Spencer Platt

Tesla (NASDAQ:NASDAQ:TSLA) may have a problem if competition in the electric vehicle [EV] space heats up dramatically into 2023-24, from the likes of General Motors (GM), Ford (F), Volkswagen AG (OTCPK:VWAGY) (OTCPK:VWAPY) (OTCPK:VLKAF), Honda (HMC) (OTCPK:HNDAF), Hyundai Motor (OTCPK:HYMLF) (OTCPK:HYMTF), Nissan (OTCPK:NSANY) (OTCPK:NSANF), Toyota (TM) (OTCPK:TOYOF) and others.

Standard Tesla Model 3 autos are going for $45,000 and up today, and are the least expensive offering from the company. That buys you rear-drive only with a battery range of 270 miles. Dual motor, all-wheel drive, with 350 miles for range will cost you more than $50,000 upfront (before tax credits or sales tax).

Tesla Model 3, Company Website

Mushrooming Competition

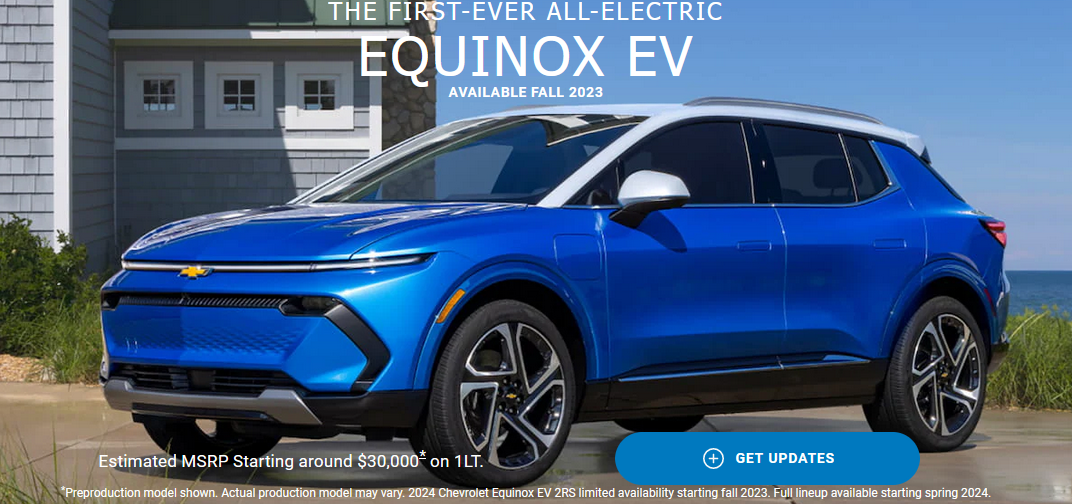

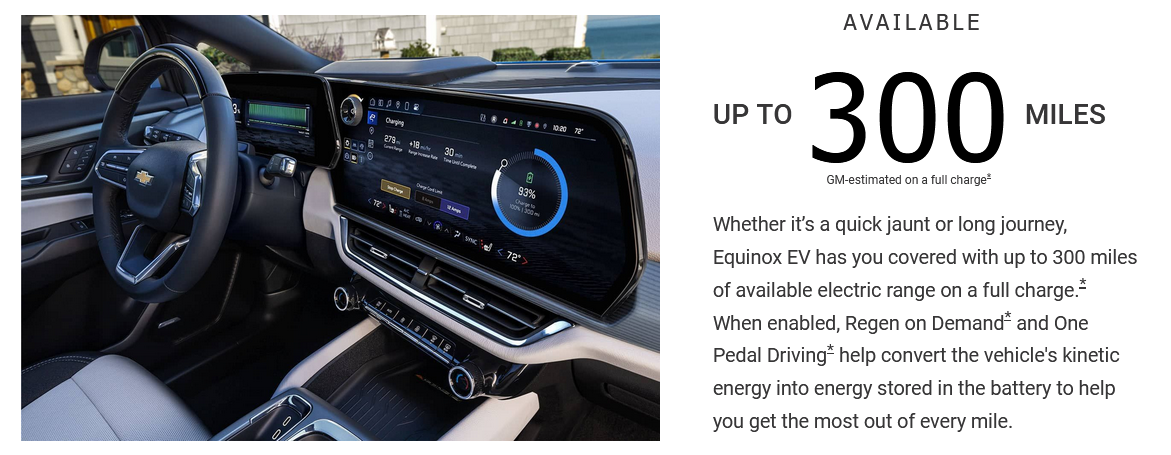

Over the last week, General Motors has been out marketing its Chevy Equinox EV model, taking preorders for delivery in 2024. The cost will be around $30,000 for a base setup, about the same as its brother SUV gas-powered Equinox option, BEFORE considering environmental tax credits from the government OR the much lower variable energy/maintenance costs of ownership.

Chevy Equinox EV, Company Website Chevy Equinox EV, Company Website Chevy Equinox EV, Company Website

