JHVEPhoto/iStock Editorial via Getty Images

The Russian invasion of Ukraine gave a start to the greatest redistribution of Europe’s energy market in decades. Even though the EU members continue to buy Russian oil to this day, the implementation of the sixth package of sanctions against the Russian oil industry in late 2022 – 2023 will open up new opportunities for companies such as Exxon Mobil Corporation (NYSE:XOM) to take some portion of Russia’s market share in Europe. In addition, a tighter oil supply will continue to keep the oil prices higher, as there are no indications that the demand will significantly deteriorate anytime soon.

Therefore, even as the stock market is on fire, it’s safe to assume that energy giants such as Exxon Mobil will continue to greatly reward their shareholders in the foreseeable future as we’re entering a new geopolitical reality.

Geopolitics is Back

It’s impossible to have a conversation about oil without talking about geopolitics. One of the main reasons why Exxon Mobil’s stock currently trades at its highest levels since 2014 is due to the record-high oil prices, which among many other reasons, were caused by Russia’s invasion of Ukraine in late February. Considering the current state of affairs, the war in Ukraine has become a war of attrition, and the Ukrainian intelligence believes that Russia has the resources to wage a war for another 12 months. Therefore, investors shouldn’t expect a signing of any kind of peace treaty anytime soon, since Ukraine is not interested in giving away any of its territories to the invading force. As a result, this geopolitical uncertainty will continue to pressurize the oil market and keep the prices at relatively high levels.

At the same time, this war has also shown Europe that it can’t rely on Russia to meet its energy needs anymore. Currently, the European Union imports around 11 million barrels of oil per day. Out of them, Russia exports to the union around 2.2 million barrels per day, making it one of the biggest single suppliers of oil to the EU. On top of that, Russia also exports 1.2 million barrels of oil products per day to the EU as well. Considering that in the past Russia has been using exports of fossil fuels as a political weapon to achieve its geopolitical goals, there’s now a risk that it will do the same thing again to force European governments to drop their support for Ukraine. Russia has already halted the flow of gas to numerous European countries, so the EU understands that it needs to look elsewhere to tackle this risk and at the same time stop the financing of Russia’s war machine.

Recently, the European Commission has unveiled a $220 billion plan to decrease its dependency on Russia’s fossil fuels. At the same time, two weeks ago the EU has also adopted the sixth package of economic sanctions against Russia, which will reshape Europe’s energy market forever. According to the adopted document, the EU will fully stop the seaborne import of Russian crude oil, which accounts for over 70% of Russia’s oil exports to Europe, by the end of this year, and at the same time, a ban on the import of all petroleum products from Russia will come into effect next February. While there are some exceptions for countries such as Bulgaria and Croatia, which will be able to import Russia’s crude oil and petroleum products for a slightly longer period, they won’t have a meaningful impact as a whole.

What’s also important to note is that the EU managed to strike a deal with the United Kingdom to prevent companies from insuring oil tankers that transfer Russian oil and oil products by the end of 2022. Given the fact that the EU and UK companies together provide 90% of global shipping insurance, such a ban will also have a meaningful impact on Russia’s ability to export oil to other countries.

While in Q1’22 Russia’s oil production stood at 11.3 million barrels per day, EIA estimates that the production will fall to 9.3 million barrels per day by the end of 2023. The decline in production is due to sanctions and the loss of companies such as Halliburton (HAL), which provided Western technology for drilling and maintenance of oil rigs before their exodus from Russia. Such sanctions will undoubtedly reshape Europe’s energy market forever and will result in the loss of one of the biggest and most prosperous markets in the world for Russia.

In addition to all of this, as Russia’s oil production is about to fall, it seems that the oil demand won’t deteriorate significantly anytime soon. EIA’s latest estimates suggest that in 2023 the total world consumption of petroleum and other liquids is going to increase to 101.32 million barrels per day, up from an estimated 99.63 million barrels per day in 2022. On top of that, EIA also believes that in the second half of this year Brent oil is going to trade at an average price of $108 per barrel, while Fitch doesn’t expect a significant decline in oil prices in the following years.

Considering all of this, the biggest beneficiaries of all of those developments are major oil companies such as Exxon Mobil, which are diversified in the upstream and downstream segments and have minimal exposure to Russia. As there is news that the company will fully exit Russia later this month, investors have nothing to worry about its future.

More Opportunities Ahead

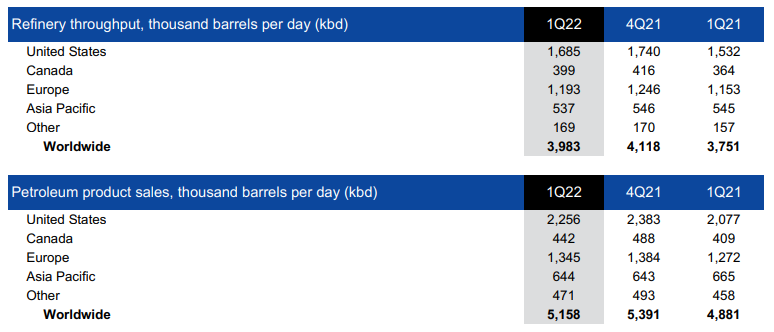

As Russia losses its dominant position on the European oil market, the void that’s going to form in late 2022 – 2023 is going to be filled by its competitors, who already have an established network of businesses on the old continent. If we go through Exxon Mobil’s Q1 earnings report, we’ll see that Europe is one of the company’s main markets, as its refinery throughput in the region is one of the highest in comparison to other markets, while its petroleum product sales in Europe account for over 25% of total sales.

Exxon Mobil sales (Exxon Mobil)

As those 1.2 million barrels of oil products per day from Russia are going to disappear from the European market, the customers will look for alternatives, which will lead to even higher margins in the oil refinery business. All of this will undoubtedly benefit Exxon Mobil, since out of the 10 biggest oil refineries in Europe the company owns three of them. On top of that, after Russia bombed Ukraine’s major oil refinery in Kremenchuk in April, the Ukrainian government began to create new supply chains of oil products from the EU, which already had a tight supply itself before the war. As a result, it’s unlikely that the profitability of the refinery business will decrease anytime soon, especially since EIA believes that the demand is only going to increase next year.

What’s also important to mention is that the European Union is currently working on the seventh package of sanctions, which should include the ban on the import of natural gas from Russia to the EU. The problem is that it’s much harder to significantly replace the flow of natural gas due to logistical constraints, so there’s a risk that the seventh package won’t be approved anytime soon. Nevertheless, there’s a possibility that Russia decides to halt the gas flows this winter, as it had done so numerous times in the past. If it does so, it will prove to Europeans that Russia is no longer a reliable supplier, and the union will have no other choice but to look for alternatives. In recent months, Germany has already struck a deal with Qatar, while Italy signed a deal with Algeria, to increase the flow of gas to Europe. On top of that, the European LNG terminals already operate at a maximum capacity, so Germany is now planning to build additional terminals to diversify its energy market.

All of this benefits Exxon Mobil as well, since the company also sells natural gas in Europe, and recently it signed a deal with Qatar to work on the expansion of the world’s largest LNG project along with a consortium of other energy behemoths. The expansion of the North Field should increase Qatar’s LNG output by 64% by 2027, which will make it easier for Europe to decrease its dependence on Russian gas in the long term.

Considering all of those developments, it’s safe to assume that Exxon Mobil will thrive in the following quarters. The Q1 earnings report already showed that the company is on track to have one of the best years in its history, as its revenue during the period increased by 53% Y/Y to $90.5 billion, while its earnings stood at $5.5 billion. Since the oil price is expected to remain high, the following quarters shouldn’t disappoint as well.

What’s The Real Value Of The Business?

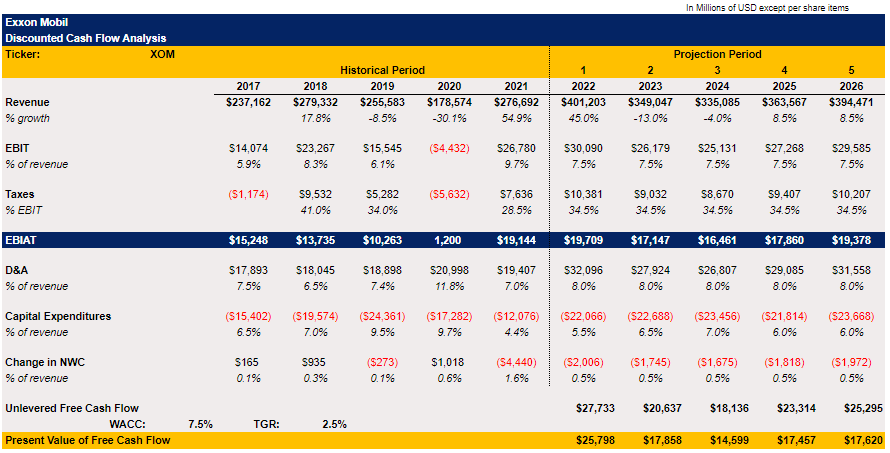

As Exxon Mobil’s stock trades close to its all-time high levels, questions begin to arise about its real value since it’s one of the few major public companies, which shows an exceptional performance amidst the overall market selloff. To get to the bottom of this question, I decided to create a DCF model, which will shed some light on the attractiveness of Exxon Mobil’s stock in the current environment.

As it’s the case with any models, they’re all about assumptions, which don’t always correlate with reality due to the number of different events that change the inputs and can’t be predicted in the first place. That’s why for the revenue forecast, I simply used the street consensus estimates for 2022, 2023, and 2024 that are presented here on Seeking Alpha. For 2025 and 2026, I used the average revenue growth rate from 2018 to 2021 and decided not to forecast any numbers beyond 2026 since it becomes impossible to predict what will happen with the oil market beyond that date. For the EBIT, taxes, D&A, and the change in net working capital forecasts I used the average percentage for the historical periods from 2017 to 2021. As for the CapEx, we know that Exxon Mobil’s management said that it plans to spend $20 to $25 billion annually through 2027 on capital spending, so my forecast aligns with the management’s goal.

Exxon Mobil DCF Analysis (Historical data: Seeking Alpha, Forecasts are made by the author)

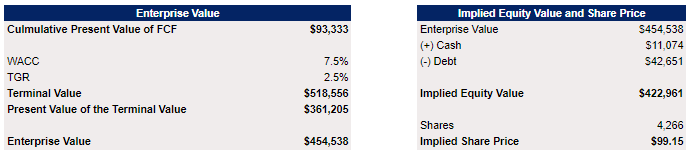

Since the cost of capital for the oil industry ranges between 6% to 8%, I decided to use a 7.5% for my assumption, while the terminal growth rate in the model stands at 2.5%. From the calculations, we arrive at the enterprise value of $454 billion, while the equity value stands at $423 billion, which translates to Exxon Mobil’s fair value of nearly $100 per share.

Exxon Mobil DCF Analysis (Historical data: Seeking Alpha, Forecasts are made by the author)

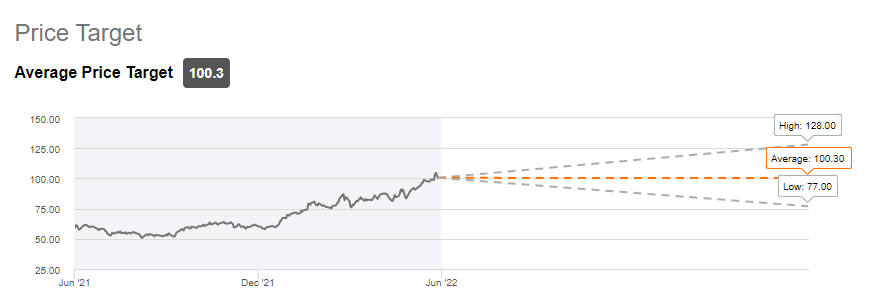

This model is pretty much in-line with what the street believes Exxon Mobil’s fair value is, as Seeking Alpha shows that the current consensus price target is around $100 per share as well.

Exxon Mobil Consensus Price Target (Seeking Alpha)

However, I do believe that revenue estimates for 2023 and 2024 are pretty conservative and it’s likely that the street will change its assumptions once Exxon Mobil’s Q2 earnings results come out. As I’ve explained earlier, Europe will be in dire need to replace Russian oil imports due to sanctions, so the company could greatly benefit from this. If the EIA forecast stands correct for 2023 and the oil demand won’t decrease while the prices will remain at the current levels, then realistically we could see another record year for Exxon Mobil, which will then indeed make a $100 per share price target look conservative, while the base case price will be significantly higher. Only the time will tell which assumptions are correct.

Counterarguments

At this stage, I see three counterarguments, which could undermine my bullish thesis on Exxon Mobil. The first counterargument is that there’s a risk that the current U.S. administration decides to prohibit the export of oil to other countries. We should not forget that the United States only in 2015 was able to repeal a 40-year oil export ban after it managed to significantly increase its domestic production thanks to the shale revolution. As gas prices soar while the inflation continues to increase, the Biden administration could revert the crude oil export ban to ease the pressure on consumers ahead of the midterm elections later this year. However, I find it hard to believe that it’s going to happen since it will put President’s Biden foreign policy at stake, as the European allies will find it even harder to source oil from other places to replace the Russian imports. Nevertheless, if the ban on exports is returned – then Exxon Mobil will indeed suffer from it since its U.S. operations will be less profitable due to the closed market.

Another counterargument is about sanctions. While the EU approved them, there’s a risk that some member states decide not to implement them if oil prices continue to increase. This will have a negative short-term impact on Exxon Mobil due to the fact that Russia will still own a portion of the European oil market in this scenario, leaving fewer opportunities for expansion for the American oil giant.

The third counterargument is about a recession, which could undermine EIA’s 2023 forecast, weaken the overall demand, and significantly lower the price of oil later on. If that’s going to be the case, then Exxon Mobil’s financials will directly suffer and it will become impossible to justify its $30 billion buyback program given the fact that it has over $40 billion in long-term debt, while the business enters a downturn.

The Bottom Line

At this stage, it seems that the demand for oil and oil products is not declining at a rapid pace even though the recession is already around the corner. In addition, it also seems that Europe is serious about stopping importing Russian oil in order to strengthen its energy security, so we should expect the European energy markets to reshape forever. While this will undoubtedly bring pain for consumers in the short term, it will also make Europe a more secure place in the long run, as it won’t rely on the unreliable Russian imports that finance the war anymore.

All of these developments are also making Exxon Mobil an attractive stock to own if the scenarios that I’ve described in the counterargument section don’t come to life. The company already has a solid presence in Europe, and thanks to sanctions against Russia along with the high oil prices, it will be able to weather the current macro challenges and create an additional shareholder value in the long term.

Mark Your Calendars For July 7

I’m happy to announce that on July 7 I’ll be launching my own marketplace service here on Seeking Alpha called BlackSquare Capital. As we’re entering a new geopolitical reality, the goal of the service will be to assist you in building an event-driven portfolio, which can weather any storm and thrive in volatile environments. There will be a very special introductory price for a limited number of the first subscribers, so stay tuned!

Be the first to comment