carloscastilla

Introduction

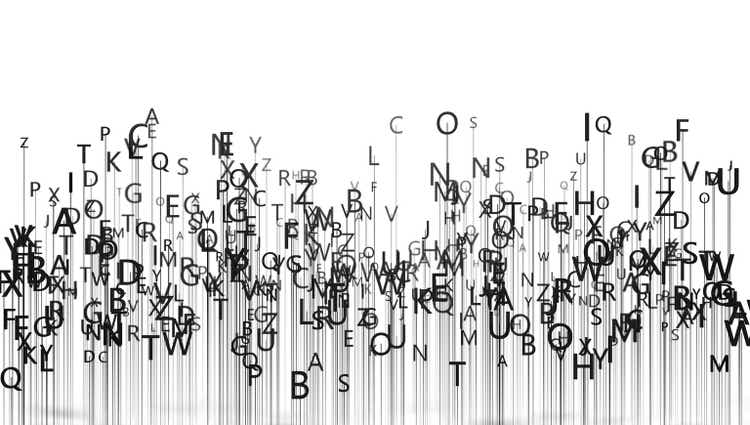

Since the Great Financial Crisis, we have seen one of the best bull markets ever. Most stocks have performed pretty well within this time, but some have accomplished even more extraordinary returns. For me, it seemed that the market deemed some stocks as the “ultimate” investment—untouchable companies with no risk of earnings downturn or price depreciation of the shares. As we have seen this year, no company is untouchable or immune to a downturn in the economy. The harsh environment 2022 presented has even brought down stocks like Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), Microsoft (MSFT), NVIDIA (NVDA), and Adobe (ADBE).

YTD performances (koyfin.com)

I call these stocks “Fallen Angels” because of their characteristics as former highflyers now down this year. I want to show you how earnings and expectations have changed, how the outlook is, and if the valuation provides a “fire sale” despite the current market environment. I will start with Alphabet in this article.

For this article, you must know that I am not as bullish as the general market seems to be right now. After the October CPI report was published on 11/09, the market rallied substantially. The CPI report showed signs of slowing inflation, with a YoY growth of just 7.7% vs. 8% expected and 8.2% prior. On a MoM basis, October inflation rose by 0.4% against the 0.7% expected. The market hopes inflation has peaked and the FED has more room to slow down – or stop – the rate hikes. I am not so sure about that due to two main reasons:

- We still talk about a 7.7% inflation rate, way above the FEDs goal of 2%.

- Powell has made it clear that he will do anything to bring down inflation at least close to the 2% goal.

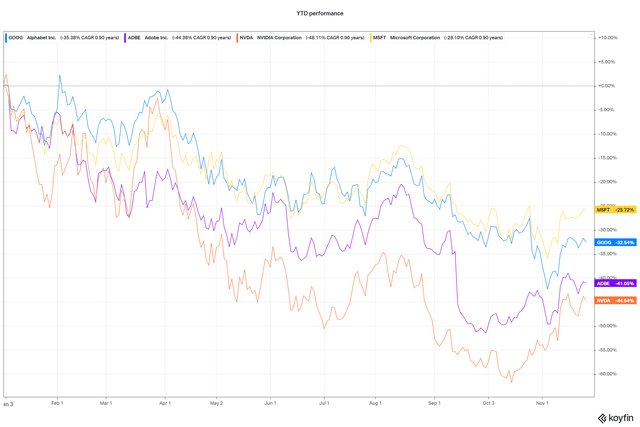

So far, Powell has done precisely what he said he would do, which is why I don’t understand the expectation that he won’t continue with that. Furthermore, history shows that most of the downturn in bear markets occurred after the fed pivot.

The S&P 500 in correlation to fed pivots (elliottwave.com)

So even if the fed pivots now, we can’t be 100% sure that this means a bottom for the market. Hence, I see the current gains more as a mixture of a year-end rally and midterm gains, expecting the market to turn down next year when we see the full consequences of those rate hikes.

But now, let’s start with the first stock of this series:

Alphabet

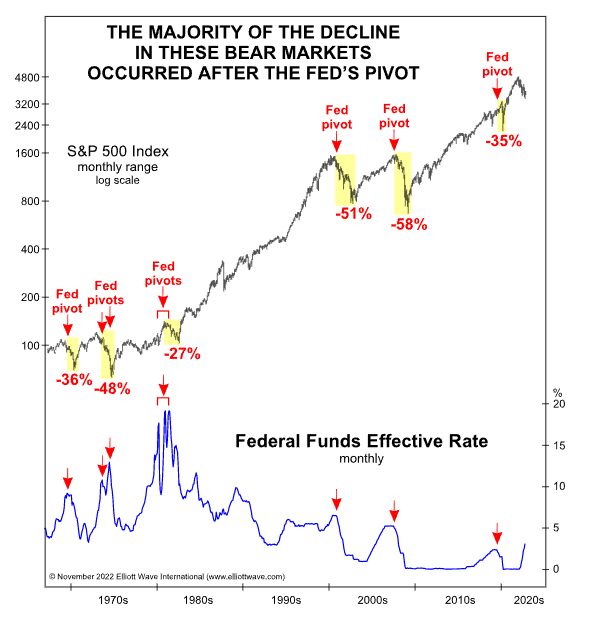

Alphabet, the parent company of Google, has done very well since going public, especially in the last five years.

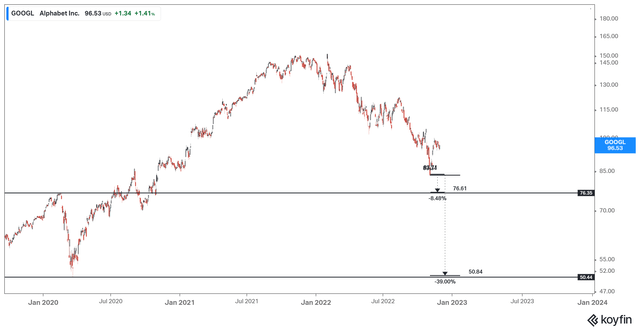

Alphabet’s five-year performance and recent downturn (koyfin.com)

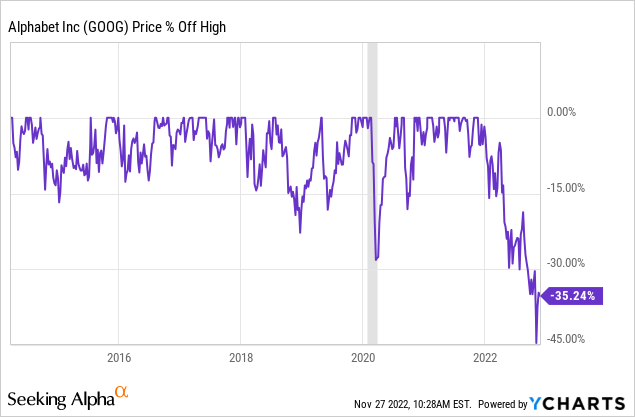

From the end of 2017 to the end of 2021, the share price rose by almost 190%, generating annual returns of over 47%. Since then, nearly 70% of these gains have evaporated, leaving shareholders with a return of 87.5%, still an excellent, market-beating annual return of 17.5%. To assess how significant this drop in performance is, we can look at the total drawdowns since Alphabet traded publicly.

In Alphabet’s history as a public company, the drawdown we see since the end of last year is by far the greatest. The second greatest was in early 2020 when the covid crash hit, and Alphabets stock lost almost 30%. The most recent sell-off is not just slightly more than the covid crash. We speak about a more than 50% larger drop in share price, which shows how significant recent losses are.

Why is that?

Other than in the prime covid timeframe, nowadays, Alphabet struggles financially.

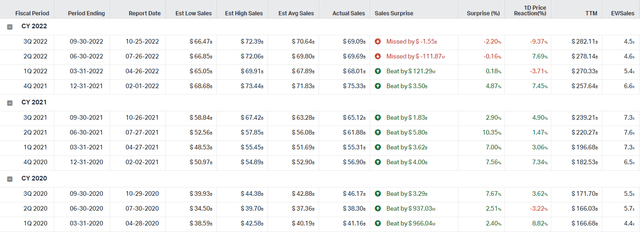

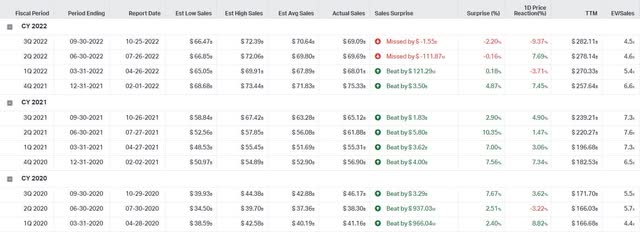

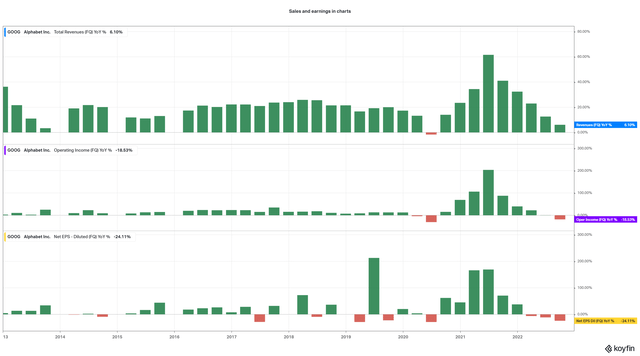

Sales from 2020 to Q3 2022:

Sales from 2020 – Q3 2022 (koyfin.com)

Alphabet had not one sales miss in 2020, while this year, we can see misses of sales estimates in 2 out of 3 quarters.

Sales from 2020 to Q3 2022:

Sales from 2020 – Q3 2022 (koyfin.com)

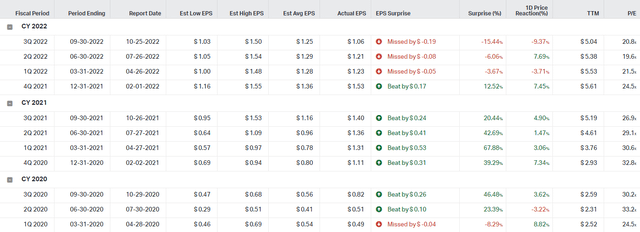

In 2020, Alphabet had just one EPS miss, while this year, they have missed EPS in every quarter so far. Additionally, the -15.44% EPS surprise is the biggest we have ever seen in the history of Alphabet.

Considering this, it shouldn’t wonder why the share price has performed the worst ever this year.

The worsening of earnings is attributable to the overall market and the global economy. In one of my previous articles on Blackrock, I analyzed the current economy thoroughly, and I recommend looking into it if you want to get the whole picture. Some think we are already in a recession, and many more think a recession will come in the coming months. I believe the full consequences of the rate hikes (cooldown of the economy) will show in 2023.A recession means fewer earnings for the better of the whole economy. The advertising budget is one of the first budgets companies cut to reduce costs. And this is hitting Alphabet hard, as ads make up 79% of its revenue. We can see the first signs of this in Alphabet’s most recent Q3 earnings: Revenue rose by 6% (11% in constant currency), pressured mainly by these two declining segments:

- YouTube ads, $7.07B (down 1.9%)

- Google Network, $7.87B (down 1.6%);

This was just partly upset by revenue growth in other segments, mainly by its cloud segment, which grew 37.6% YoY and generated $6.9B.

Earnings disappointed even more, with a negative surprise of 15.44%

EPS from 2020 – Q3 2022 (koyfin.com)

Alphabet reported a third-quarter profit of $1.06 a share on $69.1B in revenue. Analysts estimated $1.26 a share on sales of $71B. At the same time last year, Alphabet earned $1.40 a share on $65.1B in revenue. One reason for fewer earnings with more revenue is a decline in operating margin from 32% to 25%. We need to put the last year into the equation to interpret how bad this all is. Because 2021 was an exceptional year for Alphabet, as the following chart shows.

Sales, operating income, and EPS growth rates of the last years (koyfin.com)

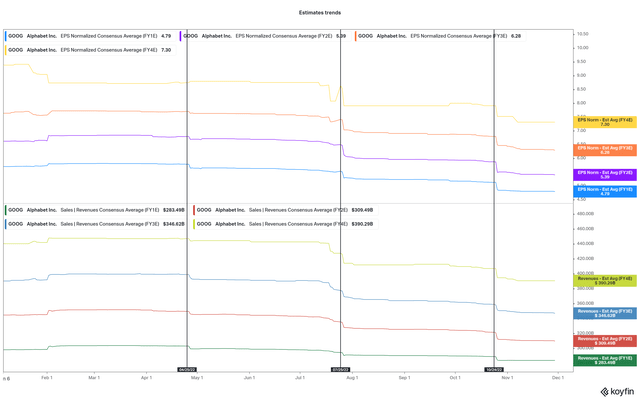

As you can see, 2021 was an extraordinary year, so a slowdown in YoY growth rates was expected and from the analyst’s predicted. But the current market conditions brought the growth rates down even more. Hence, analysts have adapted their forecasts after every earnings release this year, as you can see here:

Estimates trends (koyfin.com)

As explained earlier, I expect the market to be a lot worse than this year, which is why the current forecasts are likely to be reduced even more.

To assess if Alphabet is worth buying right now, we have to look at the valuation. For that, I use FAST Graphs because it is the easiest and most convenient way to evaluate a stock based on earnings.

FAST Graphs historical chart (fastgraphs.com)

Since 2012, Alphabet hasn’t traded so close to its fair value according to its growth rate and so much below its average historical P/E ratio as has earlier this month. This is why I bought the first tranche of my own position in Alphabet earlier this month. Because of my view of the market for 2023, I expect for these levels to come back with a great potential that the stock price goes down even more.

Let’s see the forecasted returns:

FAST Graphs forecast chart normal 10Y multiple (fastgraphs.com)

With current estimates, an investment in Alphabet would generate profits of 28% annually until the end of 2024 if the share price reverts to its 10Y average P/E multiple of 25.62. For the case that these earnings estimates will be corrected to the downside, I chose to select a 20.5 P/E multiple, which should consider a significant downward correction in earnings estimates. In this case, an investment would generate annual returns of 15% until the end of 2024. In both scenarios, Alphabet would generate market-beating returns but with a less appealing risk-return ratio in the second case. This risk-return ratio is getting better if you can get the shares cheaper, which is something I expect anyway. It is hard to predict how severe a potential recession next year could be, but the following two scenarios could be possible. A return to ”before pandemic” share prices or, worst case, a return to the pandemic low in early 2020.

5-year chart with possible downturn scenarios (koyfin.com)

But I see Alphabet right now as a perfect long-term investment. Short-term, there are better options, but if you are willing to invest for longer, Alphabet should be a great buy, regardless of if you invest for $85 or $50 a share. Because of the unpredictable character of next year’s economy, I advise to dollar cost average (DCA) down, beginning with the $85 share price.

Why should you start buying shares of Alphabet if the share price starts falling again?

I won’t go into that point in detail, as that isn’t what I intended to do with this article. Others are going into that way more profound and better, as I will do here. For that, I recommend reading this article by Z Kassotakis. But I will give a few points why I like Alphabet and think it is a buy with slightly lower share prices:

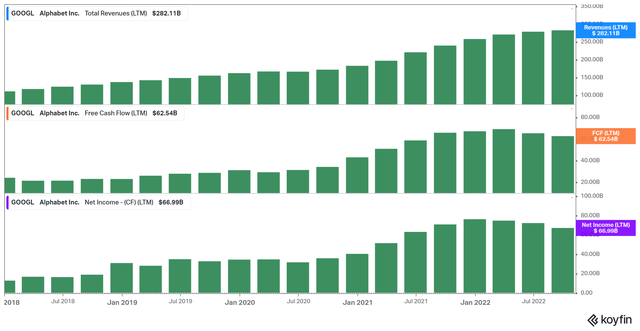

Alphabet is an absolute cash cow; let me show you why with a chart:

Sales, Free cash flow, and net income LTM (koyfin.com)

In the last twelve months, Alphabet generated revenue of over $280B, free cash flow of over $62B, and net income of nearly $67B. That is impressive. And these earnings are destined to improve in the future because Alphabet has a lot of future in its portfolio. Like AI, autonomous cars, and the cloud. Considering the market position Alphabet has, it has one of the best chances to succeed with these topics. Only a few companies have access to such an enormous amount of data from several sources. The financial conditions, especially the $116B in cash and short-term investments, should allow Alphabet to acquire suitable startups or competitors in fields like AI, autonomous cars, etc. The cloud, already a significant segment of Alphabets revenue, is often criticized compared with peers like Microsoft’s Azure and Amazon’s (AMZN) AWS. Google Cloud ranks third with 10% of the total market, behind Azure with 21% and AWS with 34% market share. Contrary to Azure and AWS, Google Cloud isn’t yet profitable despite being launched 14 years ago, and Azure and especially AWS are highly profitable. For comparison: Amazon’s operating income for Q3 2022 was $2.5B, with AWS contributing $5.4B. So, in other words: without AWS, Amazon wouldn’t be profitable. The fact that Google Cloud isn’t yet profitable doesn’t seem good initially, but it gives Alphabet one thing: operating leverage. When the cloud segment starts going over the profitability threshold, it could ramp up the earnings quickly. Adding these earnings to the existing earnings will give you an even more enormous cash cow.

Conclusion

With this article, I wanted to give you a heads up on the current state of Alphabet and a possible outlook using a few charts that helped me get a better look at this company. My opinion on Alphabet is that the current economy brought more pressure to its earnings than estimated, which isn’t a good sign. This doesn’t get better when I mention that next year will probably be even worse. Despite that, the long-term outlook looks good, and the fall in share price compensates for the short-term pain. Hence, Alphabet is a buy as soon as the share price hits its November low of around $85. Because of more downside risk, you should invest in several tranches to be able to dca down if the share price goes lower. Because Alphabet trades at $100, 17.6% above the November low, I initiate a “Hold” rating.

Be the first to comment