gorodenkoff/iStock via Getty Images

Exscientia plc (NASDAQ:EXAI) which is based in the U.K. is not a conventional biotechnology company that develops drugs in a laboratory environment but rather specializes in using its artificial intelligence platform to modernize drug research and development. It also has a precision medicine development or one where molecular information from a patient’s genomes as well as all available health data are utilized to create treatment therapies.

Company presentation (Seeking Alpha)

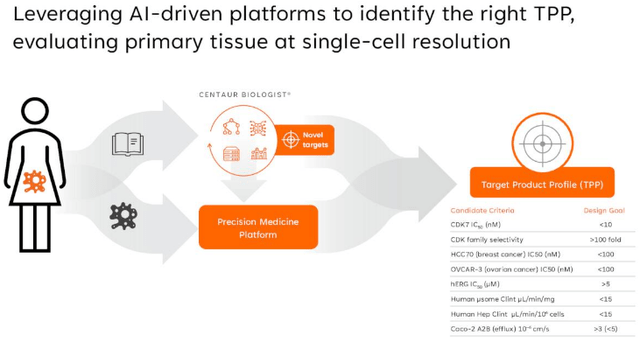

The company also uses its platform for the identification of target product profiles (“TPPs”) for drug discovery purposes in collaboration with Sanofi (NASDAQ:SNY) and Bristol-Myers Squibb (BMY). Now, these partnerships with big pharma give importance to small biotech, but, it is equally important to assess their cash-generating potential, especially in the current macroeconomic environment characterized by higher interest rates and an increase in the cost of capital.

For this purpose, I start by providing insights as to why Exscientia’s AI platform attracts large pharma in the first place.

Exscientia’s AI platform

Sanofi’s collaboration with the AI-play specifically aims to transform the way in which the research procedures for oncology (cancer) and other immunology (immune system) diseases are performed using 15 new and promising small molecules.

Going into detail, Exscientia’s platform is used to identify molecules that have the potential to be advanced to the clinical trial phase and eventually commercialized as drugs. The idea here is that machine learning techniques can provide much more accurate data than traditional methods, such as models making use of rodents like mice.

This paves the way for testing of drug candidates on lab human biological samples way before clinical trials are actually conducted on live human beings. In addition to AI, the Sanofi collaboration will also make use of Exscientia’s precision medicine for several tasks, including target identification and patient selection.

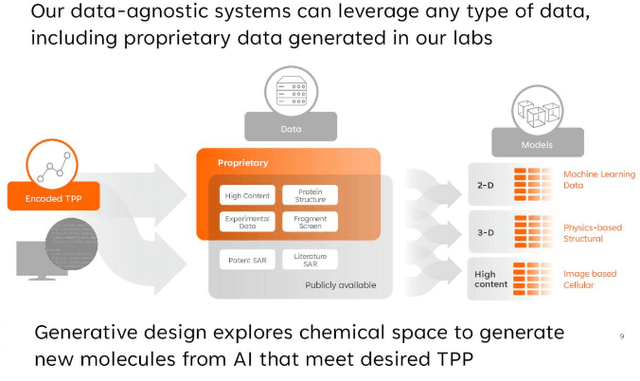

Company presentation (Seeking Alpha)

Thinking strategically, using AI represents a profound change in the way research is carried out by pharmaceuticals and this is not only about innovation. It is also about cost savings in view of the time-consuming nature of the drug development process which is also expensive. Thus, according to an estimate by Sofpromed, the average cost of a Phase 1 clinical trial for eventual approval by the U.S. Food and Drug Administration (FDA) can cost $20 million and this amount can be twice for Phase 3. Also, considering that big pharma can have dozens of molecule discovery and clinical trials at any one time, research budgets can easily reach billions of dollars.

Now, IT and conventional databases have already been used for drug research for decades, but AI and its machine learning algorithms can go a step further to take advantage of the available data, in whatever form and even if available in limited amounts, in order to rapidly identify new leads. The time factor is key here as big pharma is constantly under pressure to deliver more and more rapidly in a competitive environment. Thus, they are ready to collaborate with the likes of Exscientia for large amounts of money.

The revenues, profitability, and cash flow

The British company which was founded back in 2012 and was one of the first to apply AI to drug discovery will receive an initial payment of 88 million euros from Sanofi, which could climb up to 4.6 billion euros subject to the successful completion of all stages (R&D, clinical trials, commercialization, etc.) across the different programs agreed with the French pharma. Additionally, any drug resulting from the collaboration will be commercialized on a profit-sharing basis.

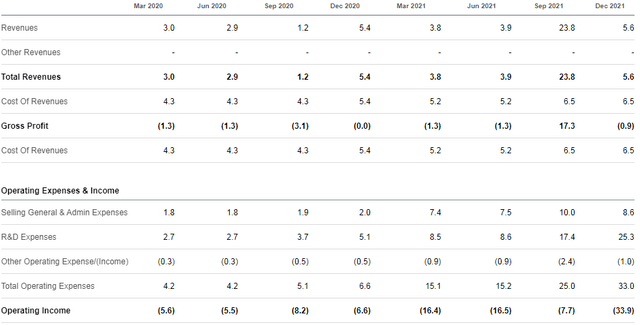

Moving to the income statement, the initial payment when converted from euros amounts to $100 million and will form part of Exscientia’s 2022 revenues. The extract below shows the quarterly income figures up till the fourth quarter of last year.

Quarterly income (Seeking Alpha)

Currently, with the cost of revenues and operating expenses totaling $39.5 million against only $5.6 million of sales, the company is loss-making. However, this should change this year, because as per the CFO, the $100 million should be cashed in the second quarter. Now, since the total quarterly expenses during the last eight quarters did not exceed the $33 million mark, the company should be profitable in Q2-2022, unless there are unforeseen expenses. To further justify the profitability narrative, partnerships with BMY and the Bill and Melinda Gates Foundation should also bring additional income.

For this matter, these partnerships generate cash flows which help to balance the outflows incurred in scaling operations. Thus, after incurring an operational cash burn of $9.1 million in Q4, future inflows are expected to result in a more balanced profile as there are a number of other smaller milestones payments to be cashed.

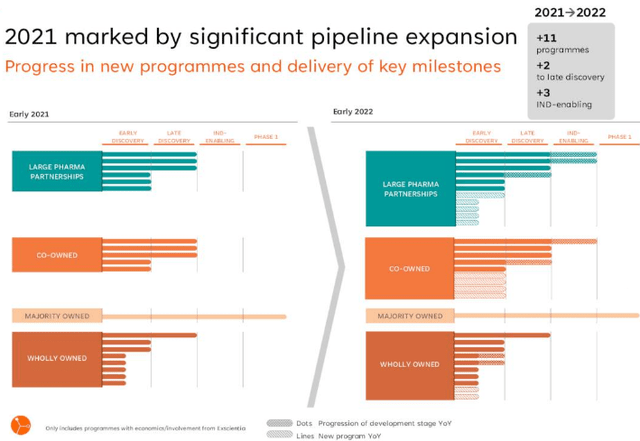

Now, this balancing act (between cash inflows and outflows) ultimately depends on the difference between the cash obtained for partnerships and the amount consumed by the company’s own internal drug development pipeline. In this respect, in addition to the technology partnerships done with big pharma, Exscientia has pipeline deals, some of which are co-owned with smaller pharmaceuticals while others are wholly owned. This is shown in the figure below, which equally shows that the number of such programs has increased from 2021 to 2022.

Company presentation (Seeking Alpha)

The above figure also shows that for large pharma, the AI-play has not only increased the number of technology partnerships, but also extended collaboration beyond the early and late discovery phases to now include IND (investigational new drug). The same has been the case for co-owned programs (in orange) where the costs are shared with partners while for wholly-owned ones (in red), there has been only a slight increase in the number of programs. Therefore, in the near term, the cash generated through technology partnerships should cover the amount spent on co-owned and wholly-owned programs.

Additionally, depending on milestone achievement, the BMY partnership which yielded $20 million in 2021 has the capacity to generate up to $1.3 billion anytime in 2022 and beyond. However, this may also take time and the net cash flow from operations will ultimately depend on whether the company’s co-owned or fully-owned programs advance to Phase 1 clinical trials, synonymous with higher expenses.

Valuations and key takeaways

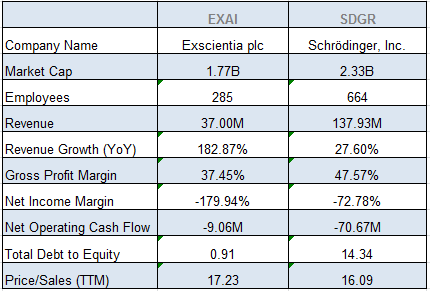

This business model which consists of being paid by large pharma for the technology part while spending money on partly or fully owned pipelines is somewhat similar to Schrödinger (NASDAQ:SDGR) which I covered last month. The latter has a higher market cap with annual revenues exceeding Exscientia’s by more than four times as shown in the table below.

Comparison with peers (Seeking Alpha)

However, this was for 2021, and with at least $100 million to be cashed this year, the British company should grow even more rapidly than last year’s 183%. Additionally, its cash burn as of the end of December 2021 was much lower than Schrödinger’s and it has a lower debt level too. As a matter of fact, the balance sheet exhibited $760.2 million of cash at the end of 2021 with debt totaling only $7 million.

Thus, Exscientia deserves better valuations. To come up with an estimate of its value, I divide the $100 million to be earned in 2022 by last year’s $37 million, to obtain a factor of 2.7. Then, adjusting the current trailing Price to Sales ratio of 17.23x, I obtain a value of 46.8x (17.23 x 2.7). This results in a target price of $34.4 (12.74 x 2.7) based on the current share price. This is a high target in view of current market conditions where stocks with negative earnings are being punished as more investors adopt the value strategy. Therefore this remains a long-term target.

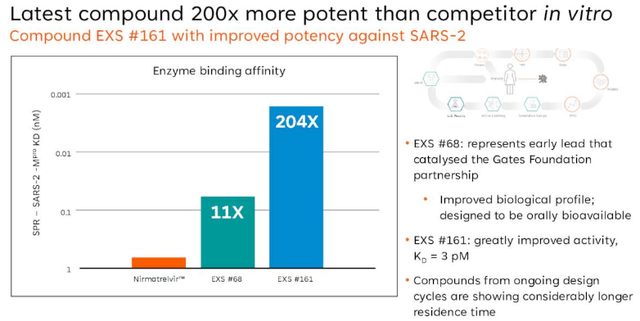

The above comparison does not cover the individual therapeutic pipelines, with both companies being involved in cancer research. One big difference is that Exscientia is involved in finding a cure for the coronavirus, namely with its EXS68 compound which was precisely the reason for which it was able to ink a partnership with the Gates Foundation.

Furthermore, as shown in the blue chart below, another of its compounds called ESX161 has shown a superior enzyme binding affinity of 204 times better than nirmatrelvir. The latter which obtained the FDA Emergency Use Authorization in December 2021 forms part of Pfizer’s (PFE) Paxlovid Covid therapy, which is also co-packaged with ritonavir tablets.

Company presentation (Seeking Alpha)

Looking across the Covid market, the reason why ESX161 makes for a worthwhile potential cure is that it is targeted at oral use which is a preferred option when compared to injectable vaccines. Moreover, despite the fact that the coronavirus has been brought into control through vaccination, there are highly-contagious variants that still constitute pandemic-level risks as the recent lockdowns in China tend to illustrate. Consequently, Exscientia’s compound has market potential and any positive therapeutic update is likely to induce positive momentum in the stock.

Considering that Merck’s (MRK) molnupiravir and Pfizer’s Paxlovid cost about $700 and $530 respectively for a five-day course, Exscientia could rake up to $100 million just by eventually commercializing 200,000 units of Covid tablets at $500 each. This depends on how fast it is able to progress through clinical trials and for this purpose, it is empowered by its AI.

Finally, with a decent balance sheet and the ability to fund the development of its pipeline through cash from technology partnerships with big pharma, this British play is a buy. On a cautionary note, due to its role shifting more to biotech with its Covid cure rather than technology partner, the stock should be more volatile in case there are any concerns about the safety factor, especially when investors’ enthusiasm has been inflating the stock price just pops on an adverse lab update.

Be the first to comment