https://www.chevrolet.com/electric/equinox-ev

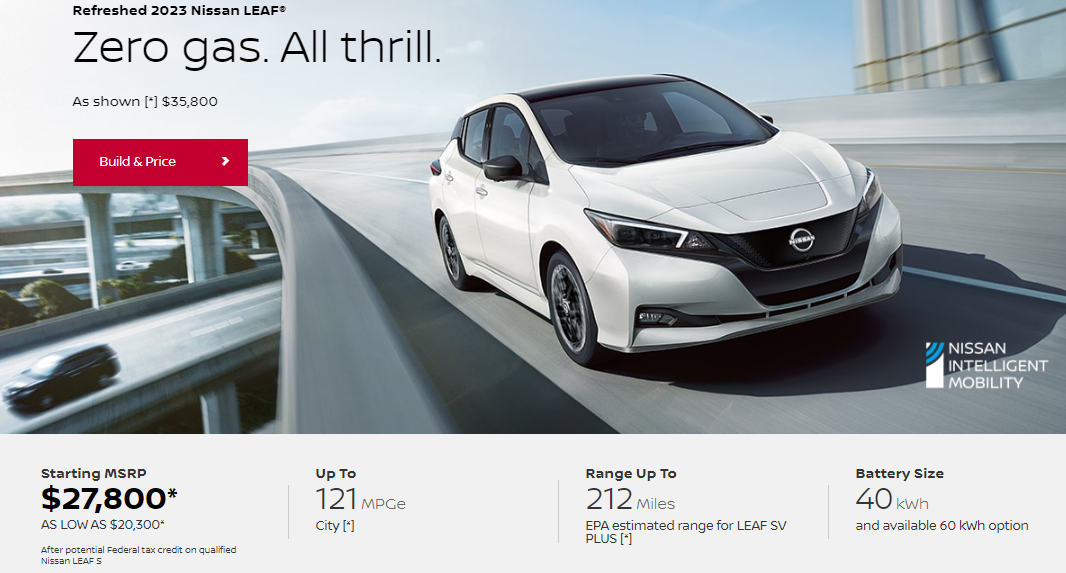

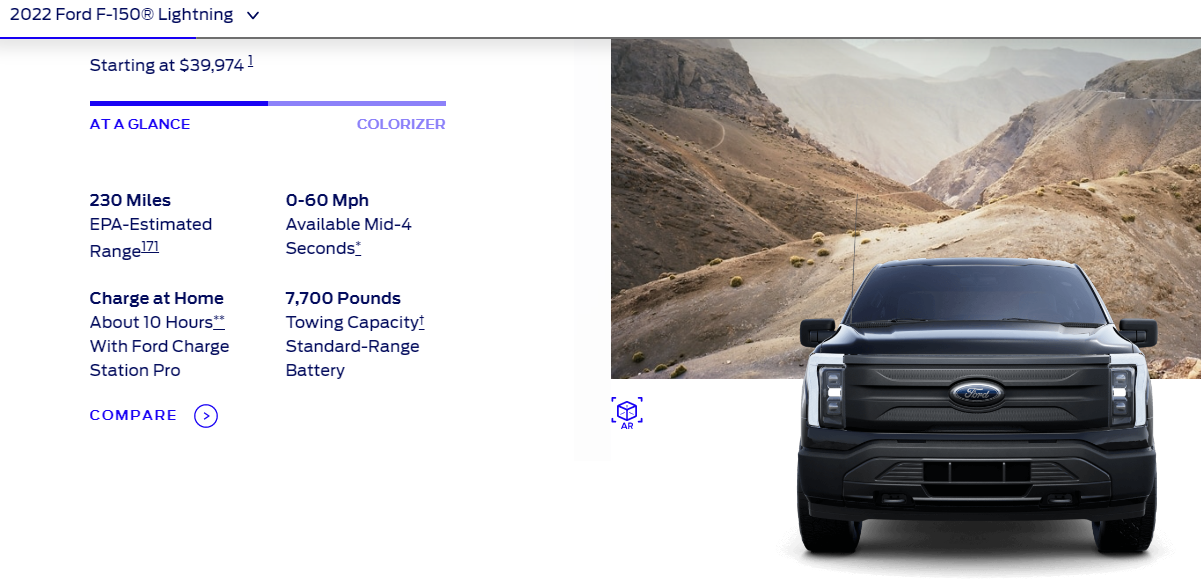

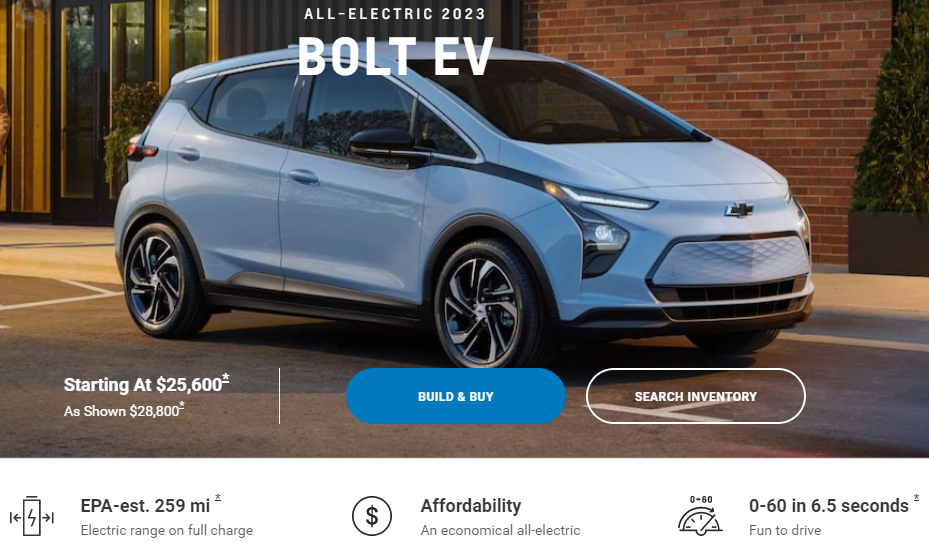

The least expensive EVs on the market currently are priced between $27,000 and $40,000, with various battery ranges under 300 miles. Pictured below is a sampling of about 30 vehicles for sale into 2023. This list includes the Nissan Leaf, Ford F-150 Lightning Truck, GM Bolt, Hyundai Kona Electric, and Volkswagen ID.4 SUV.

2023 Nissan LEAF | All-Electric Vehicle | Nissan USA 2022 Ford F-150® Lightning™ All-Electric Truck | Pricing, Photos, Specs & More | Ford.com 2023 Bolt EV: Electric Car | Chevrolet 2022 Kona Electric SUV | All-Electric SUV | Hyundai US Volkswagen ID.4 SUV – $37,000 Base Listing, vw.com

Coming Soon

Volkswagen is also releasing the first minivan soon, stylish and fun for buyers. The ID.Buzz is VW’s first minivan slash small bus for consumers and businesses, all electric for the 2024 model year in America. The cost is projected around $50,000.

