izusek

On July 26, 2022, a Virgin Atlantic flight from London’s Heathrow airport to Los Angeles made an unscheduled stop at Salt Lake City in order for an unruly passenger to be removed. Surprisingly, fellow passengers didn’t focus their anger on the passenger, but rather on Heathrow Airport and the airline, with one fellow passenger telling the Irish Sun, “I was [at the airport] for five hours and barely made my flight. People were not happy, people were very agitated.”

This summer’s travel chaos at the world’s airports has been well documented, with canceled flights, long lines, and upset passengers. Restaurants haven’t fared any better, with lots of news stories about brawls occurring there as well. Recently, this chaos spread to “the happiest place on Earth,” Disney World, when a brawl erupted at its Magic Kingdom.

Increasingly, those with the means are trying to cocoon themselves when they travel, dine, or recreate, and this is creating strong growth in what I’m terming “exclusivity stocks.” While there is risk that stagflation or a recession could bring on a decrease in spending even by the very rich, the currently low prices of the stocks mentioned in this article create an enormous upside possibility.

Exclusivity in Airports

For years, the flying elite haven’t had to fight for an electrical outlet at an overcrowded airport departure gate, but rather they have enjoyed luxurious airport lounges. These lounges, which the New York Times recently described as “bastions of civilization in airport terminals,” provide bars, snacks, free WiFi, and even beds and showers in some of them.

For years, American Airlines (AAL), Delta Air Lines (DAL), and United Airlines (UAL) have provided airport lounges for their first class and business class passengers. Now, credit card companies are getting into the act. The Platinum Card from American Express (AXP), which costs $695 annually, comes with access to multiple airport lounges, and American Express operates its own Centurion Lounges and Escape Lounges, which the company describes as allowing card members to “… escape into luxury before flying, enjoy food and drink from award-winning chefs and top mixologists, and get away from it all in thoughtfully curated spaces designed for work or relaxation.”

Holders of the Capital One (COF) Venture X card, which costs $395 a year, will have access to new lounges that are being built at the Dallas-Fort Worth, Denver, and Washington Dulles airports. In 2023, JPMorgan Chase (JPM) will offer access to airport lounges to holders of its Chase Sapphire Reserve card, which costs $550 a year.

Access to airport lounges through pay-as-you-go plans is also available. The Plaza Premium Group offers access to the Virgin Atlantic, Avianca, and Air France lounges that it manages, and the company charges $59 for two visits to its lounges within one year. Both American Airlines and United Airlines provide single-day passes to their lounges for $59, and American Express is offering pay-as-you-go access to its Escape Lounges for $40 if pre-booked, or $45 otherwise.

Privately held The Club offers single-use passes to its lounges in the U.S. for $45, and the company also has lounges at the UK’s Heathrow and Gatwick airports.

Exclusivity in the Air

For those wanting to avoid the hoi polloi both at the airport and in the air, flying private is the way to go. NetJets is the oldest private jet operator in the world and also the largest, with more than 700 planes in its fleet. These include the smaller Embraer Phenom 300, all the way up to the Bombardier Global 7500 which seats 14. Wholly owned by Berkshire Hathaway (BRK.A), NetJets offers fractional aircraft ownership through its Shares Program, where the share size equates to the number of available hours, and it also offers jet cards and a lease program.

Formed in 2013, Wheels Up (UP) began trading on the New York Stock Exchange in July 2021, becoming the first publicly traded, stand-alone private jet company. Wheels Up raised over $650 million, which it said it will use to expand its product offerings. The company has more than 1,500 aircraft including the King Air 350i, an eight-seat propeller jet, the mid-range Cessna Citation Excel/XLS, and the super-fast Cessna Citation X, which can fly for more than six hours nonstop. Wheels Up offers three membership options, ranging from entry-level to comprehensive, and in 2019, Wheels Up formed a strategic partnership with Delta Air Lines, allowing its members access to commercial aviation travel benefits.

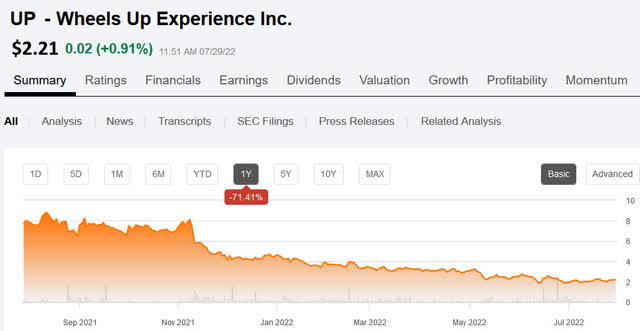

Wheels Up 1-year price chart (Seeking Alpha)

Currently, Wheels Up has a market cap of $564.27 million, and in 2021, the company brought $1.2 billion in revenue. They are estimating revenue of $1.5 billion and $1.7 billion in 2022 and 2023, respectively, and an EPS of -1.04. 41.45% of the company is held by institutions, and short interest stands at 4.82%. UP has a Quant Rating of 2.95, or Hold, and within its Sector, Industrials, and Industry, Airlines, it has a Quant Raking of 321 out of 614 in its sector, and 17 out of 28 in its industry.

This week, General Dynamics (GD), maker of Gulfstream business jets, reported that it expects its sales and earnings to be at the high end of guidance. The company reported that it delivered 22 Gulfstream business jets in Q2-22, and it expects to deliver 123 aircraft in 2022. General Dynamics has a market cap of $61.91 billion and a P/E ratio of 18.72. Its Quant Rating is 3.19, or Hold, and its Quant Rankings are 231 out of 614 in its Sector, Industrials, and 10 out of 59 in its Industry, Aerospace and Defense.

Exclusivity on the Ground

Private members’ clubs got their start in England during the 18th century, and some of them are still in operation today. The number of private clubs increased during the 1880s when new clubs were formed around members’ connections and interests. Clubs were formed for those with connections to a particular university or to a section of the armed forces, and clubs were formed for those with an interest in literature, art, exploration, travel, or a particular sport.

As the British Empire spread around the world, new private clubs opened up and they were places where much of the world’s business was conducted. Today, there is a resurgence in private clubs which can be attributed to concerns over safety and a desire for exclusivity. Indeed, recently the President and CEO of the Club Management Association of America, Jeff Morgan, told Barron’s that the “pandemic increased demand for private club memberships as individuals sought out the safety, privacy, and exclusivity.”

The most well-known members-only club is Soho House whose parent company Membership Collective Group (MCG) went public in 2021. Soho House opened its first “house” in London in 1995, and it now has 36 locations across Europe, North America, and Asia. Four new houses are set to open in Miami, Copenhagen, Stockholm, and south London.

Soho House members have access to hotel rooms, co-working spaces, bars, restaurants, salons, classes, talks, and film screenings. Currently, there are around 120,000 members who pay £1,100 ($1,326) for access to just one house, or £2,500 ($3,013) for access to all the houses. Soho House encourages younger members, those under 27, to join by charging them half the regular prices. You can’t become a Soho House member just by ponying up the entrance fee, you have to be approved by a house’s membership committee who reportedly only chooses “the coolest” applicants.

Membership Collective Group 1-year price chart (Seeking Alpha)

Despite its rapid expansion, Soho House has yet to make a profit, losing over £220 million ($265 million) in 2021. MCG has a Quant Rating of 2.69, or Hold, and in its Sector, Consumer Discretionary, and its Industry, Hotels, Resorts and Cruise Lines, MCG is ranked 362 out of 534 in its Sector and 22 out of 31 in its Industry. MCG has a market cap of $1.35 billion, and short interest stands at 5.21%. 39.02% of the company is held by PE/VC firms, 33.13% by Individuals/Insiders, and 22.38% is held by institutions.

Exclusivity on the Water

Read any tabloid lately, and it seems like every celebrity in the world is out on his or her private yacht. According to a report by Bain & Company, in 2021, sales of private yachts were up by 1%-3% over 2020 and reached $27 billion (€27 billion).

Clearwater, Florida-based MarineMax, Inc. (HZO) combines Retail Operations and Product Manufacturing, with the retail arm selling new and used sport boats, sport yachts, sport cruisers, and fishing boats. The company has 79 retail locations in the Eastern, Southeast, and Midwest areas of the country. The manufacturing arm offers marine electronics, dock and anchoring products, boat covers, trailer parts, water sport accessories, and boating accessories such as life jackets and inflatables. MarineMax also offers new or used boat finance services, and it arranges insurance coverage including boat property and casualty. The company also operates vacations in Tortola, British Virgin Islands.

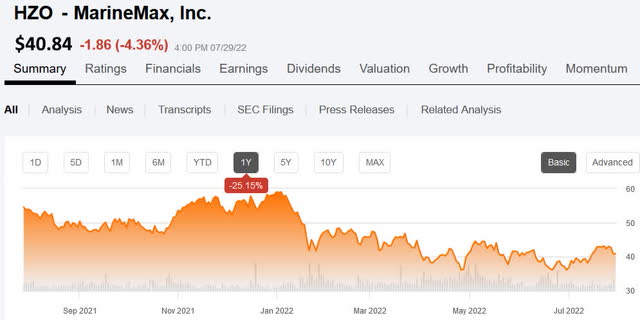

MarineMax 1-year price chart (Seeking Alpha)

With a market cap of $879.46 million and a P/E ratio of 4.89, HZO’s Quant Rating of 4.51 places it as a “Strong Buy.” Recent analysis by SA authors have also placed HZO as a Strong Buy. Within its Sector, Consumer Discretionary, and Industry, Specialty Stores, HZO is ranked 45 out of 534 in its Sector, and 3 out of 23 in its Industry.

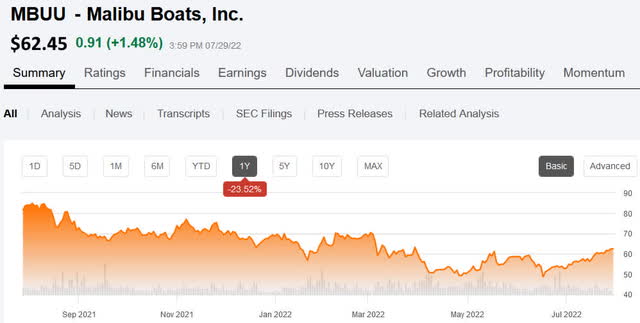

Malibu Boats, Inc. (MBUU) designs, manufactures and sells a range of recreational powerboats through independent dealers across North America, Europe, Asia, the Middle East, South America, South Africa, and Australia/New Zealand. Its Quant Rating is 4.65, a Strong Buy, and it ranks 29 out of 533 in its Sector, Consumer Discretionary, and it ranks 2 out of 23 in its industry, Leisure Products. The company was founded in 1982 and is headquartered in Loudon, Tenn.

Malibu Boats 1-year price chart (Seeking Alpha)

Bottom Line

Whether on land, sea, or air, it seems as if the desire to shield oneself, and one’s family, from others has never been stronger. Those with the means to do so are increasingly turning to private everything – aviation, cruising, and dining – and this trend only looks to strengthen, providing strong growth opportunities for the companies that provide exclusivity.

Be the first to comment