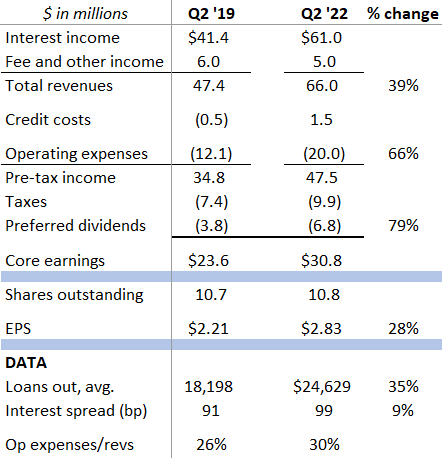

To see what I’m talking about, here is a comparison of Farmer Mac’s Q2 operating earnings for this Q2 and Q2 2019:

Farmer Mac financial reports

Sources: Farmer Mac financial reports

Over that three year stretch Farmer Mac grew is revenues by 39%, the result of 35% asset growth and a 9% improvement in its interest margin. But EPS only grew by 28% because of two types of deleveraging:

- Operating expense deleveraging. Operating expenses grew by 66%, taking Farmer Mac’s operating expenses as a percent of revenues from 26% to 30%. Management says the extra spending was for technology upgrades, increased marketing expenses and the acquisition of a loan servicing business.

- Capital deleveraging. At the end of Q2 2019 Farmer Mac’s capital ratio as a percent of assets was 13.6%, and it had $192 million of excess capital. Now its capital ratio is 14.7% and it has $506 million excess capital. A lot of the new capital came from issuing preferred stock. As the table above shows, the preferred dividend increased by 79% over that period. The increase cost EPS $0.28 per share in this past quarter.

But I believe the deleveraging is over. Management says that its goal is to maintain that 30% operating expense ratio. And Farmer Mac management said on its Q2 conference call that it doesn’t see a need to add more preferred over at least the next year. If management delivers on these two factors, Farmer Mac’s EPS growth will soon trend back to 8%+.

Farmer Mac keeps trading like a bank. But it’s better than a bank

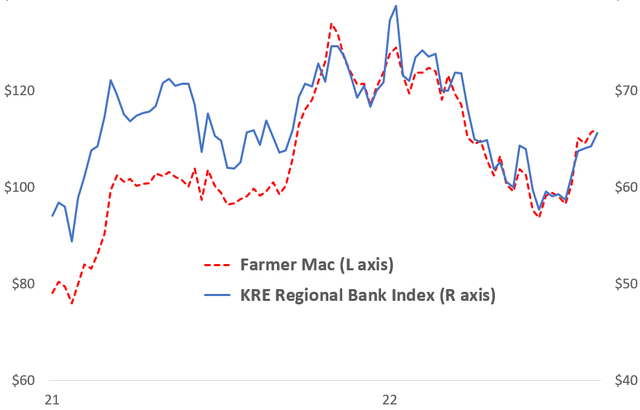

This chart illustrates Farmer Mac’s main stock driver pretty clearly. It compares Farmer Mac’s stock prices to the SPDR S&P Regional Banking ETF (KRE) since the start of 2021:

Sources: Yahoo Finance

Yes, Farmer Mac makes loans just like a bank. But it has a far safer earnings stream than a bank. As I said above, its government charter gives it that funding advantage it uses to manage credit and interest rate risk far more conservatively than banks can afford to. Recessions have come and gone, the Fed has raised or lowered interest rates, and it has made very little difference to Farmer Mac’s results, as the charts I presented above showed.

Further, Farmer Mac’s 8% or so growth rate should compare favorably to the average bank going forward. Farmer Mac’s funding advantage gives it the opportunity to safely take market share, especially as it penetrates its fairly recent authority to make rural infrastructure loans. Banks, on the other hand, have increased competition from new fintech companies eager to take market share even it means years of losses.

At present, at a 10½ P/E, Farmer Mac’s stock trades at a roughly 10% discount to the bank 11½ P/E in the KRE ETF. Based on its greater safety and similar or better growth, it seems logical that Farmer Mac should trade at a premium. And perhaps a material premium, considering the current economic and central bank risks. And with Farmer Mac’s 3.4% dividend yield, you get paid to wait for that premium valuation.

Be the first to comment