Volkswagen ID.Buzz, vw.com

The Honda Prologue SUV is expected by 2024. Rumors of an all-electric Accord model by 2024 are also floating around. Suggested base prices are around $40,000.

Vehicle Electrification – Benefits and Technologies | Honda

Toyota’s hybrid push is morphing into the all-electric arena in 2024, based on analyst expectations and company presentations. The Toyota bZ4X SUV is their first completely EV model coming to market in the U.S.

Toyota Electric Vehicles, Company Website Toyota b4ZX SUV, Company Website

NEW Big Tech Entrants

Not only is competition coming from existing automakers, but some of the richest Big Tech companies are working hard on their own versions. The Sony (SONY) (OTCPK:SNEJF) Vision-S SUV and Sedan models are expected by 2025.

Sony EVs Under Development, carwow.co.uk

Self-driving, autonomous autos are the holy grail of Big Tech research and development efforts. Apple (AAPL) is working overtime to have a vehicle by 2025 (according to widespread rumors and speculation by analysts), which I am sure will be a hit with consumers if it is affordable in the $50,000 range, with safety and autonomous features surpassing Tesla. Speculation is Apple will soon team with an existing car company to manufacture EVs on a contract basis.

Then we have the Alphabet/Google (GOOG) (GOOGL) effort, under development by its Waymo unit since 2014, tested on the streets of America. Whether they partner with another automaker or produce it entirely inhouse, Waymo’s futuristic technology will undoubtedly be available in the not-too-distant future.

Home – Waymo.com Home – Waymo.com

Tesla’s Looming Financial Problem

Battle for sales will revolve around four features in my mind: price, safety, warranties, and performance. Today, Tesla scores the strongest for safety and performance. Stellar third-party crash test results and ratings, on top of some really cool driving features are the best-selling points for new purchasers. However, price is on the high side vs. ramping competition, and old-school networks of dealership service sites all over the world for existing gas-powered automakers could become a huge problem for future Tesla company growth and profitability. If you can buy a car/truck/SUV with similar battery life and recharging mechanics, at a lower price, with adequate safety designs, yeoman performance capabilities, and smarter warranty coverage, most all consumers will opt to buy EVs not produced by Tesla.

The “cost” crossover from gasoline to EV buying logic has arrived into 2023 for American buyers, with the passage of the 2022 Inflation Reduction Act’s tax incentives. For clean emission autos assembled in the U.S., tax credits of up to $7,500 are now available. Effectively, the price to purchase many new vehicles powered solely by electricity and battery storage is now lower upfront than traditional autos with fossil-fuel burning engines. Add into this equation maintenance costs will be lower each year (as fewer parts and systems are necessary for EVs to run), while the daily “expense” to power each vehicle will drop by 50% to 75% at $3.50 per gallon gasoline. You will not sacrifice acceleration and braking performance. Safety may actually improve, and warranties may cover more potential operating issues for longer periods of 5 to 10 years, than exist currently. Why wouldn’t you buy an EV starting in 2023-24, absent the long-distance cross-country trip excuse for slow battery recharging time?

While competition is great for consumers, it is horrible news for a company holding a huge share of this market. Tesla’s dominance could easily be ending in 18-24 months, especially as a variety of new EV entrants will probably turn into trendy hits with buyers.

In the end, both Volkswagen and GM believe they will be selling more EV cars than Tesla between 2025-26, only 3-4 years from now. So, Tesla could very quickly fall from the #1 seller worldwide to #3 or lower in the not-too-distant future. The only way the company may be able to stick around is through the offering of lower-priced, lower-margin vehicle designs. My main worry is peak earnings for Tesla may occur in 2023-24, followed by a steep dive, perhaps into a permanent operating loss position thereafter.

2021-22 Peak Price & Investor Optimism?

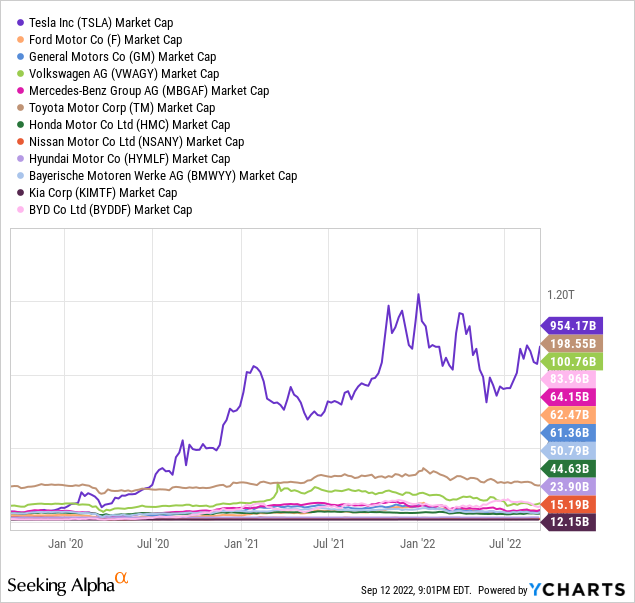

So, does an auto-industry record $950 billion in equity market capitalization make sense in September 2022? Is Tesla really worth more than the rest of the world’s auto industry COMBINED? My answers are NO. Plenty of risk is now part of the shareholder proposition, perhaps far greater downside than was baked into the investment equation a year or two ago. Below is a review of market caps vs. some of Tesla’s main competitors in the U.S., Europe and Asia. The group includes Ford, GM, Volkswagen, Mercedes-Benz (OTCPK:MBGAF) (OTCPK:DMLRY), Toyota, Honda, Nissan, Hyundai, BMW AG (OTCPK:BMWYY) (OTCPK:BAMXF) (OTCPK:BYMOF), Kia (OTCPK:KIMTF), and BYD (OTCPK:BYDDF) (OTCPK:BYDDY) a leading Chinese EV company partially owned by Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B).

YCharts, Major Automakers – Equity Market Capitalizations, 3 Years

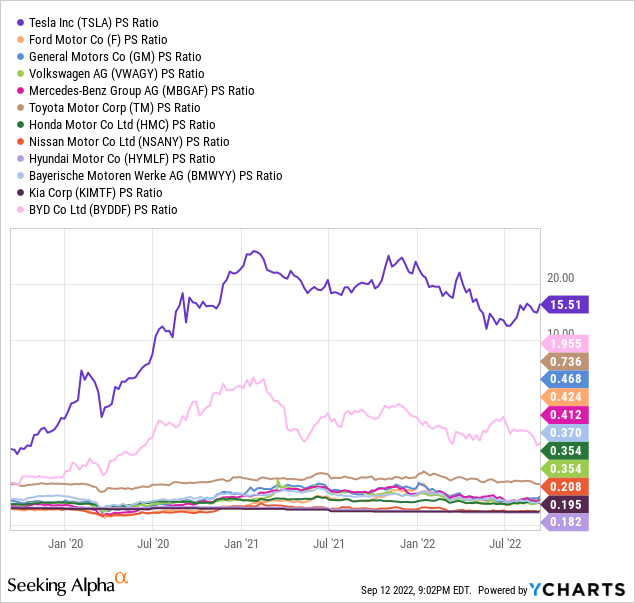

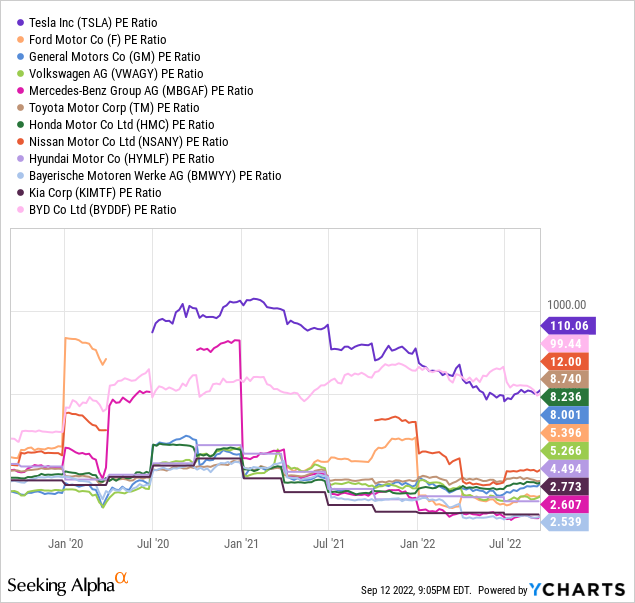

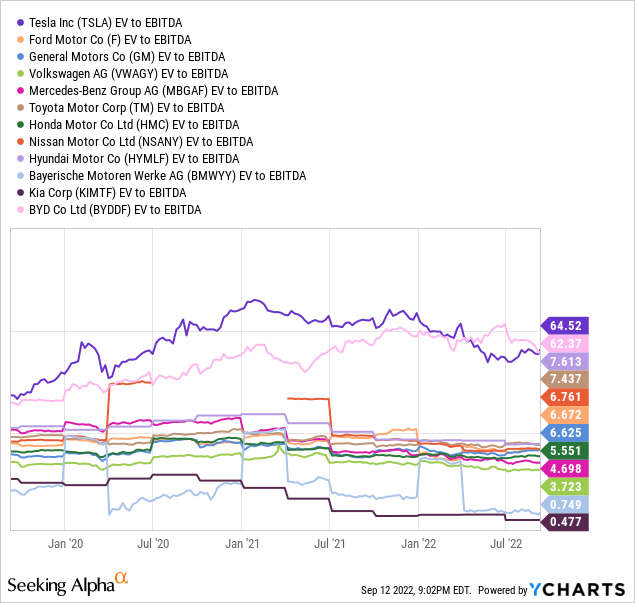

A quick review of basic trailing valuations also argues Tesla is incredibly overvalued, especially if growth peaks in 2023 from real competition. Basic ratio analysis of price to sales and earnings, or EV to EBITDA comparisons screams Tesla is amazingly expensive.

YCharts, Major Automakers – Price to Trailing Sales, 3 Years YCharts, Major Automakers – Price to Trailing Earnings, 3 Years YCharts, Major Automakers – EV to Trailing EBITDA, 3 Years

While this richly-valued setting has been normal for Tesla the last three years, no serious competitive threats existed before now. Whether shareholders like it or not, we are entering a new era of intense competition. But that’s not all the bearish news, rising interest rates and a slowing economy may have high-pointed Tesla’s valuation during January-February 2021, around the time of maximum meme-stock frenzy buying on Wall Street.

