By Howard Silverblatt

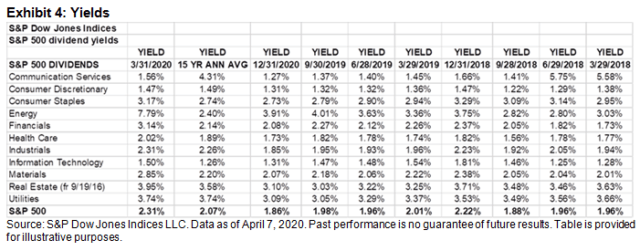

Q1 2020 ended with record dividend payments for S&P 500 issues, as shareholders reaped the benefits of a 10-year bull market. March 2020 (and the first six trading days of April 2020), however, gave a glimpse of what Q2 2020 may look like, as dividend cuts and suspensions started to be announced, with suspensions more prevalent. For 2020, liquidity and cost control are now the top priorities, with dividends lower and buybacks an endangered species.

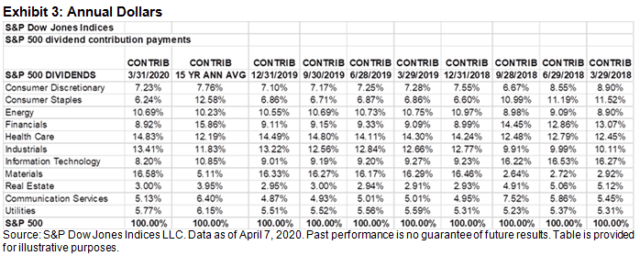

The Good: Q1 2020 dividends set a new record, paying USD 127.0 billion, up from USD 117.0 billion for Q1 2019.

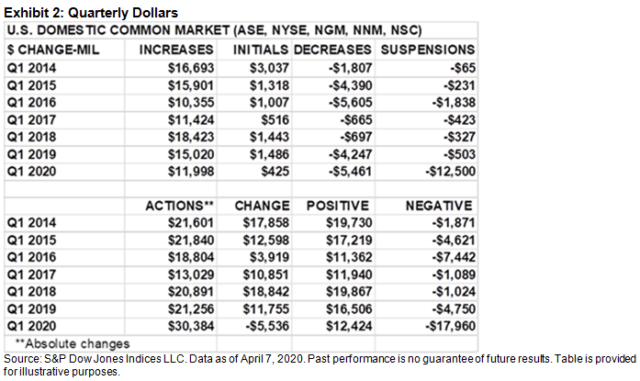

The Bad: March 2020 announcements turned negative, as 13 issues announced cuts, with 10 of them being suspensions, making for a total forward impact of USD 13.9 billion, and more cuts are expected. For U.S. common issues, the net-indicated dividend change was USD -5.5 billion, with the last negative in Q2 2009 (USD -4.9 billion) and the previous record low in Q2 2009 (USD -43.8 billion).

The Ugly: For Q2 2020 to date (the first six trading days), there were 57 actions (none of them S&P 500 issues), with 7 positive and 50 negative, and 40 of the 50 negatives being suspensions, amounting to net change of USD -4.8 billion. As for January’s predicted 2020 double-digit dividend gain for the year, just put a “-” in front of it.

The Full Reality Is Starting: Looking at the announcement dates (typically after the board of directors meetings), the next three weeks will be telling, with the first key test being when the big banks start off the earnings season. Last month, eight banks acted in unison to suspend their buybacks (to date, 27% of the S&P 500 has been cancelled, with 72% of the Financials sector).

The full impact of these cuts will start to be felt soon by investors, as fewer dividend checks are sent out, with many of those going out smaller.

At this point, the depth of the cuts are dependent on the COVID-19 economic impact, and given we don’t know what that will be, companies may be forced to take prudent measures.

Disclosure: Copyright © 2019 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit www.spdji.com/terms-of-use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment