ipopba

On June 20th, Fairfax (OTCPK:FRFHF) sold its pet insurance businesses for mainly cash of USD 1.15bn and seller notes of USD 250m. The announcement, despite being 53% of Crum & Forster equity and 9.4% of FRFHF book value, received a collective yawn by the market.

Even Seeking Alpha’s news page for FRFHF hadn’t updated the news as of July 7th – nearly three weeks after the announcement (see Fig. 1).

Fig. 1

Seeking Alpha snapshot at July 7th (Seeking Alpha)

Last year when Fairfax completed a partial sale of its OdysseyRe unit to Canadian pension funds, it followed it with a USD 1bn buyback reducing common shares by ~9% by the end of 2021 compared to the previous year.

Given the precedent and Mr. Watsa’s self-stated objective to shrink outstanding shares, you would think that Fairfax stock would be valued more than its current 0.86x book value.

The macro environment will benefit Fairfax

After nearly a decade of soft prices, Fairfax has seen its gross premiums rise over 20% annually since 2016. Premiums even accelerated into the first quarter of ’22 supported by the inflationary environment.

In the first quarter, gross premiums at the Company rose 22.8% from the last comparable period, while the expense ratio actually improved to 32.7% from 34.96% over the same period.

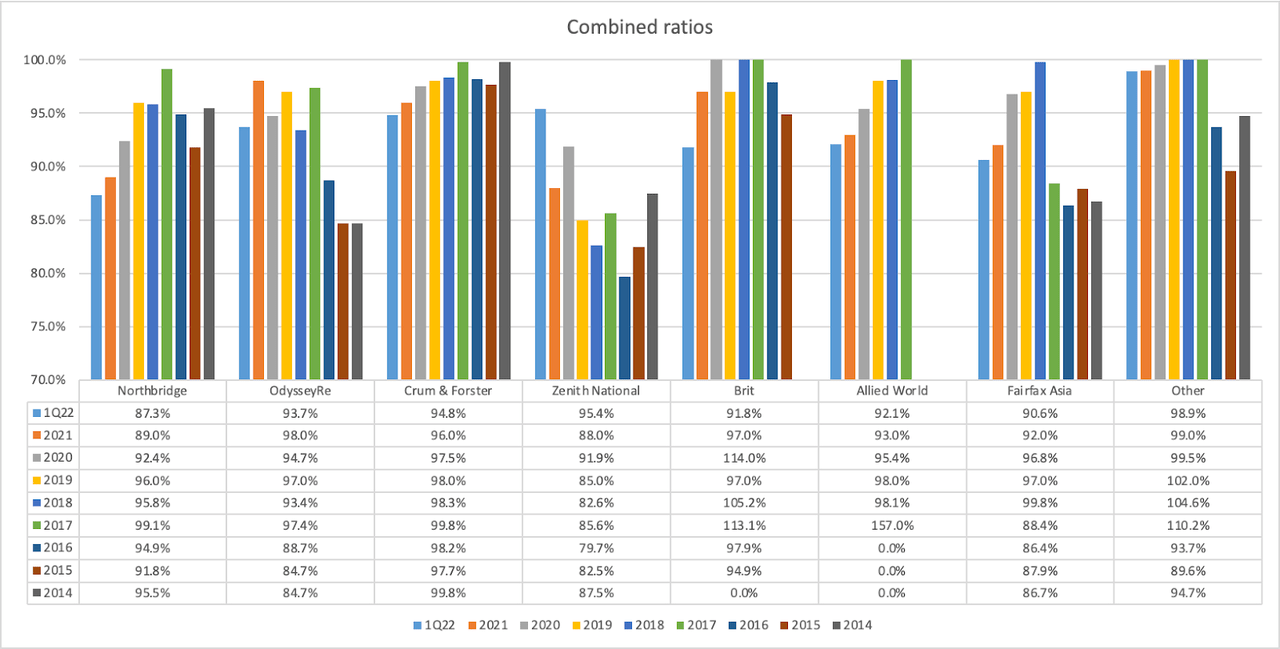

The Company’s combined ratio, a key measure of underwriting losses and expenses, has remained healthy as Fig 2. demonstrates. Meaning Fairfax has not been reaching for risk through the cycles. Over the last 8-years, Fairfax has had an average combined ratio of 96%; its last underwriting loss was in 2017 when it was 107%. But that year included the sizable Allied World acquisition where expenses would be naturally higher.

Fig 2

Fairfax combined ratios (Fairfax annual reports)

The insurance sector tends to do well in inflationary environments, but the seeds of this hard market were planted well before COVID ignited inflation around the world.

The sector has been level setting against a more volatile planet and people. A warming climate has impacted weather patterns and increased the frequency of catastrophic storms around the world, forcing (re)insurance rates to rise.

Judgements and the number and cost of lawsuits keep increasing, impacting general commercial insurance policies. And new risks from cyber attacks to ransomware have put pressure on insurance companies to adapt and readjust insurance rates. A low interest rate environment also puts pressure on (re)insurance companies to offset lost interest income with policy adjustments.

But the interest rate environment has been rapidly evolving.

Central bankers around the world are wrestling with inflation levels not seen in decades and have been increasing their respective rates to fight it. This will all benefit Fairfax in the long run.

Their fixed income portfolio was designed with a 1.2 year duration and had an average rating of AA- limiting mark-to-market and credit losses in a rising rate environment. Fairfax’s fixed income portfolio, inclusive of cash and short term treasuries, is about 72% of the investment portfolio. This is even before considering the cash from the recent JAB deal.

This strategy has set up Fairfax well to take advantage of rising interest rates that will improve interest income in the future, which is something that insurance sector investors have been waiting for a long time.

In sum

Fairfax is positioned well and investors should consider its shares while it remains under the radar and trading at a discount to book value.

Premium growth at the Company’s key (re)insurance businesses has been accelerating and will be supported by inflation, while higher rates will be a boon to investment income in its portfolio.

FRFHF stock continues to languish, partially from inattention, but Mr. Watsa has shown savvy during these occasions to buy back stock at attractive prices. Let’s not forget that last year’s buyback was conducted at a price of USD 500 per share or just 6% below today’s trading price of USD 530.

Even if another stock buyback is not in the cards this time around, there are all kinds of opportunities to deploy cash from the JAB deal whether that’s in beaten down stocks or attractive fixed income assets or growing its insurance book.

Flush with cash and with a tailwind at its key businesses, FRFHF is a good shelter in an otherwise volatile market.

Be the first to comment