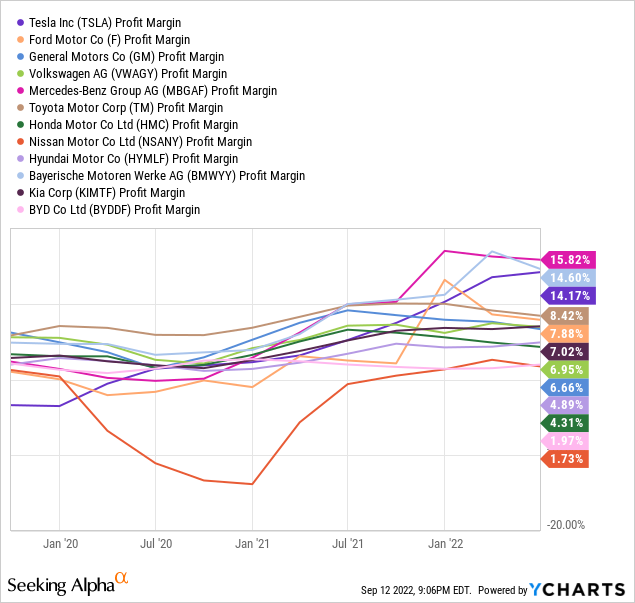

My biggest concern is Tesla’s profit margins are peaking. Competition will dramatically change the pricing outlook for electric vehicles, potentially dragging operating results closer to breakeven or into loss territory a few years out. That’s how free-market capitalism and supply/demand forces work.

YCharts, Major Automakers – Profit Margins, 3 Years

Problematic Trading Pattern

I have written several articles critical of Tesla over the past year on Seeking Alpha, and I am growing more bearish now. While price peaked in early November around $414 (split-adjusted) with other Big Tech names, upside buying momentum has been methodically topping for months into 2022. The $315 high price of August, just above the 200-day moving average, may prove a failure on the charts, especially if a downturn under the 50-day moving average confirms a bearish pattern reversal.

While some technical trading arguments were relatively bullish months ago for Tesla, my favorite momentum indicators have topped and turned lower since April. Below you can review peaks in the Accumulation/Distribution Line, Negative Volume Index, and On Balance Volume readings. For me, the most troubling reversal lower has been in the NVI (marked with the red arrow), which looks at trading changes on lower volume days. While this indicator remained bullish into June, signaling real buying interest on slow volume days, it has changed character of late.

StockCharts.com, TSLA 1-Year Chart of Daily Changes with Author Reference Points

Final Thoughts

Don’t laugh (cry maybe if you are a shareholder), but a Tesla price under $100 per share could be reality in 18-24 months. Such would still place the company as the most valuable automaker by market cap. However, it would push price into a more normal valuation zone vs. the rising and likely successful tide of EV competition approaching fast.

How could this bearish forecast end up being wrong? This question revolves around consumer demand and Tesla’s reputation. If buyers believe owning the brand name is more important than pocketbook issues, selling cars over $50,000 may remain a profitable and growing venture for the company, albeit at lower rates than the recent past of near-monopoly market share status.

My worry is cars with lower costs and comparable operating performance will be more desirable for the masses. With about 30 EV options available today in the U.S. with prices under Tesla’s lowest dollar-cost model, likely more than 50 by 2024, and as many as 150 models by 20+ automakers by 2026 [by my count, including smaller EV startups like Rivian Automotive (RIVN)], continued dominance of the sector is no longer guaranteed. Better warranties and service options, maybe even stronger safety features could torpedo Tesla sales.

If the company is forced to lower prices to keep some legitimacy in the EV market, profits and cash flow could be crushed by 2025. At that point, investors may not want to own shares anywhere near the same bubble proportions and excitement in portfolio construction as 2021-22. In other words, it could be tough sledding for both Tesla and its investors by the end of 2023. Smart investors may see the writing on the wall and decide to sell shares now, before competitive forces drive growth into the ground.

I am moving my rating from Hold to Sell. The Tesla bubble may finally be popping. The question I have for existing owners is what is your pain threshold? If you are not willing to sell now, you need to draw up some red lines that would convince you to exit – a lower stock quote, sales/earnings misses from sky-high analyst projections for 2023? Without doubt, less-risky growth stories can be found on Wall Street, many with valuations similar to the S&P 500. Why not focus on them with your investment capital?

How far and fast could Tesla’s share price fall? Well, I warned a few years ago in my articles about the intense competition coming to online streaming services, with Avoid and Sell ratings on Netflix (NFLX) and Disney (DIS). From last year’s highs, Netflix fell as much as 75% (over six months) and Disney 55% (over 14 months). In a similar vein, and perhaps from a more overvalued position, projecting a Tesla decline of 75% from last November’s all-time high gets you close to $100 per share in the first half of 2023. Don’t say it cannot happen.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment