Eric Broder Van Dyke/iStock Editorial via Getty Images

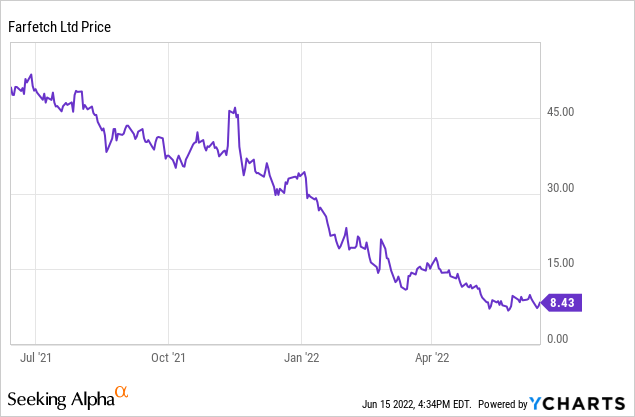

Investing in tech stocks this year, and especially in e-commerce names, has been downright painful. The pandemic-era enthusiasm for everything associated with technology has evaporated as quickly as it heated up, and pandemic favorites like Farfetch (NYSE:FTCH) are now sitting on massive losses.

Farfetch, an e-commerce company that focuses primarily on luxury brands, has seen its share price collapse by 75% year to date. At first, I considered the drop to be largely sentiment-driven, as Farfetch was still reporting strong sales growth as well as bottom-line expansion. More recently, however, Farfetch stock accelerated losses after a very poor Q1 earnings release (also accompanied by a sizable guidance cut), signaling that the fundamental picture for this company has shifted in a meaningful way.

I had been bullish on Farfetch previously; and sadly, that was an unwise call. Even despite the rapid loss of market value since the start of the year, given today’s extreme market volatility, I’m more keen to invest in tech stock rebound plays that have dropped due purely to sentiment. Farfetch, on the other hand, is facing an uphill and ugly battle with demand deceleration, especially in its key region, China. With a big question mark hanging over Farfetch’s near-term performance, I’m downgrading my view on Farfetch to bearish.

As a company, there are still positive factors to consider in Farfetch. Perhaps the most successfully out of any other e-commerce outlet, Farfetch has done a good job integrating a marketplace business as well as a proprietary brands platform, increasing its margin profile (though these brands struggled somewhat in Q1). The company has also carved out a very defensible e-commerce niche (luxury) that is not easily penetrated by Amazon (AMZN), which is more associated with cheapness and convenience rather than luxury and exclusivity.

At the same time, however, new risks have emerged. With the stated slowdown in China (the world’s most important luxury consumer, bar none), we think Farfetch will be in for a tough road ahead. In addition, the spike in inflation and raw materials prices may result in deteriorating gross margins to Farfetch’s brand platform (especially as demand is already declining, indicating that Farfetch may not have much room to pass on costs to consumers, who may already be pulling back on discretionary spending).

In addition, note that Farfetch recently committed to a $200 million equity investment in Neiman Marcus. This is a sizable chunk of Farfetch’s assets (the company has only $1.05 billion of cash on its most recent balance sheet, and from a net cash position after factoring in its debt, only ~$525 million). And though the deal comes with some brand synergies (with the Neiman Marcus brands joining the Farfetch marketplace), this does tilt Farfetch more into the physical/traditional retail space and away from e-commerce (on top of Farfetch’s existing ownership of London retailer Browns), which may influence how investors value the stock.

The bottom line here: the fundamental picture has shifted drastically for Farfetch. I recommend curtailing your positions here, as I don’t view the company to have any near-term catalysts to put a plug on the recent free-fall.

Q1 download and guidance cut

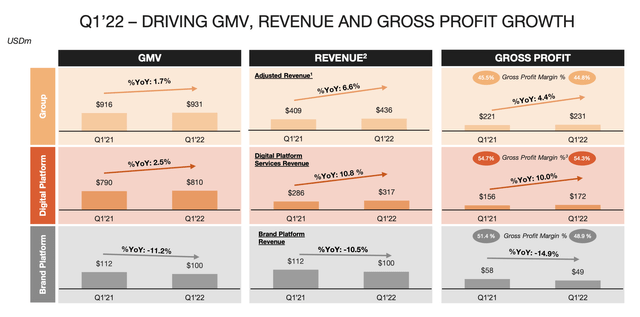

Let’s now review specifically where Farfetch has seen holes open up in its story. First, take a look at the company’s Q1 top-line trends:

Farfetch key metrics (Farfetch Q1 earnings presentation)

Both GMV and revenue slowed down considerably. GMV grew at a measly 2% y/y pace to $931 million, while revenue grew 7% y/y to $436 million. This compares incredibly poorly against Q4 growth rates of 22% y/y and 23% y/y in GMV and revenue, respectively.

Jose Neves, the company’s CEO, highlighted several specific factors that weighed on Farfetch’s performance in the quarter on the Q1 earnings call:

Before I update you on the various businesses within Farfetch, let me address the three main factors we faced in Q1 in further detail, starting with Russia. By the end of 2021, Russia has grown to become our third largest marketplace market, representing 6% of total GMV and an even higher share of the marketplace, where it posted more than 70% year-on-year growth. Naturally, we expected the continuation of robust growth from this market and our stoppage in Russia considerably in PV GMV growth.

We also believe the conflict had a spillover effect in Europe and CIS countries, where we have seen less buyer demand than expected. Based on the current status of this conflict, we have no expectations of reinitiating operations in Russia for the foreseeable future.

Moving to China, our second largest market, the rise of COVID-19 cases against the backdrop of a zero COVID policy increasingly impacted our growth trajectory. The majority of our Mainland China business consists of cross-border sales from Europe to Tier 1 cities, such as Shanghai, which serves as a major cross-border hub. And as such, we experienced significant disruptions in our delivery operations for the China market.

These recent lockdowns have been very different from those we’ve seen previously because of the impact on logistics. That said, our long-term thesis on China has not changed, as the second largest luxury goods market in the world, which is expected to become the largest by 2025, we continue to see tremendous opportunity in China and remain committed to building on our differentiated positioning as the leading Western luxury fashion platform in China.”

The optimistic view is that the large majority of these factors is transitory. Improvement in the Ukraine/Russia situation and resumption of “business as usual” in the region, as well as COVID impacts in China, may well ease. But both of these factors may also drag out into longer-term economic pain, which to me is the more likely scenario.

Additionally, do note that while Farfetch’s marketplace platform held up relatively better with positive y/y growth, Farfetch’s own brands saw a -11% y/y decline in revenue. Given that these brands are a big driver of gross margin, Farfetch suffered a one-point decline in gross margins to 45% as a result.

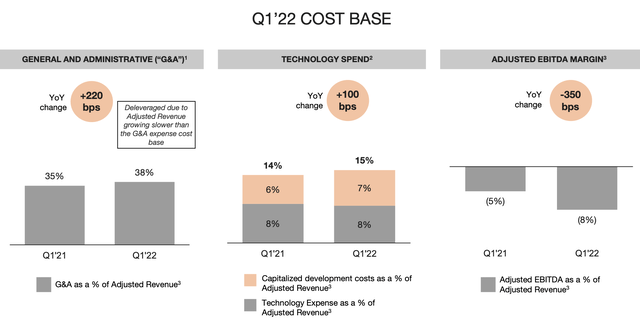

Other expense categories also saw pressure. Because of the revenue underperformance, the company saw deleveraging on general/administrative and technology spend. As a result, adjusted EBITDA losses nearly doubled to a loss of -$35.8 million, while adjusted EBITDA margins swelled to a -8% loss, three points worse than -5% in the year-ago quarter.

Farfetch bottom line metrics (Farfetch Q1 earnings presentation)

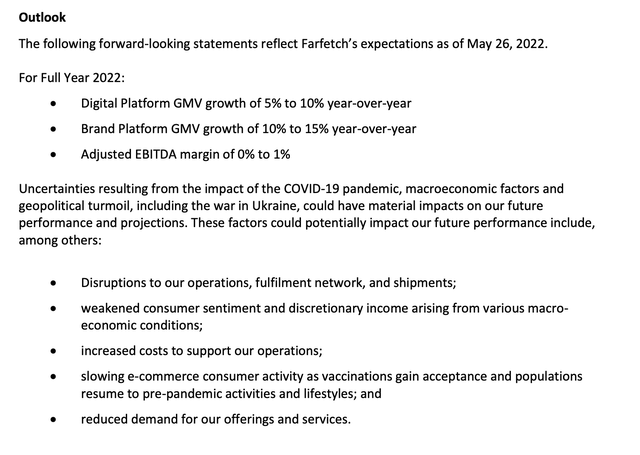

As a result of the underperformance in Q1 and Farfetch’s more grim outlook on the macro environment, the company drastically slashed its guidance for the current year.

Farfetch outlook update (Farfetch Q1 earnings presentation)

The biggest haircut here: Farfetch is now only guiding to 5-10% y/y growth in its digital platform, significantly lower than a prior view of 28-32% y/y growth. This signals a drastic waning of confidence in the business that will be very difficult to climb back from.

Key takeaways

Unfortunately, the winds are blowing south for Farfetch. Macro pressures from geopolitical tension to COVID are sapping demand, while the company has also retracted a lot of the progress it made on margins and profitability. This is not a “buy the dip” situation – steer clear here.

Be the first to comment